What agency runs the Medicare program?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the Department Of Health And Human Services (Hhs)

Who pays first – Medicare or group health?

After the coordination period, Medicare pays first and the group health plan (or retiree coverage) pays second. If you originally got Medicare due to your age or a disability other than ESRD, and your group health plan was your primary payer, then it still pays first when you become eligible because of ESRD.

How is Medicare funded?

How is Medicare funded? The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the

Will Medicare become a publicly run health plan?

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government's expenses, into a publicly run health plan program that offers "premium support" for enrollees.

Who signed the Medicare program into law?

President Lyndon JohnsonOn July 30, 1965, President Lyndon Johnson traveled to the Truman Library in Independence, Missouri, to sign Medicare into law. His gesture drew attention to the 20 years it had taken Congress to enact government health insurance for senior citizens after Harry Truman had proposed it.

Who was the first president to dip into Social Security?

Which political party started taxing Social Security annuities? A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983.

Who passed Social Security and Medicare?

The Social Security Act was signed into law by President Roosevelt on August 14, 1935. In addition to several provisions for general welfare, the new Act created a social insurance program designed to pay retired workers age 65 or older a continuing income after retirement.

Which president started Medicare and Social Security?

Meeting this need of the aged was given top priority by President Lyndon B. Johnson's Administration, and a year and a half after he took office this objective was achieved when a new program, "Medicare," was established by the 1965 amendments to the social security program.

What president took money from the Social Security fund?

3. The financing should be soundly funded through the Social Security system....President Lyndon B. Johnson.1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19646.REMARKS WITH PRESIDENT TRUMAN AT THE SIGNING IN INDEPENDENCE OF THE MEDICARE BILL--JULY 30, 196515 more rows

Which president messed up Social Security?

President Richard M. Nixon1.SPECIAL MESSAGE TO THE CONGRESS ON SOCIAL SECURITY -- SEPTEMBER 25, 19694.STATEMENT ABOUT APPROVAL OF THE WELFARE REFORM AND SOCIAL SECURITY BILL BY THE HOUSE COMMITTEE ON WAYS AND MEANS--MAY 18, 197119 more rows

Why did Social Security go down?

If you recently started receiving Social Security benefits, there are three common reasons why you may be getting less than you expected: an offset due to outstanding debts, taking benefits early, and a high income.

What President started Medicaid?

President Lyndon B. JohnsonOn July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security of our nation.

Will the United States run out of Social Security numbers?

Will the SSA ever run out of SSNs? The nine-digit SSN will eventually be exhausted. The previous SSN assignment process limited the number of SSNs that were available for assignment to individuals in each state.

Can someone who has never worked collect Social Security?

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

Who started Medicare and Medicaid?

President Lyndon B. JohnsonOn July 30, 1965, President Lyndon B. Johnson signed the Social Security Amendments of 1965 into law. With his signature he created Medicare and Medicaid, which became two of America's most enduring social programs.

Was Lyndon B Johnson a Republican?

A Democrat from Texas, he ran for and won a full four-year term in the 1964 election, winning in a landslide over Republican opponent Arizona Senator Barry Goldwater. Johnson did not run for a second full term in the 1968 presidential election. He was succeeded by Republican Richard Nixon.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

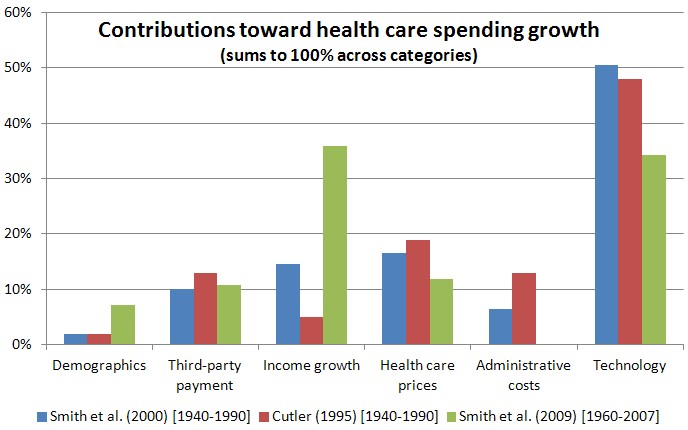

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

When did Medicare expand home health?

When Congress passed the Omnibus Reconciliation Act of 1980 , it expanded home health services. The bill also brought Medigap – or Medicare supplement insurance – under federal oversight. In 1982, hospice services for the terminally ill were added to a growing list of Medicare benefits.

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What happens when there is more than one payer?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer.

What is BCRC in Medicare?

The Benefits Coordination & Recovery Center (BCRC) consolidates the activities that support the collection, management, and reporting of other insurance coverage for Medicare beneficiaries. The BCRC takes actions to identify the health benefits available to a Medicare beneficiary and coordinates the payment process to prevent mistaken payment ...

Who is responsible for pursuing recovery from a liability insurer?

The CRC is responsible for pursuing recovery directly from a liability insurer (including a self-insured entity), no-fault insurer or workers’ compensation entity. For more information on the processes used by the CRC to recover conditional payments, see the Insurer NGHP Recovery page.

Who voted against Medicare?

When Medicare was first being considered Senate Republican Robert Dole (then in the House) voted against it. Also in opposition to Medicare, in a famous 1964 speech, Ronald Reagan explained that his opposition to Social Security and Medicare is why he switched from the Democratic Party to the Republican Party.

Which party is opposed to Social Security?

The Republican Party has always been associated with opposition to Social Security. Economic historian Max Skidmore shows that the final vote for Social Security was lopsided--only 2% of Democrats voted against it (because it wasn't generous enough) while 33% of Republicans voted against Social Security.

Why did McConnell say the Republicans would defend the tax cuts?

This poll was taken a week after Senator McConnell said the Republicans would defend the tax cuts and cut Social Security, Medicare and Medicaid in order to curb the growing deficit, caused in significant part by those very tax cuts. The Republican Party has always been associated with opposition to Social Security.

Is Social Security a fiscal discipline?

Social Security is one of the few government programs with built-in fiscal discipline. Bottom Line: Though Senator McConnell may not have meant to publicize the Republican agenda to cut Social Security, Medicare and Medicaid, the long history of Republican opposition may be an example of what Sigmund Freud and modern psychologists believe--a slip ...

Who said Social Security is designed to prevent business recovery, to enslave workers, and to prevent any possibility of

In 1935, Republican congressman John Taber said Social Security “is designed to prevent business recovery, to enslave workers, and to prevent any possibility of the employers providing work for the people.”.

Did McConnell tell the electorate that Medicare and Social Security were high on the Republican agenda?

It seems Senator McConnell, usually careful not to rock the boat before the upcoming midterm elections, did not set out to tell the electorate that Social Security, Medicare and Medicaid cuts were high on the Republican agenda.