When there is no coordination of benefits, the policies will not work together, or complement, one another. Some examples include when you have a Medicare Advantage plan, a Marketplace plan, or veterans benefits. Medicare does not coordinate with these healthcare programs.

Full Answer

Why does Medicare want to coordinate care with my doctor?

Medicare wants to be sure that all doctors have the resources and information they need to coordinate your care. Coordinated care helps prevent: Getting the same service more than once (when getting the services again isn't needed)

What types of coordinated care programs does Medicare offer?

Medicare's coordinated care programs include: Accountable Care Organizations (ACOs) Global & Professional Direct Contracting (GPDC) Model

What happens if there is no agreement between Medicare and insurance?

In the absence of an agreement, the person with Medicare is required to coordinate secondary or supplemental payment of benefits with any other insurers he or she may have in addition to Medicare. Ensures that the amount paid by plans in dual coverage situations does not exceed 100% of the total claim, to avoid duplicate payments.

Do Medicare and retiree health plans work together?

An Equal Employment Opportunity Commission (EEOC) final rule issued on Dec. 26, 2007, allows retiree health plans to be coordinated with Medicare for Medicare-eligible retirees.

What types of healthcare are not covered by Medicare?

In general, Original Medicare does not cover:Prescription drugs.Long-term care (such as extended nursing home stays or custodial care)Hearing aids.Most vision care, notably eyeglasses and contacts.Most dental care, notably dentures.Most cosmetic surgery.Massage therapy.More items...

Do Medicare Advantage plans coordinate benefits?

Medicare Advantage plans can serve as your “one-stop” center for all your health and prescription drug coverage needs. Most Medicare Advantage plans combine medical and Part D prescription drug coverage. Many also coordinate the delivery of added benefits, such as vision, dental, and hearing care.

What is a Medicare coordination plan?

Coordination of benefits (COB) allows plans that provide health and/or prescription coverage for a person with Medicare to determine their respective payment responsibilities (i.e., determine which insurance plan has the primary payment responsibility and the extent to which the other plans will contribute when an ...

What does no coordination of benefits mean?

A. No. Coordination of benefits is a coordination of reimbursement only between policies; it does not duplicate benefits or double the benefit frequency. Example: a patient has two policies, and each one covers two cleanings a year.

Can you have Medicare and Humana at the same time?

People eligible for Medicare can get coverage through the federal government or through a private health insurance company like Humana. Like Medicaid, every Medicare plan is required by law to give the same basic benefits.

Do you have to coordinate benefits?

It is common for employees to be covered by more than one group insurance plan. This is typically achieved through a spouse or common-law partner's plan. When an individual is covered by more than one plan, coordination of benefits becomes a requirement to ensure everything runs smoothly between the two plans.

Can you have a retirement plan and a Medicare Advantage Plan?

Employer-sponsored Medicare Advantage Plans offer Medicare-eligible individuals both Medicare and retiree health benefits. Some employers require that you join a Medicare Advantage Plan to continue getting retiree health benefits after becoming Medicare-eligible.

How do you determine which insurance is primary and which is secondary?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay. The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer.

Will Medicare pay if primary insurance out of network?

plan's network (See page 13 ) It's possible that neither the plan nor Medicare will pay if you get care outside your employer plan's network . Before you go outside the network, call your group health plan to find out if it will cover the service .

What are the different types of coordination of benefits?

Understanding How Insurance Pays: Types of Coordination of Benefits or COBTraditional. ... Non-duplication COB. ... Maintenance of Benefits. ... Carve out. ... Dependents. ... When Does Secondary Pay? ... Allowable charge. ... Covered amount.

How do you fix coordination of benefits?

Avoid duplicate payments by making sure the two plans don't pay more than the total amount of the claim. Establish which plan is primary and which plan is secondary—the plan that pays first and the plan that pays any remaining balance after your share of the costs is deducted. Help reduce the cost of insurance premiums.

How does it work if you have 2 insurances?

If you have multiple health insurance policies, you'll have to pay any applicable premiums and deductibles for both plans. Your secondary insurance won't pay toward your primary's deductible. You may also owe other cost sharing or out-of-pocket costs, such as copayments or coinsurance.

What is Medicare investigation?

The investigation determines whether Medicare or the other insurance has primary responsibility for meeting the beneficiary's health care costs. Collecting information on Employer Group Health Plans and non-group health plans (liability insurance ...

What is a COB plan?

Coordination of benefits (COB) allows plans that provide health and/or prescription coverage for a person with Medicare to determine their respective payment responsibilities (i.e., determine which insurance plan has the primary payment responsibility and the extent to which the other plans will contribute when an individual is covered by more than one plan).

What is BCRC in Medicare?

Benefits Coordination & Recovery Center (BCRC) - The BCRC consolidates the activities that support the collection, management, and reporting of other insurance coverage for beneficiaries. The BCRC takes actions to identify the health benefits available to a beneficiary and coordinates the payment process to prevent mistaken payment of Medicare benefits. The BCRC does not process claims, nor does it handle any GHP related mistaken payment recoveries or claims specific inquiries. The Medicare Administrative Contractors (MACs), Intermediaries and Carriers are responsible for processing claims submitted for primary or secondary payment.

Why do we need MSP records on CWF?

Establishing MSP occurrence records on CWF to keep Medicare from paying when another party should pay first. The CWF is a single data source for fiscal intermediaries and carriers to verify beneficiary eligibility and conduct prepayment review and approval of claims from a national perspective.

Does Medicare pay a claim as a primary payer?

Where CMS systems indicate that other insurance is primary to Medicare, Medicare will not pay the claim as a primary payer and will return it to the provider of service with instructions to bill the proper party.

Does BCRC cross over insurance?

Note: An agreement must be in place between the Benefits Coordination & Recovery Center (BCRC) and private insurance companies for the BCRC to automatically cross over claims. In the absence of an agreement, the person with Medicare is required to coordinate secondary or supplemental payment of benefits with any other insurers he ...

What happens if you don't enroll in Medicare?

If they don’t enroll, then generally they will have to pay from their own pocket anything that Medicare would have covered. “Employees should get in writing details about their employer-provided coverage,” Muralidharan advised.

What is Medicare bridge plan?

A Medicare bridge plan, which provides retirees health care coverage from the time they retire until they become eligible for Medicare. A Medicare wrap-around plan, which provides retirees with additional coverage for out-of-pocket expenses, including the cost of co-insurance and deductibles.

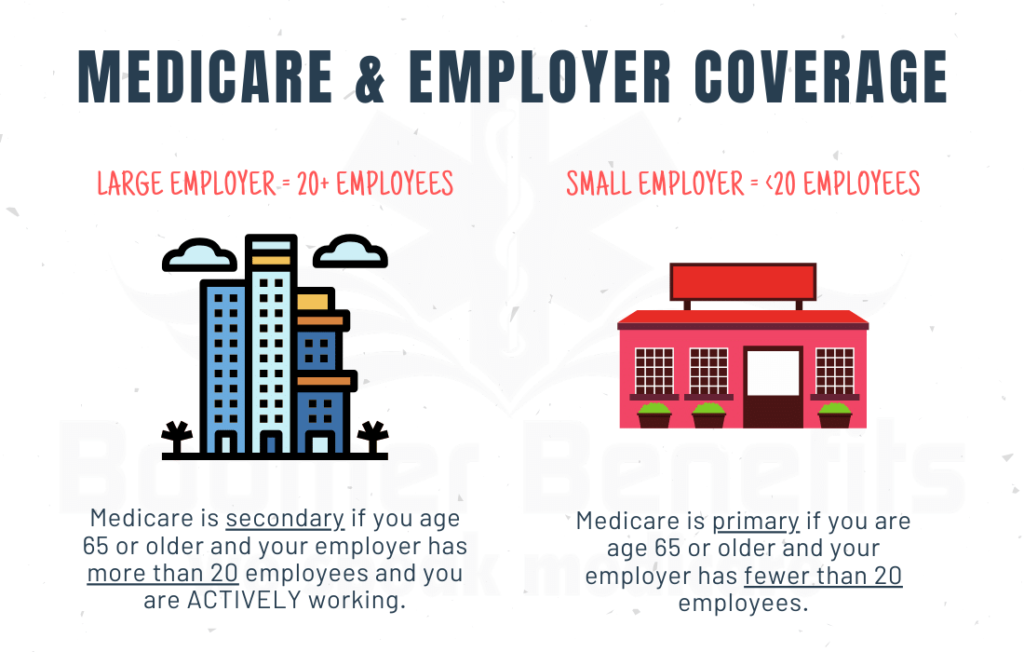

Is Medicare covered by employer?

For some, employer coverage is the primary payer of benefits, with Medicare paying costs not covered by the employer plan. For other employees, the reverse is true. “It can be confusing for employees to determine how their employer coverage coordinates with Medicare,” Muralidharan pointed out.

Do veterans need Medicare?

Depending on the level of VA benefits they receive, employees 65 and older might be covered adequately and might not need Medicare coverage.

Can you coverge with Medicare?

Thus, while coverge for current employees over age 65 may be coordinated with Medicare, the employer must offer health benefits to those employees that are equal to the benefits that it offers to other similarly situated employees (this prohibition does not apply to retirees, as discussed below).

Is Medicare the primary or secondary payer?

However, some retiree plans stipulate that Medicare is the primary payer and the retiree plan is the secondary payer. Therefore, they need to understand how much coverage is provided under their retiree health plan to determine if they need additional Medicare coverage. Retiree Health Plans and Medicare.

How to learn more about Medicare?

How to Learn More About Your Medicare Options. Primary insurance isn't too hard to understand; it's just knowing which insurance pays the claim first. Medical billing personnel can always help you figure it out if you're having trouble. While it's not hard to understand primary insurance, Medicare is its own beast.

Is Medicare primary insurance in 2021?

Updated on July 13, 2021. Many beneficiaries wonder if Medicare is primary insurance. But, the answer depends on several factors. While there are times when Medicare becomes secondary insurance, for the most part, it’s primary. Let’s go into further detail about what “primary” means, and when it applies.

Is Medicare a primary or secondary insurance?

Mostly, Medicare is primary. The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer.

Does Medicare pay your claims?

Since the Advantage company pays the claims, that plan is primary. Please note that Medicare WON’T pay your claims when you have an Advantage plan. Medicare doesn’t become secondary to an Advantage plan. So, you’ll rely on the Advantage plan for claim approvals.

Can you use Medicare at a VA hospital?

Medicare and Veterans benefits don’t work together; both are primary. When you go to a VA hospital, Veteran benefits are primary. Then, if you go to a civilian doctor or hospital, Medicare is primary. But, you CAN’T use Veterans benefits at a civilian doctor. Also, you can’t use Medicare benefits at the VA.

Is Medicare a part of tricare?

Medicare is primary to TRICARE. If you have Part A, you need Part B to remain eligible for TRICARE. But, Part D isn’t a requirement. Also, TRICARE covers your prescriptions. Your TRICARE will be similar to a Medigap plan; it covers deductibles and coinsurances.

Is Medicare a QHC?

Medicare as Qualifying Health Coverage. The Affordable Care Act established the Individual Shared Responsibility provision that requires individuals to have qualifying health care coverage (QHC), also referred to as minimum essential coverage, qualify for an exemption, or make a payment when filing their tax return.

Does Medicare have a Marketplace?

The majority of individuals with Medicare coverage have both Medicare Parts A & B and do not have other private health insurance, like a Marketplace plan. Those individuals receive all their health insurance coverage through the Medicare program, whether they have Original Medicare or have a Medicare health and/or drug plan. ...

Does Medicare Part A qualify for QHC?

Medicare Part A (including coverage through a Medicare Advantage (MA) plan) qualifies as QHC. Beneficiaries who had 12 months of QHC in 2017 simply need to check a box on their tax return to indicate that they had health coverage.

Is Medicare Part A equitable relief?

CMS is offering equitable relief to certain Medicare beneficiaries who have premium-free Medicare Part A and are currently (or were) dually-enrolled in both Medicare and the Marketplace for individuals and families. Eligible individuals can request equitable relief at any time to enroll in Medicare Part B without penalty or to reduce their Part B ...

How many people will be on Medicare in 2021?

Close to 63 million Americans are enrolled in Medicare in 2021, and this number will only continue to rise as members of the baby boomer generation continue to join the 65-and-over demographic. 1

What is Medicare Advantage?

A Medicare Advantage plan offers the same coverage as Medicare Part A and Part B , and some Medicare Advantage plans may also offer benefits such as vision, hearing and dental coverage. Some plans may also cover prescription drugs. Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state.

What is a PPO plan?

Preferred Provider Organization (PPO) plans provide a little more freedom by offering some coverage for out-of-network care and not requiring members to obtain a referral before visiting a specialist. PPO plans can come in the form of either regional PPOs or local PPOs .

Does Alaska offer Medicare Advantage?

Alaska. Compare Alaska Medicare plans online, or get assistance from the state resources below. Alaska does not offer Medicare Advantage plans (Part C), but there are still other options for you to explore your Medicare coverage options and have your questions answered. AARP Public Benefits Guide.

Does Medicare cover HMO?

There is no coverage for care received outside of the plan’s network.

Does Maine have Medicare?

Medicare beneficiaries in Maine have a number of resources at their fingertips. The Pine Tree State offers options for those with low incomes to help pay for their Medicare benefits, as well as resources to help pay for prescription drug costs and to help those with disabilities. State of Maine Bureau of Insurance.