To access more choices for their insurance coverage, beneficiaries in Florida often choose to receive their Medicare benefits through a Medicare Advantage plan. Approximately 42 percent of Florida's seniors choose this option over Original Medicare, compared with the national average of 33 percent of beneficiaries who choose an Advantage plan.

Full Answer

How do I Choose my Medicare coverage choices?

Your Medicare coverage choices Step 1: Decide if you want Original Medicare or a Medicare Advantage Plan (like an HMO or PPO) Step 2: Decide if you want prescription drug coverage (Part D) Step 3: Decide if you want supplemental coverage Other options

How do I get Medicare?

There are 2 main ways to get Medicare: Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

When Am I eligible to receive Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Who can I use for Medicare out-of-pocket costs?

You can use any doctor or hospital that takes Medicare, anywhere in the U.S. To help pay your out-of-pocket costs in Original Medicare (like your 20% coinsurance), you can also shop for and buy supplemental coverage. If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later.

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is Medicare called in Florida?

Medigap in Florida Medigap plans are standardized under federal rules, and people are granted a six-month window, when they turn 65 and enroll in Original Medicare, during which coverage is guaranteed issue for Medigap plans.

What is the difference between Medicare and Medicaid?

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income. Medicare is managed by the federal government and is mainly based on age. But there are special circumstances, like certain disabilities, that may allow younger people to get Medicare.

What is the difference between Medicare A and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What is the most popular Medicare health plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan.

Can you have Medicare and Medicaid at the same time?

Yes. A person can be eligible for both Medicaid and Medicare and receive benefits from both programs at the same time.

Can you have Medicare and Medicaid?

Some Americans qualify for both Medicare and Medicaid, and when this happens, it usually means they don't have any out-of-pocket healthcare costs. Beneficiaries with Medicare and Medicaid are known as dual eligibles – and account for about 20 percent of Medicare beneficiaries (about 12.3 million people).

How do I qualify for dual Medicare and Medicaid?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

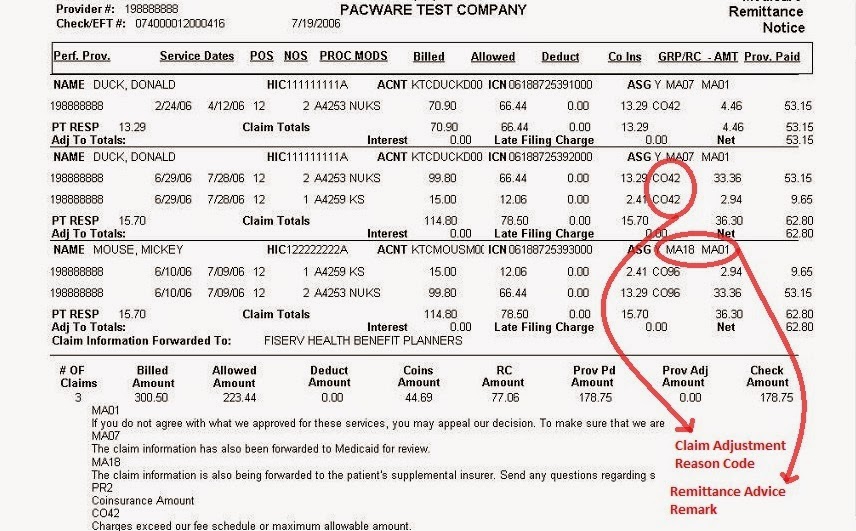

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

How to contact Medicare in Florida?

Visit the SHINE website or call 1-800-963-5337. Visit the Medicare Rights Center.

When does Medicare enroll?

For most people, Medicare coverage enrollment happens when they turn 65. But Medicare eligibility is also triggered for younger people if they’re disabled and have been receiving disability benefits for 24 months, or if they have ALS or end-stage renal disease.

What is a Medigap plan?

Medigap plans are used to supplement Original Medicare, covering some or all of the out-of-pocket costs (for coinsurance and deductibles) that people would otherwise incur if they only had Original Medicare on its own.

What is Medicare Advantage?

Medicare Advantage includes all of the basic coverage of Medicare Parts A and B, and these plans generally include additional benefits — such as integrated Part D prescription drug coverage and extras like dental and vision — for a single monthly premium.

How many Medicare Advantage plans are there in Florida?

Nearly half of Florida Medicare beneficiaries select Medicare Advantage plans. Residents in Florida can select from between seven and 83 Medicare Advantage plans in 2020, depending on where they live. Florida has a tool residents can use to compare prices on Medigap plans in each county. Florida law guarantees access to Medigap plans ...

What percentage of Florida Medicare beneficiaries are private?

43 percent of Florida Medicare beneficiaries selected private Medicare Advantage plans in 2018. Nationwide, the average was 34 percent, so Medicare Advantage is more popular in Florida than it is nationwide. Most of the remaining 52 percent of the state’s Medicare beneficiaries had opted instead for coverage under Original Medicare, ...

How many people will be on Medicare in Florida in 2020?

Medicare enrollment in Florida. Medicare enrollment in Florida stood at 4,672,774 as of October 2020. That’s more than 21 percent of the state’s total population, compared with about 19 percent of the United States population enrolled in Medicare. For most people, Medicare coverage enrollment happens when they turn 65.

Consider these factors when looking for the right Medicare plan

What is the overall cost of the plan, from your monthly premium to out-of-pocket expenses like deductible, copayments, and coinsurance?

Option 1

Want to find a plan that best meets your specific needs? Consider selecting and purchasing different types of Medicare coverage.

Option 2

What if you could have everything Medicare offers rolled into one simple plan? It could be more convenient and efficient for you to choose a Medicare Advantage plan.

Medicare Basics Guide

Florida Blue provides the information you need to choose the Medicare plan that meets your needs and budget.

Medicare & You

U.S. government handbook on Medicare benefits, rights, and protections, available health plans and more.

Just a Phone Call Away

Call us for help or for any questions you have about your Medicare insurance plan needs.

Friendly Agents

Let one of our licensed agents guide you through your Medicare plan options.

What to check after choosing Medicare Advantage?

So, after you choose a Medicare Advantage plan, you’ll want to check each year during open enrollment to see if there are any changes in your network. It’s also a good idea to find out which specialists, hospitals, home health agencies and skilled nursing facilities are in the plan’s network.

What is the copayment for Medicare?

Part D and Medicare Advantage plans with prescription drug coverage almost always charge a copayment or coinsurance for each of the medicines you purchase. Copays are a set amount you pay for each prescription filled, say $10 or $20.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance helps cover the out-of-pocket health care costs you can incur with Original Medicare Part A and Part B and hospice and home health care services. (If you have an Advantage plan, you may not purchase Medicare Supplement Insurance.) There are 10 standardized plans and premiums are regulated by the states. Massachusetts, Maine and WIsconsin have their own standardization. What you pay in monthly premiums can depend on where you live, what coverage you get and how old you are. You can learn more in this guide on comparing and selecting plans, with a side-by-side comparison of the different policies.

How much is Medicare Part B 2020?

Medicare Part B comes with an annual deductible of $198 for 2020. After you meet the deductible for the year, you typically pay 20% of the Medicare-approved amount for doctor services and other Medicare Part B benefits.

How many standardized plans are there?

There are 10 standardized plans and premiums are regulated by the states. Massachusetts, Maine and WIsconsin have their own standardization. What you pay in monthly premiums can depend on where you live, what coverage you get and how old you are.

Does Medicare.gov compare plans?

Medicare.gov offers a tool to help compare Medicare Advantage Plans.

Does Medicare have a yearly limit?

Medicare Advantage plans have a yearly limit on how much members will pay in out-of-pocket costs. Be aware that cost sharing and benefits of the Medicare Advantage plan you choose can change from year to year. If you choose Medicare Advantage and are happy with your coverage, you will still need to look for changes and compare plans ...

What Florida Medicare Plans Are Available?

With a large senior population in the state, Medicare in Florida is a commonly used program to secure health care services. The program, while beneficial, can also be complex. Therefore, it's helpful to know the various components of it are and the ins and outs of enrollment and eligibility.

Who Is Eligible for Florida Medicare?

Individuals age 65 and older who have paid into the Medicare system through taxed income are automatically eligible for the program. Those younger must have a qualifying health issue or disability, which is determined by the Social Security Administration.

How Do I Enroll in Medicare in Florida?

Those who are not automatically enrolled must sign up during a period that starts 3 months prior to turning 65 and extends 3 months after that month. While beneficiaries can enroll late, there may be a penalty for doing so. Exceptions to late enrollment penalties include those who had other insurance and suddenly lost it.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

How to find Medicare Advantage plan?

While you search for your Medicare Advantage plan, here are a few questions to keep in mind: 1 Do you have a favorite doctor you’ve been seeing for years? If you choose a plan with a network of preferred providers, make sure your doctor is on the list. The same is true of hospitals — if you have several in your region, it’s good to know that the one you prefer will accept your Advantage insurance. 2 Do you take medications on a maintenance schedule? If so, make sure that your plan includes drug coverage. Most Medicare Advantage plans do — but not all of them. 3 What is your chosen plan’s deductible? The higher the deductible, the more you’ll pay out-of-pocket before your plan kicks in. 4 Likewise, what are the copays? If you frequently need to see a healthcare professional for a chronic condition, a plan with lower copays makes sense, and may even make up for higher monthly premiums. 5 Do you have frequent vision, dental, or hearing issues? A plan that covers these health care needs may save you money.

What are the benefits of Medicare Advantage?

Medicare Advantage plans differ depending on the company that is overseeing them, but in general they offer benefits beyond what Medicare Part A and B offer, such as vision, hearing, and dental coverage, gym memberships, and drug coverage. Plus, the all-in-one nature of the plans makes them easy to manage. Choosing a plan that’s right ...

Is a HMO POS plan the same as a PPO?

An HMO POS plan is similar in many respects to the basic HMO plans, and also bears some similarities to PPO systems. You’ll choose your health care providers from within an approved network, but can go out-of-network in certain circumstances.

Can you go out of network with Medicare Advantage?

But you can go out-of-network when needed, though there may be a higher copay or coinsurance cost.