Medicare Supplement Plans G – N

| Benefits | Plan K | Plan L |

| Part A Hospital Co-insurance | Yes | Yes |

| 365 Hospital Reserve Days | Yes | Yes |

| Part B co-insurance / co-payment | 50% | 75% |

| Blood Benefit (first 3 pints) | 50% | 75% |

Full Answer

What percentage of Medicare beneficiaries have a Medigap supplement?

Nationally, more than 38% of Original Medicare beneficiaries are enrolled in a Medigap supplement, but it ranges from a low of 8% in Hawaii to nearly 64% in North Dakota. Medigap plans are standardized, which means that a Plan F in Vermont provides the same benefits as a Plan F in Florida.

Where can I find information about Medicare Advantage plans?

Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state. Click on your state on the map or from the list of states to find Medicare Advantage information and resources for your state. What types of Medicare Advantage plans are available?

What are the best States for Medicare Part D prescription drug plans?

Best States for Medicare Part D Prescription Drug Plans (PDP) State Overall Rank # Plans Available Average Premium Average Drug Deductible Alabama 39 32 $43.79 $344.06 Alaska 4 25 $37.84 $366.80 Arizona 15 32 $40.98 $335.63 Arkansas 48 31 $40.52 $331.77 46 more rows ...

Are Medicare plans different in each state?

But while these provisions apply nationwide, plan availability and prices are different from one state to another. Medicare uses a star rating system for Medicare Advantage and Part D plans, and the availability of high-quality plans is not the same in every state.

How many states offer Medicare supplement plans?

Medigap plans are standardized nationwide. However, three states offer distinct types of Medigap plans. These states are Wisconsin, Massachusetts, and Minnesota.

Are Medicare supplement plans the same in every state?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

What states have the cheapest Medicare supplement plans?

Maine, South Carolina, New Mexico, Idaho, Missouri and Nevada have the lowest average monthly Medicare Advantage premiums in 2022, with all five states having average plan premiums of $42 or less per month.

Are Medigap policies only standardized in 3 states?

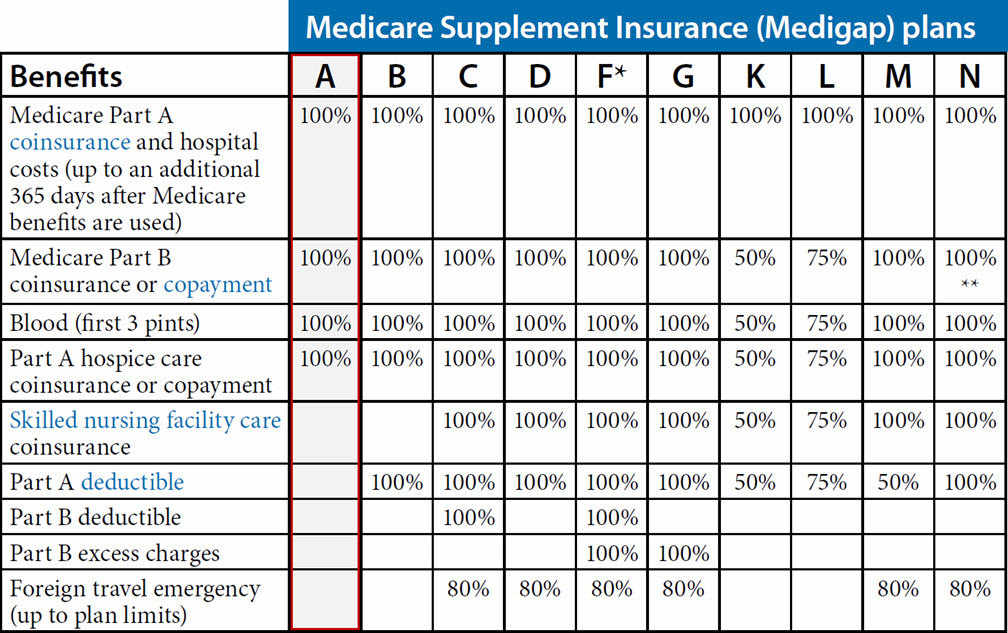

Although Medigap plans are issued by private insurance carriers, the policies are standardized. In all but three states, there are up to ten different Medigap plans available: A, B, C, D, F, G, K, L, M, and N (not all plans are available in all areas), and there are also high-deductible versions of Plan F and Plan G.

Does my Medigap policy cost change if I move from one state to another?

Medicare and Supplemental Coverage Eligibility If You Move Out of California. If you are enrolled in Original Medicare and you move out of California (or to a different service area within the state), your Medicare benefits will not change.

Do Medicare benefits vary from state to state?

Medicare Part A and Medicare Part B together are known as “original Medicare.” Original Medicare has a set standard for costs and coverage nationwide. That means your coverage will be the same no matter what state you live in, and you can use it in any state you visit.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

Why are Medicare Supplement plans so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

What states have the Medigap birthday rule?

Prior to 2022, only two states provided Medigap beneficiaries with a birthday rule. Oregon and California were the first. Now, three additional states are implementing birthday rules. These states are Idaho, Illinois, and Nevada.

Which states allow you to change Medicare Supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

How many people are in Medicare Advantage?

22 million Medicare beneficiaries (34% of all Medicare enrollees) are enrolled in a type of private Medicare plan called a Medicare Advantage plan. Another 20.6 million are enrolled in a stand-alone Medicare prescription drug plan (PDP).

How many stars does Medicare have?

Quality is important to consumers, and in eight states, at least 75% of their MAPD plans score four stars or better for quality measures by the Centers for Medicare and Medicaid Services.

How much is the MAPD premium in Arizona?

Arizona’s MAPD premium average of $16.35 is just half of the national average and the $138.71 drug deductible is nearly $30 lower than average. Plan selection is on the high side (71) while quality is on the low end (just 38% of the plans are rated four stars or higher for plan quality).

What is the average MAPD premium in Arkansas?

Arkansas’ average MAPD premium of $22.35 is about $11 below the national average. However, the average drug deductible of $207.36 is among the highest in the country and not a single one of the state’s 49 plans registered four stars or higher for plan quality, the only state to record a zero in this category.

How many MAPD plans are there in Washington?

Also, there are 118 MAPD plans available in Washington (the average is 62 per state), and nearly 70% of all MAPD plans in Washington are ranked 4 stars or higher by Medicare (the average is 59% of plans in each state).

How much does Medicare Part D cost?

Medicare Part D Prescription Drug Plan beneficiaries in the state pay an average monthly premium of $37.84 for their drug coverage. This dollar amount is right around the national average, and the average PDP deductible is roughly $44 higher than the national average at $366.80.

How much is the MAPD deductible?

The $137.50 average MAPD drug deductible is some $30 lower than the nationwide average. This general affordability of plans is in addition to having 65% of the state’s plans being rated four stars or higher for quality by Medicare, which is comfortably above the national average of 59%.

What states require community rating for Medigap?

As of 2018, eight states (Arkansas, Connecticut, Massachusetts, Maine, Minnesota, New York, Vermont, and Washington) required carriers to use community rating.

How many seniors will be covered by Medicare in 2021?

July 7, 2021. facebook2. twitter2. comment. Medicare is a federal program, covering more than 63 million seniors and disabled Americans throughout the country. Medicare beneficiaries in most areas have the option to get their coverage via private Medicare Advantage plans, and more than four out of ten do so.

How long does Medicare coverage last?

Medigap coverage is guaranteed issue for six months, starting when you’re at least 65 and enrolled in Medicare Parts A and B.

When is Medicare Part D open enrollment?

Federal guidelines call for an annual open enrollment period (October 15 to December 7) for Medicare Advantage and Medicare Part D coverage in every state. And as of 2019, there’s also a Medicare Advantage open enrollment period (January 1 through March 31) that allows people who already have Medicare Advantage to switch to a different Advantage plan or switch to Original Medicare. But while these provisions apply nationwide, plan availability and prices are different from one state to another.

How many Part D prescriptions will be available in 2021?

Part D prescription drug plan availability differs from state to state as well, with the number of plans for sale in 2021 varying from 25 to 35, depending on the region. The number of available premium-free (“benchmark”) prescription plans for low-income enrollees varies from five to ten, depending on the state.

How old do you have to be to enroll in Medigap?

Some states have implemented legislation that makes it easier for seniors to switch from one Medigap plan to another, and for people under age 65 to enroll in Medigap plans.

Does Alaska have Medicare Advantage?

Not surprisingly, the popularity of Medicare Advantage plans varies significantly from one state to another, with only one percent of the Medicare population enrolled in Advantage plans in A laska. (There are no individual Medicare Advantage plans available at all in Alaska.

What states have standardized Medicare Supplement plans?

The only states that they drastically differ in are Massachusetts, Minnesota, and Wisconsin, these states have their own standardized plans.

How many Medsup plans are there?

In almost all states there are around 10 Medsup plans that are standardized and they are named with letters. These letters go from A to N and most of the time you will hear about Medicare Supplement Plan N, Medicare Supplement Plan G or Medicare Supplement Plan F.

What is a Medigap plan?

You will also see this policy referred to as a Medsup plan which is just a shortened version of Medicare (Med) Supplements (Sup) = Medsup.

How long does Wisconsin Medicaid cover?

Wisconsin Medigap plans must cover 30 days of skilled nursing care in a skilled nursing facility (SNF). No prior hospital stay is required and the facility doesn’t need to be certified by Medicare, but must be a licensed skilled nursing facility. Care must meet medically necessary standards of the insurance company.

Does Wisconsin require medicare?

Wisconsin requires that Medicare Supplement policies have a few “mandated or required” benefits. The mandates were put into place to make sure you had enough coverage when you purchase a Medsup Plan in Wisconsin. Wisconsin Medigap plans must cover 30 days of skilled nursing care in a skilled nursing facility (SNF).

Does Wisconsin have Medicare Supplement?

Wisconsin is the third and final state where you won’t see the 10 standard Medicare Supplement plans. Like in other states, the plans will still work along side your Original Medicare which is Part A & Part B, to help cover specific expenses.

Does Medicare Part A work with Part B?

Overall the plans will still work along side your Original Medicare which is Part A & Part B, to help cover specific expenses. . As you can see above, Medigap plans are usually grouped into 10 standardized plans but Massachusetts, along with Wisconsin and Minnesota have their own plans.

What are the different types of Medicare?

Medicare is divided into a few “parts.” Each part of Medicare covers different healthcare needs. Currently, the parts of Medicare include: 1 Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term, inpatient stays in hospitals and skilled nursing facilities or for some in-home services like limited home healthcare or hospice. 2 Medicare Part B. Medicare Part B is medical insurance that covers everyday care needs like doctor's appointments, therapist visits, medical equipment, and urgent care visits. 3 Medicare Part C. Medicare Part C is also called Medicare Advantage. These plans combine the coverage of parts A and B into a single plan. Medicare Advantage plans are offered by private insurance companies and are overseen by Medicare. 4 Medicare Part D. Medicare Part D is prescription drug coverage. Part D plans are standalone plans that only cover prescriptions. These plans are also provided through private insurance companies. 5 Medigap. Medigap is also known as Medicare supplement insurance. Medigap plans help cover the out-of-pocket costs of Medicare, like deductibles, copayments, and coinsurance amounts.

When is Medicare Advantage open enrollment?

Medicare Advantage open enrollment ( January 1–March 31 ). During this period, you can switch from one Medicare Advantage plan to another or go back to original Medicare. You cannot enroll in a Medicare Advantage plan if you currently have original Medicare. Part D enrollment/Medicare add-ons (April 1–June 30).

How long do you have to sign up for Medicare if you have delayed enrollment?

If you delayed Medicare enrollment for an approved reason, you can later enroll during a special enrollment period. You have 8 months from the end of your coverage or the end of your employment during which to sign up without penalty. Medicare Advantage open enrollment ( January 1–March 31 ).

What is Medicare insurance?

Medicare overview. Medicare is a government-funded health insurance program that provides medical coverage for people ages 65 or older. You can also qualify if you have certain health conditions or disabilities. Medicare is divided into a few “parts.”. Each part of Medicare covers different healthcare needs.

How long does it take to sign up for Medicare?

Initial enrollment period. This is a 7-month window around your 65th birthday when you can sign up for Medicare. It begins 3 months before your birthday, includes the month of your birthday, and extends 3 months after your birthday. During this time, you can enroll for all parts of Medicare without a penalty.

What is Medicare Part A?

Currently, the parts of Medicare include: Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term, inpatient stays in hospitals and skilled nursing facilities or for some in-home services like limited home healthcare or hospice.

Does zip code affect Medicare?

Even if the plan has the same name and covers the same services, your ZIP code could affect the price you pay. Both Medicare Part D and Medigap plans work similarly. Like Medicare Advantage plans, they’re offered by private companies.

How many people will be on Medicare in 2021?

Close to 63 million Americans are enrolled in Medicare in 2021, and this number will only continue to rise as members of the baby boomer generation continue to join the 65-and-over demographic. 1

What is Medicare Advantage?

A Medicare Advantage plan offers the same coverage as Medicare Part A and Part B , and some Medicare Advantage plans may also offer benefits such as vision, hearing and dental coverage. Some plans may also cover prescription drugs. Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state.

Does Alaska offer Medicare Advantage?

Alaska. Compare Alaska Medicare plans online, or get assistance from the state resources below. Alaska does not offer Medicare Advantage plans (Part C), but there are still other options for you to explore your Medicare coverage options and have your questions answered. AARP Public Benefits Guide.

Does Medicare cover HMO?

There is no coverage for care received outside of the plan’s network.

Does Maine have Medicare?

Medicare beneficiaries in Maine have a number of resources at their fingertips. The Pine Tree State offers options for those with low incomes to help pay for their Medicare benefits, as well as resources to help pay for prescription drug costs and to help those with disabilities. State of Maine Bureau of Insurance.

How many states have Medigap coverage?

States with mandated Medigap coverage options for those under 65. According to a report by the Kaiser Family Foundation, there are 30 states that require insurers to offer at least one Medigap plan to qualifying Medicare beneficiaries under 65. 1 Certain states guarantee coverage options for those with ESRD, for those with a disability, or both.

How many Medigap plans are required for a 65 year old?

The 30 states in the chart above have a guaranteed issue requirement, which means that insurance companies must offer at least one plan to qualifying applicants under the age of 65. If applicants are under 65 and have Medicare Part A and Part B coverage, the insurance company must offer at least one Medigap plan to them in the qualifying states.

How old do you have to be to get Medicare?

For Medicare beneficiaries who are at least 65 years old, access to a Medigap policy is guaranteed during their Medigap open enrollment period. However, beneficiaries under the age of 65 do not have the same protections nationwide. Instead, those protections are regulated at the state level. Some states guarantee that applicants under 65 will have ...

What age can I enroll in Medigap?

This is a period when Medicare beneficiaries under the age of 65 can enroll in a Medigap policy without having to go through medical underwriting.

Does California require a Medigap plan?

For example, if you live in California and have Medicare coverage due to ESRD, a Medigap insurance company is not legally required to offer you a Medigap plan. The state only protects applicants under 65 with a qualifying disability.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

Best States For Medicare: Overview

2022 National Average Medicare Premiums, Deductibles and Quality

- MAPD plans and Prescription Drug Plans are both reasonably affordable in 2022. 1. The average 2022 MAPD premium is $62.66 per month, though many areas may offer plans that feature $0 monthly premiums. The average deductible for the drug coverage offered by MAPD plans is $292.98 for the year. 2. The average PDP premium is $47.59 per month in 2022, with an averag…

Best States For Medicare: 2022 Average Medicare Costs by State

- Factors in Medicare Advantage Premiums

The national average cost of a Medicare Advantage Prescription Drug plan in 2022 is $62.66 per month. But as you can see from the table above, the cost of an MA-PD plan can vary quite dramatically by location. 1. In Massachusetts, Michigan, Rhode Island and the Dakotas, average … - Medicare Advantage Plan Quality by State

Every year, the Centers for Medicare & Medicaid Services rates all Medicare Advantage plans according to a five-star scale based on various quality metrics. Three stars represents a plan of average quality, while four stars is considered above average and five stars is excellent. The met…

Expert Analysis

- As of October 15, millions of American seniors have the opportunity to purchase a private Medicare insurance plan for the first time or switch to a new coverage option during the Medicare Annual Enrollment Period (AEP). This period, also called the fall Medicare Open Enrollment period, lasts until December 7. We asked a panel of experts for their insight on what Medicare beneficia…

Methodology

- This project used data provided by the Centers for Medicare & Medicaid Services (CMS). The 2022 MA Landscape Source Files and 2022 PDP Landscape Source Fileswere used for analysis.

Fair Use Statement

- Of course we would love for you to share our work with others. We just ask that if you do, please grant us the proper citation with a link to this study so that we may be given credit for our efforts.

Research and Reports

- Our research reports analyze a number of issues important to seniors, from health perceptions, medical communication, health habits, and more. 1Every year, Medicare evaluates plans based on a 5-star rating system.