An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

- Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. ...

- Employers also pay 1.45%. ...

- The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions.

What reduces Medicare taxable wages?

What Pretax Deductions Lower FICA?

- Deductions Exempt From FICA. Qualified benefits offered under a cafeteria or Section 125 plan are exempt from FICA. ...

- Pretax Versus After-Tax Deductions. ...

- Benefits That Do not Lower FICA Earnings. ...

- Wages Excluded From FICA. ...

- FICA Wages on a W-2. ...

Why are Medicare wages higher than wages?

The most common reason why medicare wages are higher is due to 401(k) contributions (W2, Box 12, Code D) or other pre-tax retirement plan contributions. They are subject to medicare tax but not to federal or state income tax.

What can employer deduct from wages?

Your employer is not allowed to make deductions unless:

- it’s required or allowed by law, for example National Insurance, income tax or student loan repayments

- you agree in writing

- your contract says they can

- there’s a statutory payment due to a public authority

- you have not worked due to taking part in a strike or industrial action

- there’s been an earlier overpayment of wages or expenses

How much Medicare tax does the average American worker pay?

The ad has a point that Americans 65 and over have "paid in" to Medicare through the payroll taxes they’ve paid throughout their working lives. Currently, workers pay a 1.45 percent payroll tax for Medicare, while employers kick in an additional 1.45 percent. Self-employed people pay both parts of the tax.

Are any wages exempt from Medicare tax?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.

What wages are considered Medicare wages?

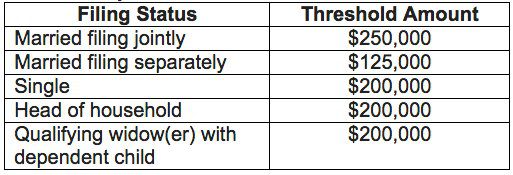

For Single Taxpayers: The first $200,000 of your wages. For Married Taxpayers Filing Jointly: The first $250,000 of your wages. For Married Taxpayers Filing Separately: The first $125,00 of your wages.

What wages are excluded from Medicare wages?

The non-taxable wages are deductions appearing on the pay stub under 'Before-Tax Deductions. ' These include medical, vision, and dental insurance premiums, Flexible Spending Account Health Care, and Flexible Spending Account Dependent Care. Employers are required to withhold Medicare tax on employees' Medicare wages.

Are all wages subject to Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

What is included in Medicare wages and tips?

Medicare wages and tips: The total wages, tips and other compensation that are subject to Medicare taxes. There is no limit on the amount of wages that are subject to Medicare taxes. Medicare tax withheld: The amount of Medicare tax withheld from your Medicare taxable wages, tips and other compensation.

Is Medicare tax based on gross income?

The tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.

What makes up Medicare wages on W-2?

It should also be 6.2% of the amount in Box 3 on your W-2. Total wages in Box 5 are the wages subject to Medicare (Medic) tax. These wages are taxed at 1.45% and there is no limit on the taxable amount of wages.

Are Medicare premiums based on adjusted gross income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What deductions reduce Medicare wages?

Medicare wages are reduced by pre-tax deductions such as health/dental/vision insurances, parking and flex spending but not reduced by your contributions to a retirement plan (403b or 457.)

Who is exempt from Social Security and Medicare withholding?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

What counts as income for Social Security?

We only count your earnings up to the month before you reach your full retirement age, not your earnings for the entire year. If your earnings will be over the limit for the year and you will receive retirement benefits for part of the year, we have a special rule that applies to earnings for one year.

What wages are subject to CA SDI?

State Disability Insurance (SDI) The SDI taxable wage limit is $145,600 per employee, per year. The 2022 DI/PFL maximum weekly benefit amount is $1,540.00.

What is Medicare tax?

The Medicare Program. The Medicare tax deducted from employee wages goes towards the Medicare program provided to Americans over 65 years of age. A line item in an employee pay stub, Medicare tax is implemented under FICA (Federal Insurance Contributions Act) and calculated on the employee’s Medicare taxable wage.

What is the Medicare tax rate on W-2?

Employers are required to withhold Medicare tax on employees’ Medicare wages. This is a flat rate of 1.45%, with employers contributing a matching amount. Medicare tax is reported in Box 5 of the W-2 ...

What are the gross earnings?

Gross earnings are made up of the following: Regular earnings . Overtime earnings. Paid time-off earnings. Payouts of time-off earnings (Sick, holiday, and vacation payouts) Non-work time for paid administrative leave, military leave, bereavement, and jury duty. Bonus pay.

When was Medicare enacted?

In 1965 , Medicare was enacted into law, with Medicare coverage intending to be an important source of post-retirement health care. Medicare is divided into four parts: Part A, Hospital Insurance: This helps pay for hospice care, in-patient hospital care, and nursing care.

What is Part B medical insurance?

Part B, Medical Insurance: This helps pay towards out-patient hospital visits, doctor’s fees, and medical services/supplies that Part A doesn’t cover.

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

What if an employer does not deduct Medicare?

An employer that does not deduct and withhold Additional Medicare Tax as required is liable for the tax unless the tax that it failed to withhold from the employee’s wages is paid by the employee. An employer is not relieved of its liability for payment of any Additional Medicare Tax required to be withheld unless it can show that the tax has been paid by filing Forms 4669 and 4670. Even if not liable for the tax, an employer that does not meet its withholding, deposit, reporting, and payment responsibilities for Additional Medicare Tax may be subject to all applicable penalties.

How much did M receive in 2013?

M received $180,000 in wages through Nov. 30, 2013. On Dec. 1, 2013, M’s employer paid her a bonus of $50,000. M’s employer is required to withhold Additional Medicare Tax on $30,000 of the $50,000 bonus and may not withhold Additional Medicare Tax on the other $20,000.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

What is the Imputed Cost of Life Insurance?

The imputed cost of coverage in excess of $50,000 is subject to social security and Medicare taxes, and to the extent that, in combination with other wages, it exceeds $200,000, it is also subject to Additional Medicare Tax withholding. However, when group-term life insurance over $50,000 is provided to an employee (including retirees) after his or her termination, the employee share of Social Security and Medicare taxes and Additional Medicare Tax on that period of coverage is paid by the former employee with his or her tax return and is not collected by the employer. In this case, an employer should report this income as wages on Form 941, Employer’s QUARTERLY Federal Tax Return (or the employer’s applicable employment tax return), and make a current period adjustment to reflect any uncollected employee social security, Medicare, or Additional Medicare Tax on group-term life insurance. Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, an employer may not report the uncollected Additional Medicare Tax in box 12 of Form W-2 with code N.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

What is Medicare tax?

Medicare tax by definition goes to fund the federal insurance program for elderly and disabled people. It's deducted from your paychecks along with Social Security tax, which pays for that federal program, as well as ordinary federal and state income tax.

How much is exempt from Medicare?

Also, amounts you receive for educational assistance under your employer’s program earn you a pretax deduction; up to $5,250 annually is exempt from Medicare tax.

How to show Medicare on W-2?

Your employer puts your annual Medicare wages in Box 5 of your W-2 and Medicare tax withheld for the year in Box 6. The amount shown in Box 5 does not include pretax deductions which are exempt from Medicare tax. Your last pay stub for the year may show a different year-to-date amount for Medicare wages than your W-2. In this case, add your pretax deductions which are exempt from Medicare tax to the amount shown in Box 5 of your W-2. The result should equal the amount shown on your last paycheck stub for the year.

What is the Social Security tax rate?

The Social Security tax rate is 6.2 percent payable by the employee and 6.2 percent payable by the employer. Self-employed people must pay what is called self-employment tax, which includes the employee and employer portions of Social Security and Medicare taxes, so they pay a 15.3 percent tax rate.

Where is Medicare tax withheld on W-2?

Your employer puts your annual Medicare wages in Box 5 of your W-2 and Medicare tax withheld for the year in Box 6. The amount shown in Box 5 does not include pretax deductions which are exempt from Medicare tax. Your last pay stub for the year may show a different year-to-date amount for Medicare wages than your W-2.

Is Medicare tax exempt from Social Security?

Pretax deductions that are excluded from Medicare tax are typically exempt from Social Security tax as well. Your Medicare wages are usually the same as your Social Security wages except that Social Security tax has an annual wage limit and Medicare tax has none. If you have multiple jobs that collectively put you over the wage limit, you may get a refund for over-withheld Social Security tax

Is pretax income tax exempt from Medicare?

Deductions from your wages used to pay for your employer-sponsored benefits reduce your income and are excluded from taxes. In many cases, pretax deductions are exempt from Medicare tax; however, this isn’t always the case.