| Question | Answer |

|---|---|

| Which has been banned as a result of legislation passed by some states? | balance billing |

| Which is a written document provided to a medicare beneficiary by a provider prior to rendering a service that is unlikely to be reimbursed by medicare | advance beneficiary notice (ABN) |

Do you have to notify the beneficiary of Medicare non-covered items?

Medicare does not require you to notify the beneficiary before you furnish items or services that are not a Medicare benefit or that Medicare never covers. For a list of Medicare noncovered items and services, refer to the Medicare Claims Processing Manual, Chapter 30, Section 20.1.

Why offer prescription drug coverage to Medicare beneficiaries?

offer prescription drug coverage to all Medicare beneficiaries that may help lower prescription drug costs and help protect against higher costs in the future. is the maximum fee a nonPAR may charge for a covered service.

Are suppliers required to submit a claim to Medicare?

Per Section 1848 (g) (4) of the Social Security Act, suppliers are not required to submit a claim to Medicare when an item (s) is categorically excluded from Medicare benefits (e. g., tub/shower stools, personal comfort items, etc.); however, if a beneficiary requests a supplier submit a claim, a supplier must comply.

Do I need an ABN for a Medicare beneficiary?

However, this is not required unless any of the conditions described above apply to the given situation. Notifiers may give a beneficiary a single ABN describing an extended or repetitive course of non-covered treatment provided that the ABN lists all items and services that the notifier believes Medicare will not cover.

What is a written form given to Medicare patients?

An ABN notifies Medicare that the patient acknowledges that certain procedures were provided. It also gives the patient the opportunity to accept or refuse the item or service and protects the patient from unexpected financial liability if Medicare denies payment.

What provides information for Medicare beneficiaries?

Beneficiaries and their representatives can request specific case status information by contacting the Benefits Coordination & Recovery Center (BCRC) Monday through Friday, from 8:00 a.m. to 8:00 p.m., Eastern Time, except holidays, at toll-free lines: 1-855-798-2627 (TTY/TDD: 1-855-797-2627 for the hearing and speech ...

Which form must be obtained and signed for Medicare beneficiaries?

An Advance Beneficiary Notice (ABN), also known as a waiver of liability, is a notice a provider should give you before you receive a service if, based on Medicare coverage rules, your provider has reason to believe Medicare will not pay for the service.

What is an ABN form used for?

An ABN is a written notice from Medicare (standard government form CMS-R-131), given to you before receiving certain items or services, notifying you: Medicare may deny payment for that specific procedure or treatment. You will be personally responsible for full payment if Medicare denies payment.

What is Medicare beneficiary?

Beneficiary means a person who is entitled to Medicare benefits and/or has been determined to be eligible for Medicaid.

What is Medicare beneficiary identifier?

The Medicare Beneficiary Identifier (MBI) is the new identification number that has replaced SSN-based health insurance claim numbers (HICNs) on all Medicare transactions, such as billing, claim submissions and appeals.

What is ABN CMS R 131?

The Advance Beneficiary Notice of Noncoverage (ABN), Form CMS-R-131, is issued by providers (including independent laboratories, home health agencies, and hospices), physicians, practitioners, and suppliers to Original Medicare (fee for service - FFS) beneficiaries in situations where Medicare payment is expected to be ...

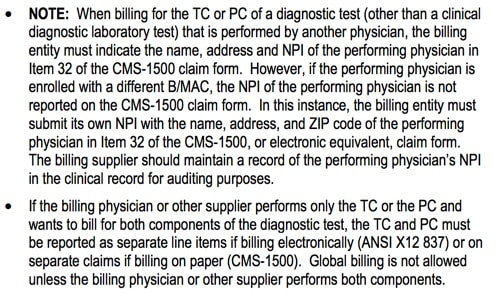

How do I get a CMS 1500 form?

In order to purchase claim forms, you should contact the U.S. Government Printing Office at 1-866-512-1800, local printing companies in your area, and/or office supply stores. Each of the vendors above sells the CMS-1500 claim form in its various configurations (single part, multi-part, continuous feed, laser, etc).

Who uses ABN form Medicare A or B?

Medicare Advantage is offered by commercial insurance carriers, who receive compensation from the federal government, to provide all Part A and B benefits to enrollees. Therefore, an ABN is used for services rendered to Original Medicare FFS (Part A and Part B) enrollees.

Is an ABN form only for Medicare?

The ABN, or Advance Beneficiary Notice, is a form that is intended for only for Medicare beneficiaries – not Medicare advantage plans or Medicare part C, just true Medicare.

Which of the following information is required to include on an advance beneficiary notice form?

To do this, you'll need to include the following information in your written request: Your name, address, and Medicare number. The specific items or services you disagree with, and their dates. An explanation of why you think the items or services should be covered.

Are ABN forms required for Medicare Advantage plans?

This article was updated on April 5, 2021, to reiterate that the form shall not be used. Independence requires participating providers to comply with all Centers for Medicare & Medicaid Services (CMS) rules and regulations.

What is an ABN for Medicare?

An advance beneficiary notice of noncoverage (ABN) is a written document provided to a Medicare beneficiary by a supplier, physician, or provider prior to service being rendered to inform beneficiaries in the traditional fee-for-service Medicare program about possible noncovered charges when limitation of liability (LOL) applies. The ABN indicates that the service is unlikely to be reimbursed by Medicare, specifies why Medicare denial is anticipated, and requests the beneficiary to sign an agreement that guarantees personal payment for services. A beneficiary who signs an ABN agreement will be held responsible for payment of the bill if Medicare denies payment. ABNs should be generated whenever the supplier or provider believes that a claim for the services is likely to receive a Medicare medical necessity denial (a denial of otherwise covered services that were found to be not “reasonable and necessary”), or when the service would be considered custodial care. The provider is held liable for the service and cannot bill the Medicare administrative contractor (MAC) or the Medicare beneficiary unless the beneficiary signs an ABN, which makes the beneficiary liable for payment if they opt to receive the service after notice was provided. Providers must also have patients sign an ABN prior to providing preventative services that are usually covered by Medicare but will not be covered because the frequency of providing such services has been exceeded.

Why do providers need to have patients sign an ABN?

Providers must also have patients sign an ABN prior to providing preventative services that are usually covered by Medicare but will not be covered because the frequency of providing such services has been exceeded.

What is a secondary payer for Medicare?

Medicare Secondary Payer (MSP) Medicare is secondary when the patient is elgible for Medicare and is also covered by one or more of the following plans: * An employer-sponsored group health plan that has more than 20 covered employees.

Does Medicare cover experimental procedures?

Medicare will not cover procedures that are. deemed to be experimental in nature. Medicare is considered the primary payer under the following circumstances: * The employee is eligible for group health plan but has declined to enroll or has recently dropped coverage.

How long is a Medicare extended treatment notice valid?

A single notice for an extended course of treatment is only valid for 1 year. If the extended course of treatment continues after 1 year, issue a new notice.

How long does it take for Medicare to refund a claim?

Medicare considers refunds timely within 30 days after you get the Remittance Advice from Medicare or within 15 days after a determination on an appeal if you or the beneficiary file an appeal.

Is an ABN valid for Medicare?

An ABN is valid if beneficiaries understand the meaning of the notice. Where an exception applies, beneficiaries have no financial liability to a non-contract supplier furnishing an item included in the Competitive Bidding Program unless they sign an ABN indicating Medicare will not pay for the item because they got it from a non-contract supplier and they agree to accept financial liability.

Does Medicare cover frequency limits?

Some Medicare-covered services have frequency limits. Medicare only pays for a certain quantity of a specific item or service in each period for a diagnosis. If you believe an item or service may exceed frequency limits, issue the notice before furnishing the item or service to the beneficiary.

What happens if Medicare is not properly notified?

If the beneficiary was not properly notified of possible disallowed Medicare claims, the RR state that suppliers must refund any amounts collected. The RR provisions require that a beneficiary is notified and agrees to the financial liability.

What is an ABN in Medicare?

An Advance Beneficiary Notice of Noncoverage (ABN) is a written notice a supplier gives to a Medicare beneficiary before providing an item and/or service. It must be issued when the health care provider (including independent laboratories, physicians, practitioners and suppliers) believes that Medicare may not pay for an item or service which is ...

What does "not all inclusive" mean in Medicare?

Items or Situations Which Do Not Meet Definition of a Medicare Benefit (Not all inclusive) Parenteral or enteral nutrients that are used to treat a temporary (rather than permanent) condition; Enteral nutrients that are administered orally; Infusion drugs that are not administered through a durable infusion pump;

Do you have to submit a claim to Medicare?

Per Section 1848 (g) (4) of the Social Security Act, suppliers are not required to submit a claim to Medicare when an item (s) is categorically excluded from Medicare benefits (e.g. tub/shower stools, personal comfort items, etc.); however, if a beneficiary requests a supplier submit a claim, a supplier must comply.

Does Medicare deny a claim?

Prior to rendering a service in which Medicare may consider not medically necessary, a supplier should notify the beneficiary, in writing, that Medicare will likely deny his/her claim and that he/she will be responsible for payment.

What happens if a Medicaid beneficiary denies a claim?

If the beneficiary has full Medicaid coverage and Medicaid denies the claim (or will not pay because the provider does not participate in Medicaid), the ABN could allow the provider to shift financial liability to the beneficiary per Medicare policy, subject to any state laws that limit beneficiary liability.

Who must write the date of the ABN?

The beneficiary (or representative) must write the date he or she signed the ABN. If the beneficiary has physical difficulty with writing and requests assistance in completing this blank, the date may be inserted by the notifier.

What happens if Medicare denies coverage?

If Medicare denies coverage and the provider did not give the beneficiary an ABN, the provider or supplier may be financially liable. When Medicare coverage denial is expected, all health care providers and suppliers must issue an ABN in order to transfer financial liability to the beneficiary, including:

How long is an ABN valid?

An ABN is valid if you: Use the most recent version of it. Use a single ABN for an extended course of treatment for no longer than 1 year. Complete the entire form.

What is an ABN form?

The Advance Beneficiary Notice of Non-coverage (ABN), Form CMS-R-131 helps Medicare Fee-For-Service (FFS) beneficiaries make informed decisions about items and services Medicare usually covers but may not cover because they are medically unnecessary. If Medicare denies coverage and the provider did not give the beneficiary an ABN, the provider or supplier may be financially liable.

What to do if a beneficiary refuses to sign an ABN?

If the beneficiary or the beneficiary’s representative refuses to choose an option or sign the ABN, you should annotate the original copy indicating the refusal to choose an option or sign the ABN. You may list any witnesses to the refusal, although Medicare does not require a witness.

Do you need an ABN for Medicare Advantage?

The beneficiary wants the item or service before Medicare gets the advance coverage determination. Do not use an ABN for items and services you furnish under Medicare Advantage (Part C) or the Medicare Prescription Drug Benefit (Part D). Medicare does not require you to notify the beneficiary before you furnish items or services ...