Full Answer

How many Medicare supplement enrollees are there in Illinois?

In 2019, there were nearly 800,000 Medicare Supplement enrollees in Illinois. Plans F and G are the most popular and comprehensive Medigap plan types in Illinois. Plan F is no longer available to people who are eligible for Medicare after December 31, 2019.

Which companies offer the best Medicare supplement plans?

Top-Rated Medicare Supplement Companies Manhattan Life Medicare Supplement Plans Continental Life Insurance Medicare Supplement Plans Humana Medicare Supplement Plans Blue Cross Blue Shield Medicare Supplement Plans Anthem Medicare Supplement Plans Mutual of Omaha Medicare Supplement Plans Aetna Medicare Supplement Plans

What does Benistar do for companies?

By working with brokers and consultants we provide retiree medical and prescription drug solutions for companies and organizations nationwide including: Benistar provides retiree health and retirement plans for more than 1,300 plan sponsors throughout the U.S. We administer more than $200 million in premiums annually.

What are Medicare supplement insurance plans?

Medicare Supplement insurance plans help pay for health care costs that are not covered by Original Medicare, Parts A and B. Medicare Supplement plans – which are sometimes called Medigap policies - are sold through private insurance companies. They may protect you against medical costs that are not covered or are unexpected.

What is the difference between Medicare Part C and Part F?

Plan F covers everything Plan C does, and also covers Medicare Part B excess charges. These two plans are some of the most comprehensive Medicare Supplement Insurance plans you can purchase, which makes them a very attractive option.

How Much Does Medicare Plan G cost in Illinois?

about $25 to $349 each monthExpect to pay about $25 to $349 each month for a Medigap plan A, G, or N in Illinois if you enroll during your open enrollment period. Premiums will vary depending on your insurer and how your premium is rated.

How Medicare supplement plans work with Medicare Parts A B C & D?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the difference between Plan G and Plan G Plus?

Medigap G PLUS covers everything that a standard Plan G does, and more. Medigap G PLUS provides additional hearing, vision, and dental benefits.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Does Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Is Medigap the same as Part C?

Medigap Plan C is a supplemental insurance coverage plan, but it's not the same as Medicare Part C. Medigap Plan C covers a range of Medicare expenses, including the Part B deductible. Since January 1, 2020, Plan C is no longer available to new Medicare enrollees.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What are the most popular Medigap plans?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan.

Is a Medigap plan better than an Advantage plan?

If you are in good health with few medical expenses, Medicare Advantage can be a suitable and money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

In this Article

When Can You Enroll? Most Popular Plans How Do You Choose? What Are Alternatives? Resources Next Steps

What Are Medicare Supplement Plans in Illinois?

Medicare is a health insurance plan for people age 65 or older and younger people with disabilities and end-stage renal disease (ESRD). It has two parts: Medicare Part A, which is your hospital insurance, and Part B, which is your medical insurance. You pay a monthly premium for Part B. 1 2

When Can You Enroll in a Medigap Policy?

You can apply for a Medigap policy any time after you’re eligible for Medicare. Insurance companies can use medical underwriting to determine your eligibility unless you’re in your Medigap Open Enrollment Period or you have guaranteed issue rights.

What Are the Most Popular Medicare Supplement Plans?

After you decide which lettered plan, A-N, might best meet your needs, check several insurers to see which ones in your area of Illinois offer the best price.

How Do You Choose a Medicare Supplement Plan?

To choose a Medicare Supplement plan, start by reviewing your plan options. Remember, plans are standardized, so a Plan N has the same benefits no matter which company you purchase it from.

Do Medicare Supplement Plans Include Prescription Coverage?

Medigap policies do not include prescription coverage. For prescription benefits, consider enrolling in a Medicare Part D plan. 10

What If You Want to Change Your Medigap Policy?

You can apply for a different Medigap policy at any time. Keep in mind that insurance can decline your application or charge you more based on your health unless you have guaranteed issue rights. 11

How does Benistar help with Medicare?

Benistar’s experts can assist you in providing the most current solutions to your current and prospective clients. We can provide the consulting expertise to assist you in choosing the right plan for your client. Through our relationships with the most reputable, highly-rated insurance carriers, you can offer your clients flexible and cost-competitive options. When you rely on Benistar to handle your clients’ Medicare needs, you will have more time to focus on meeting new clients. Further, the ability to offer quality, competitive retiree health plans to your prospects can be a differentiating factor in winning new business. We will assist you throughout the process, with fast and expert quote processing and implementation. Our experts know the Medicare environment and will take care of the details so that you can manage other aspects of your business.

How to contact Benistar pharmacy?

If you need any assistance using this tool, please contact the Benistar retiree customer service department at 1-800-236-4782.

What is Benistar medical?

Benistar is a nationwide leader in group retiree medical benefits. We are focused on the design and administration of retiree medical and prescription drug plans. By working with brokers and consultants we provide retiree medical and prescription drug solutions for companies and organizations nationwide including: 1 Publicly and privately-held companies 2 Labor Unions 3 City and County Government entities 4 Educational Organizations 5 Religious Organizations

Attend a FREE seminar

Understand your Medicare options to make your best choice. Webinars available.

You want specifics

Provide your information and we'll send you an information kit at no cost.

Services available to every customer

To make our Medicare supplement insurance plans even better for you, we’ve added new services 3 you can use at no additional cost. They are provided directly to customers as an extension of our efforts to help fight medical identity theft and fraud related to medical services and payments.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

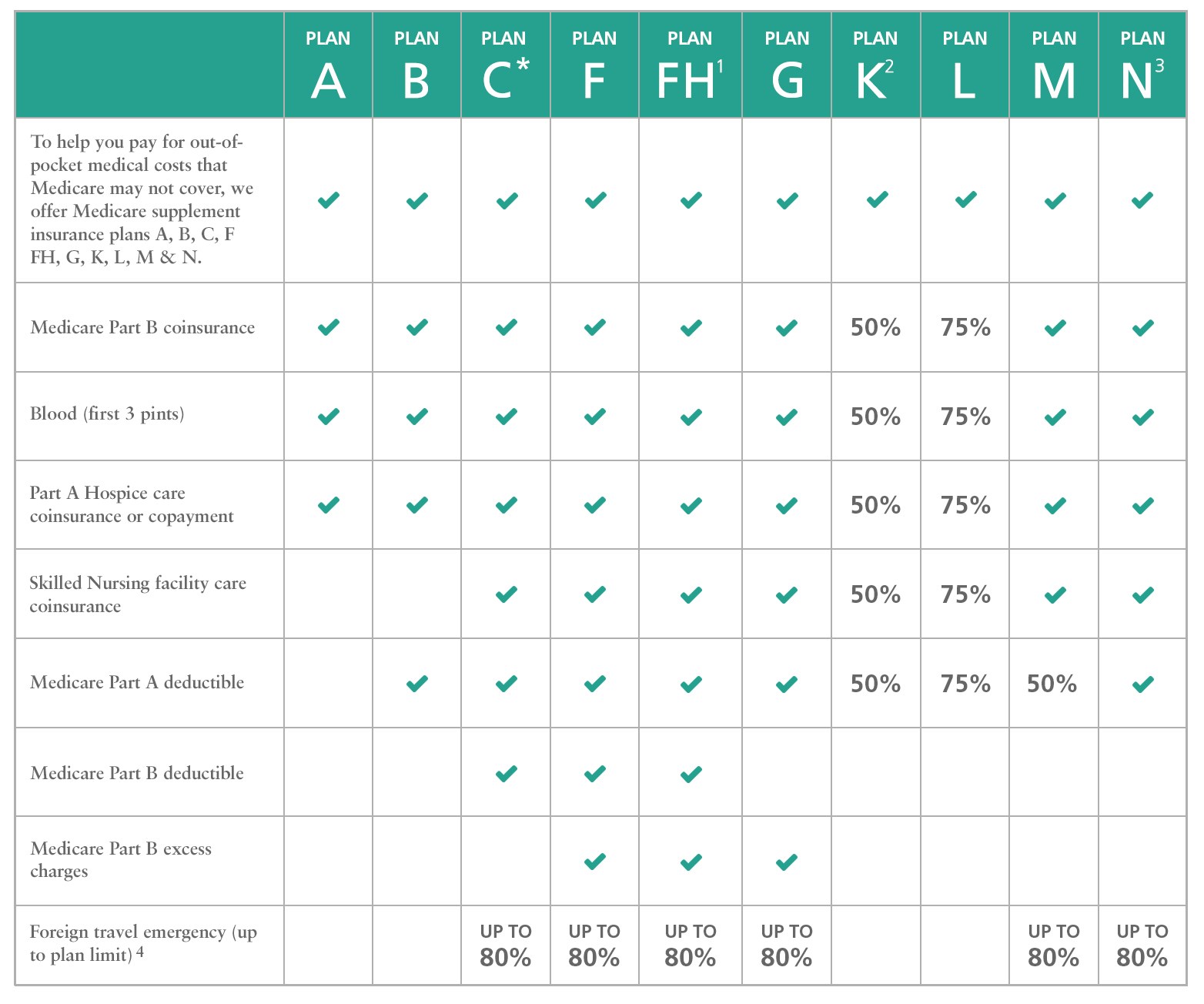

What are the letters in Medicare Supplement?

Plans are identified by the letters A, B, C, D, F, G, K, L, M and N . Each plan covers a different set of costs. Some plans only cover basic benefits. Other plans cover a wider range of health care costs and benefits. Medicare Supplement Insurance Plans do not cover hearing, dental or vision care, or prescription drugs.

How much does Medicare pay?

And finally, Original Medicare may only pay 80 percent for certain coverages. You will have to pay for the other 20 percent. Look carefully at the costs of the plans to decide whether a Medicare Supplement insurance plan will help you.

What does "standardized" mean in Medicare?

They may protect you against medical costs that are not covered or are unexpected. Medicare Supplement insurance plans are "standardized" by the government and are named by the letters A through N. Standardized means that all the companies' plans are the same.

Does Medicare Supplement cover prescriptions?

The plan gives you the freedom to choose your own doctors, specialists and hospitals. Medicare Supplement insurance plans do not include prescription drug coverage. You can't have a Medicare Supplement Insurance Plan and a Medicare Advantage Plan at the same time, ...

Does Medicare Supplement Insurance cover all costs?

A Medicare Supplement Insurance Plan works with Original Medicare. While Medicare Parts A and B cover a lot of health care costs, they don’t cover all costs. A Medicare Supplement Insurance Plan covers the costs that Original Medicare doesn’t, like:

What is Medicare for post 65?

The federal government offers healthcare for post-65 retirees through the national healthcare program known as Medicare. Medicare is broken down into four distinct parts, A, B, C, D. Each of the four segments of Medicare deal with different programs designed to meet the needs of the retiree population. A summary will be given for each of them below. Benistar Administration Services specifically deals with parts A, B & D within the scope of consultation and administration of group supplemental coverages throughout the United States.

Is Medicare Part C private or public?

Insurance policies through Medicare Part C are only available through private insurance companies. These are known as Medicare Advantage plans, and take the place of Original Medicare (Part A and Part B). Retirees are free to choose the insurance policy that will best suit their needs, generally through a health maintenance organization (HMO) or preferred provider organization (PPO) plan.