Yes, you may be eligible to purchase a Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Is Plan G the best Medicare supplement plan?

Oct 05, 2020 · To be eligible for an AARP UnitedHealthcare Medicare Supplement Plan G, you must be an AARP member. Membership starts at $12 per year and comes with many perks such as financial advisory tools, health and wellness programs, shopping discounts, and more. UnitedHealthcare provides discount programs tailored for its Medicare Supplement Plan G.

Should You Choose Medicare supplement plan F or Plan G?

Dec 03, 2021 · Medicare Supplement Plan G covers: Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out. Part A deductible ($1,556 in 2022) Part A hospice care coinsurance or copayment. Part B coinsurance or copayment. Part B excess charges. Blood (the first three pints needed for a transfusion)

What does plan G Medicare supplement cover?

Doctors and other healthcare providers must accept a Medigap Plan G if they accept Original Medicare. Plan G policies can be used across the U.S. since they do not have network limitations, and the premium costs can be very reasonable for the coverage you receive.

What is the best Medicare supplement insurance plan?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2022 is $233. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

What is Plan G on Medicare supplement?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Does AARP Offer Plan G?

Medicare Supplement Insurance benefits are standardized by the federal government. That means Medigap Plan G purchased through AARP will feature the same basic benefits as a Plan G purchased through a different carrier.Sep 21, 2021

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

Can I switch from Plan F to Plan G?

If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance. However, every state has different rules worth considering before making the switch.Nov 18, 2021

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much does G plan cost?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov.Jan 24, 2022

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Is Medicare Plan G good?

Is Medicare Plan G worth it? Absolutely, Plan G is worth the cost because it covers the expenses you'd otherwise pay. The policy is especially beneficial when your health starts to decline or when you need routine care.

What is the difference between AARP Plan F and Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.Feb 18, 2021

What is the difference between AARP Plan F and G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Is Plan G better than F?

In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible. Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($233 for 2022).

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

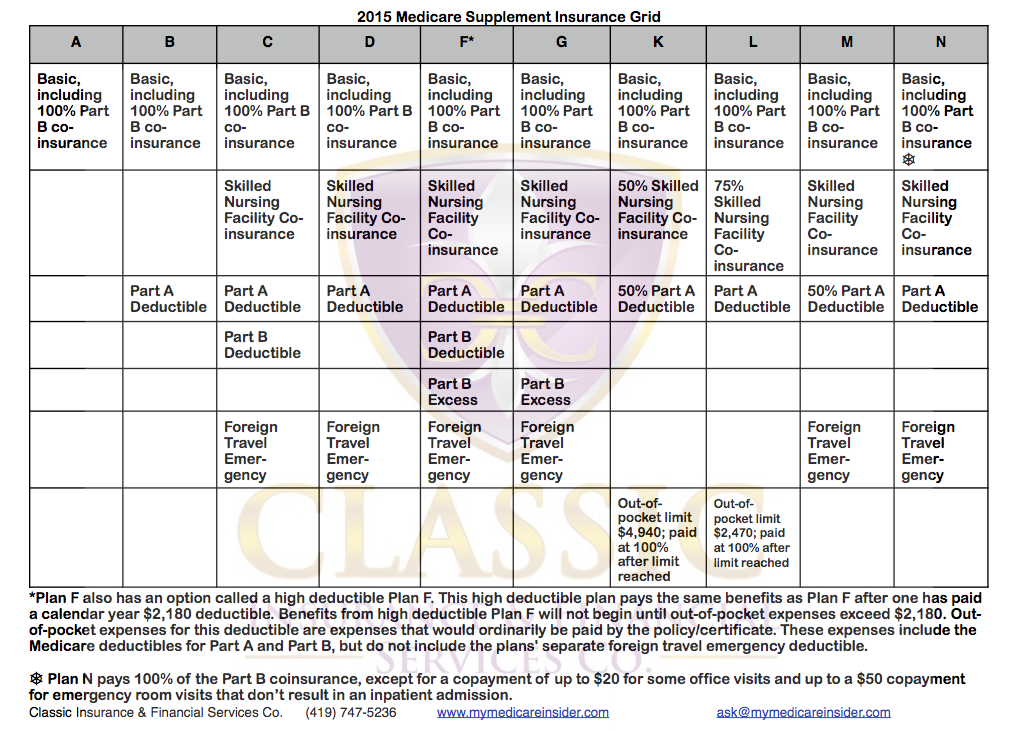

What is a Part D plan?

Part D prescription drug plans. After that come the 10 different Medigap plans – otherwise known as Medicare Supplement insurance – which each have a letter title, including Plans A, B, C, D, G, F, K, L, M and N.

What is Medicare Plan G?

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans.

How much does Medicare Part B cost?

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate ($20) plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan (besides Plan F) which pays both the $20 coinsurance and the $15 excess charge in this example.

What is the deductible for diabetes without Plan G?

Without Plan G, your yearly cost for all that care would be the Part B deductible of $203 plus all the copays and coinsurance required for your diabetes supplies and care. With Plan G, once you pay the deductible, you are 100% covered for those costs; you never pay another dollar that year.

How much does Medicare pay for an appointment?

State law may add more limits in some states. So, if Medicare allows a fee of $100 for a doctor’s office appointment, a physician who doesn’t accept assignment may charge an additional 15% ($15) for the appointment. Medicare Part B pays 80% of only the allowed rate, or $80.

How much is Plan G deductible?

Let’s imagine a situation where the Plan G premium is $120 a month where you live. That’s $1,440 a year. If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,484 for each benefits period in 2021 before your Part A benefits kick in.

What is a Part B coinsurance?

Part B coinsurance or copayment. Part B excess charges. Blood (the first three pints needed for a transfusion) Skilled nursing facility coinsurance. Foreign travel emergency care (up to plan limits of $50,000) The only thing that Plan G does not cover that Plan F does is the Part B deductible.

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

How long does a hospital stay last after Medicare runs out?

It also covers the expensive daily copays that you might encounter for a hospital stay that runs longer than 60 days. It provides an additional 365 days in the hospital after Medicare runs out, and it covers your skilled nursing facility co-insurance, too.

How often does Frank see his doctor?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Does Medicare Supplement have a doctor network?

The benefits of a Plan G will be the same regardless of the company you select. Doctor’s Network – Medicare Supplement insurance companies don’t have their own doctor’s networks. Their plans are only supplements to your primary Medicare Parts A & B coverage.

Does Medicare pay your portion?

It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicare’s instructions.

Is Plan G more cost effective than Plan F?

Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option. Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F.

How long do you have to be on Cigna to get a discount?

To qualify for the online discount, you must be a new Medicare Supplement policy holder with Cigna**, without an active policy in the last 90 days. You must submit your Medicare Supplement Insurance application online at Cigna.com to qualify for the discount.

What is the phone number for Medicare Part B?

Or call: 1 (855) 222-0548. Mon-Fri, 8:30 am-8:30 pm, ET. This plan provides almost the same level of coverage as Plan F (which offers the highest level of coverage with no out-of-pocket expenses for Medicare covered services ). The difference is you will pay the Medicare Part B (Medical) annual deductible before Plan G will kick in ...

What is an excess charge for a doctor?

A doctor may charge an amount for services that exceeds what Medicare covers. This is called an “excess charge.” Medicare puts a 15 percent limit on the extra amount a doctor can charge.

How long do you have to be in a hospital to qualify for skilled nursing?

Skilled Nursing Facility Care 2. Must have been in a hospital for at least 3 days and have entered a Medicare-approved facility within 30 days after discharge from the hospital. Services. Medicare Pays. Plan G Pays. You Pay. First 20 days. All approved amounts. $0.

Is Medicare Supplement Plan G the same as Medicare Supplement Plan G?

Rates for Medicare Supplement Plan G. While the benefits of Medica re Supplement Plan G remain the same regardless of your insurance company (as mandated by the government), in some states the premium you pay may vary according to a number of factors, including age, location, gender, and overall health.

Is Plan G a good fit for Medicare?

Plan G may be a good fit for you if you want a lower premium, and are able to pay the Part B deductible, if needed. Review the chart below for all the details of Plan G coverage or explore other Medicare Supplement plans.

What is a Medigap Plan G?

The takeaway. Medigap Plan G is a Medicare supplement insurance plan. It covers a variety of expenses that aren’t covered by Medicare parts A and B, such as coinsurance, copays, and some deductibles. If you buy a Plan G policy, you’ll pay a monthly premium, which can vary by the company offering the policy.

How do companies set their premiums?

The three main ways they set premiums are: Community rated. Everyone with the policy pays the same monthly premium, regardless of his or her age. Issue-age rated. Monthly premiums are set based on how old you are when you purchase your policy.

What is issue age rated?

Issue-age rated. Monthly premiums are set based on how old you are when you purchase your policy. Individuals who buy at a younger age will have lower monthly premiums. Attained-age rated. Monthly premiums are set based on your current age. Because of this, your premiums will increase as you get older.

What is Medicare Part B?

Medicare Part B (medical insurance) Medicare Part C (Medicare Advantage) Medicare Part D (prescription drug coverage) While Medicare covers manyexpenses, there are some things that aren’t covered. Because of this, about 90 percent. Trusted Source. of people with Medicare have some form of supplemental insurance.

What is a plan G?

Additionally, Plan G covers 80 percent of health services provided during foreigntravel. Medigap plans are standardized, which means each company must offer the same basic coverage. When you purchase a Plan G policy, you should receive all of the benefits listed above regardless of the company you purchase it from.

Can you enroll in Medicare Part B in 2020?

These changes are because Medigap plans sold to those new to Medicare can no longer cover the Medicare Part B deductible , which is included in Plan F. Those who already have Plan F or were new to Medicare prior to January 1, 2020 may still have a Plan F policy.

Do you have to pay monthly premiums for Medigap?

Monthly premiums. If you enroll in a Medigap plan, you’ll have to pay a monthly premium . This will be in addition to your Medicare Part B monthly premium. Because private insurance companies sell Medigap policies, monthly premiums will vary by policy. Companies can choose to set their premiums in a variety of ways.

Supplemental Insurance: 3 Crucial Things To Know

If you are early in your journey towards understanding Medicare (or in need of a refresher), this section is for you.

Medicare Supplement Plan G Vs. Plan F

Medicare Supplement Plan G 2022 is the most popular Plan among new enrollees (likely because it offers the most comprehensive Coverage).

Lab & X-Ray

Medicare Supplement Plan G is one of the most popular Medigap plans on the market. Next to Plan F (not available to new Medicare enrollees), Plan G covers the most comprehensive range of benefits. Additionally, Plan G premiums tend to be lower than premiums for Plan F.

What age do you have to be to get Medicare Supplement?

Disabled Under 65 . In 27 states, Medicare Supplement Insurance companies are required to sell policies to people under age 65 who receive Medicare benefits because of a qualifying disability or medical condition.

Do you pay more for Medigap than over 65?

You will probably pay more for your plan than people over 65. Some states require insurance companies to sell you a Medigap policy for the same price as people over 65, but most states allow companies to charge you more if you are under 65 and disabled. You may have to settle on a less comprehensive plan. State laws vary, but some states only ...

Do you have to have Medicare to be under 65?

State laws vary, but some states only require insurance companies to offer certain plans to people under 65. For example, Texas only requires companies to offer Medigap Plan A, which is the least comprehensive plan available. If you live in a different state, you may be denied altogether. Only the 27 states above are required to offer any Medicare ...