What kind of Medicare do I get in Florida?

About Medicare in Florida Medicare beneficiaries in Florida may choose to receive their coverage from Original Medicare, Part A and Part B, or through a Medicare-approved insurance company that offers Medicare Advantage plans. Not every Medicare plan may be available everywhere in Florida. Types of Medicare coverage in Florida

What is the Florida serving health insurance needs of Elders program?

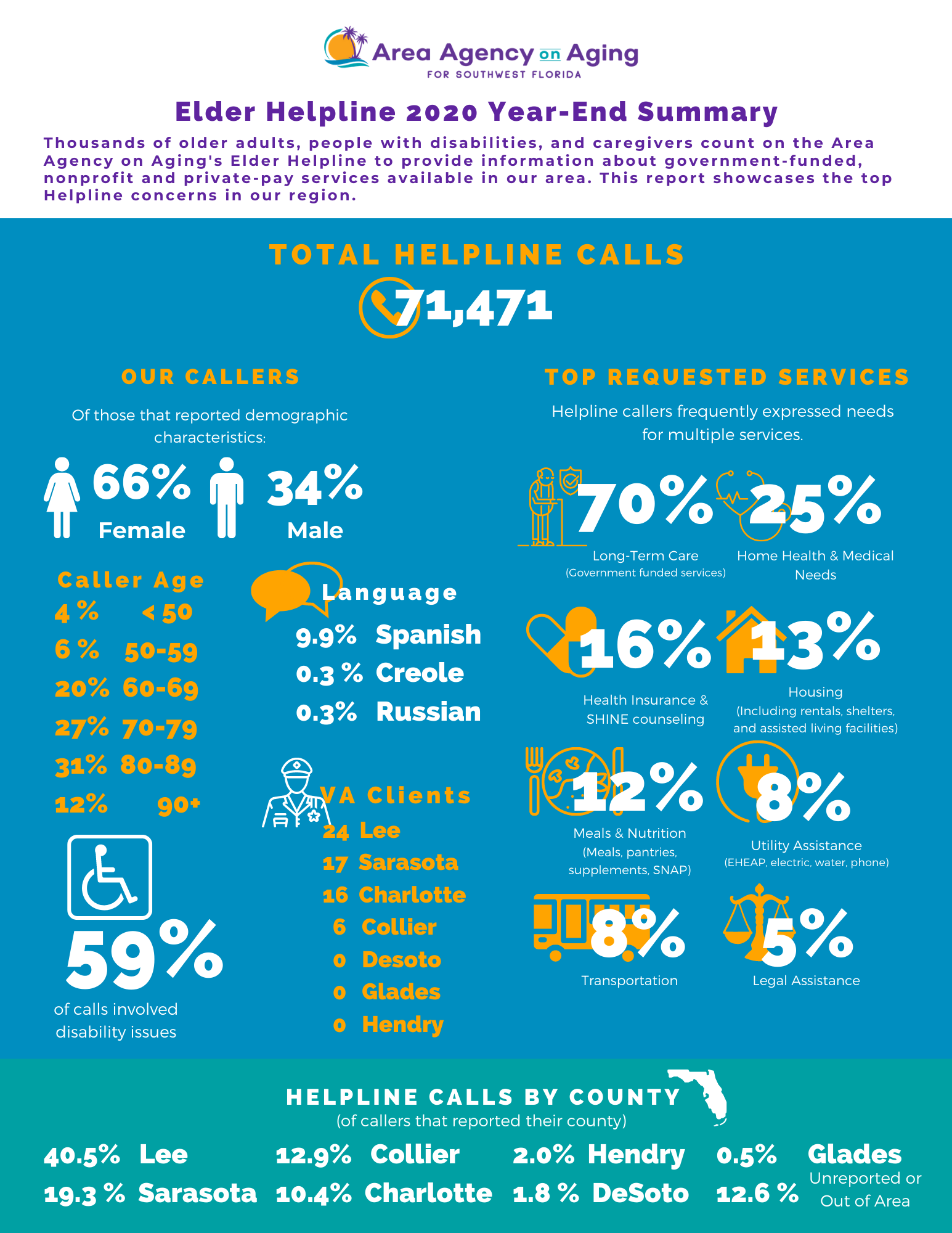

Florida Serving Health Insurance Needs of Elders: Most states have a program called SHIP (State Health Insurance Program) that helps beneficiaries to understand their Medicare rights/protections. In Florida, this program is called SHINE (Serving Health Insurance Needs of Elders).

Who qualifies for Medicaid spend-down in Florida?

In Florida, applicants with incomes above the eligibility limit can enroll in the Medicaid spend-down. Medicare beneficiaries with low incomes may qualify for Extra Help in Florida.

Does Florida Medicaid cover long-term care for seniors?

Florida does not allow seniors with slightly higher incomes to pay what they can afford toward their care, and have Medicaid pay the rest. This means applicants with modest incomes just above the eligibility limit can struggle to pay for long-term care.

Who handles Medicare in Florida?

First Coast has proudly served as one of the nation's largest Medicare administrators for 50 years, and is the current Medicare Administrative Contractor (MAC) for Jurisdiction N (JN), which includes Florida, Puerto Rico and the U.S. Virgin Islands.

Is Florida Blue Medicare or Medicaid?

Shop for Medicare plans in your area. Florida Blue has proudly served Medicare beneficiaries since 1965. We offer a variety of affordable Medicare plans with more benefits than Original Medicare.

How does Medicare work in Florida?

Even if you still have employer health insurance at 65, Medicare benefits work in coordination with that coverage to enhance or supplement it. For example, Medicare Part A covers hospital stay costs, and is free if you've worked 10 years or more while paying Medicare taxes.

How do I find my Florida Blue Medicare number?

Make notes and write down any questions you may have. Call or visit your local agency to speak to a Florida Blue Medicare agent. Call Florida Blue Medicare directly at 1-844-335-0532 (TTY: 1-800-955-8770).

Is Florida Blue the same as Blue Cross Blue Shield of Florida?

About Florida Blue Headquartered in Jacksonville, Fla., it is an independent licensee of the Blue Cross and Blue Shield Association.

Which is the best Medicare Advantage plan in Florida?

What is the best Medicare Advantage plan in Florida? We recommend AARP/UnitedHealthcare Medicare Advantage as the best overall provider in Florida. The company offers $0 plans in all of Florida's 67 counties. Plus, it is well rated and has in-network providers across the country.

Is there a Medicare in Florida?

Medicare Coverage Overview for Florida. The federal Medicare program provides health insurance coverage to eligible United States citizens and permanent legal residents who are age 65 or older, or under 65 with certain medical disabilities or illnesses, including those in Florida.

How do I get Medicare in Florida?

Online (at Social Security) – It's the easiest and fastest way to sign up and get any financial help you may need. (You'll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.) Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Who owns Florida Blue?

GuideWellBlue Cross and Blue Shield of Florida / Parent organizationGuideWell, formally GuideWell Mutual Holding Corporation, is a mutual insurance holding company primarily focused on health insurance in Florida. It was created in 2013 by a reorganization initiated by Florida Blue, a member company of the Blue Cross Blue Shield Association. Wikipedia

What is the Florida Blue provider number?

(800) 352-2583Blue Cross and Blue Shield of Florida / Customer service

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

About Medicare in Florida

Medicare beneficiaries in Florida may choose to receive their coverage from Original Medicare, Part A and Part B, or through a Medicare-approved in...

Types of Medicare Coverage in Florida

Original Medicare, Part A and Part B, is federally funded health insurance available to all eligible Medicare beneficiaries. Part A provides inpati...

Local Resources For Medicare in Florida

Medicare Savings Programs in Florida: For residents whose income falls below a certain limit, there are various programs that can assist with payin...

How to Apply For Medicare in Florida

The Medicare enrollment process is the same no matter what state you live in. To qualify for Medicare, you must be either a United States citizen o...

What is Medicare Advantage Plan?

These plans are required to cover everything that Original Medicare does (except for hospice care), but may include additional benefits like vision, dental, hearing, and prescription drug coverage.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, provides coverage for out-of-pocket costs that are not covered by Original Medicare, which includes deductibles, copayments and, in some cases, medical care when traveling outside of the United States .

Does Florida have Medicare?

Not every Medicare plan may be available everywhere in Florida.

Educating Floridians since 2015

Medicare Webinars is a 1-hour online educational workshop free to the community brought to you by www.flmedicare101.org. The workshop is only for educational purposes and no plan-specific benefits or details will be shared. This is not a sales event.

Virtual Webinar

Join a group for a virtual educational workshop that can be accessed from the comfort and safety of your home.

One-on-One Phone Appointment with a Medicare Specialist

Sign up for a one-on-one phone appointment that can be accessed from the comfort and safety of your home.

What is Medicare for seniors?

Medicare is a government-sponsored health insurance program for people aged 65 or older. People under age 65 may also qualify if they have certain health conditions, such as End-Stage Renal Disease. Although Medicare pays the majority of costs for covered services, beneficiaries are responsible for monthly premiums, deductibles, co-insurance, ...

Why do people wait to sign up for Medicare?

The most common reason people wait to register is because they have coverage through an employer or through their spouse’s employer.

How long does Medicare open enrollment last?

Anyone who is enrolled in Original Medicare and over the age of 65 is eligible for Medigap. Your Medigap open enrollment period lasts for six months and starts as soon as you enroll in Part B.

When is the open enrollment period for Medicare?

What Is the Open Enrollment Period? The Open Enrollment Period happens every year from October 15 through December 7. During this time, you can switch from Original Medicare to Part C. Or, you can switch from Medicare Advantage back to Parts A and B, or choose a new MA plan.

Does Medicare Advantage cover dental?

Many Medicare Advantage plans include prescription drug coverage, and some also cover vision, hearing, and dental care.

Do you have to enroll in Medicare Part B if you are not receiving Social Security?

As with Part A, if you are not receiving Social Security or RRB when you turn 65, you must enroll in Part B. Unless you meet certain income requirements, you have a monthly premium for your Medicare Part B services. This applies even to those who choose Medicare Advantage (MA) plans instead of Original Medicare.

How to contact Medicare in Florida?

Free volunteer Medicare counseling is available by contacting the Florida SHINE at 1-800-963-5337. This is a State Health Insurance Assistance Program (SHIP) offered in conjunction with the State Department of Elder Affairs.

What is Medicare Savings Program in Florida?

A Medicare Savings Program (MSP) can help Florida Medicare beneficiaries who struggle to afford the cost of Medicare coverage. The MSPs help some Floridians pay for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums. Qualified Medicare Beneficiary ...

How much can a spouse keep on Medicaid in Florida?

If only one spouse needs Medicaid, the other spouse can keep up to $128,640. In Florida, the asset limit for nursing home enrollees increases – to $5,000 if single and $6,000 if married – if an applicant’s income is below $961 a month if single and $1,261 a month if married, meaning they also qualify for Medicaid ABD.

How long does it take to recover Medicaid in Florida?

There is a 5-year lookback period for asset transfers in Florida. Florida has chosen to pursue estate recovery for all Medicaid costs received starting at age 55. The state where you reside has a significant impact on the care you receive and how much you pay as a Medicare beneficiary.

What is Medicaid ABD in Florida?

This program is called Medicaid for the Aged and Disabled (MEDS-AD) in Florida. In Florida, Medicaid ABD covers dental services in emergencies.

What is the maximum home equity for Medicaid?

In 2020, states set their home equity limits based on a federal minimum home equity interest of $595,000 and a maximum of $893,000.

What is Medicaid spend down?

If an individual’s income is over the eligibility limit for Medicaid for the aged, blind and disabled but their assets are below the resource limit, they can enroll in the Medicaid spend-down, which is also called the “Medically Needy Program.”.