Developed jointly by the Centers for Medicare & Medicaid Services (CMS) and the National Association of Insurance Commissioners (NAIC) Who should read this guide? If you're thinking about buying a Medicare Supplement Insurance (Medigap) policy or you already have one, this guide can help you understand how it works.

Full Answer

How does Medicare supplement insurance work with Medicare?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people new to Medicare can no longer cover the Part B deductible.

What is the history of Medicare supplement plans?

The history of Medicare Supplement Plans – Medigap insurance takes us back to 1980. What began as voluntary standards governing the behavior of insurers increasingly became requirements.

What changes have been made to Medicare supplement plans?

Consumer protections were continuously strengthened, and there was a trend toward the simplification of Medicare Supplement Plans – Medigap Insurance reimbursements whenever possible.

What Medicare supplement insurance plans does Medico sell?

Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What is the difference between Medicare and Original Medicare?

What is Medicare Advantage?

What is a Medigap policy?

What happens if you buy a Medigap policy?

How many people does a Medigap policy cover?

Does Medicare cover all of the costs of health care?

Does Medigap cover everything?

See more

About this website

How are Medicare Supplement plans regulated?

The California Department of Insurance (CDI) regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies.

Which entities has been authorized by Congress to standardize Medicare supplement policies?

Centers for Medicare & Medicaid Services (CMS), HHS.

What is the Commission for Medicare Supplements?

A recent report indicates that first-year commissions for enrollments in Medigap are approximately 20 percent of annual premiums, but they can vary based on the state or plan type. The commission for subsequent years (i.e., the renewal commission) is set at 10 percent of the premium.

Who is the largest Medicare supplement insurance company?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

When did Medicare Supplement plans became standardized?

Medicare SELECT was authorized by OBRA-1990 as a 15-State demonstration and became a national program in 1995.

Why did Congress act to standardized Medigap policies?

The 1990 medigap reform legislation had multiple objectives: To simplify the insurance market in order to facilitate policy comparison, provide consumer choice, provide market stability, promote competition, and avoid adverse selection.

How does Medicare commision work?

Medicare Advantage commissions are paid per application. Initial commissions and renewal commissions are how they get it. Typically, both Medicare Advantage commissions and Medicare Part D plan commission payments are paid one year in advance. In other words, the companies pay the full year's commission upfront.

How do insurance agents get paid?

When a policy is sold to you, an insurance agent earns a commission. Also, there are promised rewards that are paid over the commissions for the sales targets achieved by them. The new rule by Irdai could work in the interest of policyholders.

Are Medicare brokers unbiased?

Working with an independent Medicare insurance agent means you get to choose policy options from different companies. Independent agents and brokers are more likely to give unbiased plan recommendations and advice. But they may not have in-depth knowledge of these plans.

What are the top 3 most popular Medicare supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

Which insurance company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

What is Medigap insurance? - AARP

En español | Medigap is also sometimes referred to as a Medicare supplemental insurance. A Medigap policy, sold by private insurance companies, can help pay some of the health care costs (“gaps”) Original Medicare doesn’t cover, such as Medicare deductibles, coinsurance and some extra benefits such as care when you travel outside the U.S.

Medicare Part D coverage gap - Wikipedia

Details. In 2006, the first year of operation for Medicare Part D, the doughnut hole in the defined standard benefit covered a range in true out-of-pocket expenses (TrOOP) costs from $750 to $3,600. (The first $750 of TrOOP comes from a $250 deductible phase, and $500 in the initial coverage limit, in which the Centers for Medicare and Medicaid Services (CMS) covers 75 percent of the next $2,000.)

Medicare: What Are Medigap Plans? - WebMD

Medigap policies are extra health insurance that you buy from a private company to pay for services that Original Medicare doesn't cover. WebMD gives you the details.

Medigap (Medicare Supplement Health Insurance) | CMS

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

Updated 2022 | Medicare Supplement Comparison Chart ...

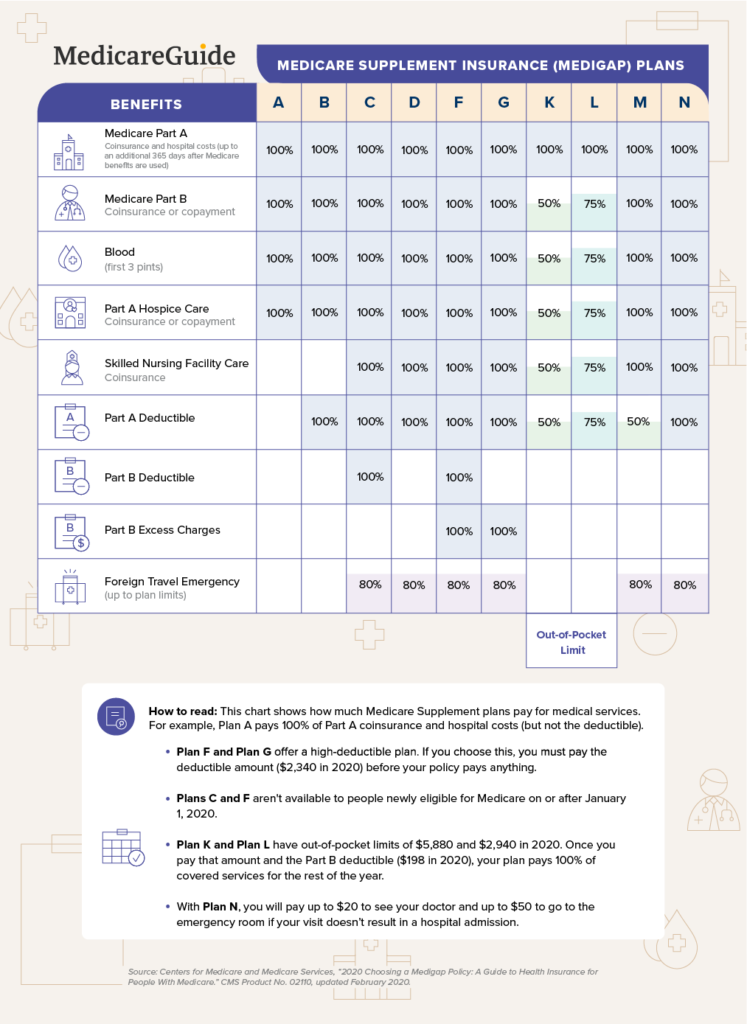

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,490 in 2022. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

Is Wellcare a Fortune company?

In 2020, WellCare was named one of Fortune Magazine’s “Most Admired Companies,” and the company boasts a number of community-based programs designed to help members navigate their local social support network and connect to community resources. 4

Medicare Part D and Medicare Advantage Agent Compensation

CMS-regulated maximum commissions from carriers differ between Medicare Part D prescription drug plans (PDP) and Medicare Advantage Prescription Drug (MAPD) plans. Compensation amounts for both types of plans increased from 2019 to 2020.

Medicare Supplement Commissions

Commissions for selling Medigap plans vary from carrier to carrier. It may sound confusing, but it works in your favor to partner with a great FMO that can connect you to many different carriers. You want to provide your clients with the plans that can offer the most benefit, and provide yourself with opportunities to earn more.

How to Increase Your Commission

Maintaining strong client relationships is the key to maximizing your compensation. People are much more willing to buy from someone they know and trust. Follow up with your clients and use a CRM to document every interaction in order to make sales tracking more efficient.

How We Help Agents Earn Top Medicare Commissions

At Senior Market Advisors, we give our agents the tools they need to succeed. When you partner with us, you have the opportunity to sell plans from all of the major carriers and maximize your potential to make money. You’ll also gain free access to our proprietary CRM and have an experienced sales and marketing team to help your business grow.

Start Earning 6-Figures

Connect with a dedicated specialist in your market to learn how you can become a TRUE Senior Market Advisor.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.