Full Answer

Who has the best Medicare Part D plan?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

Who is not eligible for Medicare Part D?

There are times you may be eligible for Medicare but are not allowed to enroll in a Part D plan. This occurs when you reside outside of the country or U.S. territories. When you return to the United States, you will be eligible to sign up. When you are incarcerated, you receive benefits from the prison system, not Medicare.

Who qualifies for a Medicare Part D prescription drug plan?

Those who qualify for Medicare Part D must live in the plan’s service area No matter what type of Medicare Prescription Drug Plan you have (or you want to sign up for), you must reside in the plan’s service area. It’s easy to find plans available where you live – just enter your zip code and click on the button on this page.

Who qualifies for Medicare Part D plan?

Medicare Part D covers prescription drug costs. Anyone enrolled in Medicare Part A or B is eligible for Medicare Part D. This drug insurance coverage was created by the Medicare Prescription Drug, Improvement, and Modernization Act in 2003.

Do you automatically get Part D with Medicare?

You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

How do I submit Medicare Part D?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

Is Medicare Part D deducted from Social Security?

If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit or to pay the plan provider directly.

How can I find the best Medicare Part D plan for me?

Use Medicare.gov to find plans. Because plans can change each year and because new plans become available each year, it makes sense to shop for the best Part D coverage for you during each annual Medicare open enrollment period (Oct. 15 to Dec. 7).

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is CVS Caremark Part D?

CVS Caremark Part D Services, L.L.C. provides pharmacy benefit management services. The Company offers mail service pharmacy, formulary management, drug purchase arrangements, prescription management systems, clinical and disease management services, as well as retails pharmacy network management services.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

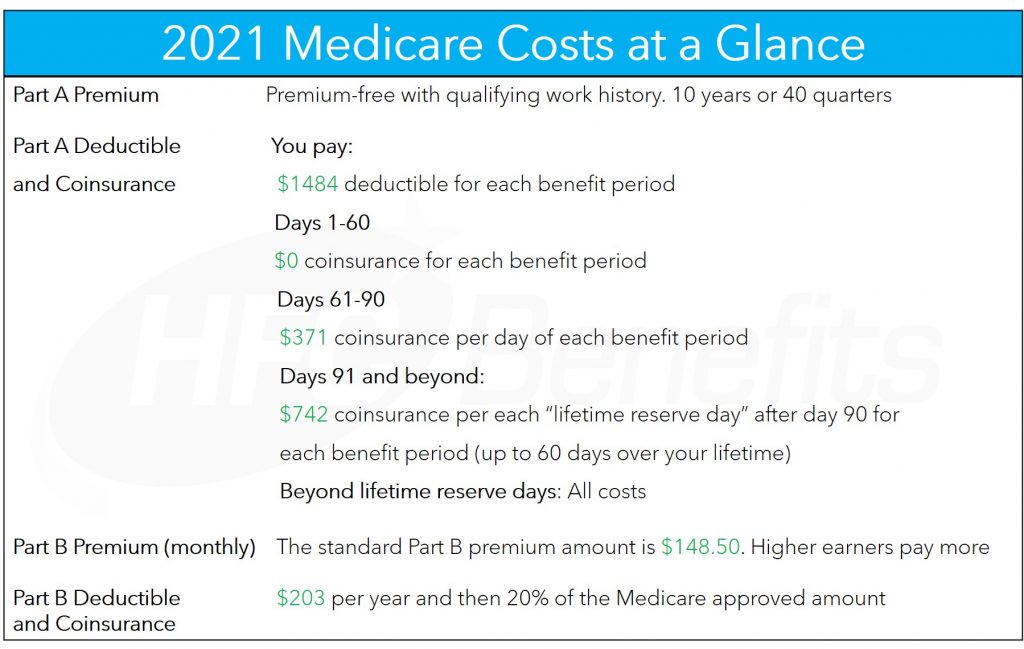

How much does Medicare Part D cost in 2021?

If your filing status and yearly income in 2019 was:File individual tax returnFile joint tax returnYou pay each month (in 2021)above $170,000 and less than $500,000above $340,000 and less than $750,000$71.30 + your plan premium$500,000 or above$750,000 and above$77.90 + your plan premium4 more rows

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

Are all Medicare Part D plans the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the second requirement for Medicare?

The second requirement for Medicare eligibility is to demonstrate medical need. Medicare leaves no room for interpretation here. You will be eligible for the program if you meet at least one of the following criteria.

What is Medicare a federal program?

Medicare is a federal healthcare program that Americans pay into with taxes. It makes sense that the government would want to make sure that you have ties to the country before they allowed you access to that benefit.

What happens if you don't sign up for Medicare?

If you do not sign up yourself, you will be automatically enrolled in Original Medicare and a Part D plan by the government. You will have the option to change to a MA-PD or pick a different Part D plan at a later time. What It Means to Be Dual Eligible for Medicare and Medicaid.

Can you switch to a MA-PD plan if you are dual eligible?

Although Part D plans are voluntary for most Medicare beneficiaries, those who are dual eligible have no choice. Medicaid requires that you sign up for Medicare as soon as you are eligible and this includes signing up for a Part D plan. If you do not sign up yourself, you will be automatically enrolled in Original Medicare and a Part D plan by the government. You will have the option to change to a MA-PD or pick a different Part D plan at a later time.

Can you get Medicare if you have kidneys?

This does not mean your kidneys are just having a tough time. It means that your kidneys are functioning so poorly they require dialysis or a kidney transplant for you to stay alive. In order to be eligible for Medicare, you or your spouse must have also paid a certain amount of Social Security taxes into the system.

Can you have a disability if you are on the railroad?

Alternatively, you could have a disability that is recognized by the Railroad Retirement Board. Medicare eligibility, in that case, would start right away.

Do you pay Part D premiums?

You'll likely just pay a Part D premium, but in some cases, you may pay more. If you don't sign up when you're first eligible, you may have to pay a late enrollment penalty. Also, you'll pay an extra amount each month if you have a higher income that's more than $87,000 filing individually or $174,000 if you're married filing jointly. 4

When do you have to enroll in Medicare Part D?

For most people, you first become eligible to enroll in Medicare Part D from 3 months before your 65 th birthday to 3 months after your birthday. When you find a plan to join, you’ll need to provide your unique Medicare number and the date you became eligible.

When is Medicare Part D enrollment?

Medicare Part D enrollment. The Medicare Part D enrollment period takes place each year form April 1 to June 30. If you enrolled in coverage for Medicare parts A or B and want to add Part D, you can enroll during this period the first time. After this, to change Part D plans, you must wait for open enrollment to come around again.

What are the different types of Medicare coverage?

What are the Medicare prescription drug coverage options? 1 Part D. These plans cover prescription medications for outpatient services. All plans have to offer some basic level of drug coverage based on Medicare rules. Specific plan coverage is based on the plans’ formulary, or drug list. If your doctor wants a drug covered that’s not part of that plan’s list, they’ll need to write a letter of appeal. Each nonformulary medication coverage decision is individual. 2 Part C (Advantage plans). This type of plan can take care of all your medical needs (parts A, B, and D), including dental and vision coverage. Premiums might be higher and you might have to go to network doctors and pharmacies. 3 Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums. Choose the best option to give you maximum benefits at the lowest rates.

What is the right Medicare plan for you?

The right plan for you depends on your budget, medication costs, and what you want to pay for premiums and deductibles. Medicare has a tool to help you compare plans in your area looking ahead to 2020. Part D. These plans cover prescription medications for outpatient services.

How long do you have to stay in Medicare Part D?

You’ll have to stay in the plan an entire year, so choose carefully. When using the Medicare plan finder to choose a Part D plan, enter your medications and doses, then select your pharmacy options. Of the available drug plans, you’ll see the lowest monthly premium plan displayed first.

What is Part D insurance?

Part D. These plans cover prescription medications for outpatient services. All plans have to offer some basic level of drug coverage based on Medicare rules. Specific plan coverage is based on the plans’ formulary, or drug list. If your doctor wants a drug covered that’s not part of that plan’s list, they’ll need to write a letter of appeal. Each nonformulary medication coverage decision is individual.

What is the number to call for a railroad employee with end stage renal disease?

Railroad employees with ESRD can contact Social Security to find out about eligibility for Medicare at 800-772-1213.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

Is Medicare a creditable drug?

It may be to your advantage to join a Medicare drug plan because most Medigap drug coverage isn't creditable. You may pay more if you join a drug plan later.

Can you join Medicare with meds by mail?

This is a comprehensive health care program in which the Department of Veterans Affairs shares the cost of covered health care services and supplies with eligible beneficiaries. You may join a Medicare drug plan, but if you do, you won’t be able to use the Meds by Mail program which can give your maintenance drugs to you at no charge (no premiums, deductibles, and copayments). For more information, visit va.gov/communitycare/programs/dependents/champva/ or call CHAMPVA at 800-733-8387.

Does Medicare help with housing?

, you won't lose your housing assistance. However, your housing assistance may be reduced as your prescription drug spending decreases.

Does Medicare cover drug costs?

Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs.

Does Medicare pay for prescription drugs?

Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs. In most cases, you'll pay a small amount for your covered drugs. If you have full coverage from Medicaid and live in a nursing home, you pay nothing for covered prescription drugs.

What is Medicare Part D?

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance.

What is Medicare Part D enrollment?

Medicare Part D enrollment is the first step in getting the coverage you need for your prescription medications. With multiple plans to choose from, it is helpful to compare plans carefully to find the right plan for you. You can start by entering your zip code on this page.

How long can you go without Medicare Part D?

However, if you go without Medicare Part D or other creditable prescription drug coverage for a continuous period of 63 days or longer after your IEP is over, you could be subject to a Part D late enrollment penalty. Coverage could come from a stand-alone prescription drug plan, a Medicare Advantage plan with prescription drug coverage (Part C), ...

What is Medicare Advantage Plan?

A Medicare Advantage plan is an alternative way to get your Original Medicare (Part A and Part B) benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

How much is Part D late enrollment penalty?

The amount of the Part D late enrollment penalty depends on how long you went without prescription drug coverage. Medicare calculates the amount by multiplying the number of months you didn’t have prescription drug coverage by 1% of the national base beneficiary premium. In 2021, the national base beneficiary premium is $33.06.

What is a SEP in Medicare?

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.

When is the fall open enrollment period for Medicare?

Medicare also offers a Fall Open Enrollment Period (OEP) every year that runs from October 15 to December 7. This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

What is Medicare Advantage?

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

Is Medicare a federal or state program?

Medicaid is a joint federal and state program that provides health coverage for some people with limited income and resources. Medicaid offers benefits, like nursing home care, personal care services, and assistance paying for Medicare premiums and other costs.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

Is eligibility.com a DBA?

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

What is Medicare Part D?

Medicare Part D is prescription drug coverage , as you may know. You might decide you need this coverage, but when can you get it? We’ll fill you in on when and how to enroll in Medicare Part D. Find affordable Medicare plans in your area. Find Plans.

What happens if you don't sign up for Medicare?

There’s another reason to think about signing up for Part D: if you don’t sign up when you’re first eligible for Medicare, you might have to pay a late enrollment penalty if you need medications at a later date and decide to sign up. Learn more about the Part D late enrollment penalty.

How long does Medicare enrollment last?

The most common enrollment periods are: Your Medicare Initial Enrollment Period. For most people, this is the seven-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and continues three months after that.

When is the AEP for Medicare?

The Annual Election Period (AEP), also called Fall Open Enrollment, October 15 – December 7 every year. The 5-Star Special Enrollment Period. You can switch to a Medicare prescription drug plan with a 5-star rating from December 8 one year to November 30 the next Read more about the 5-star special enrollment period.

Does Medicare cover Part B?

But when it comes to medications you take at home, Original Medicare doesn’t cover them in most cases. There’s another reason to think about signing up for Part D: if you don’t sign up when you’re first eligible for Medicare, ...

Can you make other coverage changes during enrollment periods?

You might also be able to make other coverage changes during some of these enrollment periods.

Do you get Part D if you are in Medicare?

But you don’t automatically get Part D, even if you’re one of the many who get enrolled in Medicare Part A and Part B automatically. Original Medicare, Part A and Part B, doesn’t include prescription drug coverage, except in certain cases.

What is Medicare Extra Help?

Medicare Extra Help is a program that helps people with limited income and financial resources pay for Medicare Part D costs such as premiums, deductibles and copayments. If you qualify for both Medicaid and Medicare, you automatically qualify for Extra Help. Extra Help is also referred to as the Part D Low-Income Subsidy (LIS).

Can you get Medicare and Medicaid?

If you are eligible for both Medicare and Medicaid, you may also be eligible to join a Dual-eligible Special Needs Plan (D-SNP). This is a certain type of Medicare Advantage plan that offers all of the same coverage as Medicare Part A and Part B along with additional benefits that are tailored to the needs of someone with limited income and resources.

Can you get Medicare Part D?

Beneficiaries who are eligible for both Medicaid and Medicare can get Part D prescription drug coverage through the Medicare Extra Help program or a Medicare Special Needs Plan. We explain more about each of those programs below.

Does Medicaid work with Medicare?

Medicaid works with Medicare in several ways, and Medicaid works particularly close with Medicare Part D.

Is prescription drug coverage an optional benefit?

While prescription drug coverage is an optional Medicaid benefit (which means individual state Medicaid programs decide how drugs are covered in that state), all states in America provide Medicaid drug coverage to eligible beneficiaries.