What are your requirements for Medicare Part D creditable coverage?

What Are Your Requirements for Medicare Part D Creditable Coverage? As an employer, you are required to send the Medicare Part D Disclosure to eligible employees informing them about whether the prescription drug coverage offered is "creditable" by October 15, 2020.

Is Medicare Part D available through private insurance companies?

Medicare Part D is optional, and it’s available only through private insurance companies that contract with Medicare. What is Medicare Part D? A history Medicare Part D prescription drug coverage was created by the Medicare Modernization Act (MMA) of 2003 and implemented in 2006.

What is Medicare Part D and how does it work?

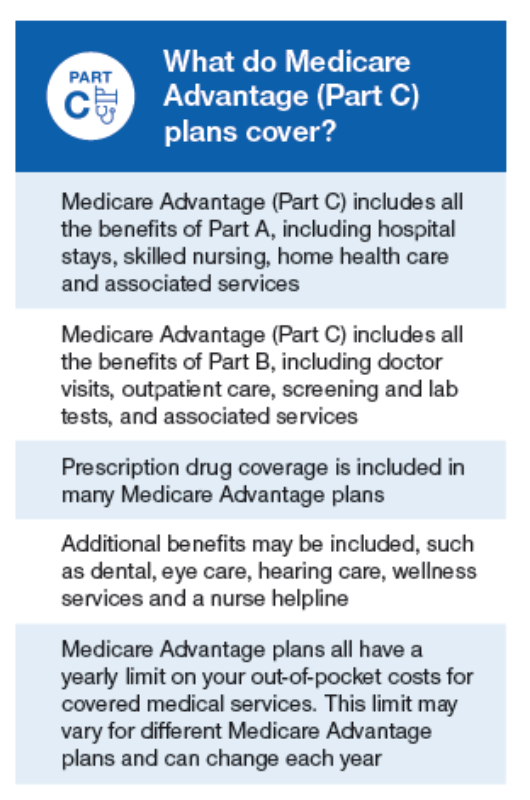

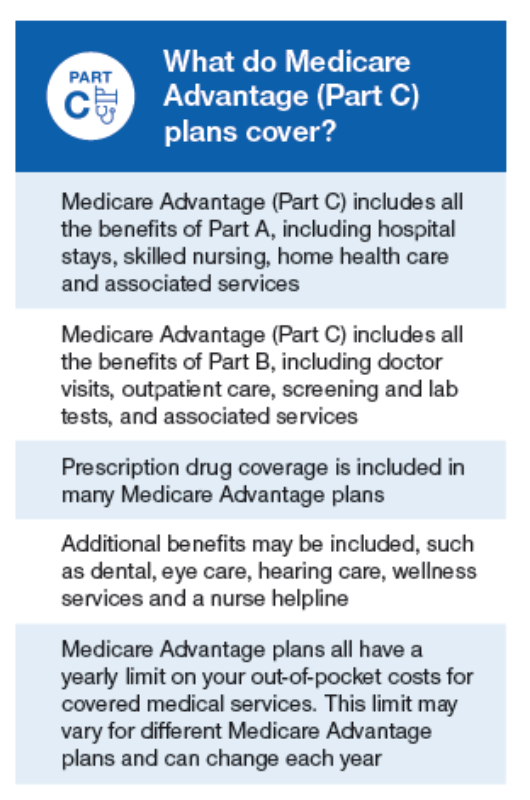

What is Medicare Part D? There are four parts to the Medicare program: Part B, which covers outpatient services and durable medical equipment (Part A and Part B are called Original Medicare) Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare

Who is eligible for Medicare Part D prescription drug coverage?

Anyone with Medicare coverage—either Medicare Part A (hospital insurance) or Part B (medical insurance) or both parts—may be eligible for a stand-alone Medicare Part D prescription drug coverage. You can’t be turned down because of your health status or income.

Who should receive the Medicare Part D creditable coverage notice?

Employers must provide creditable or non-creditable coverage notice to all Medicare eligible individuals who are covered under, or who apply for, the entity's prescription drug plan (Part D eligibles), whether active employees or retirees, at least once a year.

What does Medicare Part D creditable mean?

A group health plan's prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage.

Who are Medicare Part D eligible individuals?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease.

What qualifies as creditable coverage?

Examples of Creditable Coverage Under Medicare Some of the most common types of creditable coverage are: Large employer group plans. Union-sponsored health plans. Federal Employee Health Benefits (FEHB)

What is not considered creditable coverage?

Non-creditable coverage: A health plan's prescription drug coverage is non-creditable when the amount the plan expects to pay, on average, for prescription drugs for individuals covered by the plan in the coming year is less than that which standard Medicare prescription drug coverage would be expected to pay.

Why is creditable coverage important?

Creditable drug coverage matters because it may allow you to delay enrolling in Medicare and avoid the Part D late enrollment penalty. The penalty is charged if you enroll in a Medicare Part D plan after your Initial Enrollment Period (IEP) ends and don't qualify for an exception.

Does everyone get Medicare Part D?

Medicare Cost Plan Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

How does Medicare Part D work?

You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug's cost. The insurance company will pay the rest.

Are you automatically enrolled in Medicare Part D?

Enrollment in a Part D prescription drug plan is not automatic, and you still need to take steps to sign up for a plan if you want one. Part D late penalties could apply if you sign up too late. If you want a Medicare Advantage plan instead, you need to be proactive. Pay attention to the Medicare calendar.

Are HSA plans Medicare Part D creditable?

The vast majority of standard health plans provide creditable coverage. Generally, the only major medical plans with non-creditable drug coverage are high deductible health plans like HSA-compatible plans with out-of-pocket maximums near the statutory limits that do not provide a first-dollar drug benefit.

Is a Medicare Advantage plan considered creditable coverage?

Medicare Advantage plans must offer benefits that are at least as comprehensive as Medicare Parts A and B. Therefore, all Medicare Advantage plans have creditable coverage.

What entities are required to provide a disclosure of creditable coverage status to CMS?

A disclosure is required whether the entity's coverage is primary or secondary to Medicare. Health plans and other entities that must comply with these provisions are listed in 42 CFR §423.56(b) and are also referenced on the creditable coverage homepage at http://www.cms.hhs.gov/creditablecoverage.

What Is Medicare Part D Prescription Drug Coverage?

As a Medicare beneficiary, you don’t automatically get Medicare Part D prescription drug coverage. This Medicare Part D coverage is optional, but c...

What Types of Medicare Part D Prescription Drug Plans Are available?

You can get Medicare Part D prescription drug coverage in two different ways, depending on whether you’re enrolled in Original Medicare or Medicare...

Am I Eligible For A Medicare Part D Prescription Drug Plan?

You’re eligible for Medicare Part D prescription drug coverage if: 1. You have Part A and/or Part B. 2. You live in the service area of a Medicare...

When Can I Sign Up For Medicare Part D Coverage?

As mentioned, you don’t have to enroll in Medicare Part D coverage. That decision will not affect the Original Medicare coverage you have, but if y...

What’S The Medicare Part D Coverage Gap (“Donut Hole”), and How Can I Avoid It?

The coverage gap (or “donut hole”) refers to the point when you and your Medicare Part D Prescription Drug Plan or Medicare Advantage Prescription...

What Does Medicare Part D Cost?

Your actual costs for Medicare Part D prescription drug coverage vary depending on the following: 1. The prescriptions you take, and how often 2. T...

Can I Get Help With My Medicare Prescription Drug Plan Costs If My Income Is Low?

As mentioned, Medicare offers a program called the Low-Income Subsidy, or Extra Help, for eligible people with limited incomes. If you are enrolled...

What is a copayment for Medicare?

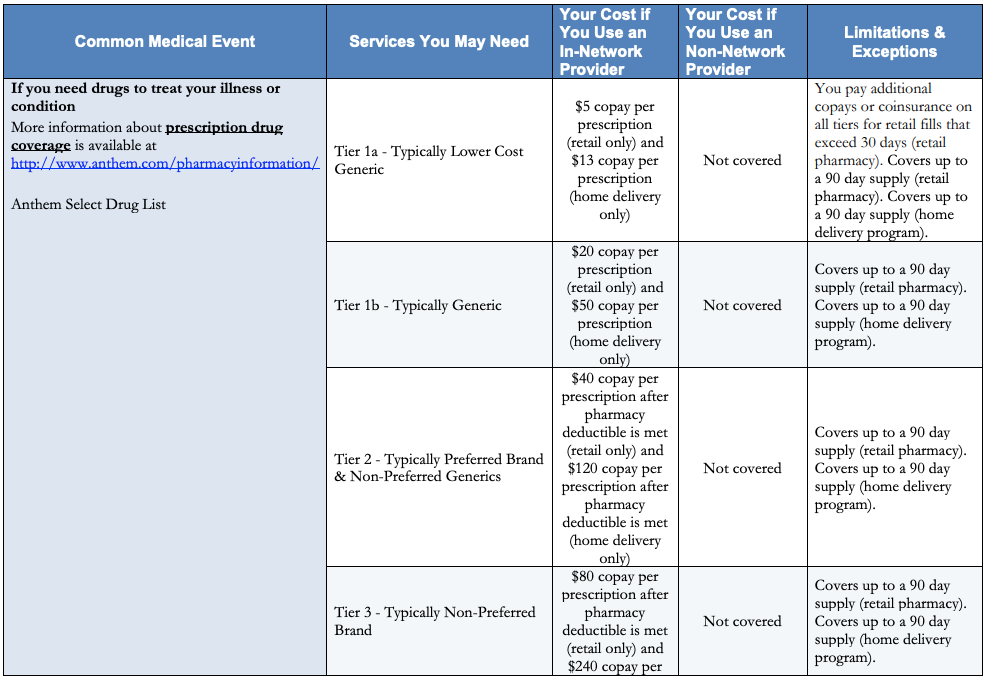

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What type of insurance is considered creditable?

The types of insurance listed below are all considered. creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage .

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is employer or union health coverage?

Employer or union health coverage. This is health coverage from your, your spouse’s, or other family member’s current or former employer or union. If you have drug coverage based on your current or previous employment, your employer or union will notify you each year to let you know if your drug coverage is creditable.

Do you have to have a Medicare drug plan to get tricare?

Most people with TRICARE entitled to Part A must have Part B to keep TRICARE drug benefits. If you have TRICARE, you don’t need to join a Medicare drug plan.

Can you keep a medicaid policy?

Medigap policies can no longer be sold with prescription drug coverage, but if you have drug coverage under a current Medigap policy, you can keep it. If you join a Medicare drug plan, your Medigap insurance company must remove the prescription drug coverage under your Medigap policy and adjust your premiums.

Can you join a Medicare plan without a penalty?

, you'll have a special enrollment period to join a Medicare drug plan without a penalty when COBRA ends.

Who must provide a creditable coverage notice to Medicare?

A: You must provide a creditable coverage notice to all Medicare eligible individuals who are covered under, or apply for, your prescription drug plan. This requirement applies to active Medicare beneficiaries and those who are retired, as well as Medicare-eligible spouses who are covered as actives or retirees.

When does Medicare Part D end?

Before an individual’s initial opportunity to enroll in Part D (generally satisfied by the. requirement to provide notice to all Medicare-eligible employees prior to October 15); Before the effective date of coverage for any Medicare-eligible individual who joins your plan; When, if ever, your plan’s prescription drug coverage ends ...

How much is a deductible for integrated health insurance?

For employers that have integrated prescription drug and health coverage, the integrated health plan has no morethan a $250 deductible per year, has no annual benefit maximum or a maximum annual benefit of at least $25,000 andhas no less than a $1,000,000 lifetime combined benefit maximum.

When is Medicare Part D disclosure required?

As an employer, you are required to send the Medicare Part D Disclosure to eligible employees informing them about whether the prescription drug coverage offered is "creditable" by October 15, 2020. Read through the Frequently Asked Questions below for more information on the disclosure requirements.

Do you have to review your prescription drug plan?

A: You must annually review your prescription drug plan using generally accepted actuarial principles and following Centers for Medicare and Medicaid Services (CMS) guidelines. Typically carriers will perform this analysis for fully insured plans.

Can I send a CMS notice to my spouse?

A: Yes, use one of the CMS notices and send to all your employees via mail or email. You can customize the sample notices with your company name/carrier/contact information. We suggest sending it to all employees, since you might not know whether a spouse is Medicare eligible and an individual’s status may change unexpectedly, e.g., due to disability.

Can a retiree get a drug subsidy?

A: Yes , CMS states that an employer plan sponsor who does not apply for a retiree drug subsidy can determine creditable coverage status by determining that the plan: Provides coverage for brand and generic prescriptions. Provides reasonable access to retail providers.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Why was Medicare Part D created?

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

How many Medicare Part D plans are there in 2021?

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. It’s important to comparison shop to find the one that’s right for you.

What is coinsurance in Medicare?

Copayments (flat fee you pay for each prescription) Coinsurance (percentage of the actual cost of the medication ) Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically won’t pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage.

Why is it important to enroll in a Part D plan?

It’s important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you don’t enroll in Part D when you are first able, you’ll pay a penalty of 1% of the national base premium for each month you go without coverage.

What is a formulary in Medicare?

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments.

What are the different types of Medicare?

There are four parts to the Medicare program: 1 Part A, which is your hospital insurance 2 Part B, which covers outpatient services and durable medical equipment (Part A and Part B are called Original Medicare) 3 Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare 4 Part D, which is your prescription drug coverage

How much is coinsurance for 2021?

If you and your plan spend more than $4,130 on prescription medications in 2021, special coverage rules kick in.

When did Medicare Part D start?

The MMA established an Initial Enrollment Period (IEP) for Part D for all Medicare beneficiaries that began on November 15, 2005 and extended through May 15, 2006. After May 15, 2006, the Initial Enrollment Period for Part D is concurrent with the individual’s IEP for Part B which is the 7-month period that begins 3 months before the month an individual first meets the eligibility requirements for Parts A & B and ends 3 months after the month of first eligibility.

Who is required to provide a disclosure notice to Medicare?

The Disclosure Notice must be provided to all Part D eligible individuals who are covered under , or who apply for , the entity’s prescription drug coverage. Neither the statute nor the regulations create any exemption based on whether prescription drug coverage is primary or secondary coverage to Medicare Part D. Thus, for example, the Disclosure Notice requirement applies with respect to Medicare beneficiaries who are active employees, disabled, on COBRA, and are retired, as well as Medicare beneficiaries who are covered as spouses or dependents (including those spouses or dependents that may be disabled or on COBRA) under active employee coverage and retiree coverage.

What is 42 CFR 423.56(f)?

42 CFR §423.56(f) specifies the times when creditable coverage disclosures must be made to Part D eligible individuals. At a minimum, disclosure must be made at the following times:

How long does a Part D drug plan have to be enrolled?

42 CFR §423.46 provides for a late enrollment penalty for Part D eligible individuals who enroll in a Part D drug plan after experiencing a lapse in creditable prescription drug coverage for any continuous period of sixty-three (63) days or longer after the end of their initial Part D enrollment period. The higher premium charge is based on the number of months that the individual did not have creditable coverage. The premium that would otherwise apply is increased by at least 1% of the base beneficiary premium (which is set by CMS and published each year) for each month without creditable coverage. This penalty may apply for as long as the individual remains enrolled in Part D. The individual’s higher premium charge will be recalculated each year, because the base beneficiary premium changes annually.

What is 423.56(e) disclosure?

42 CFR §423.56(e) requires all entities described in 42 CFR §423.56(b) to disclose to CMS whether their prescription drug coverage is creditable or non-creditable. The disclosure must be made to CMS on an annual basis, and upon any change that affects whether the coverage is creditable. CMS posted guidance on the timing, format, and the Disclosure to CMS Form on January 4, 2006. The Disclosure to CMS guidance and Disclosure to CMS form can be found on the CMS website at

Does a qualified actuary have to attestation a creditable coverage?

The determination of creditable coverage status does not require an attestation by a qualified actuary unless the entity is an employer or union electing the retiree drug subsidy. See 42 CFR §423.884(d).

Is Medicare coverage creditable?

As defined in 42 CFR §423.56(a), coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard Medicare prescription drug coverage, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS actuarial guidelines. In general, this actuarial determination measures whether the expected amount of paid claims under the entity’s prescription drug coverage is at least as much as the expected amount of paid claims under the standard Medicare prescription drug benefit.