Summary: You are not required to have Medicare Part B coverage if you have employer coverage. You can drop Medicare Part B coverage and re-enroll in it when you need it. You also may choose to defer enrollment in Medicare Part B coverage if you are employed at age 65 or older and eligible for Medicare.

Full Answer

Do I have to pay for Medicare Part A and B?

Just the essentials... Medicare Part B is very rarely “free”, there are monthly premiums most people have to pay for their Medicare Part B coverage. There are several programs that can help to reduce the cost of your Medicare Part B premium and even cover the cost entirely. The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low …

What's not covered by Medicare Part A&Part B?

If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them. If you're not lawfully present in the U.S., Medicare won't pay for your Part A and Part B claims, and you can't enroll in a Medicare Advantage Plan or a Medicare drug plan.

What happens if I don’t enroll in Medicare B?

You pay nothing for most preventive services if you get the services from a health care provider who accepts assignment . Part B covers things like: Clinical research Ambulance services Durable medical equipment (DME) Mental health Inpatient Outpatient Partial hospitalization Limited outpatient prescription drugs

Who doesn't have to pay a premium for Medicare Part A?

If you earn more than $142,000 and up to $170,000 for the year as a single person, you’ll pay $442.30 per month for Part B premiums. Individuals who earn more than $170,000 but less than $500,000 per year will pay $544.30 in Medicare Part B premiums per month.

Does everyone have to pay Part B of Medicare?

How do I not pay for Medicare Part B?

Who does not pay into Medicare?

Is Medicare Part B automatically deducted from Social Security?

How do I get my $144 back from Medicare?

Who is eligible for Medicare Part B?

Is Medicare Part A free at age 65?

Do high income earners pay more for Medicare?

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

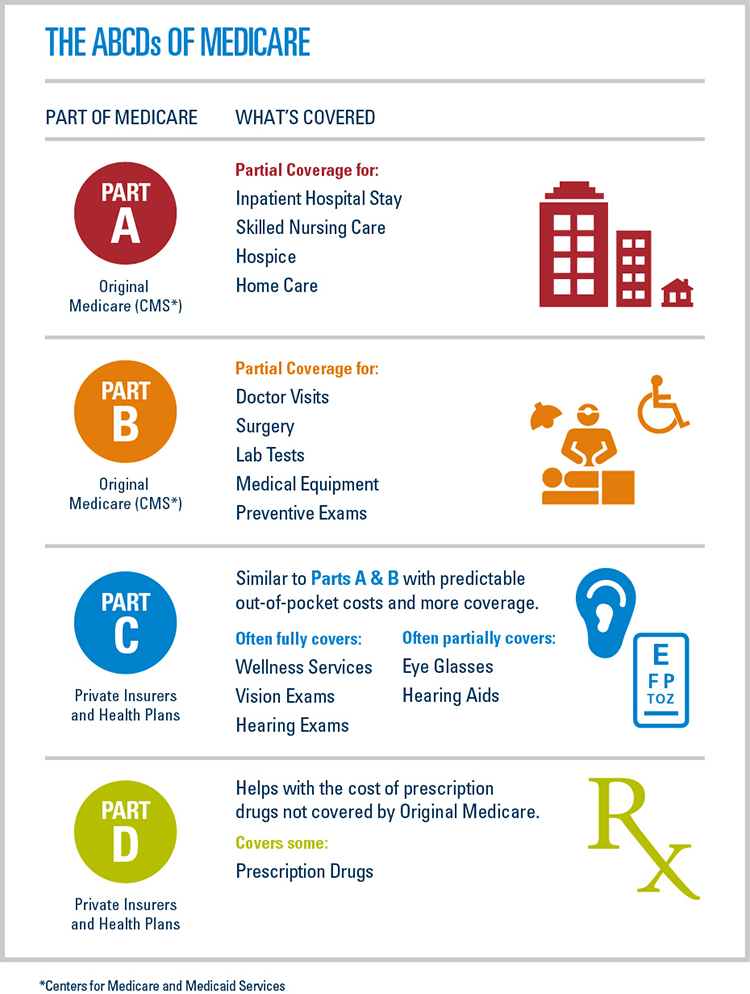

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

Why don't people enroll in Medicare Part B?

And some people choose not to enroll in Medicare Part B, because they don’t want to pay for medical coverage they feel they don’t need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage.

What is covered by Medicare Part B?

In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

How to reduce Medicare premiums?

One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

What happens if you miss your Medicare enrollment window?

What happens if you miss your initial enrollment window? If you delay Medicare Part B enrollment, then you’ll have to wait to enroll when the general enrollment period starts. In this example, your birthday is March 8. Because you missed your initial window, you’ll have to wait until January of the following year to enroll and July of the following year to start receiving coverage.

How much does Medicare pay if you make less than $500,000?

Individuals who earn more than $163,000 but less than $500,000 per year will pay $462.70 in Medicare Part B premiums per month. If you earn $500,000 per year or more, your Medicare Part B premium will be $491.60 per month. These amounts reflect individual incomes only.

How long do you have to be in Medicare to get Medicare Part B?

You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

How much is Medicare Part B in 2021?

That premium changes each year, usually increasing. In 2021, the Part B premium is $148.50 a month. You’ll also have an annual deductible of $203 in 2021 (an increase from the $198 deductible in 2020).

What happens if you don't sign up for Medicare?

If you don’t sign up for Part B as soon as you’re eligible for Medicare, you might have to pay a late-enrollment penalty each month when you do enroll into Part B, for as long as you get Medicare Part B benefits. The penalty adds 10% to your Part B premium for each year (12-month period) that you could have signed up for Part B, but didn’t enroll.

When do you have to be enrolled in Medicare?

Most people who are eligible for Medicare are automatically enrolled in Original Medicare (Part A and Part B) at age 65, if they’re receiving Social Security or Railroad Retirement Board benefits. Some are enrolled when they are diagnosed with a qualifying illness or disability before age 65 and receive Social Security disability benefits.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B premium is $148.50.

What happens if you delay enrollment in Part B?

If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see below.

Do you pay more for Medicare if you have high income?

You might pay more if you have a high income. See details below. The standard premium also may apply to you if get both Medicare and Medicaid benefits, but your state may pay the standard Medicare Part B premium if you qualify. If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see ...

Is Medicare Part B automatically deducted from Social Security?

In most cases, your Medicare Part B premium is automatically deducted from your benefits payment, which makes managing your premium payment easy. If you’re billed for your Part B premium each month (that is, if it’s not automatically deducted from your Social Security benefits), your premium payment might be somewhat higher than if it were ...

Do you have to pay late enrollment penalty for Part B?

If you qualify for a Special Enrollment Period to enroll in Part B, you may not have to pay a late-enrollment penalty. For example, if you delayed Part B enrollment because you were still covered by an employer’s plan (either your employer or your spouse’s), you might qualify for an SEP when you can enroll in Part B without a penalty.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

What to do if Social Security says no?

If he or she tells you no, be sure you get a full explanation on why you are able to delay your. Get a second opinion if you are unsure, and never rely on Social Security to give you the right answer. We’ve seen too many people get wrong answers from inexperience government employees.

Can you use FEHB instead of Medicare?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of Medicare are one group . The most common situation though is with Veterans.

Is Boomer Benefits free?

Not sure if you need to enroll? Well that’s what we are here for. Reach out to one of our team of Medicare experts here at Boomer Benefits. Our service is free, and we’d be glad to help.

What happens if you don't enroll in Medicare B?

People who don’t enroll in Medicare B when first eligible are charged a late enrollment penalty that amounts to a 10 percent increase in premium for each year they were eligible for Medicare B but not enrolled.

How long do you have to pay Medicare taxes if you have end stage renal disease?

You have end-stage renal disease (ESRD) and are receiving dialysis, and either you or your spouse or parent (if you’re a dependent child) worked and paid Medicare taxes for at least 10 years.

How long does Medicare coverage last?

Medicare coverage begins as soon as your SSDI begins, and Medicare Part A has no premiums as long as you or your spouse (or parent, if you’re a dependent child) worked and paid Medicare taxes for at least 10 years.

How much is Medicare premium for 2020?

These premiums are adjusted annually. Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly). For 2020, the threshold for having to pay higher premiums based on income increased.

Do you have to pay Social Security premiums if you are 65?

You may also not have to pay the premium: If you haven’t reached age 65, but you’re disabled and you’ve been receiving Social Security benefits or Railroad Retirement Board disability benefits for two years. You have end-stage renal disease (ESRD) and are receiving dialysis, and either you or your spouse or parent (if you’re a dependent child) ...

Do you have to pay Medicare premiums?

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don’t pay a premium for Part A. You may also not have to pay the premium: If you haven’t reached age 65, but you’re disabled and you’ve been receiving Social Security benefits ...