Who administers funds for Medicare?

The Centers for Medicare and Medicaid Services, part of the Department of Health and Human Services, administers Medicare. In Medicare's first dozen-and-a-half years, there was little oversight on claims and payments from Medicare to providers. The result: inflated claims and increasing health care costs, putting a major strain on the Medicare trust fund.

Is Medicare funded by taxes?

Medicare is funded through a combination of taxes deposited into trust funds, beneficiary monthly premiums, and additional funds approved through Congress. According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

Is Medicare going to run out of money?

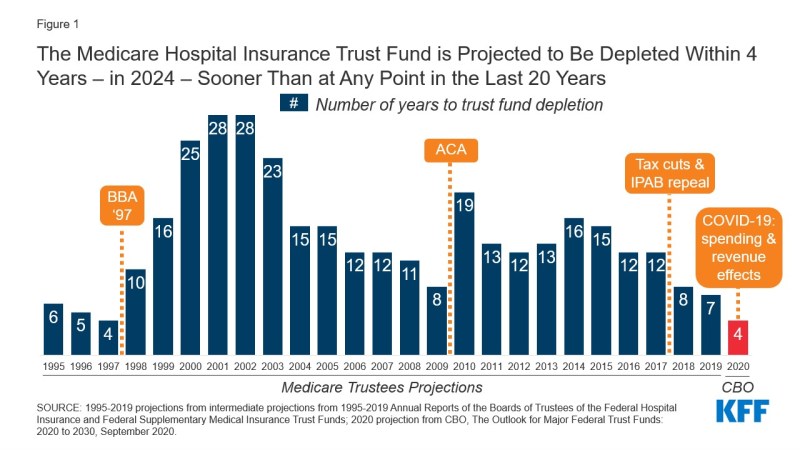

Medicare trustees announced on Tuesday that the Medicare hospital insurance trust fund will run out of money by 2026, three years earlier than reported in 2017. This is due to: Spending in 2017 that was higher than estimated; Legislation that increases hospital spending; Higher payments to private Medicare Advantage plans; As for Social Security, it will become insolvent by 2034.

Who should pay for Medicare?

- Provider Considerations. Medicare Advantage plans have a network of providers. ...

- Medigap Open Enrollment. Medigap is often referred to as the alternative to Medicare Advantage. ...

- Skilled Nursing Care. Historically, there are very few issues with skilled nursing care when billing original Medicare. ...

Who is Medicare funded by?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Where does the money come from to support Medicare?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries. Other sources include taxes on Social Security benefits, payments from states, and interest.

Is Medicare paid for by the government?

Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients.

How is Medicare funded and administered?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Does Medicare take money from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How much of the federal budget goes to Medicare?

12 percentMedicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How is healthcare funded in the US?

There are three main funding sources for health care in the United States: the government, private health insurers and individuals. Between Medicaid, Medicare and the other health care programs it runs, the federal government covers just about half of all medical spending.

Is Medicare funded by private insurance companies?

Medicare is funded through a mix of general revenue and the Medicare levy. The Medicare levy is currently set at 1.5% of taxable income with an additional surcharge of 1% for high-income earners without private health insurance cover.

Is Original Medicare federally funded?

Original Medicare is provided by the federal government and covers inpatient and home health care (Part A), as well as medically necessary services (Part B). Seniors can also choose Medicare Advantage plans through approved private insurance companies.

How is Medicare Part A paid for?

You pay a deductible and coinsurance costs for Medicare Part A services when you receive inpatient or skilled nursing care. There are state programs, called Medicare savings programs, that can help you cover the costs of your coinsurance and deductibles for Medicare Part A, if you're eligible.

How does Medicare get money?

Medicare gets money from two trust funds : the hospital insurance (HI) trust fund and the supplementary medical insurance (SMI) trust fund. The trust funds get money from payroll taxes, as allowed by the Federal Insurance Contributions Act (FICA) enacted in 1935.

How much did Medicare spend in 2019?

According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

How much is the Medicare deductible for 2020?

A person enrolled in Part A will also pay an inpatient deductible before Medicare covers services. Most recently, the deductible increased from $1,408 in 2020 to $1,484 in 2021. The deductible covers the first 60 days of an inpatient hospital stay.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is a HI trust fund?

The HI trust fund covers the services provided through Medicare Part A, which pays for inpatient hospital stays and care, including nursing care, meals, and a semi-private room. Part A also covers skilled nursing care, hospice services, and home health.

What is Medicare for adults?

Medicare is the federal healthcare program for adults aged over 65, adults with disabilities, and people with end stage renal disease. The program provides coverage for inpatient and outpatient services, and prescription drugs. Medicare gets money from two trust funds: the hospital insurance (HI) trust fund and the supplementary medical insurance ...

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How Is Medicare Funded?

According to the Henry J. Kaiser Family Foundation (KFF), spending on Medicare accounted for 15 percent of the federal budget in 2015. The KFF further reveals that Medicare funding comes from three primary sources:

Where does Medicare money come from?

General revenue: This part of Medicare funding comes primarily from federal income taxes that Americans pay.

What Is Medicare?

The U.S. government created Medicare to offer health care insurance for retired Americans. Until the Affordable Care Act went into effect, many citizens could only receive health insurance through their employers. After they retired, citizens needed a way to continue paying for doctors’ visits, trips to the emergency room, prescription medications, and other health care costs. Medicare fills that need for those who need it.

How much do employees pay for FICA?

Self-employed professionals pay the full amount for both employees and employers, which means that they devote 2.9 percent of their earnings toward FICA.

Does Medigap cover medical bills?

Medigap insurance, for example, can often help with medical bills. Depending on the Medigap plan you choose, Medigap can cover expenses that Medicare does not cover by itself. A Medigap plan can reduce the amount of money you pay out of pocket for health care expenses so that you don’t have to worry about using your retirement savings to pay for expenses.

Will Medicare Funding Run Out?

Many people worry that Medicare funding will run out. However, in its current status, Medicare will be able to fund Part A health care expenses for beneficiaries through 2028. Additionally, the program can adjust for inflation and increase deductions to fund the program well into the 2030 decade.

Additional Cares Act Funding

On March 27, 2020, former President Donald Trump signed the CARES Acta $2 trillion coronavirus emergency relief package into law. A sizable chunk of those funds$100 billionwas earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19.

How Is The Delivery System Organized And How Are Providers Paid

Physician education and workforce: Most medical schools are public. Median tuition fees in 2019 were $39,153 in public medical schools and $62,529 in private schools.

How Is Medicare Financed

Medicare is funded primarily from general revenues , payroll taxes , and beneficiary premiums .

Judge Blocks Portions Of Centers For Medicare And Medicaid Services Vaccine Mandate

On November 5, 2021, the federal Centers for Medicare and Medicare Services issued an emergency regulation requiring that many types of health care facilities and providers that receive Medicare or Medicaid funds ensure that their staff, contractors, and volunteers receive at least their first COVID-19 vaccine dose by December 6, 2021 and be fully vaccinated by January 4, 2022.

How Medicare Is Funded

Medicare is funded by two trust funds that can only be used for the program. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits.

Disproportionate Share Hospital Payments

Medicaid is not exactly known for being generous when it comes to paying for health care. According to the American Hospital Association, hospitals are paid only 87 cents for every dollar spent by the hospital to treat people on Medicaid.

Overview Of Medicare Spending

Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2017, 30 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

How does Medicare get its funding?

Medicare funding comes from two trust funds, which are funded by tax revenue and premiums paid by Medicare beneficiaries

Where does Medicare money come from?

Technically, Medicare funding comes from the Medicare Trust Funds. Those are two separate funds — the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) Trust Fund — which each pay for different parts of the Medicare program. Money in those two funds can only go toward paying for Medicare.

What is the Medicare tax?

Some of these payroll taxes go toward paying your personal income taxes and some go toward FICA taxes. The Federal Insurance Contributions Act (FICA) requires all U.S. employers and employees to pay income taxes to help fund the federal insurance programs of Social Security and Medicare.

What is the Medicare trust fund?

The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’ s investments.

How is Medicare Part A paid?

Medicare Part A (hospital insurance) is paid through the HI Trust Fund. The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’s investments.

What is the surtax for Medicare?

If you have a high income, you may have to pay a surtax (an extra tax) called the Additional Medicare Tax. The surtax is 0.9% of your income and when you start paying it depends on your income and filing status. The table below has the thresholds for the Additional Medicare Tax in 2021.

How many people will be covered by Medicare in 2020?

The future of Medicare funding. As of July 2020, Medicare covers about 62.4 million people, but the number of beneficiaries is outpacing the number of people who pay into the program. This has created a funding gap.

How is Medicare funded?

Medicare is financed by multiple tax-funded trust funds, trust fund interest, beneficiary premiums, and additional money approved by Congress. This article will explore the various ways each part of Medicare is funded and the costs associated with enrolling in a Medicare plan. Share on Pinterest.

Where does Medicare Part D get its money from?

Although Medicare Part D receives some funding from the SMI trust fund , a portion of the funding for both Medicare Part D and Medicare Advantage (Part C) comes from beneficiary premiums. For Medicare Advantage plans in particular, any costs not covered by Medicare funding must be paid for with other funds.

What is Medicare Part D coinsurance?

Coinsurance. Coinsurance is the percentage of the cost of services that you must pay out of pocket. For Medicare Part A, the coinsurance increases the longer you use hospital services.

What is a deductible for Medicare?

Deductibles. A deductible is the amount of money that you pay before Medicare will cover your services. Part A has a deductible per benefits period, whereas Part B has a deductible per year. Some Part D plans and Medicare Advantage plans with drug coverage also have a drug deductible.

What is Medicare premium?

A premium is the amount you pay to stay enrolled in Medicare. Parts A and B, which make up original Medicare, both have monthly premiums. Some Medicare Part C (Advantage) plans have a separate premium, in addition to the original Medicare costs. Part D plans and Medigap plans also charge a monthly premium. Deductibles.

How much does Medicare Part A cost?

Medicare Part A costs. The Part A premium is $0 for some people, but it can be as high as $458 for others, depending on how long you worked. The Part A deductible is $1,408 per benefits period, which begins the moment you are admitted to the hospital and ends once you have been released for 60 days.

How many people did Medicare cover in 2017?

In 2017, Medicare covered over 58 million beneficiaries, and total expenditures for coverage exceeded $705 billion.

How is Medicare Financed?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7) .

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.