Things to know about Medicare Advantage Plans

- You're still in the Medicare Medicare is the federal health insurance program for: People who are 65 or older Certain younger people with disabilities People with End-Stage Renal Disease (permanent ...

- You still have Medicare rights and protections.

- You still get complete Part A and Part B coverage through the plan. ...

How to find doctors who accept your Medicare Advantage plan?

- Your plan may pay less toward your care. ...

- The fees for health services may be higher. ...

- Any amount you pay might not contribute to your plan deductible, if you have one.

- You may need preauthorization for any services you receive in order for any coverage to apply.

Why Choose Medicare Advantage over Original Medicare?

When relying solely on original Medicare, seniors can incur significant out-of-pocket costs after seeing a doctor or staying at the hospital. This is why many Medicare beneficiaries choose Medicare Advantage plans in order to improve their health care coverage.

Who has the best Medicare Advantage plan?

- Best Medicare Advantage Plan Providers

- Compare Medicare Advantage Plans

- What is a Medicare Advantage Plan

- Medicare Law and Medicare Advantage Plans

- Best Medicare Insurance Providers 1. ...

- Pros + Cons of Medicare Advantage Plans Advantages of Medicare Part C Disadvantages of Medicare Part C

- How to Compare Medicare Advantage Plans

Does Medicare Advantage offer much advantage?

Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

Is Medicare Advantage available to everyone?

Over 24 million Americans have chosen to get their Medicare benefits through a Medicare Advantage (Part C) healthcare plan. Anyone who is eligible for Part A and Part B can enroll in a Medicare Advantage plan.

What patient population is generally excluded from joining a Medicare Advantage plan?

End-Stage Renal DiseasePeople with End-Stage Renal Disease (permanent kidney failure) generally can't join a Medicare Advantage Plan. How much do Medicare Advantage Plans cost? In addition to your Part B premium, you usually pay one monthly premium for the services included in a Medicare Advantage Plan.

Is Medicare Advantage based on your income?

Unlike Original Medicare Plan B, Medicare Advantage premiums are not based on income but rather the options offered within a particular plan. Plans that limit coverage to standard Plan A and Plan B offerings may have little to no additional premium.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

Can you be denied coverage for a Medicare Advantage plan?

When Can a Medicare Plan Deny Coverage? Coverage can be denied under a Medicare Advantage plan when: Plan rules are not followed, like failing to seek prior approval for a particular treatment if required. Treatments provided were not deemed to be medically necessary.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

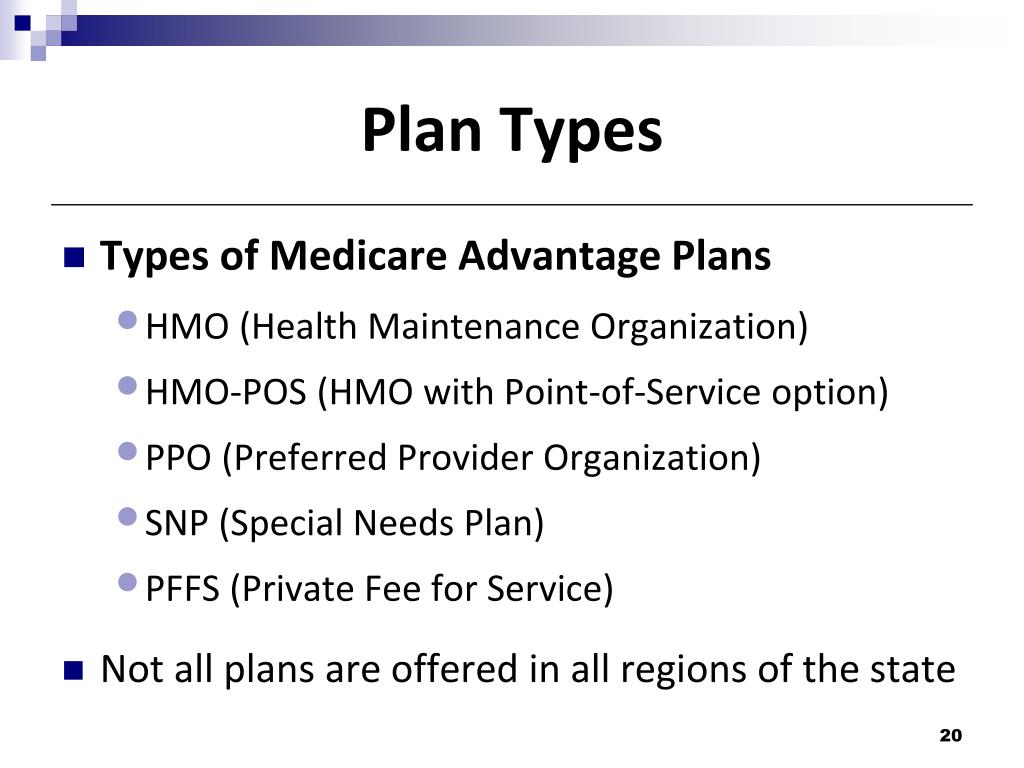

Is eligibility for all Medicare Advantage plans the same?

No, not all Medicare Advantage plan eligibility is the same. Some plans, called Special Needs Plans (SNPs) have very specific eligibility standards...

What if I can’t afford the plan I want?

If you’ve found a Medicare Advantage plan that seems to suit you but you are worried that you cannot afford its premiums or other costs, you may be...

Do all Medicare Advantage plans include prescription drug coverage?

Many Medicare Advantage plans include coverage for Medicare Part D (Prescription Drug Coverage). However, this coverage is not mandatory, so some p...

How should I decide which Medicare Advantage plan is right for me?

Deciding which MA plan is right for you can require quite a bit of time and thought. All MA plans must offer coverage that’s roughly equal to or be...

What is Medicare Advantage?

Medicare Advantage plans provide a way to get Medicare coverage from a quality private insurance company rather than directly from the government.

How many Medicare Advantage plans are there in New York City?

As of March 2020, in New York City there are 50 Medicare Advantage plan choices. Options in less populous areas are likely to be far more limited, with moderately populated locations offering perhaps 20 to 25 options. Some extremely rural areas may have only one or two plan options.

Why are Medicare Advantage plans considered SNPs?

SNPs exist because Medicare allows insurance companies to create plans catering to specific groups of people with complex health and/or financial needs. These plans can often serve some patients more efficiently than a plan for general use can. Of course, to use an SNP a senior must actually have the need to which the plan caters. Insurance companies are never required to offer SNPs, so their availability can vary dramatically by region.

What is a dual eligible SNP?

Dual Eligible SNP (D-SNP): Many low-income and/or disabled seniors are simultaneously eligible for both Medicare and Medicaid. These individuals are referred to as “dual eligible.”. They can sign up for a Dual Eligible SNP (D-SNP) that is uniquely designed to help them understand their coverage under both programs.

What are the conditions that Medicare covers?

Specific Conditions: Medicare addresses two specific health conditions in its eligibility standards: Amyotrophic Lateral Sclerosis (commonly called ALS or Lou Gehrig’s Disease) and End-Stage Renal Disease. These are both disabling conditions, and those who have ESRD or ALS can begin receiving Medicare without waiting for their 25th month of collecting disability.

How to find out which Medicare plans are available to seniors?

To find out which plans are available to seniors in your area, you can use the Health Plan Finder. This tool allows you to search for Medicare Advantage plans, Prescription Drug plans (which often come with Medicare Advantage), and Medigap plans (which are not Medicare Advantage and which can only be used with Original Medicare). When you use this tool, you’ll be shown available plans based on your zip code.

How long is open enrollment for Medicare?

When added together, open enrollment periods account for roughly 4.25 months of each year. The two different open enrollment periods have slightly different rules. During the first one seniors can join a Medicare Advantage plan for the first time, switch from one plan to another, or switch back to Original Medicare.

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan and Medicare share the difference between the bid and the benchmark ; the plan's share of this amount is known as a "rebate," which must be used by the plan's sponsor to provide additional benefits or reduced costs to enrollees.

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

How many people will be on Medicare Advantage in 2020?

Enrollment in the public Part C health plan program, including plans called Medicare Advantage since the 2005 marketing period, grew from zero in 1997 (not counting the pre-Part C demonstration projects) to over 24 million projected in 2020. That 20,000,000-plus represents about 35%-40% of the people on Medicare.

How much does Medicare pay in 2020?

In 2020, about 40% of Medicare beneficiaries were covered under Medicare Advantage plans. Nearly all Medicare beneficiaries (99%) will have access to at least one Medicare Advantage ...

How much has Medicare Advantage decreased since 2017?

Since 2017, the average monthly Medicare Advantage premium has decreased by an estimated 27.9 percent. This is the lowest that the average monthly premium for a Medicare Advantage plan has been since 2007 right after the second year of the benchmark/framework/competitive-bidding process.

When did Medicare start providing prescription drugs?

Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information, you may wish to visit the Prescription Drug Coverage site.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. ( Note: If you have Lou Gehrig's disease, your Medicare benefits begin the first month you get disability benefits.)

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Who Should Consider Medicare Advantage for Financial Reasons?

Medicare Advantage plans are designed with multiple features that can save seniors money in the long run. Which features save you the most money depends on your typical use of medical services. Below you can learn about the kinds of seniors that will save the most money by switching to Medicare Advantage.

How much does Medicare Advantage cost?

The average Medicare Advantage enrollee who gets prescription drug coverage pays just $36 for their health plan premium (s). This is a very reasonable cost, and many seniors would be willing to pay even more than that if it meant quality coverage. However, it’s important to remember that to get Medicare Advantage, seniors also need to pay their Original Medicare premiums. Most seniors will owe a Part B premium of approximately $145 and a Part A premium of $0 in 2020. However, those with high incomes and those who did not pay into the Medicare system via taxes for an extended period of time while they worked may have higher premiums for Parts A or B.

What is Medicare with Medigap?

Original Medicare with Medigap: Medigap is supplemental insurance offered by private companies that is designed to cover Medicare deductibles, copays, and coinsurance. Coverage for these items can be partial or full, depending on the plan. Seniors pay a monthly premium in exchange for the Medigap policy covering many of their out-of-pocket expenses. There are several kinds of Medigap plans which are heavily regulated by the federal and state governments. Learn more about plan types here .

What is ESRD in Medicare?

End-Stage Renal Disease (ESRD, kidney failure) is the final stage of kidney disease in which a patient becomes dependent on dialysis and needs a transplant. Kidney disease leading to ESRD can be caused by a variety of factors including uncontrolled diabetes, high blood pressure, genetic diseases, autoimmune disorders, and more. Those who are diagnosed with ESRD have special opportunities to join Original Medicare even if they otherwise would not be old enough. You can read about how ESRD affects Original Medicare eligibility if you’d like to learn more. Despite the increased likelihood of being eligible for Original Medicare, however, those who have ESRD have unusually limited opportunities to join a Medicare Advantage plan.

How many stars are Medicare Advantage plans?

Medicare has created a rating system so that patients can see how Medicare Advantage plans perform. A plan rating, which is always between one and five stars, can be clearly seen on the right-hand corner of the plan details on the plan finder. According to a recent CMS study, 81% of Medicare Advantage enrollees are in plans that have a rating of four stars or better in 2020. If you’re looking for a plan in your area, and you realize that the only plans available have ratings of three stars or lower, you’ll want to think seriously about whether or not those plans will be valuable to you.

Does Medicare cover mental health?

According to a 2012 study, about one in five seniors struggle with a mental illness and/or a substance use disorder. In many cases, poor health and problems with mobility, chronic pain, and social isolation can exacerbate underlying mental health and substance abuse issues. Original Medicare, in recognition of mental health struggles in older populations, provides many options for mental healthcare, including depression screenings, wellness visits, psychotherapy, and more. For many patients, the level of mental health care provided by Original Medicare may be enough. However, for seniors who have had serious, chronic difficulty with managing their mental health successfully, turning to a Medicare Advantage Chronic Condition Special Needs Plan (C-SNP) may offer the extra support required.

Does Medicare cover prescriptions?

Original Medicare covers very few prescription drugs. Part B of Original Medicare covers prescriptions that are typically given in the doctor’s office- things like specialized infusions, injections, antigens, and blood-clotting medication. However, it does not usually cover medications that one takes at home on a regular basis. With 45% of seniors in 2019 who were in fair to poor health saying that they found paying for their prescription drugs “difficult,” it’s clear that many seniors need help with purchasing prescriptions. Seniors in need can find relief through Medicare Advantage plans, which, unlike Original Medicare, frequently include robust drug coverage (Part D).

:max_bytes(150000):strip_icc()/Blue_Cross_Sheild-cde3943ba00843159f80878f47a64cd2.jpg)