MEDICARE PART B PREMIUM AMOUNTS The standard Part B premium amount in 2018 will be $134 (or higher depending on your income). However, most people who get Social Security benefits will pay less than this amount.

How much does Medicare pay for Medicare Part B?

May 06, 2021 · Most people actually pay less than the standard Medicare Part B premium amount, which is determined by the federal government each year. In 2021, the standard Medicare Part B premium is $148.50. You might pay more if you have a high income. See details below. The standard premium also may apply to you if get both Medicare and Medicaid …

What if I Don't Pay my Medicare Part B premiums through social security?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022. While you don't technically get money back, you do pay the reduced premium ...

When are you eligible for Medicare Part B benefits?

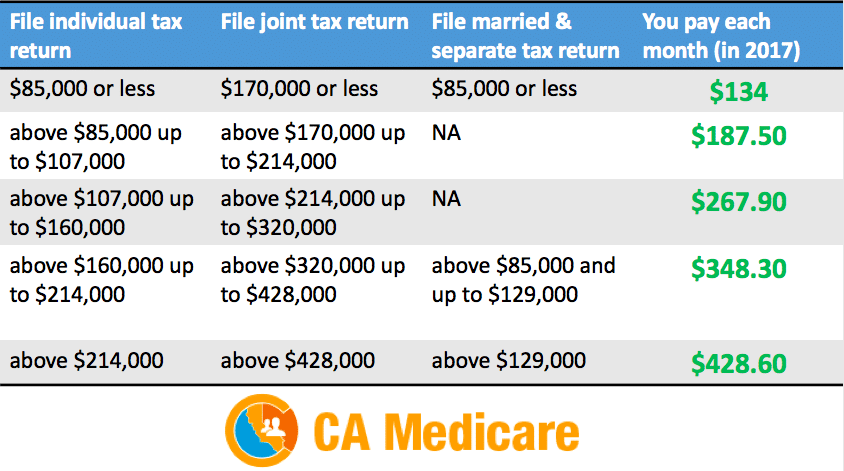

Jul 18, 2017 · The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount. This is because the Part B premium increased more than the cost-of-living increase for 2017 Social Security benefits. If you pay your Part B premium through your monthly Social Security benefit, …

What is the penalty for not enrolling in Medicare Part B?

Mar 03, 2017 · Answer: We’ll try. The 2017 premium is officially $134, but about 70% of beneficiaries (those receiving Social Security benefits in December and not subject to high-income surcharges) will pay much...

Do some people pay less for Medicare Part B?

Does everyone pay the same for Part B Medicare?

Who pays the 20% of a Medicare B claim?

Why is my husbands Medicare premium higher than mine?

Why is my Medicare Part B premium so high?

Does Medicare Part B pay for prescriptions?

Does Medicare B pay 100%?

Does Medicare Part B pay 80% of covered expenses?

Does Medicare Part B pay 80 percent?

Can husband and wife both pay Medicare Part B premiums?

Medicare considers you and your spouse's combined income (if you're married and file your income taxes jointly) when calculating Part B premiums. In most cases, you'll each pay the standard monthly Part B premium, which is $170.10 per month in 2022.Nov 19, 2021

What is Part B premium reduction?

Do both spouses pay Part B?

What Factors Can Affect My Medicare Part B Premium?

Most people actually pay less than the standard Medicare Part B premium amount, which is determined by the federal government each year. In 2018, t...

What Is The Medicare Part B Late Enrollment Penalty?

If you don’t sign up for Part B as soon as you’re eligible for Medicare, you might have to pay a late-enrollment penalty each month when you do enr...

How Will I Know How Much My Medicare Part B Premium Will be?

The Social Security Administration (SSA) – or the Railroad Retirement Board, if that applies to you – will tell you how much your Part B premium wi...

What happens if you delay enrollment in Part B?

If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see below.

When do you have to be enrolled in Medicare?

Most people who are eligible for Medicare are automatically enrolled in Original Medicare (Part A and Part B) at age 65, if they’re receiving Social Security or Railroad Retirement Board benefits. Some are enrolled when they are diagnosed with a qualifying illness or disability before age 65 and receive Social Security disability benefits.

What happens if you don't sign up for Medicare?

If you don’t sign up for Part B as soon as you’re eligible for Medicare, you might have to pay a late-enrollment penalty each month when you do enroll into Part B, for as long as you get Medicare Part B benefits. The penalty adds 10% to your Part B premium for each year (12-month period) that you could have signed up for Part B, but didn’t enroll.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B premium is $148.50.

Do you pay more for Medicare if you have high income?

You might pay more if you have a high income. See details below. The standard premium also may apply to you if get both Medicare and Medicaid benefits, but your state may pay the standard Medicare Part B premium if you qualify. If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see ...

Is Medicare Part B automatically deducted from Social Security?

In most cases, your Medicare Part B premium is automatically deducted from your benefits payment, which makes managing your premium payment easy. If you’re billed for your Part B premium each month (that is, if it’s not automatically deducted from your Social Security benefits), your premium payment might be somewhat higher than if it were ...

Do you have to pay late enrollment penalty for Part B?

If you qualify for a Special Enrollment Period to enroll in Part B, you may not have to pay a late-enrollment penalty. For example, if you delayed Part B enrollment because you were still covered by an employer’s plan (either your employer or your spouse’s), you might qualify for an SEP when you can enroll in Part B without a penalty.

What happens if you don't pay Medicare Part B?

If you don't pay your monthly Medicare Part B premiums through Social Security, the giveback benefit would be credited to your monthly statement. Instead of paying the full $148.50, you'd only pay the amount with the giveback benefit deducted.

How to find Part B buy down?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B monthly premium is $148.50. Beneficiaries also have a $203 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What does it mean to be dually eligible for Medicare?

If you're dually eligible, it means you have both Medicare and Medicaid.

Can you enroll in Medicare Advantage if you have Medicaid?

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Does Medicare give back Medicare?

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Do retirees get Medicare Part B?

However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

How much is Medicare Part B for 2017?

The basic premium for Medicare Part B for someone who signs up this year is $134 a month.

How to contact Social Security about overpayment?

We’ve heard that the most efficient way to handle this is to call Social Security (800-772-1213) to set up a face-to-face meeting at a local office. If you wind up paying the surcharge for a month or two before your appeal is approved, Social Security will reimburse you for the overpayment. health insurance. Medicare.

How much is Social Security premium for 2017?

The 2017 premium is officially $134, but about 70% of beneficiaries (those receiving Social Security benefits in December and not subject to high-income surcharges) will pay much less, averaging about $109.

Can you reduce COLA benefits below December?

The rising premium offsets the COLA, but it can’t reduce the benefit below December’s level. Those who start receiving benefits in 2017 will pay $134 a month, because they’re not protected by the “benefits can’t go down” rule, unless that is, their income is high enough to trigger a surcharge.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How to appeal Social Security monthly adjustment?

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration (Form SSA-561-U2) or contact your local Social Security office to file an appeal.

Does Medicare Part B premium change?

You probably know that your Medicare Part B premium can change each year. Do you know why? Or how the amount is calculated? Or why it may increase?

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.