You can qualify for Medicare Advantage if:

- You live in a region that’s served by the Medicare Advantage plan in which you want to enroll

- You’re already registered in Original Medicare Parts A and B and have a Medicare number

- You’re not enrolled in a Medigap plan

Who qualifies for a Medicare Advantage plan?

- All-Dual

- Full-Benefit

- Medicare Zero Cost Sharing

- Dual Eligible Subset

- Dual Eligible Subset Medicare Zero Cost Sharing Who is eligible for a DSNP? ...

- You must be a United States citizen or have been a legal resident for at least five years.

- You must be 65 years old or have a qualifying disability if younger than 65.

Who can join a Medicare Advantage plan?

What you should know

- Medicare Advantage is a private Medicare plan, also referred to as Medicare Part C or MA plans.

- Medicaid is offered to those who meet low-income eligibility and covers additional health services that are not covered by Medicare.

- “Dual eligibles” can have both Medicare Advantage and Medicaid at the same time.

What are the pros and cons of Medicare Advantage plans?

Medicare Advantage Plans have pros and cons when compared to Original Medicare. Benefits include better coverage and the potential for lower premiums. Cons include less stability than Original Medicare and rules that govern coverage.

Is Medicare better than Advantage plans?

Traditional Medicare and Medicare Advantage enrollees have historically had different characteristics, with Medicare Advantage enrollees somewhat healthier. 4 Black and Hispanic beneficiaries and those with lower incomes have tended to enroll in Medicare Advantage plans at higher rates than others. 5 Traditional Medicare has historically performed better on beneficiary-reported metrics, such as provider access, ease of getting needed care, and overall care experience. 6

Is Medicare Advantage available to everyone?

Over 24 million Americans have chosen to get their Medicare benefits through a Medicare Advantage (Part C) healthcare plan. Anyone who is eligible for Part A and Part B can enroll in a Medicare Advantage plan.

What patient population is generally excluded from joining a Medicare Advantage plan?

End-Stage Renal DiseasePeople with End-Stage Renal Disease (permanent kidney failure) generally can't join a Medicare Advantage Plan. How much do Medicare Advantage Plans cost? In addition to your Part B premium, you usually pay one monthly premium for the services included in a Medicare Advantage Plan.

Can I be turned down for a Medicare Advantage plan?

Generally, if you're eligible for Original Medicare (Part A and Part B), you can't be denied enrollment into a Medicare Advantage plan. If a Medicare Advantage plan gave you prior approval for a medical service, it can't deny you coverage later due to lack of medical necessity.

What is the difference between Medicare Advantage and Original Medicare?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is excluded from a Medicare Advantage plan?

Non-medical services, including a private hospital room, hospital television and telephone, canceled or missed appointments, and copies of x-rays. Most non-emergency transportation, including ambulette services. Certain preventive services, including routine foot care.

Can you switch back to traditional Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Is Medicare Advantage cheaper than Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

Does Medicare Advantage cost more than Medicare?

Medicare spending for Medicare Advantage enrollees was $321 higher per person in 2019 than if enrollees had instead been covered by traditional Medicare. The Medicare Advantage spending amount includes the cost of extra benefits, funded by rebates, not available to traditional Medicare beneficiaries.

Is eligibility for all Medicare Advantage plans the same?

No, not all Medicare Advantage plan eligibility is the same. Some plans, called Special Needs Plans (SNPs) have very specific eligibility standards...

What if I can’t afford the plan I want?

If you’ve found a Medicare Advantage plan that seems to suit you but you are worried that you cannot afford its premiums or other costs, you may be...

Do all Medicare Advantage plans include prescription drug coverage?

Many Medicare Advantage plans include coverage for Medicare Part D (Prescription Drug Coverage). However, this coverage is not mandatory, so some p...

How should I decide which Medicare Advantage plan is right for me?

Deciding which MA plan is right for you can require quite a bit of time and thought. All MA plans must offer coverage that’s roughly equal to or be...

What is Medicare Advantage?

Medicare Advantage plans provide a way to get Medicare coverage from a quality private insurance company rather than directly from the government.

How many Medicare Advantage plans are there in New York City?

As of March 2020, in New York City there are 50 Medicare Advantage plan choices. Options in less populous areas are likely to be far more limited, with moderately populated locations offering perhaps 20 to 25 options. Some extremely rural areas may have only one or two plan options.

What is a dual eligible SNP?

Dual Eligible SNP (D-SNP): Many low-income and/or disabled seniors are simultaneously eligible for both Medicare and Medicaid. These individuals are referred to as “dual eligible.”. They can sign up for a Dual Eligible SNP (D-SNP) that is uniquely designed to help them understand their coverage under both programs.

How long is open enrollment for Medicare?

When added together, open enrollment periods account for roughly 4.25 months of each year. The two different open enrollment periods have slightly different rules. During the first one seniors can join a Medicare Advantage plan for the first time, switch from one plan to another, or switch back to Original Medicare.

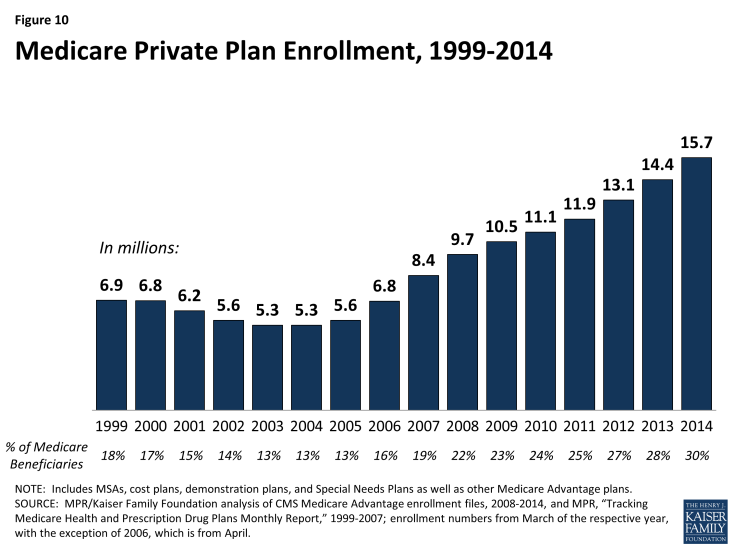

How much has Medicare increased in 2019?

According to a recent study by J.D. Powers, enrollment in Medicare Advantage plans increased by almost 10% between 2018 and 2019.

When can seniors switch to 5 star Medicare?

Medicare also allows plan changes due to the “5-star special enrollment period.”. Every year between December 8th and November 30th seniors can move from a Medicare Advantage plan they already have to a 5-star Medicare Advantage plan if one is offered in their area.

Can I use Medicare Advantage if I have ESRD?

However, those with the preexisting condition ESRD may not be eligible for any Medicare Advantage plan except for a C-SNP. Those who don’t have access to a C-SNP that accepts ESRD patients will most likely need to use Original Medicare instead of Medicare Advantage.

How much is Medicare Advantage?

There is no premium for Part A, but there is for Part B. In 2019, that was set at a standard of $135.50 or higher, depending on income level. In addition to any premiums that are ...

How old do you have to be to get Medicare?

Generally, you can get Medicare if one of these conditions applies: You are at least 65 years old. You are disabled and receive Social Security Disability Insurance (SSDI) or Railroad Retirement disability payments. You have End-Stage Renal Disease, or ESRD.

What are the benefits of Medicare Part B?

Medicare Part B builds on the benefits of Part A by providing the following coverages: 1 Doctor visits 2 Lab tests 3 Ambulance services 4 Durable medical equipment, like blood sugar monitors, crutches, or wheelchairs 5 Mental health care, including inpatient and outpatient services and partial hospitalization 6 Some limited outpatient prescription drugs, including those you would get in a hospital or outpatient setting as opposed to those you’d give yourself. This includes flu shots and other vaccinations, as well as transplant drugs, and those for end-stage renal disease.

Is there a single way to sign up for Medicare Advantage?

Every Medicare Advantage plan has its own requirements and processes, and thus there’s no single way to sign up. Your first task is to find out what coverage plans are accessible in your area and compare the benefits of the plans with the benefits you’d have in Original Medicare.

Does Medicare cover kidney transplants?

Many Medicare Advantage plans will not cover you if you have permanent kidney failure that requires regular dialysis, or if you’ve had a kidney transplant. You’ll need to talk to a membership coordinator at the company you’re interested in working with to see if they will cover you, if you are in this situation.

Does Medicare Advantage cover hospice?

The only part of the Original Medicare coverage that is not necessarily covered by Medicare Advantage is hospice care, but don’t worry: even if you’re with Medicare Advantage, you can still access the Original Medicare hospice coverage.

How old do you have to be to get Medicare?

People can enroll in Original Medicare if they are 65 years of age or older and are a citizen of the United States or have been a legal permanent resident for at least 5 years. Specific rules apply to those younger than 65 who have certain illnesses or disabilities. Read more about eligibility under the age of 65 here.

How long do you have to be a resident to qualify for Medicare?

They must also be a U.S. citizen or have been a legal permanent resident for at least 5 years.

What is Medicare Part C?

Medicare Part C, or Medicare Advantage, provides an alternative way for individuals with Medicare Parts A and B to receive their benefits. Medicare contracts private insurance companies to administer Medicare Part C plans.

What is a SNP plan?

Medicare has designed SNPs specifically for people who have particular health needs. The eligibility criteria for an SNP depends on the health conditions that the plan covers. SNP membership is available to individuals who: live in certain institutions, such as a nursing home.

What is the enrollment period for Medicare?

The Medicare initial enrollment period (IEP) begins from 3 months before a person turns 65 and lasts for 7 months. During this enrollment period, a person can enroll in: 1 Medicare Parts A and B 2 Medicare Part C (Medicare Advantage) 3 Medicare Part D

What is a medical savings account?

Medical Savings Accounts. A Medical Savings Account (MSA) plan allows the insured person to choose their healthcare services and providers. An MSA has two parts. The first part is a health plan that covers costs once the insured person has met a high yearly deductible. The second part is a Medical Savings Account.

When is the AEP for Medicare?

It is also called the annual enrollment period or Medicare open enrollment. The AEP dates run from October 15 through December 7.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).