How much does Medicare cost at age 65?

Jul 01, 2021 · Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare. The Additional Medicare Tax goes toward funding features of...

Who qualifies for Medicare extra help?

Feb 02, 2022 · February 2, 2022. Learn about the additional benefits you could get by switching to Medicare Advantage. Original Medicare (Medicare Part A and Part B) helps cover some hospital and medical costs for people age 65 and older and people younger than 65 who have a qualifying disability or medical condition.

What is SSA extra help?

On Nov. 26, 2013, the IRS issued final regulations ( TD 9645 PDF) implementing the Additional Medicare Tax as added by the Affordable Care Act (ACA). The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and …

What are Medicare extra benefits?

If you are a high earner, you are subject to the 0.9% additional Medicare tax on earned income in excess of the threshold amount. The threshold amounts are based on your filing status: Single, head of household, or qualifying widow (er) — $200,000 Married filing jointly — $250,000 Married filing separately — $125,000

How do you qualify to get $144 back from Medicare?

- Are enrolled in Part A and Part B.

- Do not rely on government or other assistance for your Part B premium.

- Live in the zip code service area of a plan that offers this program.

- Enroll in an MA plan that provides a giveback benefit.

What are the extra Medicare benefits?

Who is eligible for Medicare Part B reimbursement?

What is the give back benefit for Social Security?

What is the income limit for extra help in 2021?

What is the income limit for extra help in 2022?

Is Medicare Part B ever free?

How do I get my Part B premium back?

- If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.

- If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.

Can you claim Medicare Part B on your taxes?

Will Social Security get a $200 raise in 2021?

Can you have Medicare and Humana at the same time?

Why does zip code affect Medicare?

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How much does Medicare pay?

Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings. Self-employed people pay the entire 2.9 percent on their own.

When did Medicare tax increase?

The Additional Medicare Tax has been in effect since 2013. Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare. The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

What are the benefits of the Affordable Care Act?

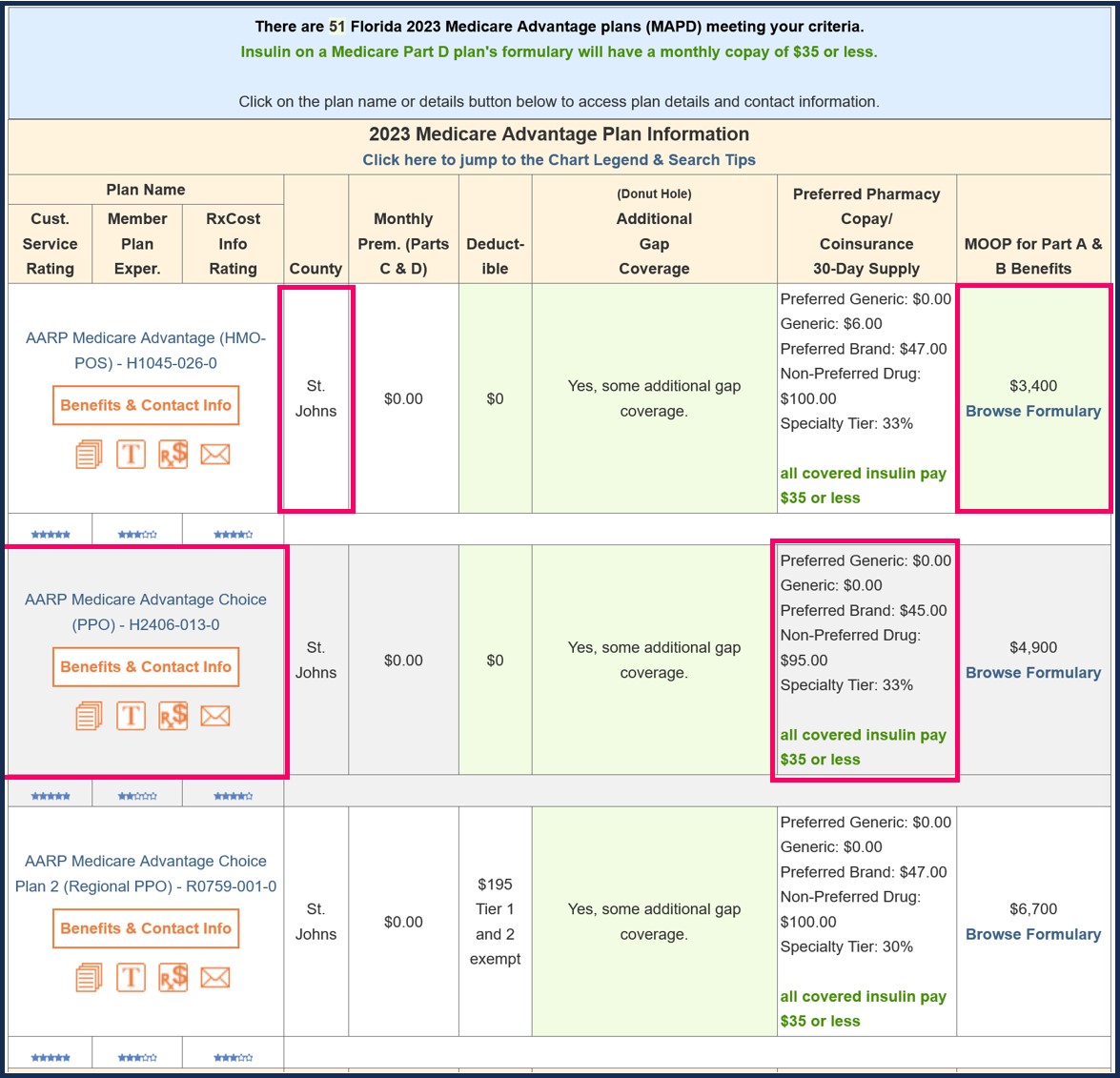

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How to speak to a licensed insurance agent about Medicare Advantage?

Medicare Advantage deductibles and coinsurance vary by plan. You can speak with a licensed insurance agent at. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week to learn more.

Does Medicare Advantage have to be the same as Original Medicare?

Every Medicare Advantage plan must provide at least the same minimum benefits as Original Medicare, but they may include additional benefits not covered by Medicare Part A or Part B, such as:

What are the benefits of Medicare Advantage?

Beginning in 2019, some Medicare Advantage plans began offering additional benefits such as transportation to doctor's appointments, bathroom grab bars and home-delivered healthy meals. And in 2020, some Medicare Advantage plans are offering new benefits to beneficiaries with chronic illnesses.

Does Medicare cover prescription drugs?

Prescription drug coverage. Many Medicare Advantage plans provide coverage for prescription drugs. In addition to your Medicare Advantage out-of-pocket costs, you’ll typically pay a copayment or coinsurance for covered drugs. Specific drug costs will vary depending on the plan’s formulary (a list of drugs the plan covers) and the tier ...

Does Medicare cover dental insurance?

If you’re enrolled in a Medicare Advantage plan that covers dental, you will pay a coinsurance (a percentage of the total cost) for covered dental services once your deductible is met. Specific coinsurance amounts will vary by plan.

Do you have to pay Medicare Part B premium?

Part B premium. Even with Medicare Advantage, you will have to pay the Medicare Part B premium. Medicare Advantage premium. Medicare Advantage premium amounts vary from plan to plan, but some MA plans have monthly premiums as low as $0. Deductibles and coinsurance.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Can you combine wages with Medicare?

No. Wages paid by an agent with an approved Form 2678 on behalf of an employer are not combined with wages paid to the same employee by any of the above other parties in determining whether to withhold Additional Medicare Tax.

Can an employer combine wages to determine if you have to withhold Medicare?

No. An employer does not combine wages it pays to two employees to determine whether to withhold Additional Medicare Tax. An employer is required to withhold Additional Medicare Tax only when it pays wages in excess of $200,000 in a calendar year to an employee.

When was Medicare added to the ACA?

On Nov. 26, 2013, the IRS issued final regulations ( TD 9645 PDF) implementing the Additional Medicare Tax as added by the Affordable Care Act (ACA). The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

Do tips get taxed on Medicare?

Yes. Tips are subject to Additional Medicare Tax, if, in combination with other wages , they exceed the individual’s applicable threshold. Tips are subject to Additional Medicare Tax withholding, if, in combination with other wages paid by the employer, they exceed the $200,000 withholding threshold.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

Does Medicare withhold income tax?

No. Additional Medicare Tax withholding applies only to wages paid to an employee that are in excess of $200,000 in a calendar year. Withholding rules for this tax are different than the income tax withholding rules for supplemental wages in excess of $1,000,000 as explained in Publication 15, section 7.

Does an employer withhold Medicare tax on tips?

An employer withholds Additional Medicare Tax on the employee’s reported tips from wages it pays to the employee.

What is Medicare tax?

What is the Additional Medicare Tax? Medicare is a federal health insurance program consisting of three parts (A, B, and D). Most people don’t pay for Medicare Part A (hospital insurance) because its funded by taxpayer contributions to the Social Security Administration.

Why don't people pay for Medicare?

Most people don’t pay for Medicare Part A (hospital insurance) because its funded by taxpayer contributions to the Social Security Administration. Employees pay 1.45% of their earnings, employers pay another 1.45%, and self-employed individuals pay the full 2.9% on their own.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans include Part D prescription drug coverage, but be sure to read your plan documents to understand what medications are covered, if any, and your financial responsibility for covered medications, since this can vary greatly from plan to plan.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is simply an alternate way of getting your benefits under Original Medicare (Part A and Part B). There are many different Medicare Advantage benefits available depending on the plan you choose.

Does Medicare cover eye exams?

Original Medicare does not cover routine eye exams or prescription eye glasses except in certain limited situations. However, depending on where you live, you may have Medicare Advantage benefits for routine vision care, prescription eyewear, and contact lenses. Dental care.

What is a personal emergency response system?

Personal emergency response system to notify emergency personnel in the event of fall or other medical event. Telemedicine or other remote health services, including a nursing hotline; in some cases, you may also qualify for remote monitoring devices.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a health care provider?

Tell your doctor and other. health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. about any changes in your insurance or coverage when you get care.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a multi-employer plan have?

At least one or more of the other employers has 20 or more employees.

Does Medicare tax self employed?

The new Medicare tax also affects self-employed individuals who earn over a specific amount. If you are both an employee and self-employed, all sources of earned income (as opposed to investment income) are combined to reach the levels where the Additional Medicare Tax is applicable.

What is the Medicare tax rate?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1.

Is fringe benefit taxable?

Some wages and fringe benefits are taxable to the employee for income tax purposes , but some wages may not be taxable to the employee for Social Security and Medicare taxes, including the Additional Medicare Tax. You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to ...

Who is Jean Murray?

Jean Murray, MBA, Ph.D., is an experienced business writer and teacher. She has written for The Balance on U.S. business law and taxes since 2008. The Additional Medicare Tax is owed by higher-income employees, and employers are responsible for withholding this tax and paying it to the Internal Revenue Service (IRS).

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What are the benefits of Medicare Advantage?

Medicare Advantage (also known as Part C) 1 Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. 2 Plans may have lower out-of-pocket costs than Original Medicare. 3 In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. 4 Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What is Medicare Extra Help?

This means that the amount of help a person receives from the government may vary as it depends on income and financial need. Medicare Extra Help could save an individual a substantial amount of money each year by helping them to pay for premiums, deductibles, and copayments.

What is Medicare Part D?

Medicare Part D is a plan that covers prescription drugs. The plan is also known as a prescription drug plan (PDP). When a person has a PDP, they must usually pay monthly premiums, copayments, and deductibles. Private insurance companies administer PDPs, and because of this, different benefits and coverage options may apply.

What is the FPL for Medicare?

The government uses the federal poverty level (FPL) to set its income limits. The level is set for each state every year, depending on the cost of living and average income. The income limit for Medicare Extra Help changes in line with the federal poverty level.

What is extra help?

Alternative options. Summary. Extra Help is a financial support program for those with Medicare. It helps people with limited resources manage the cost of prescribed drugs. An income limit is set which determines eligibility. Extra Help is also known as a low income subsidy (LIS). This means that the amount of help a person receives from ...

What is a SLMB?

Specified Low-Income Medicare Beneficiary (SLMB) programs help pay Part B premiums for those who have Part A and a limited income. Qualifying Individual (QI) programs help pay Part B premiums for those who have Part A and a limited income. A person must apply every year and cannot apply if they qualify for Medicaid.