Who qualifies for a Medicare Advantage plan?

- All-Dual

- Full-Benefit

- Medicare Zero Cost Sharing

- Dual Eligible Subset

- Dual Eligible Subset Medicare Zero Cost Sharing Who is eligible for a DSNP? ...

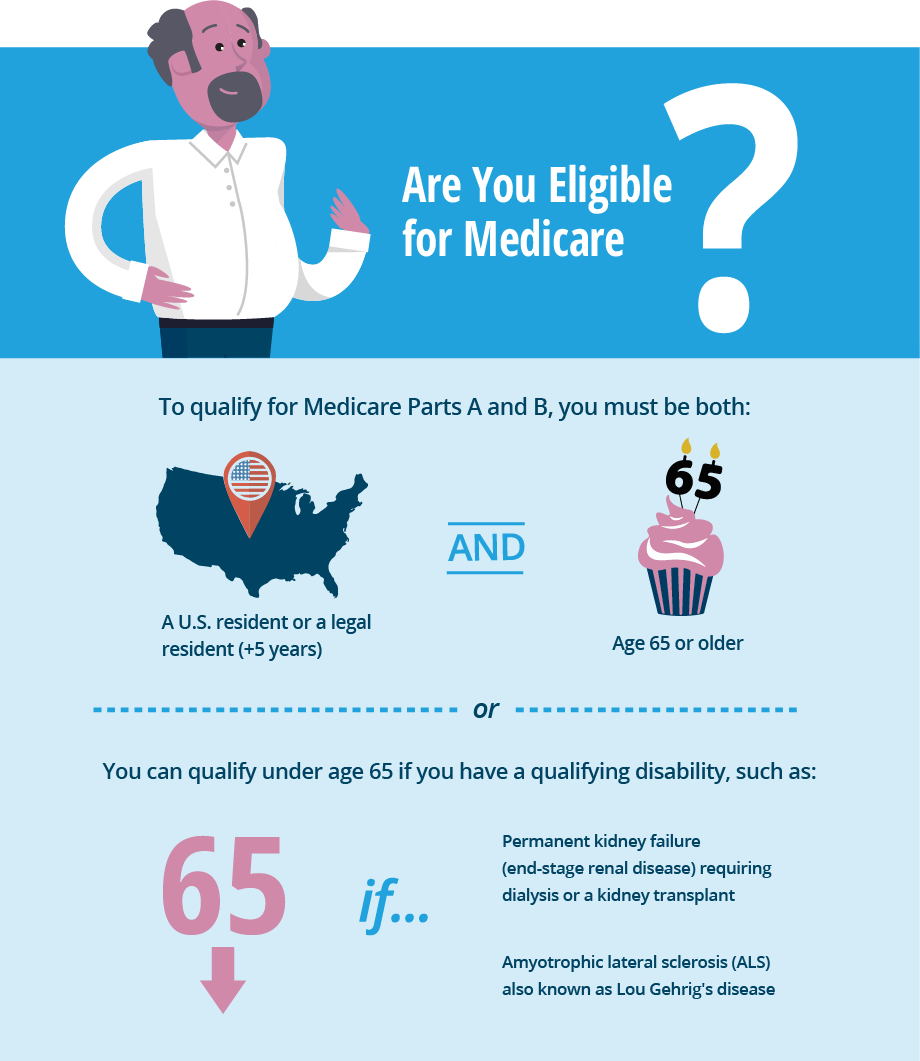

- You must be a United States citizen or have been a legal resident for at least five years.

- You must be 65 years old or have a qualifying disability if younger than 65.

Who qualifies for free Medicare?

- You’re eligible for or receive monthly benefits under Social Security or the railroad retirement system.

- You’ve worked long enough in a Medicare-covered government job.

- You’re the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or in a Medicare-covered government job.

Can you get Medicare at 62?

Your Medicare eligibility date, however, is later. You are eligible to sign up for both Medicare Part A and Part B at age 65, regardless of whether you have signed up for retirement income benefits yet. When you enroll in Social Security does, however, affect whether your Medicare enrollment is automatic or requires you to take action.

What are the qualifications for Medicare?

You qualify for full Medicare benefits if:

- You are a U.S. ...

- You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

- You or your spouse is a government employee or retiree who has not paid into Social Security but has paid Medicare payroll taxes while working.

Does everyone get Medicare Part A and B?

Anyone who is eligible for premium-free Medicare Part A is eligible for Medicare Part B by enrolling and paying a monthly premium. If you are not eligible for premium-free Medicare Part A, you can qualify for Medicare Part B by meeting the following requirements: You must be 65 years or older.

Does everyone get Medicare Part A at 65?

To be eligible for premium Part A, an individual must be age 65 or older and be enrolled in Part B. Enrollment in premium Part A and Part B can only happen at certain times. (The section titled Enrollment Periods and When Coverage Begins explains the times when someone can enroll).

Can you have Medicare Part A only?

Eligible people can choose to join Medicare Part A only, but it covers only hospital stay expenses. Delayed enrollment in Part A can mean a 10% increase to your premium when you do sign up. If you sign up for Part A only, a similar penalty applies to delayed enrollment in Part B.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who is not eligible for Medicare Part A?

Why might a person not be eligible for Medicare Part A? A person must be 65 or older to qualify for Medicare Part A. Unless they meet other requirements, such as a qualifying disability, they cannot get Medicare Part A benefits before this age. Some people may be 65 but ineligible for premium-free Medicare Part A.

What does Medicare type a cover?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Does Medicare Part A cover ambulance?

Part A covers hospital costs, including the ER, but doesn't cover the cost of an ambulance. Medicare Part A doesn't require referrals for specialists, so the specialists you may see in an emergency room will typically be covered. Most people don't pay for Medicare Part A.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

Does everyone have to pay for Medicare?

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don't pay a premium for Part A.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How to Enroll in Medicare and When You Should Start Your Research Process

Getting older means making more decisions, from planning for your kids’ futures to mapping out your retirement years. One of the most important dec...

Who Is Eligible to Receive Medicare Benefits?

Two groups of people are eligible for Medicare benefits: adults aged 65 and older, and people under age 65 with certain disabilities. The program w...

When Should You Enroll For Medicare?

Just because you qualify for something doesn’t mean you need to sign up, right? Not always. In the case of Medicare, it’s actually better to sign u...

Can You Delay Medicare Enrollment Even If You Are Eligible?

The short answer here is yes, you can choose when to sign up for Medicare. Even if you get automatically enrolled, you can opt out of Part B since...

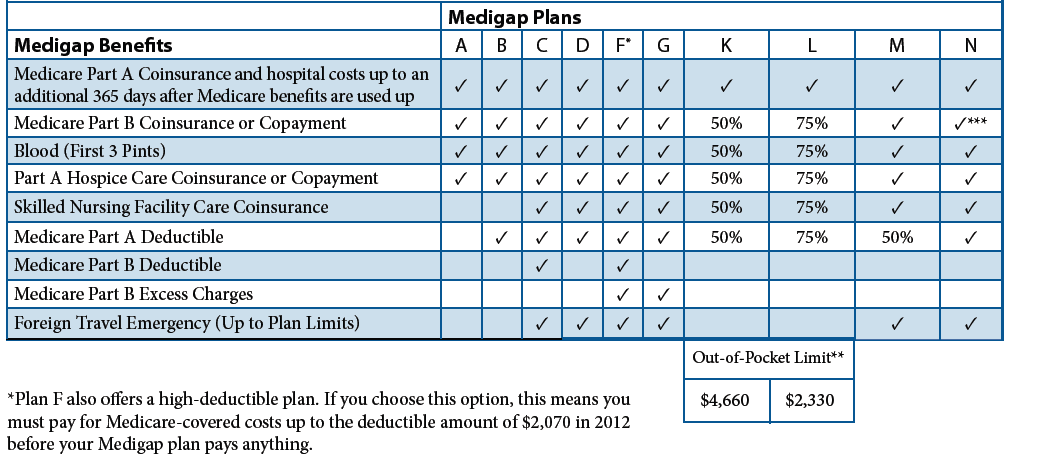

What About Medigap Plans?

Original Medicare covers a good portion of your care, but it’s not exhaustive. There’s a wide range of services that Parts A and B don’t cover, inc...

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

Who is eligible to receive Medicare benefits?

Two groups of people are eligible for Medicare benefits: adults aged 65 and older, and people under age 65 with certain disabilities. The program was created in the 1960s to provide health insurance for senior citizens. Older Americans had trouble finding affordable coverage, which spurred the government to create a program specifically for this portion of the population. It’s an entitlement program in that the federal government finances it to some degree, but it’s also supported and financed directly by the very people who use it. You’re eligible for Medicare because you pay for it, in one way or another.

How long do you have to be a US citizen to qualify for Medicare?

To receive Medicare benefits, you must first: Be a U.S. citizen or legal resident of at least five (5) continuous years, and. Be entitled to receive Social Security benefits.

What About Medigap Plans?

Original Medicare covers a good portion of your care, but it’s not exhaustive. There’s a wide range of services that Parts A and B don’t cover, including dental and vision care. About a third of Medicare enrollees choose the private version of the program – Medicare Advantage – because it tends to cover more than its original counterpart. But if you like the flexibility of original Medicare and don’t need the benefits that Advantage affords, but you still want additional coverage to offset your out-of-pocket costs, then consider adding a Medigap supplemental policy to your plan.

How long do you have to sign up for Medicare before you turn 65?

And coverage will start…. Don’t have a disability and won’t be receiving Social Security or Railroad Retirement Board benefits for at least four months before you turn 65. Must sign up for Medicare benefits during your 7-month IEP.

When do you sign up for Medicare if you turn 65?

You turn 65 in June, but you choose not to sign up for Medicare during your IEP (which would run from March to September). In October, you decide that you would like Medicare coverage after all. Unfortunately, the next general enrollment period doesn’t start until January. You sign up for Parts A and B in January.

How long does it take to enroll in Medicare?

If you don’t get automatic enrollment (discussed below), then you must sign up for Medicare yourself, and you have seven full months to enroll.

When does Medicare open enrollment start?

You can also switch to Medicare Advantage (from original) or join a Part D drug plan during the Medicare annual open enrollment period, which runs from October 15 through December 7 each year. Eligibility for Medicare Advantage depends on enrollment in original Medicare.

How to qualify for Medicare premium free?

To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child. To receive premium-free Part A, the worker must have a specified number of quarters of coverage (QCs) and file an application for Social Security or Railroad Retirement Board (RRB) benefits. The exact number of QCs required is dependent on whether the person is filing for Part A on the basis of age, disability, or End Stage Renal Disease (ESRD). QCs are earned through payment of payroll taxes under the Federal Insurance Contributions Act (FICA) during the person's working years. Most individuals pay the full FICA tax so the QCs they earn can be used to meet the requirements for both monthly Social Security benefits and premium-free Part A.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

When do you have to apply for Medicare if you are already on Social Security?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B. People living in Puerto Rico who are eligible for automatic enrollment are only enrolled in premium-free Part A.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

When do I sign up for Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.

What is Medicare Part A coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided in the U.S. without a break for at least five years. You’re eligible if you’re 65 and older or under age 65 with certain disabilities. You may also qualify at any age if you have end-stage renal disease or amyotrophic lateral sclerosis (also known as Lou Gehrig’s disease). Together with Medicare Part B, it makes up what is known as Original Medicare, the federally administered health-care program. Medicare Part A helps pay for the cost of inpatient hospital care, while Part B covers outpatient medical services.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

How old do you have to be to get Medicare?

Typically, you must be age 65 to enroll in Medicare. To receive Medicare Part A free of charge, you must meet the following criteria: You’ve worked and paid Medicare taxes at least 40 quarters or roughly 10 years. If your spouse worked, but you did not, you can still qualify.

How long does it take to get Medicare Part A?

For the most part, signing up for Medicare Part A depends on when you turn age 65. You have a 7-month time period during which you can enroll. You can enroll as early as 3 months before your birth month, during your birth month, and up to 3 months after your 65th birthday.

How long does Medicare cover inpatient hospital care?

After 90 days of inpatient hospital care, you enter what Medicare calls lifetime reserve days. Medicare covers 60 lifetime reserve days in total over your lifetime. After you meet your lifetime reserve days, you’re expected to pay all costs.

How much is Medicare Part A monthly?

Part A monthly premium. 40 quarters or more. $0. 30–39 quarters. $259. fewer than 30 quarters. $471. Of course, a free premium doesn’t mean you won’t pay anything for hospital care. There are other costs involved with Medicare Part A, several of which have increased for 2021.

How much is a deductible for Medicare 2021?

A deductible is the amount you pay out of pocket before Part A starts covering the costs of your care. In 2021, you’ll pay $1,484 for each benefit period. A benefit period starts the day you’re admitted as an inpatient to a hospital, skilled nursing facility, or any other inpatient facility.

What happens if you don't enroll in Medicare?

If you don’t enroll during this time period, you could face financial penalties that result in you having to pay more for your healthcare coverage. This also delays how fast your Medicare benefits begin.

What is Medicare Part A 2021?

What You Need to Know About Medicare Part A in 2021. Medicare Part A is the hospital coverage portion of Medicare. For many people who worked and paid Medicare taxes, Medicare Part A is free of charge, starting when you reach age 65.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Supplement Insurance?

You can get a Medicare Supplement Insurance (Medigap) policy to help pay your remaining out-of-pocket costs (like your 20% coinsurance). Or, you can use coverage from a former employer or union, or Medicaid.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is QMB in Medicare?

If you or your spouse worked fewer than 30 quarters (7.5 years) If your income is low, you may be eligible for the Qualified Medicare Beneficiary (QMB) program, which pays for your Medicare Part A and B premiums and other Medicare costs.

How much is Social Security premium 2021?

In 2021, your monthly Part A premium will be: $0.

Is Medicare Part A free?

Register. Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits. Or, have a spouse that qualifies for premium -free Part A. [bsa_pro_ad_space id=3]

What are the requirements to qualify for Medicare Advantage?

There are 2 general eligibility requirements to qualify for a Medicare Advantage plan (Medicare Part C): 1. You must be enrolled in Original Medicare ( Medicare Part A and Part B). 2. You must live in the service area of a Medicare Advantage insurance provider that is accepting new users during your application period.

Who can sign up for Medicare Advantage?

Anyone who is enrolled in Original Medicare (Part A and Part B) may be eligible to sign up for a Medicare Advantage (Part C) plan. This includes people under the age of 65 who have qualified for Medicare because of a disability.

How does Medicare Part C work?

Medicare Part C plans are sold by private insurance companies as an alternative to Original Medicare. Medicare Part C plans are required by law to offer at least the same benefits as Medicare Part A and Part B.

What is covered under Medicare Part C?

Medicare Part C plans provide all of the same benefits as Original Medicare. Most Medicare Advantage plans also offer prescription drug benefits, which Original Medicare doesn't cover.

When can I enroll in a Part C plan?

If you are eligible for a Medicare Advantage plan and there is a plan available in your service area, you still need to wait for an enrollment period to join.

How much is Medicare Advantage 2021?

In 2021, the weighted average premium for a Medicare Advantage plan that includes prescription drug coverage is $33.57 per month. 1. 89 percent of Part C plans available throughout the country in 2021 cover prescription drugs, and 54 percent of those plans feature a $0 premium.

How long does Medicare enrollment last?

When you first become eligible for Medicare, you will be given an Initial Enrollment Period (IEP). Your IEP lasts for seven months. It begins three months before you turn 65 years old, includes the month of your birthday and continues on for three more months.