Does everyone get Part D Medicare?

Medicare Cost Plan Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

Do you automatically get Part D with Medicare?

You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

How do I know if I have Medicare Part D?

Checking Part D Is Easy and Simple Conveniently, one can go online to Medicare.gov to check eligibility and status in any part of Medicare. When it comes to Medicare prescription drug coverage, beneficiaries will choose whether to have a combination plan or a stand-alone drug plan.

Are prescriptions covered by Medicare?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

When did Medicare Part D become mandatory?

January 1, 2006In 2003 the Medicare Modernization Act created a drug benefit for seniors called Part D. The benefit went into effect on January 1, 2006.Aug 10, 2017

Is Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

Is prolia covered by Medicare Part B or Part D?

What Part of Medicare Pays for Prolia? For those who meet the criteria prescribed above, Medicare Part B covers Prolia. If you don't meet the above criteria, your Medicare Part D plan may cover the drug. GoodRx reports that 98% of surveyed Medicare prescription plans cover the drug as of October 2021.Oct 13, 2021

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

How do I claim medication on Medicare?

Download and complete the Patient claim for refund Pharmaceutical Benefits Scheme (PBS) form. You can use this form to claim a refund if either you: didn't show your Medicare card or concession card when you purchased the medicine at the pharmacy. spend over your yearly PBS Safety Net threshold.Feb 9, 2022

What are the different types of Medicare?

You may have the choice of two types of Medicare plans—a stand-alone Medicare Part D Prescription Drug Plan or a Medicare Advantage Prescription Drug plan. Your Part D coverage choices are generally: 1 A stand-alone Medicare Part D Prescription Drug Plan, if you have Medicare Part A or Part B or both. 2 Medicare Advantage Prescription Drug plan, if you have both Medicare Part A and Part B. If you choose a Medicare Advantage Prescription Drug plan, you get your Part A and Part B coverage through the plan.

When is the AEP for Medicare?

Annual Enrollment Period (AEP). Also known as Fall Open Enrollment, the AEP occurs from October 15th to December 7th every year. At this time you can enroll in a stand-alone Medicare Part D Prescription Drug Plan or a Medicare Advantage Prescription Drug plan. You might be able to make other coverage changes during this time.

How long does it take to enroll in Medicare Part D?

For most people, this is the seven-month period that begins 3 months before the month you meet Medicare eligibility requirements, includes that month, and ends 3 months later.

What is Medicare Part D?

Your Part D coverage choices are generally: A stand-alone Medicare Part D Prescription Drug Plan, if you have Medicare Part A or Part B or both. Medicare Advantage Prescription Drug plan, if you have both Medicare Part A and Part B. If you choose a Medicare Advantage Prescription Drug plan, you get your Part A and Part B coverage through the plan.

When is the open enrollment period for Medicare?

Medicare Advantage Open Enrollment Period. This period goes from January 1 – March 31 every year (starting in 2019). This is a one-time chance to enroll in a Medicare Advantage Prescription Drug plan. You can also disenroll from a Medicare Advantage plan, return to Original Medicare, and enroll in a stand-alone Medicare Part D Prescription Drug ...

What happens if you don't sign up for Part D?

That is, if you don’t sign up for Part D prescription drug coverage during your Initial Enrollment Period, and then decide you want that coverage later – a penalty could be attached to your monthly Part D premium. Learn more about Medicare late enrollment penalties.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What happens if you don't enroll in Medicare Part D?

If you don’t enroll when you’re first eligible and don’t have creditable coverage, you could face a late enrollment penalty. Let’s take a closer look at using an example. Tip: Medicare Plan D and Part D aren’t the same things.

Why is Medicare Part D important?

For many, prescription medications are vital to maintaining a healthy lifestyle. The costs of medications can drain finances, Medicare Part D prescription helps those who need assistance with medications .

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Medicaid a federal or state program?

Medicaid is another Federal and State government medical health insurance program. Medicaid provides coverage for individuals and families that have low incomes or limited resources. Not all will qualify for Medicaid coverage in addition to Medicare coverage. Medicare beneficiaries with full Medicaid benefits are dually eligible.

Does Medicare add late enrollment penalties?

Medicare may add a Part D Late Enrollment Penalty to your Part D premium each month you have Part D coverage. Unless you enroll in a Part D plan when you’re first eligible during your IEP.

How old do you have to be to qualify for Medicare?

To be eligible for Medicare, you must qualify in one of the following ways: You’re age 65 and you can enroll in Medicare parts A and B. You’ve received Social Security disability payments for at least 2 years. The waiting period for Medicare is waived if you receive a diagnosis of amyotrophic lateral sclerosis (ALS).

What is Medicare Supplement?

Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums.

What are the different types of Medicare coverage?

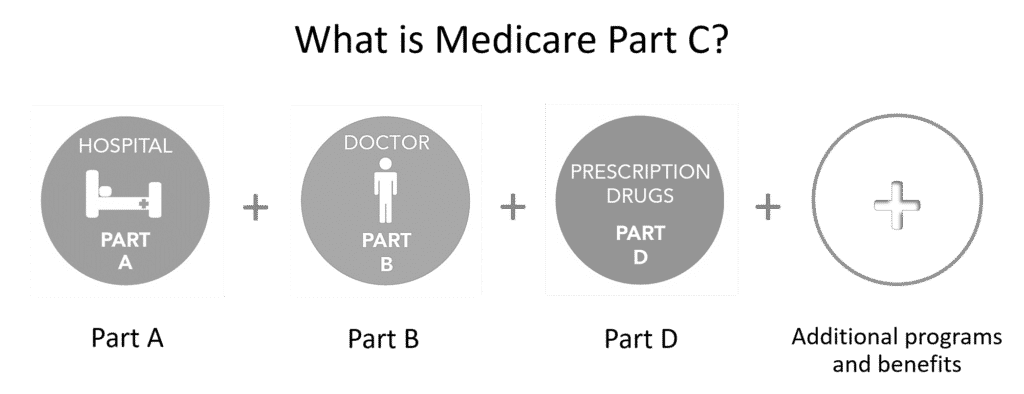

What are the Medicare prescription drug coverage options? 1 Part D. These plans cover prescription medications for outpatient services. All plans have to offer some basic level of drug coverage based on Medicare rules. Specific plan coverage is based on the plans’ formulary, or drug list. If your doctor wants a drug covered that’s not part of that plan’s list, they’ll need to write a letter of appeal. Each nonformulary medication coverage decision is individual. 2 Part C (Advantage plans). This type of plan can take care of all your medical needs (parts A, B, and D), including dental and vision coverage. Premiums might be higher and you might have to go to network doctors and pharmacies. 3 Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums. Choose the best option to give you maximum benefits at the lowest rates.

What is a Part C plan?

Part C (Advantage plans). This type of plan can take care of all your medical needs (parts A, B, and D), including dental and vision coverage. Premiums might be higher and you might have to go to network doctors and pharmacies. Medicare supplement (Medigap).

When do you have to enroll in Medicare Part D?

For most people, you first become eligible to enroll in Medicare Part D from 3 months before your 65 th birthday to 3 months after your birthday. When you find a plan to join, you’ll need to provide your unique Medicare number and the date you became eligible.

How long do you have to be on disability to receive Part D?

If you’re not 65 but have a disability that qualifies you to receive Social Security or Railroad Retirement Disability benefits, you’re eligible for Part D 3 months before the 25 th month of benefit payments until 3 months after your 25 th month of receiving benefits.

When is Medicare Part D enrollment?

Medicare Part D enrollment. The Medicare Part D enrollment period takes place each year form April 1 to June 30. If you enrolled in coverage for Medicare parts A or B and want to add Part D, you can enroll during this period the first time. After this, to change Part D plans, you must wait for open enrollment to come around again.

What are the requirements for Medicare Part D?

Not everybody is eligible for Medicare Part D. Potential customers must meet certain criteria to enrol in a Medicare Part D plan. For example, there are some of the qualifying categories: 1 You are aged 65 or older 2 You have a qualifying disability for which you have been receiving Social Security Disability Insurance (SSDI) for more than 24 months 3 You have been diagnosed with End-Stage Renal Disease (permanent kidney failure requiring a kidney transplant or dialysis) 4 You are entitled to Medicare Part A and/or enrolled in Medicare Part B

How many tiers are there for Medicare Part D?

The drugs evaluated for Medicare Part D plans are done in five tiers. Tiers 1 and 2 are drugs that fall within ‘regular’ usage and are commonly purchased by many people.

What is Medicare Part D?

Medicare Part D is one of four parts that make up the Medicare program. It offers assistance with the cost of prescription drug charges, and is available as a stand-alone coverage option, or as a prescription drug benefit added to a Medicare Advantage Prescription Drug Plan.

What is the first stage of cost sharing?

This stage begins after a customer reaches their deductible. If their plan has no deductible, then of course this is the first stage of their plan. It is at this stage that cost sharing begins, which means that customers co-pay for their drugs until they reach their plan’s initial coverage limit.