You’re generally eligible when you are 65 or older, but you may qualify under 65 through disability or having certain conditions. You’ll be enrolled automatically as soon as you’re eligible if: You or your spouse is receiving Social Security benefits or Railroad Retirement Board benefits.

Do I qualify for Medicare if my spouse is on social security?

Qualifying for Medicare is different than Social Security benefits. You can be eligible for your spouse/ex-spouse Social Security benefits at age 62, and you won’t qualify for Medicare until age 65. Of course, you may be eligible for Medicare sooner if you have End-Stage Renal Disease or disability for at least two years.

Who is eligible for Medicare coverage?

You may also be eligible for Medicare coverage if you are younger than 65 but have a qualifying disability or end-stage renal disease. Your personal Medicare insurance policy does not cover anyone but you. Your spouse or family members cannot be included in your coverage.

Does my age affect my spouse’s Medicare Part A qualification?

It’s important to note that your age, as the working spouse, will affect when your non-working spouse qualifies for premium-free Medicare Part A. You must be at least 62 years old and eligible for Social Security benefits before your spouse can enroll, because his or her qualification is based on your work record.

Do I qualify for Medicaid in New York State?

For New York residents, 65 and over who do not meet the eligibility requirements in the table above, there are other ways to qualify for Medicaid. 1) Medically Needy Pathway – In a nutshell, one may still be eligible for Medicaid services even if they are over the income limit if they have high medical bills.

Can my wife get Medicare at 65?

To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 (or any age under 65), he or she could only qualify for Medicare by disability.

When can my husband get Medicare?

age 62When you turn age 62 and your spouse is age 65, your spouse can usually receive premium-free Medicare benefits. Until you're age 62, your spouse can receive Medicare Part A, but will have to pay the premiums if they don't meet the 40 quarters of work requirement.

Can my spouse enroll in Medicare when I retire?

To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 (or any age under 65), he or she could only qualify for Medicare by disability.

Who qualifies for Medicare in NY?

You can qualify for Medicare if you are age 65 or older and/or if you have certain disabilities or End-Stage Renal Disease (ERSD).

Can my wife be covered under my Medicare?

Does Medicare cover people's spouses? Medicare offers federal health insurance coverage for those aged 65 years and over, as well as those with a permanent disability. Medicare does not cover spouses specifically.

Is my spouse eligible for Medicare if she never worked?

A non-working spouse can receive premium-free Medicare part A as long as the other partner is at least 62 years old and has satisfied Medicare's work requirements. For example, John is 65 years old and has never worked or paid Medicare taxes.

Can I get Medicare through my husband?

To qualify for Medicare, you need to have paid into the Social Security system. Just like with Social Security benefits, you can qualify for Medicare coverage under your spouse's record. That continues if you divorce, provided you meet certain conditions outlined by the Social Security Administration.

How does Medicare work for married couples?

Medicare has no family plans, meaning that you and your spouse must enroll for Medicare benefits separately. This also means husbands, wives, spouses and partners pay separate Medicare premiums.

How do I apply for spousal Medicare benefits?

Form SSA-2 | Information You Need to Apply for Spouse's or Divorced Spouse's Benefits. You can apply: Online, if you are within 3 months of age 62 or older, or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

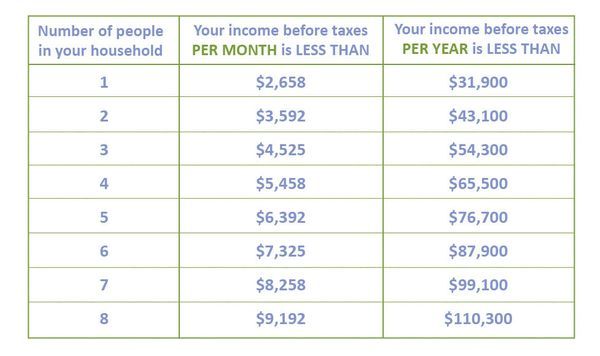

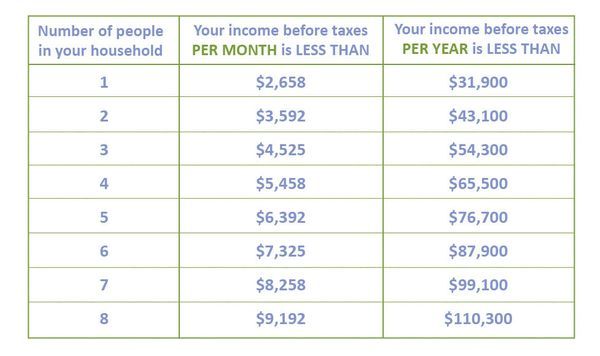

What is the income limit for Medicare in NY?

The monthly income limits to be eligible for HCBS in New York are $875 (single) and $1,284 (if married and both spouses are applying).

What is the maximum income to qualify for Medicaid in NY?

View coronavirus (COVID-19) resources on Benefits.gov....Who is eligible for New York Medicaid?Household Size*Maximum Income Level (Per Year)1$18,0752$24,3533$30,6304$36,9084 more rows

Who are eligible for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

About Medicare in New York

Medicare beneficiaries in New York enjoy a variety of Medicare offerings, from the federal option of Original Medicare, Part A and Part B, to plans...

Types of Medicare Coverage in New York

Original Medicare, Part A and Part B, refers to federal Medicare coverage. Medicare Part A (hospital insurance) and Part B (medical insurance) are...

Local Resources For Medicare in New York

Medicare Savings Programs in New York: Programs in New York can assist beneficiaries in paying for things like their monthly premiums. Usually in o...

How to Apply For Medicare in New York

To apply for Medicare in New York, you must be a United States citizen or legal permanent resident of at least five continuous years. You’re genera...

Who Is Eligible for Medicare in New York?

You may have Medicare eligibility in New York if you’re a U.S. citizen or a permanent legal resident who has lived in the U.S. for more than five years and one or more of the following applies to you: 3

How Does Medicare Work in New York?

If you’ve established that you are eligible for Medicare, it’s time to review your choices. You can opt for the government’s “Original Medicare” or choose an all-in-one plan from a private insurance company.

How long do you have to be a resident of New York to qualify for Medicare?

How to apply for Medicare in New York. To apply for Medicare in New York, you must be a United States citizen or legal permanent resident of at least five continuous years. You’re generally eligible when you are 65 or older, but you may qualify under 65 through disability or having certain conditions. You’ll be enrolled automatically as soon as ...

When do you get Medicare benefits?

A “Welcome to Medicare” packet should be mailed out approximately three months before you turn 65. If you are under 65 and collect disability benefits from the Social Security Administration (SSA), or certain disability benefits from the Railroad Retirement Board (RRB), then you become eligible for Medicare once you enter into the 25th consecutive month of collecting those benefits. If you have ALS, your Medicare coverage starts the first month you collect SSA or RRB benefits.

What is Medicare Part A and Part B?

Original Medicare, Part A and Part B, refers to federal Medicare coverage. Medicare Part A (hospital insurance) and Part B (medical insurance) are available in any state in the U.S. Medicare Advantage, Part C, refers to plans offered by private health insurance companies with Medicare’s approval.

How many Medicare Supplement plans are there?

Medicare Supplement, also called Medigap, features up to 10 plans, each with a letter designation (A, B, C, D, F, G, K, L, M, N). Plan benefits within each letter category do not change, no matter where the plan is purchased;

What is a Ship in New York?

New York State Health Insurance Counseling and Assistance Program (SHIP): In New York, SHIP is called the Health Insurance Information, Counseling and Assistance Program ( HIICAP ). HIICAP educates New York residents about Medicare and other health insurance issues.

Does New York have Medicare?

About Medicare in New York. Medicare beneficiaries in New York enjoy a variety of Medicare offerings, from the federal option of Original Medicare, Part A and Part B , to plans offered by Medicare-ap proved insurance companies such as Medicare Advantage, Medicare Part D (prescription coverage), and Medicare Supplement insurance plans.

Does Medicare Part B cover vision?

These plans must cover at least what Original Medicare , Part A and Part B does, but can also include additional benefits, like vision, dental, and prescription drug coverage. You continue paying your monthly Medicare Part B premium when you’re enrolled in a Medicare Advantage plan along with any premium charged by the Medicare Advantage plan chosen.

How old do you have to be to qualify for Medicare?

Qualifying for Medicare is different than Social Security benefits. You can be eligible for your spouse/ex-spouse Social Security benefits at age 62, and you won’t qualify for Medicare until age 65. Of course, you may be eligible for Medicare sooner if you have End-Stage Renal Disease or disability for at least two years.

What to do if you lost your spouse on Medicare?

It’s your responsibility to enroll in a new policy as soon as possible to ensure eligibility. If you recently lost a spouse and your Medicare policy, please call an agent at the number above to start discussing your options.

Can you lose Medicare if your spouse dies?

If you lose Medicare coverage due to the death of a spouse, you become eligible for a Special Election Period; but, that period doesn’t last forever.

Is there a family plan for Medicare?

There’s no family plan for Medicare; plans are individual. Meaning, your spouse’s eligibility may not match yours.

Can a Non-Working Spouse Qualify for Medicare?

Yes, as long as the working spouse worked enough quarters and you’ve been married for at least one year.

What languages are eligible for Medicare?

You Must Apply for Medicare. This document is also available in the following languages: Spanish, Russian, Italian, Korean, Chinese, Haitian Creole. If you are turning 65 within the next 3 months or you are 65 years of age or older, you may be entitled to additional medical benefits through the Medicare program.

Can medicaid pay for premiums?

If so, then the Medicaid program can pay or reimburse your Medicare premiums. If the Medicaid program can pay your premiums, you will be required to apply for Medicare as a condition of Medicaid eligibility. You may apply for Medicare by calling the Social Security Administration at 1-800-772-1213 or by applying on-line at: ...

Is Medicare a federal program?

Medicare is a federal health insurance program for people over 65 and for certain people with disabilities regardless of income. When a person has both Medicare and Medicaid, Medicare pays first and Medicaid pays second. You are required to apply for Medicare if:

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. ( Note: If you have Lou Gehrig's disease, your Medicare benefits begin the first month you get disability benefits.)

When did Medicare start providing prescription drugs?

Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information, you may wish to visit the Prescription Drug Coverage site.

What is the eligibility for Medicaid in New York?

For New York long-term care Medicaid eligibility, an applicant must have a functional need for such care. This most commonly means one must require a nursing facility level of care. Furthermore, additional criteria may need to be met for some program benefits.

What is Medicaid in New York?

New York Medicaid Definition. Medicaid is a wide-ranging, state and federally funded, health care program for low-income individuals of all ages. While there are several different eligibility groups, including pregnant women, children, and disabled individuals, this page is focused on Medicaid eligibility for New York senior residents ...

What are countable assets for Medicaid?

Countable assets (often called resources) include cash, stocks, bonds, investments, vacation homes, and savings and checking accounts. However, for Medicaid eligibility purposes, there are many assets that are considered exempt (non-countable). Exemptions include IRA’s and 401K’s in payout status, personal belongings, household items, a vehicle, burial funds up to $1,500, and pre-paid funeral agreements (given they cannot be refunded). One’s primary home is also exempt, as long as the Medicaid applicant lives in the home or has intent to return home, and his/her home equity interest is under $906,000. (Equity interest is the amount of the home’s value of which the applicant outright owns). There is one exception to the home exemption rule, which is if the applicant’s spouse lives in the home. If this is the case, the house is exempt regardless of where the applicant spouse lives and his/ her home equity interest.

How long does it take for Medicaid to look back in New York?

At the time of this update, the look back rule only applies to Institutional Medicaid and is a period of 60 months (5 years) that immediately precedes one’s Medicaid application date.

What is considered income for Medicaid?

What Defines “Income”. For Medicaid eligibility purposes, all income that one receives from any source is counted towards the income limit. This may include employment wages, alimony payments, pension payments, Social Security Disability Income, Social Security Income, gifts, and payments from annuities and IRAs.

How much can a spouse retain in 2021?

In 2021, the community spouse can retain half of the couple’s joint assets, up to $130,380, as the chart indicates above. However, if the couple has more limited assets, the non-applicant spouse is able to retain 100% of their joint assets, up to $74,820.

Is Medicaid managed care in New York?

Make note, Medicaid in New York is sometimes referred to as Medicaid Managed Care. Medicaid for the Disabled, Aged or Blind (DAB) is also known as NON-MAGI. The American Council on Aging now offers a free, quick and easy Medicaid eligibility test for seniors.

How old do you have to be to get Medicare?

You must be at least 62 years old and eligible for Social Security benefits before your spouse can enroll, because his or her qualification is based on your work record. You don’t have to actually start getting your Social Security benefits; you just need to be old enough to file for them if you wanted to. If you are younger than 62, your spouse may choose to pay the premium for Medicare Part A, if needed, until the premium-free benefit kicks in.

What Happens If One of You Becomes Eligible for Medicare Before the Other?

Unless you and your spouse were born in the same month of the same year, one of you will become eligible for Medicare before the other. If you both are covered by your employer health insurance, and one of you turns 65, you’ll have decisions to make about Medicare. In this case, it will depend on the employer and their rules around covered dependents of Medicare age. Some employers may require spouses who are eligible to get Medicare to do so at age 65 in order to remain on the employer plan.

What happens if you have both health insurance and one turns 65?

If you both are covered by your employer health insurance, and one of you turns 65, you’ll have decisions to make about Medicare. In this case, it will depend on the employer and their rules around covered dependents of Medicare age.

Can a spouse and spouse have Medicare?

The answer is no. Medicare is individual insurance, so spouses cannot be on the same Medicare plan together. Now, if your spouse is eligible for Medicare, then he or she can get their own Medicare plan. But, what’s interesting is that there are some things to think about in regards to your non-working spouse and Medicare.

When do you have to make decisions about Medicare?

You’ll need to make some decisions about Medicare when you become eligible, whether or not you continue working past age 65.

Can my spouse continue to work and keep my employer's coverage?

Your spouse may continue coverage through your employer plan if you keep working and keep the employer coverage .

Can A Non-Working Spouse Qualify for Medicare?

Medicare isn’t just for people who retire after many years of working. Anyone who meets Medicare eligibility requirements can get Medicare, including spouses. But when a person asks “Can my non-working spouse get Medicare?” they really are asking “Can my spouse be on my Medicare plan?”

Enrolling in Medicare at 65

If you want to enroll when you are turning 65, you can enroll in Medicare Parts A & B, Part D prescription drug coverage or a Medicare Advantage (Part C) plan. You can also look at adding a Medicare supplement insurance plan to Original Medicare (Parts A & B) to help with the out-of-pocket costs of Medicare.

Enrolling in Medicare Part A at 65

Many people who are covered by a spouse’s employer plan choose to either wait to enroll until they lose their spouse’s employer coverage or choose to only enroll in Part A since Part A usually has no premium.

Delaying Medicare Enrollment

Just because you are turning 65, doesn’t necessarily mean you have to get Medicare right now. If you decide that waiting to enroll in Medicare is the best option both financially and in terms of healthcare coverage for you, just follow Medicare’s rules, and you’ll avoid enrollment penalties when you do enroll.

When Would I Enroll If I Delay or Only Take Part A?

If you are able to delay enrolling in either all or part of Medicare, you will have a Special Enrollment Period of eight months that begins when the employer coverage is lost or when your spouse retires. During this time, you’ll be able to enroll in Medicare Parts A & B. You can also enroll in a Part D prescription drug plan.

Medicare Made Clear

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Medicare Made Clear

Whether you're just starting out with Medicare, need to brush up on the facts, or are helping a loved one, start your journey here.