- Be age 65 or older;

- Be a U.S. resident; AND

- Be either a U.S. citizen, OR

- Be an alien who has been lawfully admitted for permanent residence and has been residing in the United States for 5 continuous years prior to the month of filing an ...

Full Answer

Is the Flex card real for seniors?

Jan 26, 2022 · The Lowdown On Medicare Flex Cards. A new benefit getting a lot of attention is Medicare Flex cards. These cards allow you to buy specific items instead of using money out of your pocket. The products and services you can use the flex card on will vary according to the plan you select. These cards are debit cards typically linked to a flexible ...

What can I buy with my FSA card?

Dec 21, 2021 · While some carriers offer a flex card benefit, it is rare to receive such a large amount. The average Flex Card in 2022 is pre-loaded with $500. Further, the ads tend to be unclear about which items are eligible for purchase with flex cards. According to one commercial, you can use the card for gas, groceries, new clothing, and shoes.

Is the Flex card for seniors legit?

Mar 29, 2022 · For a total of $1,600 per year, the most extensive valid flex plan identified featured a $1,000 flex card and a $50 monthly debit card for other out-of-pocket expenses. That’s a lot less than the original asking price of $2,880. Even if you are eligible, you should carefully consider any Medicare Advantage plan.

How to Check Your FLEX debit card balance?

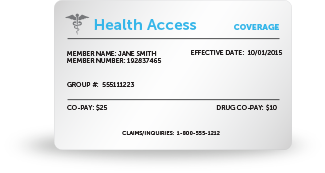

Apr 12, 2022 · A flexible spending account, or flex card, is a type of flexible spending account that reimburses medical expenses. This card, however, must be linked to a Medicare Advantage Plan, which is a paid ...

How do you qualify for a senior flex card?

What is a Medicare Flex Plan?

What is the Flex card for seniors?

What is the Medicare flex card and how does it work?

Is the Flex card free?

Can you buy groceries with a flex card?

Does Humana offer flex card?

Does UnitedHealthcare offer a flex card?

How can I check my flex card balance?

What can FSA be used for 2021?

- Monthly period supplies (cups, tampons, liners, period underwear, and pads)

- Personal protective equipment (hand sanitizer, masks,sanitizing wipes)

- Over-the-counter medications (Tylenol, allergy relief, cold medicine)

Is the Flex card for seniors legit?

Millions of seniors are now eligible to get a "Flex Card" with a $2,880 annual limit free of charge. This Medicare Benefit is finally available and...

What are flex cards for seniors?

These costs may include:DeductiblesCo-paysPrescription medicationsOver-the-counter medicationsMedical equipment (crutches, etc.)First aid equipment...

What is the seniors flex card?

Senior Flex Cards - Step 1. Seniors over the age of 64 can get a special benefit that was passed to help with OTC bills, dental, health and essenti...

What is a Flex Benefit Card?

Going the extra mile to provide benefits that make a real differenceCreating a better employee experienceProviding a more personalised employee exp...

What is a Seniors Flex Card?

Starting in late summer 2021, advertisements started to appear everywhere offering a senior flex card. Depending on the advertisement, some claimed these cards could be worth $2,880 or more!

What is a flex card?

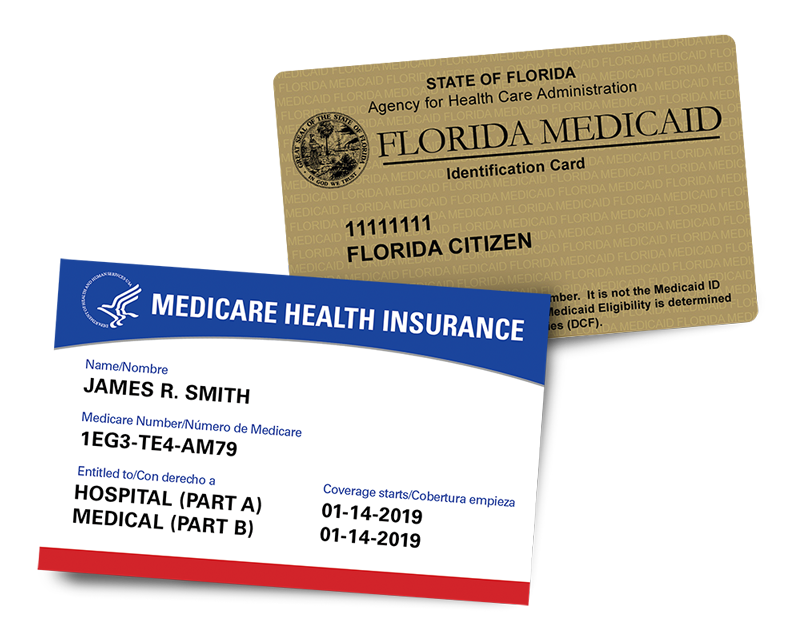

Flex cards are tied to health insurance, and these flex card for seniors are actually a health insurance marketing tactic designed to lure seniors into switching to specific Medicare Advantage plans.

What does a flex card pay for?

According to Healthcare.gov, a flex card can be used to pay for certain out-of-pocket health care costs. These costs may include:

Who qualifies for the flex card?

Flex cards are typically offered alongside health insurance plans. In order to qualify for a flex card, you must qualify for a health insurance plan with a flexible spending account.

Is the flex card real?

I was able to identify many flex cards from legitimate insurers like Humana but I could not find any that offered as much money as the advertisements claimed. The largest legitimate flex plan I found included a $1,000 flex card and a $50 monthly debit card for other out-of-pocket costs, for a total of $1,600 per year.

Why are there so many Medicare scams?

Scammers love Medicare open enrollment season. Historically, the open enrollment period between October and December is a prime time for scammers who want to prey on seniors because this is when seniors can change their health care plans.

How can you protect yourself from Medicare scams?

The whole point of the flex card for seniors is to lure seniors into enrolling in new Medicare Advantage plans while it’s open enrollment season. As you may know from our previous video on Medicare benefits, Medicare has many parts and is very complicated.

Comprehensive Flex Card Benefits

Home delivery and in-store access to over-the-counter health and wellness products.

Analytics & Intelligence

"At Convey, customer support and engagement are at the heart of our services and we have always put the best interests of our members first."

Extend your dental, vision, or hearing coverage where you need it most

When you choose a Wellcare Medicare Advantage plans, you can personalize your coverage with the NEW Visa Flex Card. The Flex Card gives you the freedom to extend your dental, vision, or hearing coverage, where you need it most. The choice is yours.

Ready to learn about your local plan options? Call 1-877-823-8267 (TTY 711)

Plan benefits vary by location. Call to learn more. Cosmetic procedure not covered by this benefit.

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Who Is Eligible For The Medicare Part B Give Back Benefit?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

Applying For A Medicare Part B Give Back Benefit

So, what is the enrollment process for the Give Back benefit? Many people are looking to save as much money as possible when it comes to their health care costs, so they want to know how to get signed up for this program. The process is quite simple, so here is how to do it.

The Bottom Line

Since most people on Medicare are receiving Social Security benefits, finding a way to reduce the cost of your health insurance is always a plus. The Medicare Give Back program can do just that by paying for a portion or even all of your Medicare Part B premium.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit.

What is a debit card for FSA?

A: Your benefits debit account is a tax-advantaged account, with money taken from your paycheck on a pre-tax basis to fund it. As such, the IRS has strict guidelines on how the account may be used. MedCost automatically verifies (or substantiates) nearly 90% of FSA debit card transactions using claim information from available claims data. If we are unable to substantiate a transaction automatically, we are required by the IRS to request supporting documentation and will contact you by email or letter to request a detailed receipt. To avoid confusion or disruption in the use of your card, please make sure that your receipt includes the product or service and the date the product or service was purchased.

Can you use a Flex debit card at CVS?

A: There are many retailers, such as Walmart, Walgreens, and CVS, that can distinguish an eligible expense from an ineligible expense. If you receive services from any of these retailers, you may use the flex debit card for any eligible expenses. The cashier may have to run any ineligible item as a separate transaction, however, and you will be asked to use another method of payment for that transaction.