Resident of a State that did not expand Medicaid (code "G") - If the taxpayer lived at any time during the tax year in one of the States that did not expand Medicaid and their household income was below 138% of the federal poverty level for their family size, the taxpayer may be eligible to claim a Coverage Exemption to the Shared Responsibility Payment under the Affordable Care Act (ACA).

Full Answer

What exemptions are available for health insurance?

Exemptions are available based on a number of circumstances, including certain hardships, some life events, health coverage or financial status, and membership in some groups. You claim most health coverage exemptions on your federal tax return. Some require you to fill out and mail an application to the Marketplace.

Who is eligible for the ACA Medicaid expansion?

The ACA expanded Medicaid coverage to nearly all adults with incomes up to 138% of the Federal Poverty Level ($17,609 for an individual in 2020). As of February 2021, 12 states have not adopted the ACA Medicaid expansion.

Is the uninsured rate lower in Medicaid expansion States?

The uninsured rate, particularly among low-income residents, is considerably lower in Medicaid expansion states. What is Medicaid expansion? A provision in the Affordable Care Act ( ACA) called for the expansion of Medicaid eligibility in order to cover more low-income Americans.

What does it mean to be a non exempt employee?

Non-exempt employees are usually paid an hourly wage or earn a salary that’s less than a minimum amount determined by the DOL. What does non-exempt mean? If employees are non-exempt, it means they are entitled to minimum wage and overtime pay when they work more than 40 hours per week.

Who is exempt from the Affordable Care Act mandate?

If you're seeking an exemption because you can't afford coverage, you're a member of a federally recognized tribe, you're incarcerated, or you participate in a recognized health care sharing ministry, you have two options: The exemptions can be claimed when you complete your federal tax return.

Who is exempt from the individual mandate?

Unlawful Resident Individuals who are not lawfully present in the United States are exempt. Coverage Gap No penalty will be imposed on those without coverage for less than three months, but this exemption applies only to the first short coverage gap in a calendar year.

Who is not automatically eligible for Medicare?

People who must pay a premium for Part A do not automatically get Medicare when they turn 65. They must: File an application to enroll by contacting the Social Security Administration; Enroll during a valid enrollment period; and.

What assets are exempt from Medicare?

Exempt AssetsPrimary Residence. An applicant's primary residence is exempt if it meets a few fundamental requirements. ... Car. ... Funeral and Burial Funds. ... Property for Self-Support. ... Life Insurance Policies.

Who is exempt from individual shared responsibility?

Coverage exemption If individuals have a gross income below the tax return filing threshold for a certain year, they are automatically exempt from the shared responsibility provision for that year. Most exemptions are claimed using Form 8965, Health Coverage Exemptions, when a tax return is filed.

What is exemption G on Form 8965?

IRS Form 8965, Health Coverage Exemptions, is the form you file to claim an exemption to waive the penalty for not having minimum health insurance coverage. If you have coverage through your employer, buy insurance through a Marketplace, or use private insurance, you do not need to file tax Form 8965.

Is everyone entitled to Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Which of the following customers are eligible for Medicare?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

How much money can you have in the bank if your on Medicare?

4. How to Qualify. To find out if you qualify for one of Medi-Cal's programs, look at your countable asset levels. As of July 1, 2022, you may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member.

What are non countable assets?

These non-countable assets include the home, a car, personal effects, household goods and furnishings, some prepaid funeral and burial arrangements, and a limited amount of cash ($3,000 for a couple), to name just a few.

Does inheritance count as income for Medicare?

Medicare eligibility is based on age, illness and/or disability status rather than income. Inheriting money or receiving any other windfall, such as a lottery payout, does not bar you in any way from receiving Medicare benefits.

Why is the individual mandate unconstitutional?

The U.S. Court of Appeals for the 5th Circuit in 2019 ruled the individual mandate unconstitutional because Congress had repealed the tax penalty enforcing the mandate, and sent the case back to a district court in Texas to determine which of the law's provisions could survive without the mandate.

What is the point of the individual mandate?

The rationale behind the individual mandate is that if everyone is required to have insurance—especially healthy people—the risk pools will be broad enough to lower premiums for everyone, even those with expensive medical conditions.

Is the individual mandate gone?

As of 2019, the Obamacare individual mandate – which requires you to have health insurance or pay a tax penalty –no longer applies at the federal level.

Why is the individual mandate controversial?

The individual mandate has always been a controversial part of the Affordable Care Act. While the law was being debated in Congress, and in the years after it was enacted, opponents argued that the government shouldn't be allowed to penalize people for not buying something.

When are exceptions granted?

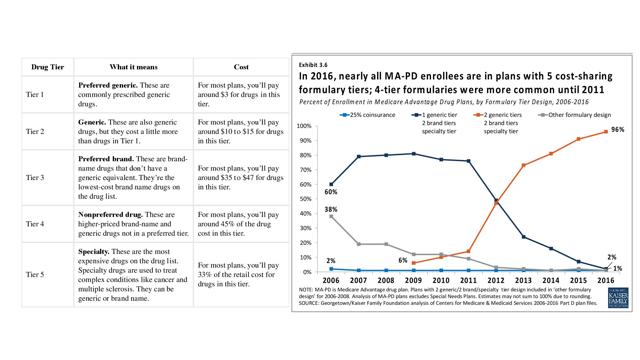

Exceptions requests are granted when a plan sponsor determines that a requested drug is medically necessary for an enrollee. Therefore, an enrollee's prescriber must submit a supporting statement to the plan sponsor supporting the request.

What is a formulary exception?

A formulary exception should be requested to obtain a Part D drug that is not included on a plan sponsor's formulary, or to request to have a utilization management requirement waived ( e.g., step therapy, prior authorization, quantity limit) for a formulary drug.

What is tiering exception?

Exceptions. An exception request is a type of coverage determination. An enrollee, an enrollee's prescriber, or an enrollee's representative may request a tiering exception or a formulary exception. A tiering exception should be requested to obtain a non-preferred drug at the lower cost-sharing terms applicable to drugs in a preferred tier.

How long does it take to get an exception request from a plan sponsor?

For requests for benefits, once a plan sponsor receives a prescriber's supporting statement, it must provide written notice of its decision within 24 hours for expedited requests or 72 hours for standard requests. The initial notice may be provided verbally so long as a written follow-up notice is ...

Can a prescriber submit a supporting statement?

A prescriber may submit his or her supporting statement to the plan sponsor verbally or in writing. If submitted verbally, the plan sponsor may require the prescriber to follow-up in writing. A prescriber may submit a written supporting statement on the Model Coverage Determination Request Form found in the " Downloads " section below, ...

Which states have expanded Medicaid?

Voters in Utah, Nebraska, and Idaho elected to expand Medicaid on their 2018 midterm ballots. Each of these states has discussed work requirements for Medicaid enrollees, and Utah has drafted a waiver.

How does Medicaid expansion help the opioid epidemic?

Medicaid expansion can play an important role in addressing the epidemic by providing access to treatment for affected individuals who otherwise would have been uninsured. In fact, expansion states have been able to use expansion funds for treatment (e.g. BH counseling; addiction treatment; Medication Assisted Treatment) so that they can use other federal resources for prevention while non-expansion states must use more federal resources for treatment since the expansion resources are not available. [11]

How much will Medicaid expansion be in 2020?

Although Medicaid expansion still will have a 10 percent state share in 2020, the short-term impact is often savings. This is because most non-expansion states are operating state-funded-only health programs, mainly in the areas of mental health and substance abuse as well as corrections.

When did Arizona adopt Medicaid?

While 49 states adopted the program by 1970 (five years after the bill creating the Medicaid program was signed) the last holdout, Arizona, did not adopt Medicaid until 1982 – a full 12 years after the 49th adoption. There are certainly parallels between the order in which states adopted Medicaid and the order in which states adopted Medicaid ...

Does Medicaid help with incarceration?

Incarceration Pressures. Medicaid expansion can provide ongoing healthcare support to individuals transitioning out of the criminal justice system. Both sides of the partisan aisle are looking for ways to work together for criminal justice reform and are searching for ingredients to reduce incarceration rates.

Did repeal and replace keep Medicaid in place?

It is also noteworthy that since the beginning of the 2016 election cycle (and before), while “repeal and replace” bills have been a point of contention in Congress, most of the introduced “repeal and replace” bills kept the Medicaid expansion in place.

Is the verdict considered during Medicaid expansion?

However, it is possible that the verdict is considered during Medicaid expansion discussions in non-expansion states, along with a number of other factors that we discuss in more detail below.

What happens if you don't have health insurance?

The fee for not having health insurance no longer applies. If you don’t have coverage, you don’t need an exemption to avoid the penalty . If you’re 30 or older and want a “Catastrophic” health plan, you must apply for a hardship exemption to qualify. See details about exemptions and catastrophic coverage. If you live in Maryland, visit Maryland ...

Do you have to apply for hardship exemption if you don't have health insurance?

If you don’t have coverage, you don’t need an exemption to avoid the penalty. If you’re 30 or older and want a “Catastrophic” health plan, you must apply for a hardship exemption to qualify. See details about exemptions and catastrophic coverage.

What is hardship exemption?

Hardship exemptions. You had a financial hardship or other circumstances that prevented you from getting health insurance. Application required. See all hardship exemptions and get the application form.

What happens if you don't have health insurance in 2019?

If you don’t have coverage after 2019, you don’t need an exemption to avoid the penalty. (The fee is sometimes called the "Shared Responsibility Payment" or "mandate.") If you’re 30 or older and want a “Catastrophic” health plan, see details about exemptions and catastrophic coverage.

Which states have Medicaid expansion?

Five states — Texas, North Carolina, Florida, Georgia, and Tennessee — account for the lion’s share of the coverage gap population, and they are among the 14 states where expansion is still a contentious issue and the legislature and/or governor are still strongly opposed to accepting federal funding to expand Medicaid.

How many states have expanded Medicaid?

Thirty-six states and DC have either already expanded Medicaid under the ACA or are in the process of doing so. Fourteen states continue to refuse to adopt Medicaid expansion, despite the fact that the federal government will always pay 90% of the cost.

What is the ACA expansion?

A provision in the Affordable Care Act ( ACA) called for expansion of Medicaid eligibility in order to cover more low-income Americans. Under the expansion, Medicaid eligibility would be extended to adults up to age 64 with incomes up to 138 percent of the federal poverty level (133 percent plus a 5 percent income disregard).

What is the difference between exempt and non-exempt employees?

The key difference between exempt and non-exempt employees is that non-exempt workers are entitled to certain protections under the Fair Labor Standards Act, a federal law that sets minimum wage and overtime requirements. And although the FLSA has evolved since its passage in 1938, one thing remains the same – employers must classify their ...

What is an exempt employee?

Exempt employees are required to meet certain DOL job criteria known as the duties test. For example, someone who qualifies for the executive exemption must participate in the hiring and management of other employees. Job titles alone are not enough to grant exempt status.

What is the exemption for FLSA?

Employees exempt from the FLSA typically must be paid a salary above a certain level and work in an administrative, professional, executive, computer or outside sales role. The Department of Labor (DOL) has a duties test that can help employers determine who meets this exemption criteria.

What is the term for a company that fails to properly distinguish exempt from non-exempt employees?

Employee classification. Failure to properly distinguish exempt from non-exempt employees, sometimes referred to as misclassification , can adversely affect businesses. Misclassification may result in: Regulatory enforcement action. Fines and penalties.

How many hours do you have to work to be exempt?

Does an exempt employee have to work 40 hours a week? No, however, many businesses have company policies mandating a 40-hour workweek for exempt employees. Employers may take disciplinary action, including termination, against anyone who doesn’t fulfill that requirement, but they usually can’t deduct pay.

How to calculate hourly rate for non-exempt employees?

If a non-exempt employee isn’t paid by the hour, the hourly rate can be calculated by dividing the total compensation earned by the total hours worked. Vacation, holidays or sick days should not be included when performing these calculations unless the employee worked on those days.

How much do you have to make to be exempt from overtime?

Employees may be considered exempt if they are paid a salary, earn at least $684 per week or $35,568 annually, and perform the job duties of one of the exempt professions (administrative, executive, etc.).