Beneficiaries Who Don't Qualify for Medicare Part A

- Single, Never Married. Take your Notice of Award, Disapproved Claim or both to your local ID card office to update your DEERS record and get a new ID card.

- Widow/Widower. Apply for Medicare Part A under your deceased spouse’s social security number. ...

- Married/Divorced: Spouse Age 62 or Older. ...

- Married/Divorced: Spouse Younger than Age 62. ...

Full Answer

Which providers cannot enroll in Medicare?

Who is Not Eligible? The Medicare program is available to people aged 65 or older. This means people below age 65 who do not meet other eligibility requirements cannot enroll in the program until they turn 65 or qualify through other means. If you have been diagnosed with ALS or end-stage renal disease, you can enroll in Medicare while under 65.

Which group of people is not served by Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance). You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and …

Can you be penalized for not enrolling in Medicare?

Since Medicare is open to people aged 65 or older, if you are under 65 and do not meet other qualifying requirements, you cannot enroll in the program until you become eligible. People diagnosed with end-stage renal disease or amyotrophic lateral sclerosis can enroll in Medicare even while under 65.

What is the penalty for not signing up for Medicare?

Who is not automatically eligible for Medicare? People who must pay a premium for Part A do not automatically get Medicare when they turn 65. They must: File an application to enroll by contacting the Social Security Administration; Enroll during a valid enrollment period; and. What are the 3 requirements for a member to be eligible for a Medicare?

Who is not qualified for Medicare?

receive Social Security disability benefits for at least 2 years. receive disability pension benefits from the Railroad Retirement Board. have amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig's disease. have end stage renal disease (ESRD), or kidney failure.

Can you be denied from Medicare?

Medicare can deny coverage if a person has exhausted their benefits or if they do not cover the item or service. When Medicare denies coverage, they will send a denial letter. A person can appeal the decision, and the denial letter usually includes details on how to file an appeal.Aug 20, 2020

Does everyone have to get Medicare?

Strictly speaking, Medicare is not mandatory. But very few people will have no Medicare coverage at all – ever. You may have good reasons to want to delay signing up, though.

How do I not get Medicare?

If you keep working beyond age 65, you may have health insurance through your employer or have purchased a plan outside of Medicare. In this case, you may choose to refuse Medicare coverage.

Why would a person be denied Medicare?

Medicare may issue denial letters for various reasons. Example of these reasons include: You received services that your plan doesn't consider medically necessary. You have a Medicare Advantage (Part C) plan, and you went outside the provider network to receive care.May 18, 2020

What to do if Medicare denies a claim?

If Medicare denies payment of the claim, it must be in writing and state the reason for the denial. This notice is called the Medicare Summary Notice (MSN) and is usually issued quarterly. Look for the reason for denial. coverage rule), it must be stated on the notice.

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Can my spouse get Medicare if she never worked?

If you don't have enough work quarters to qualify for premium-free Part A through your own work history, you may be able to qualify through your spouse. Note that you'll both have to separately enroll in Medicare, but neither of you would have to pay a monthly premium for Part A.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can I decline Medicare Part B?

Declining Part B Coverage You can decline Medicare Part B coverage if you can't get another program to pay for it and you don't want to pay for it yourself. The important thing to know about declining Part B coverage is that if you decline it and then decide that you want it later, you may have to pay a higher premium.

How do you pay for Medicare if you are not collecting Social Security?

If you are not yet receiving Social Security benefits, you will have to pay Medicare directly for Part B coverage. Once you are collecting Social Security, the premiums will be deducted from your monthly benefit payment.

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

How old do you have to be to get Medicare?

citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by: Paying premiums for Part A, the hospital insurance.

How long do you have to live to qualify for Medicare?

You qualify for full Medicare benefits if: You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and. You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

How much will Medicare premiums be in 2021?

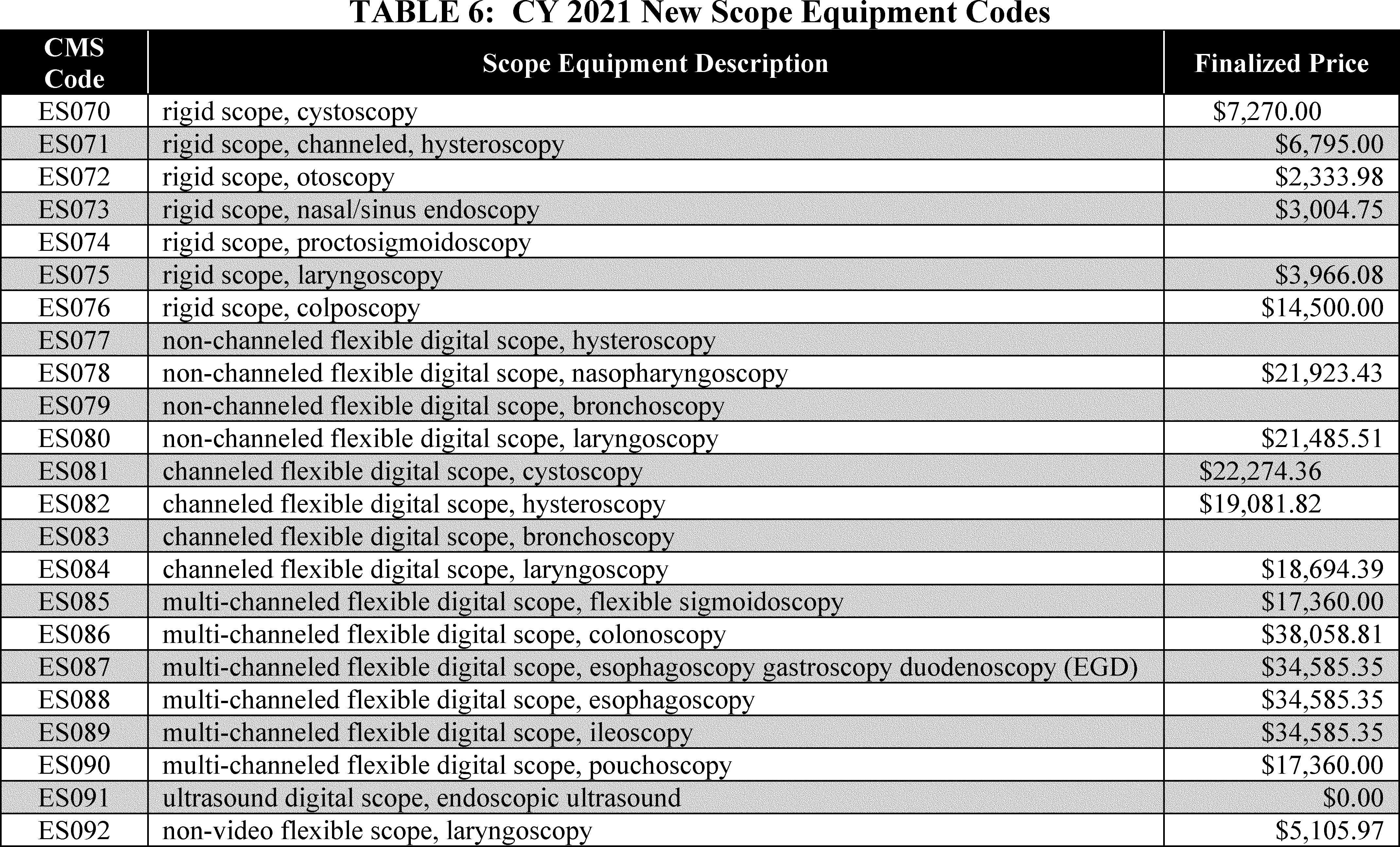

If you have 30 to 39 credits, you pay less — $259 a month in 2021. If you continue working until you gain 40 credits, you will no longer pay these premiums. Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay.

What is Lou Gehrig's disease?

You have Lou Gehrig’s disease, also known as amyotrophic lateral sclerosis (ALS), which qualifies you immediately; or. You have permanent kidney failure requiring regular dialysis or a kidney transplant — and you or your spouse has paid Social Security taxes for a specified period, depending on your age.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security disability benefits for at least 24 months (that need not be consecutive); or. You receive a disability pension from the Railroad Retirement Board and meet certain conditions; or.

How many credits do you get in 2021?

Work credits are earned based on your income; the amount of income it takes to earn a credit changes each year. In 2021 you earn one work credit for every $1,470 in earnings, up to a maximum of four credits per year. If you have accrued fewer than 30 work credits, you pay the maximum premium — $471 in 2021.

How old do you have to be to get Medicare?

If you are age 65 or older, you are generally eligible to receive Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) if you are a United States citizen or a permanent legal resident who has lived in the U.S. for at least five years in a row.

What happens if you refuse Medicare Part B?

If you refuse it, you don’t lose your Medicare Part B eligibility. However, you may have to wait for a valid enrollment period before you can enroll . You may also have to pay a late enrollment penalty for as long as you have Medicare Part B coverage.

How long do you have to work to pay Medicare?

You or your spouse worked long enough (40 quarters or 10 years) while paying Medicare taxes. You or your spouse had Medicare-covered government employment or retiree who has paid Medicare payroll taxes while working but has not paid into Social Security. Normally, you pay a monthly premium for Medicare Part B, no matter how many years you’ve worked.

When do you get Medicare Part A and Part B?

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

Is Medicare available to everyone?

Medicare coverage is not available to everyone. To receive benefits under this federal insurance program, you have to meet Medicare eligibility requirements. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

What age do you have to be to get Medicare?

You must also meet at least one of the following criteria for Medicare eligibility: Be age 65 or older and eligible for Social Security: You may be automatically enrolled in Medicare Part A (hospital insurance) when you reach age 65 and become eligible for Social Security. But, if you’re not receiving retirement benefits from Social Security or ...

What happens if you don't sign up for Medicare Part B?

Be aware that if you don’t sign up for Medicare Part B when you first become eligible, you may have to pay a 10% penalty (added to your monthly premium) for each full 12-month period you could have had it but didn’t sign up (some exceptions apply).

What is Medicare Part C?

Medicare Part C (also called Medicare Advantage ) is an alternative way to get your Medicare Part A and Part B benefits. Medicare Advantage plans are available through private insurers. To be eligible for Medicare Part C, you must already be enrolled in Medicare Part A and Part B, and you must reside within the service area ...

How long does Medicare Advantage last?

The Medicare Advantage plan (Part C) Initial Coverage Election Period is generally the same as the Initial Enrollment Period for Medicare Part A and Part B (the seven-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65).

How much is the Part B premium for 2021?

In addition, you must also pay the Part B premium each month. The standard premium is $148.50 in 2021. Also, keep in mind that individuals with a higher income may have to pay more for their Part B premium.

How long do you have to be disabled to get a disability?

Be permanently disabled and receive disability benefits for at least two years: You automatically get Part A and Part B after you get disability benefits from Social Security for 24 months or certain disability benefits from the Railroad Retirement Board (RRB) for 24 months. Have end-stage renal disease (ESRD) (permanent kidney failure ...

Is there a penalty for not signing up for Medicare Part C?

Medicare Part C is optional, and there is no penalty for not signing up. But you must have Medicare Part A and Part B to get Part C, and live in the service area of a Medicare Advantage plan. If you have Medicare Part C, you must continue paying your Part B premium even if you enroll in a Medicare Advantage plan.

How old do you have to be to get Medicare?

To apply, you must be 65 years old and a U.S. citizen or a lawfully admitted noncitizen who has lived in the United States for 5 years or more. If you buy Medicare Part A coverage, you must also enroll in Medicare Part B and pay those monthly premiums. The 2021 monthly premium for Part A coverage can be up to $471 per month. ...

When will I get Medicare if I have SSDI?

If you have a disability and have been receiving SSDI benefits for at least 24 months (2 years), you will automatically be enrolled in premium-free Medicare at the beginning of the 25th month.

How long do you have to be a working person to get Medicare Part B?

There’s no work history requirement to enroll in Medicare Part B. You can enroll as long as you’re at least 65 years old. Once you enroll in Medicare Part B, you will pay a monthly premium of $148.50 in 2021. Your premium may be more if your income is higher.

What is Medicare Advantage?

Medicare Advantage is a private insurance option that offers the same basic benefits as original Medicare (Part A and Part B), plus additional benefits like vision and dental care. You must be eligible for original Medicare to qualify for a Medicare Advantage plan.

How long does it take for Medicare to cover prescriptions?

While this plan is optional, Medicare requires you to have sufficient prescription drug coverage within 63 days of the date you become eligible for Medicare. This applies whether you get that coverage through Medicare, your employer, or another source.

How long does Medicare last?

Medicare is health insurance that’s provided through the U.S. government. It’s available once you turn 65 years old or if you: receive Social Security disability benefits for at least 2 years. receive disability pension benefits from the Railroad Retirement Board.

How many quarters can you work to get Medicare?

In general, Medicare is available premium-free if you’ve worked a total of 40 quarters (10 years or 40 work credits). But can you still get Medicare if you haven’t worked for ...

What percentage of Medicare is paid for out-of-hospital services?

Medicare usually pays: the full schedule fee for general practitioner services. 85% of the schedule fee for other out-of-hospital services. 75% of the schedule fee for in-hospital services as a public patient. You may receive a higher benefit under the Medicare safety net if you have a lot of medical expenses. Find out what Medicare covers.

What is Medicare payment?

Medicare provides payments and services that can help when you, or someone you provide care for, use health care services or buy medicines.

Does private insurance cover hearing aids?

Private health insurance may cover some of your costs for things like glasses, or hearing or mobility aids. You may also be eligible for free or low-cost medical aids under the Medical Aids Subsidy Scheme. Last updated: 10 December 2014.

Does Medicare cover hearing aids?

Medicare does not cover a range of costs like: private patient costs in hospital. extras services like dental and physiotherapy. medical aids like glasses or hearing aids. You may choose to take out private health insurance to help with these costs. Private health insurance may cover some of your costs for things like glasses, ...