There are times you may be eligible for Medicare but are not allowed to enroll in a Part D plan. This occurs when you reside outside of the country or U.S. territories. When you return to the United States, you will be eligible to sign up. When you are incarcerated, you receive benefits from the prison system, not Medicare.

Full Answer

Who has the best Medicare Part D plan?

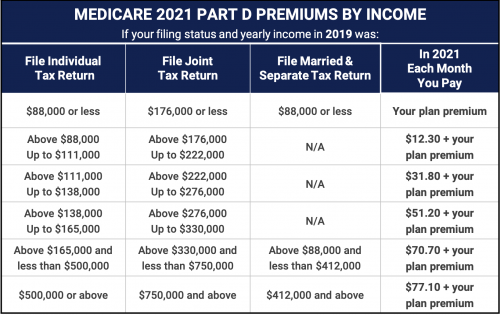

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What plans are available for Medicare Part D?

- Monthly premiums

- Annual deductible (maximum of $445 in 2021)

- Copayments (flat fee you pay for each prescription)

- Coinsurance (percentage of the actual cost of the medication)

Who qualifies for a Medicare Part D prescription drug plan?

Those who qualify for Medicare Part D must live in the plan’s service area No matter what type of Medicare Prescription Drug Plan you have (or you want to sign up for), you must reside in the plan’s service area. It’s easy to find plans available where you live – just enter your zip code and click on the button on this page.

What is covered by Medicare Part D?

QUINCY (WGEM) - For those of you with a Medicare D plan, a list of vaccines is now covered for you in Adams County. Starting on Monday, the Adams County Health Department will begin offering vaccines for Shingles, Tetanus, Hepatitis A and B, and more.

Can you be denied for Medicare Part D?

Depending on the reason for the denial, you may be entitled to request an Exception (Coverage Determination); to obtain your drug. If your Coverage Determination is denied, you have the right to Appeal the denial. There are several reasons why your Medicare Part D plan might refuse to cover your drug.

Does everyone get Medicare Part D?

Medicare Cost Plan Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

Does everyone get Part D?

This total includes plans open to everyone with Medicare, including stand-alone PDPs and MA-PDs, and plans for retirees of a former employer or union. Part D enrollment has doubled since the program started in 2006, when the number of enrollees was 22.0 million, or roughly half of all Medicare beneficiaries.

Who is most likely to be eligible to enroll in a Part D prescription drug plan?

You are eligible for Medicare Part D drug benefits if you meet the qualifications for Medicare eligibility, which are: You are age 65 or older. You have disabilities. You have end-stage renal disease.

What makes you eligible for Medicare Part D?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease.

Is Medicare Part D optional?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Can you add Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

When did Medicare Part D become mandatory?

2006The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

Do I need Part D if I have Medicare Advantage?

Plans can now cover more of these benefits. You can join a separate Medicare drug plan (Part D) to get drug coverage. Drug coverage (Part D) is included in most plans. In most types of Medicare Advantage Plans, you don't need to join a separate Medicare drug plan.

What is considered creditable coverage for Medicare Part D?

Under §423.56(a) of the final regulation, coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS actuarial ...

In what circumstances can the plan make a formulary exception for a non covered prescription?

For formulary exceptions, the prescriber's supporting statement must indicate that the non-formulary drug is necessary for treating an enrollee's condition because all covered Part D drugs on any tier would not be as effective or would have adverse effects, the number of doses under a dose restriction has been or is ...

When can I add Part D to my Medicare coverage?

The first opportunity for Medicare Part D enrollment is when you're initially eligible for Medicare – during the seven-month period beginning three months before the month you turn 65. If you enroll prior to the month you turn 65, your prescription drug coverage will begin the first of the month you turn 65.

What is Medicare Part D?

Medicare Part D is an important benefit that helps pay for prescription drugs not covered by original Medicare (parts A and B). There are private medication plans that you can add to your original Medicare coverage, or you can choose a Medicare Advantage plan (Part C) with drug coverage.

When do you have to enroll in Medicare Part D?

For most people, you first become eligible to enroll in Medicare Part D from 3 months before your 65 th birthday to 3 months after your birthday. When you find a plan to join, you’ll need to provide your unique Medicare number and the date you became eligible.

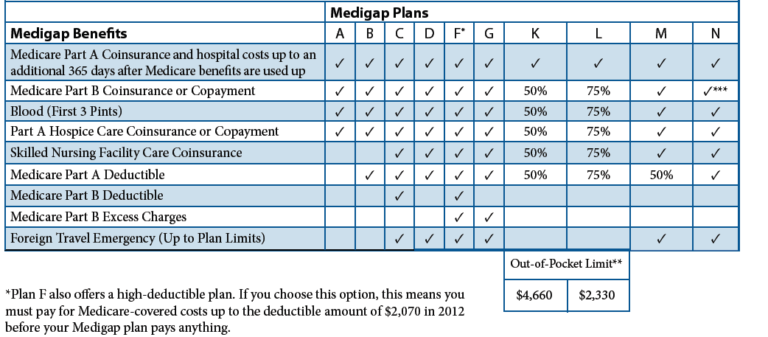

What is Medicare Supplement?

Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums.

What are the different types of Medicare coverage?

What are the Medicare prescription drug coverage options? 1 Part D. These plans cover prescription medications for outpatient services. All plans have to offer some basic level of drug coverage based on Medicare rules. Specific plan coverage is based on the plans’ formulary, or drug list. If your doctor wants a drug covered that’s not part of that plan’s list, they’ll need to write a letter of appeal. Each nonformulary medication coverage decision is individual. 2 Part C (Advantage plans). This type of plan can take care of all your medical needs (parts A, B, and D), including dental and vision coverage. Premiums might be higher and you might have to go to network doctors and pharmacies. 3 Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums. Choose the best option to give you maximum benefits at the lowest rates.

What is the right Medicare plan for you?

The right plan for you depends on your budget, medication costs, and what you want to pay for premiums and deductibles. Medicare has a tool to help you compare plans in your area looking ahead to 2020. Part D. These plans cover prescription medications for outpatient services.

How long does it take for Medicare to pay late enrollment penalty?

Medicare adds on a permanent 1 percent late enrollment penalty to your premiu if you don’t enroll within 63 days of your initial eligibility period. The penalty rate is calculated based on the national premium rate for the current year multiplied by the number of months you didn’t enroll when you were eligible.

How long do you have to stay in Medicare Part D?

You’ll have to stay in the plan an entire year, so choose carefully. When using the Medicare plan finder to choose a Part D plan, enter your medications and doses, then select your pharmacy options. Of the available drug plans, you’ll see the lowest monthly premium plan displayed first.

What happens if you don't enroll in Medicare Part D?

If you don’t enroll when you’re first eligible and don’t have creditable coverage, you could face a late enrollment penalty. Let’s take a closer look at using an example. Tip: Medicare Plan D and Part D aren’t the same things.

Why is Medicare Part D important?

For many, prescription medications are vital to maintaining a healthy lifestyle. The costs of medications can drain finances, Medicare Part D prescription helps those who need assistance with medications .

How long do you have to change your plan if you are no longer eligible for Part D?

If you’re no longer eligible for Extra Help for the following year, you will have a 3-month window to change plans. This period starts either the date you’re notified or when you’re no longer eligible;

Is it necessary to take prescriptions on a regular basis?

For many seniors, taking prescription drugs on a regular basis is not optional. Patients who have regular medication needs should be sure to enroll as soon as Medicare Part D eligibility begins. Unexpected or not, the cost of medications can be financially exhausting, Part D plans provide you with a much lower cost for the same quality ...

Can Medicare delay Part D?

Delaying Part D When Eligible. Medicare may add a Part D Late Enrollment Penalty to your Part D premium each month you have Part D coverage. Unless you enroll in a Part D plan when you’re first eligible during your IEP. As we grow older our chances of needing prescriptions will often increase. If you have no creditable prescription drug coverage, ...

Do I need a Medicare Advantage plan if I have supplemental insurance?

But if you have a Medicare Advantage plan that includes Part D, you can’t have a separate Part D plan.

Do dual eligible beneficiaries have Part D?

Dual eligible beneficiaries now automatically have Part D . Before Part D began, the Medicaid program provided drug coverage for dual-eligible beneficiaries. If a dual eligible beneficiary wants to make changes to their plan or benefits, they may do so but only at certain times of the year.

Who is Not Eligible for Medicare?

Medicare is a health insurance program designed to cover essential healthcare costs such as durable medical equipment, hospice care, preventive screenings, and more.

Who is Not Eligible?

The Medicare program is available to people aged 65 or older. This means people below age 65 who do not meet other eligibility requirements cannot enroll in the program until they turn 65 or qualify through other means. If you have been diagnosed with ALS or end-stage renal disease, you can enroll in Medicare while under 65.

Give Us A Call Today!

If you’re still not sure about your Medicare eligibility, Carolina Insurance Partners are here to help. We understand the importance of knowing when to enroll and making sure you enroll on time to avoid any late enrollment penalties.

How old do you have to be to qualify for Medicare?

You’re an American citizen who lives in the country or a permanent resident who has lived here for five or more continuous years, and. You’re 65 or older or under 65 and qualify for Medicare due to having a disability, ESRD, or ALS.

What happens if you don't get Part B?

If you decide not to get Part B when you’re first eligible and you don’t qualify for special enrollment, you may be subject to a penalty when you do enroll. The penalty permanently increases your Part B premium by 10%. 11.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers inpatient hospital, hospice, and skilled nursing facility care. Part A also covers home health care. You can sign up for Part A: During your Initial Enrollment Period (IEP), if you’re not automatically enrolled, or. At any time after you’re first eligible.

How long does it take to get Medicare?

Generally, you’re eligible to enroll in Medicare once you turn 65 and you enter your Initial Enrollment Period . Your initial enrollment is a seven-month period : It begins three months before the month you turn 65 and ends three months after you turn 65. For example, if you turn 65 in September, you can apply for Medicare from June ...

What is a Part C plan?

Part C Plans Are an Alternative to Original Medicare. Medicare Advantage plans provide Part A and Part B benefits. Most plans have built-in Part D prescription drug coverage. Some also offer other benefits, such as vision and dental coverage.

How much is Part B insurance in 2021?

The standard premium for Part B is $148.50 in 2021. This can be higher depending on your income. If you (or your spouse) are still working when you turn 65 and you get health insurance through a union plan or a job with 20 or more employees, it may be best to delay Part B enrollment.

When is the open enrollment period for Medicare?

The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year. If you’re already enrolled in a Medicare Advantage plan, you can switch to a different one (with or without drug coverage) or drop your plan and return to Original Medicare.