What is Medicare Part D, and do I need It?

Feb 28, 2022 · Medicare Part D eligibility is dependent on Medicare Part A and Part B enrollment. To be eligible for Medicare Part D, you must first enroll in Medicare Part A, Medicare Part B, or both. Medicare Part D provides beneficiaries with coverage for the cost of prescription drugs. For many, prescription medications are an essential element in maintaining a healthy lifestyle.

What drugs are covered in Part D?

Mar 06, 2021 · Initial Enrollment Period for Medicare Part D Enrollment Your Initial Enrollment Period (IEP) occurs when you first become eligible for Medicare. For most people, eligibility happens when you turn 65. The IEP begins three months before the month you turn 65. It includes your birthday month and the three months following for a total of seven months.

How do I know if I have Medicare Part D?

Mar 06, 2022 · Part D adds prescription drug coverage to your existing Medicare health coverage. You must have either Medicare Part A or Part B to get it. When you become eligible for Medicare (usually when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 3.

How much does it cost for Medicare Part D?

Feb 28, 2022 · CY2021 Part D Reporting Requirements 120920 (PDF) CY 2021 Technical Specifications 11252020 (PDF) 2020 Bene-Level MTMP Submission Instructions (12312020) (PDF) CY2020_Part D Reporting Requirements_082719 (PDF) Updated CY 2020 Technical Specifications_111920 (PDF)

Is it mandatory to have Part D Medicare?

En español | Part D drug coverage is a voluntary benefit; you are not obliged to sign up. You may not need it anyway if you have drug coverage from elsewhere that is “creditable” — meaning Medicare considers it to be the same or better value than Part D.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Is Medicare Part D for everyone?

Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

When did Medicare Part D become mandatory?

January 1, 2006In 2003 the Medicare Modernization Act created a drug benefit for seniors called Part D. The benefit went into effect on January 1, 2006.Aug 10, 2017

What happens if I refuse Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

Can I opt out of Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Is Part D mandatory?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Which medication would not be covered under Medicare Part D?

For example, vaccines, cancer drugs, and other medications you can't give yourself (such as infusion or injectable prescription drugs) aren't covered under Medicare Part D, so a stand-alone Medicare Prescription Drug Plan will not pay for the costs for these medications.

Can I add Medicare Part D anytime?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Do I have to pay Irmaa Part D if I don't have Part D Medicare?

No. You should not pay an Income-Related Monthly Adjustment Amount (IRMAA) for Medicare Part D if you are not enrolled in a Medicare Part D drug plan.

What is required for Medicare?

All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.

How long does Medicare Part D cover?

It includes your birthday month and the three months following for a total of seven months. During that time, you can enroll in a Part D Prescription Drug plan or a Medicare Part C plan that includes prescription drug coverage.

How long can you go without Medicare Part D?

However, if you go without Medicare Part D or other creditable prescription drug coverage for a continuous period of 63 days or longer after your IEP is over, you could be subject to a Part D late enrollment penalty. Coverage could come from a stand-alone prescription drug plan, a Medicare Advantage plan with prescription drug coverage (Part C), ...

What is Medicare Advantage?

A Medicare Advantage plan is an alternative way to get your Original Medicare (Part A and Part B) benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications. Medicare Part D enrollment provides you with choices of plans in most service areas.

What is a SEP in Medicare?

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.

What is the difference between Medicare Part A and Part B?

Original Medicare helps you pay many of your medical expenses. Part A pays a portion of your bills if you are a hospital inpatient. Part B covers other medical care, like doctor visits and some medical equipment.

When is the fall open enrollment period for Medicare?

Medicare also offers a Fall Open Enrollment Period (OEP) every year that runs from October 15 to December 7. This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

What happens if you decline Medicare?

Declining. Late enrollment penalties. Takeaway. If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later. Medicare is a public health insurance program designed for individuals age 65 and over ...

What is the national base beneficiary premium for 2021?

In 2021, the national base beneficiary premium is $33.06 and changes every year. If you have to pay the penalty, the penalty amount will be rounded to the nearest $.10, and this amount will be added to your monthly Part D premium for the rest of the time you are enrolled.

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

Is Medicare Part D mandatory?

Medicare Part D is not a mandatory program, but there are still penalties for signing up late. If you don’t sign up for Medicare Part D during your initial enrollment period, you will pay a penalty amount of 1 percent of the national base beneficiary premium multiplied by the number of months that you went without Part D coverage.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

Do you have to have a Medicare drug plan to get tricare?

Most people with TRICARE entitled to Part A must have Part B to keep TRICARE drug benefits. If you have TRICARE, you don’t need to join a Medicare drug plan.

Can you keep a medicaid policy?

Medigap policies can no longer be sold with prescription drug coverage, but if you have drug coverage under a current Medigap policy, you can keep it. If you join a Medicare drug plan, your Medigap insurance company must remove the prescription drug coverage under your Medigap policy and adjust your premiums.

Can you join a Medicare plan without a penalty?

, you'll have a special enrollment period to join a Medicare drug plan without a penalty when COBRA ends.

Does Medicare help with housing?

, you won't lose your housing assistance. However, your housing assistance may be reduced as your prescription drug spending decreases.

Does Medicare pay for prescription drugs?

Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs. In most cases, you'll pay a small amount for your covered drugs. If you have full coverage from Medicaid and live in a nursing home, you pay nothing for covered prescription drugs.

What are the parts of Medicare?

There are four parts to Medicare: A, B, C , and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse. Part C, called Medicare Advantage, is a private-sector alternative to traditional Medicare.

How much does Medicare Part A cost?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1

How much is Part B insurance in 2021?

1 If you're on Social Security, this may be deducted from your monthly payment. 11 . The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021.

How many days do you have to pay deductible?

Additionally, if you're hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day's expenses. If you're admitted to the hospital multiple times during the year, you may need to pay a deductible each time. 8 .

Why won't my insurance agent help me with Part D?

Part D is a Huge Time Investment for your Agent Too. Another reason many agents won’t help you with Part D is that the support needed on the back end is high . Pharmacies charge the wrong rate or the insurance company requires an exception from your doctor.

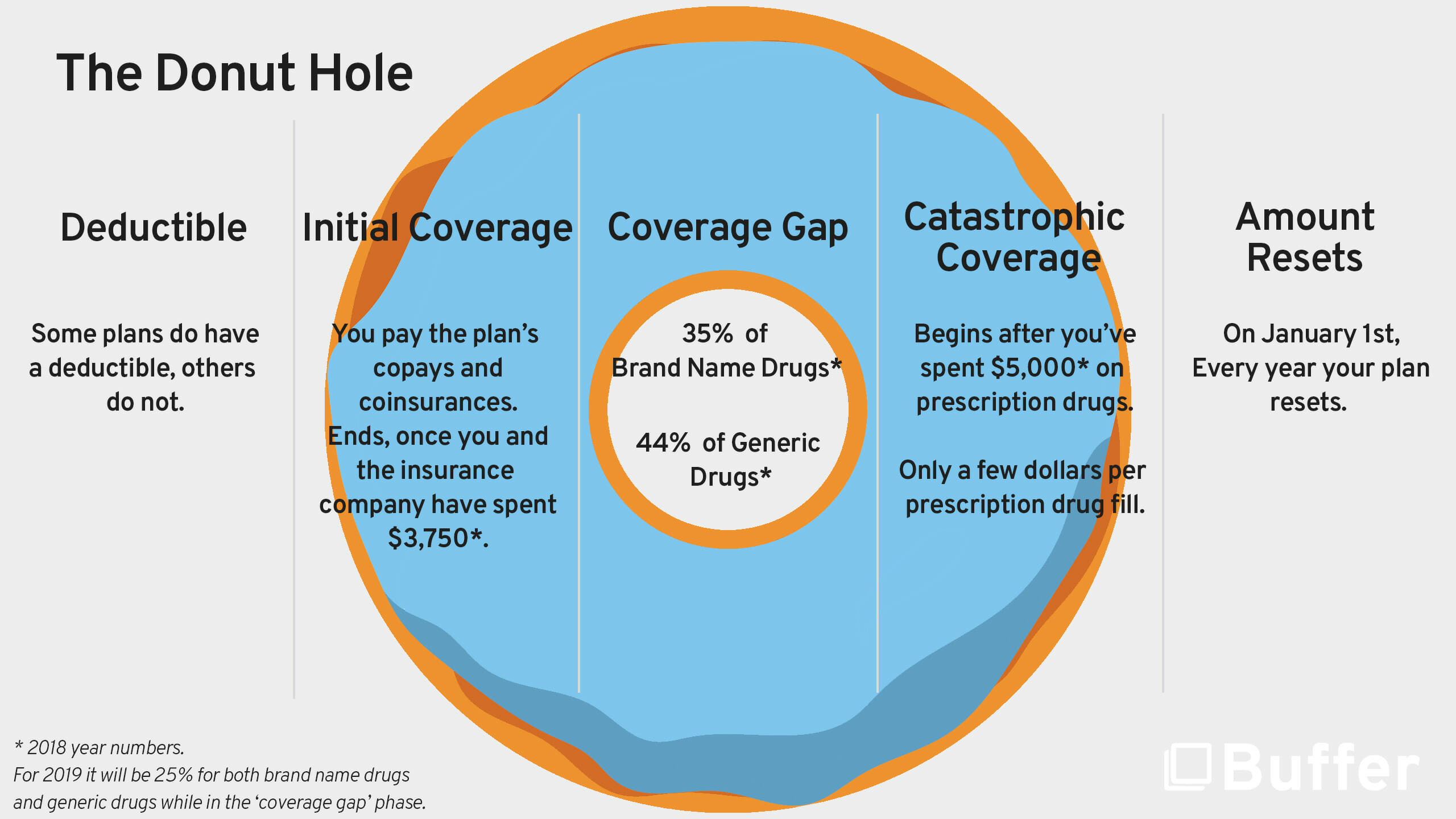

What happens when you buy Part D?

I cannot stress this enough. When you buy Part D, you are not buying it just for the meds you are using now. You are buying insurance coverage for future drug needs. Part D has a catastrophic coverage limit, and it is the best part of the coverage.

Do Part D plans come with catastrophic coverage?

You don’t want to risk paying a fortune for a critical medication. If you don’t take many prescription medications now, enroll in one of the least expensive Part D drug plans in the market. All of them come with catastrophic coverage . That way you aren’t spending too much, but you have the coverage for a rainy day.

Is an agent getting rich off Part D?

An agent would have to write thousands of them just to barely make a living. So I assure you, no agent is getting rich off Part D. Lazy agents will write your Medigap plan and throw you to wolves on Part D because it’s not worth their effort.

Is Part D a money maker?

Part D is NOT a Money Maker for your Agent. Some of you reading this are thinking – “Well of course you recommend Part D because agents get paid to sell Part D.”. Let me shed some light on this. Part D commissions for agents are so low that most agents will no longer help people with Part D.

Is Medicare Part D voluntary?

Medicare Part D, however, is a voluntary program. So even though we’ll explain why you need Part D, some people will choose to believe that “it wont’ happen to me.”. Every year, we meet dozens of Medicare beneficiaries who choose not to enroll despite the risks.

When is Medicare Part D notice?

Medicare Part D Notices – An Overview for Employers. Employers and their group health plan sponsors will want to mark October 15, 2020 on their calendars. This is the deadline for plan sponsors to disclose to individuals who are eligible for Medicare Part D and to the Centers for Medicare and Medicaid Services ...

What is a Part D notice?

Part D Notices, or notices of “Creditable Coverage,” are simply an official document given to an employee from their employer (or union) that states whether their prescription drug coverage plan is equal to or better than the prescription drug coverage provided through Medicare. The purposes of these notices is to help beneficiaries of the plan make the best decision for their prescription health coverage moving forward.

Can Part D be included in new enrollment materials?

Part D notices can even be included in new enrollment materials for employees. It is important for employers to understand the rules about printed notices and electronic notices. A single printed notice may be delivered to an address, even if multiple beneficiaries of the plan live at that address. However, if it is known that a beneficiary ...