Almost any party involved in the personal injury settlement or payment, including the attorneys, has responsibility for complying. Any settlement or payment must be reported to Medicare within 60 days and their valid lien amount must be paid. Medicare Actively Enforces These Liens

Who is responsible for a Medicare lien in a liability claim?

May 01, 2018 · Step One: Obtain Medicare Information from the Client at the Initial Meeting and Warn Them that Medicare Liens are Difficult and Can Cause Delays throughout Their Case. In addition to finding out information about any type of lien claim at your first meeting with the client, be sure to find out if the client receives Medicare benefits.

What happens after a Medicare lien is paid?

Apr 02, 2020 · However, you will still need to confirm this with Medicare prior to any settlement through a request for lien information to the Centers for Medicare and Medicaid Services’ (CMS) relevant contractor. The CMS contractor that handles lien recovery in accepted workers’ compensation claims is the Commercial Repayment Center (CRC).

How do I handle a Medicare lien?

For those payments, Medicare calls itself a “secondary payer,” and it claims the tortfeasor and its insurance carrier are the “primary payers.” Medicare’s right to recovery is established under the Medicare Secondary Payer Act (MSP). (42 U.S.C. § 1395y.) Under the MSP, original Medicare claims have priority over other lien claims.

What is a lien claim under Medicare Part D?

Dec 01, 2021 · Attorney Services. By law, 42 U.S.C. §1395y (b) (2) and § 1862 (b) (2) (A)/Section and § 1862 (b) (2) (A) (ii) of the Social Security Act, Medicare may not pay for a beneficiary's medical expenses when payment “has been made or can reasonably be expected to be made under a workers’ compensation plan, an automobile or liability insurance ...

How do Medicare liens resolve?

- Submit Proof of Representation or Consent to Release documentation.

- Request conditional payment information.

- Dispute claims included in a conditional payment letter.

- Submit case settlement information.

Can Medicare liens be negotiated?

How do I avoid a Medicare lien?

- Client Should Provide Medicare Information. ...

- Contact the BCRC. ...

- Await Confirmation. ...

- Submit Proof of Representation. ...

- Await the Conditional Payment Letter. ...

- Review the Conditional Payment Letter. ...

- Monitor the Case. ...

- Inform Medicare of a Received Settlement.

Do you have to pay back Medicare?

What is the Medicare set aside?

Does Medicare have a statute of limitations?

For Medicaid and Medicare fraud, federal law establishes (1) a civil statute of limitations of six years (42 U.S.C. § 1320a-7a(c)(1)), and (2) a criminal statute of limitations of five years (18 U.S.C. § 3282).

How do I get reimbursed from Medicare?

How long does it take to be reimbursed from Medicare?

Why would I get a letter from CMS?

Who is eligible for Medicare reimbursement?

How does Medicare Part B reimbursement work?

How do you qualify to get 144 back from Medicare?

What is the black hole in Medicare?

It takes FOREVER to get a response from the black hole that is known as Medicare's Benefits Coordination and Recovery Contractor. The BCRC collects the information for Medicare and opens the file with the Medicare Secondary Payor Recovery Center (MSPRC).

Does Medicare move quickly?

As you will see, Medicare does not move quickly in providing information at any step of this process. Warning your client at the outset will prevent many anxious calls from your client at the end of your case when they are wondering why they have not gotten their settlement money.

Can you send proof of representation to the MSPRC?

Make sure that you send Proof of Representation to the MSPRC. The MSPRC will take no action on your case without it, and they will not let you know that they are missing anything, which, as you can imagine, is super helpful. But not.

How to contact MSPRC?

Step 7: Monitor Your Case with MSPRC. Call MSPRC at (866) 677-7220, if you have not received the documents you are waiting for, and the time period for producing them have passed. Have other work to do though; wait times can be very long.

What are the parts of Medicare?

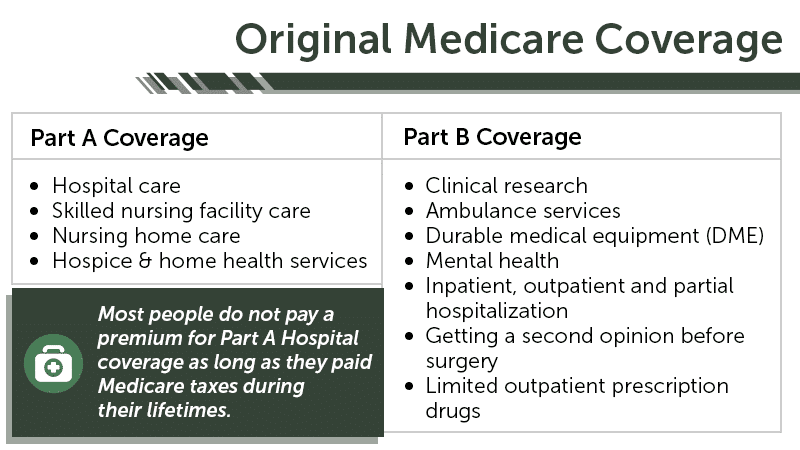

(The other parts of the Medicare Act are not discussed in this compendium.) The four parts are: Medicare Part A and Part B.

What is Medicare for Social Security?

Medicare is a healthcare program for Social Security beneficiaries. It is administered by the Centers for Medicare and Medicaid Services (CMS). Generally, Medicare coverage is for individuals who qualify for Social Security benefits. The Medicare program is controlled by the Medicare Act. (42 U.S.C. § 1395 et seq.)

What is Medicare 2020?

2020 March. Medicare is a healthcare program for Social Security beneficiaries. It is administered by the Centers for Medicare and Medicaid Services (CMS). Generally, Medicare coverage is for individuals who qualify for Social Security benefits. The Medicare program is controlled by the Medicare Act. (42 U.S.C. § 1395 et seq.)

What is Medicare Part A and Part B?

Medicare Part A and Part B. Medicare Part A, for hospitalization, and Part B, for medical doctors and healthcare services , are known as original ( aka traditional) Medicare. Original Medicare is a fee-for-service program. The Medicare beneficiary can choose any healthcare provider that honors original Medicare coverage.

What is Medicare Advantage?

§ 1395w -21 to -29) and funded by CMS, usually on a capitated basis. The Medicare Advantage private insurance carrier is known as a Medicare Advantage Organization (MAO). The MAO provides all original Medicare Part A and Part B healthcare.

What is supplemental insurance?

Private insurance coverage , known as “supplemental” insurance, is available for purchase by the beneficiary. The supplemental insurance, inter alia, pays the 20% Part B costs and some of the hospitalization expenses not covered by Part A. Medicare Part C, Medicare Advantage.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

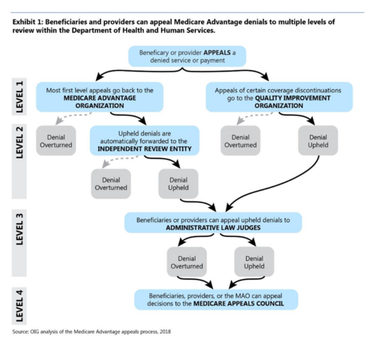

How long does it take to appeal a debt?

The appeal must be filed no later than 120 days from the date the demand letter is received. To file an appeal, send a letter explaining why the amount or existence of the debt is incorrect with applicable supporting documentation.

Attorney Services

By law, 42 U.S.C.

Conditional Payment Information

Once the BCRC is aware of the existence of a case, the BCRC begins identifying payments that Medicare has made conditionally that are related to the case. The BCRC will issue a conditional payment letter with detailed claim information to the beneficiary.

Reimbursing Medicare

When a case settles or there is a judgment, award, or other payment, the BCRC issues a formal demand letter advising the beneficiary and his attorney or other representative of its primary payment responsibility.

Medicare’s Demand Letter

- In general, CMS issues the demand letter directly to: 1. The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. 2. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals ...

Assessment of Interest and Failure to Respond

- Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pu…

Right to Appeal

- It is important to note that the individual or entity that receives the demand letter seeking repayment directly from that individual or entity is able to request an appeal. This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the ri…

Waiver of Recovery

- The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of the amount owed if the following con…