Let’s begin by describing who is subject to the Net Investment Income Tax (“NIIT”), also referred to as the Medicare surtax.4 An individual unmarried taxpayer is subject to the Medicare surtax when his/her Modified Adjusted Gross Income (“MAGI”)5 is greater than $200,000.

...

Who Is Subject to the NIIT?

| Filing status | Threshold Amount |

|---|---|

| Married Filing Jointly, Qualifying Surviving Spouse with Dependent Child | $250,000 |

How to calculate Medicare surtax?

Medicare levy calculator. This calculator helps you estimate your Medicare levy. It includes any reductions or exemptions you are allowed. It can be used for the 2013–14 to 2020–21 income years. For most taxpayers the Medicare levy is 2% of their taxable income. The Medicare levy surcharge (MLS) is a separate levy from Medicare levy.

What is the maximum income taxed for Medicare?

- When it comes to receiving Medicare benefits, there are no income restrictions.

- You may be asked to pay more money for a premium depending on your income.

- If you have a minimal income, you may be eligible for Medicare premium assistance.

Is Medicare considered a regressive tax?

regressive tax —A tax that takes ... Excise taxes can also be considered proportional since everyone is taxed at the same rate. ... (Medicare is withheld on all wages and tips.) People with income from interest and dividend payments do not have to pay any Social Security tax on this income.

What income is subject to Medicare tax?

Typically, self-employment tax is required if you earned over $400 per year from self-employment. Taxes on self-employment usually require an amount of 92 dollars. Self-employment earnings are subject to a 35% tax. Even if you are receiving social security benefits, you will still be responsible for paying self-employment tax.

Is investment income subject to additional Medicare tax?

The 0.9 percent Additional Medicare Tax applies to individuals' wages, compensation, and self-employment income over certain thresholds, but it does not apply to income items included in Net Investment Income. For additional information on Net Investment Income Tax, see our questions and answers posted on IRS.gov.

What income is subject to the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

Who is subject to the additional Medicare tax?

A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

Is NIIT the same as the Medicare surtax?

The Net Investment Income Tax (“NIIT”) or Medicare Tax is a 3.8% Surtax imposed by Section 1411 of the Internal Revenue Code on investment income....What are the statutory thresholds amounts for the NIIT?Filing StatusThreshold AmountMarried filing jointly$250,000Married filing separately$125,0003 more rows

Who is not subject to net investment?

Single taxpayer with income less than the statutory threshold. Taxpayer, a single filer, has wages of $180,000 and $15,000 of dividends and capital gains. Taxpayer's modified adjusted gross income is $195,000, which is less than the $200,000 statutory threshold. Taxpayer is not subject to the Net Investment Income Tax.

At what income does the 3.8 surtax kick in?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.

Who pays the Medicare surtax?

The takeaway Everyone who earns income pays some of that income back into Medicare. The standard Medicare tax is 1.45 percent, or 2.9 percent if you're self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What income is not subject to Medicare tax?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.

What is subject to NIIT?

The NIIT applies to income from a trade or business that is (1) a passive activity, as determined under § 469, of the taxpayer; or (2) trading in financial instruments or commodities, as determined under § 475(e)(2).

Which income source is not subject to the net investment income tax NIIT?

Overview of the NIIT Net investment income does not include wages, unemployment compensation, nonpassive business income, Social Security Benefits, alimony, tax-exempt interest, and distributions from some tax-preferred retirement accounts; for example, 401(k)s, 403(b)s, and 457(b)s.

What is net investment income?

In general, net investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

What happens if you don't pay quarterly estimated taxes?

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax, the individual may be subject to an estimated tax penalty. The Net Investment Income Tax is separate from the new Additional Medicare Tax, which also went into effect on January 1, 2013.

Is investment income subject to income tax?

To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax.

What is the surtax on NIIT?

Donors with modified adjusted gross income (MAGI) above an applicable threshold pay a 3.8% surtax called the Net Investment Income Tax or NIIT. This surtax is imposed on the lesser of (1) net investment income or (2) the amount by which modified adjusted gross income (MAGI) exceeds the applicable threshold. It is imposed on top of the taxpayer’s regular income tax. The tax took effect on January 1, 2013.

Is PIF income taxed?

PIF income is surtaxed. The beneficiary will be surtaxed on taxable distributions from a pooled income fund. The PIF itself is not exempt, and as a trust it may be surtaxed on short-term gains not distributed by the trust, if the trust’s undistributed net investment income exceeds $12,150 for 2014. Long-term gains retained by the pooled income fund and set aside for charity are excludable, as they are for the regular income tax.

Is a grantor CLT taxed?

Grantor CLTs are surtaxed on the donor. Grantor charitable lead trusts are exempt at the trust level but any net investment income passes through to the donor’s tax return, with no deduction for the charitable payout, in the same way as there is already no charitable deduction for the regular income tax imposed on the donor for grantor CLT income and capital gains.

How much is net investment income tax?

The Net Investment Income Tax is based on the lesser of $70,000 (the amount that Taxpayer’s modified adjusted gross income exceeds the $200,000 threshold) or $90,000 (Taxpayer’s Net Investment Income). Taxpayer owes NIIT of $2,660 ($70,000 x 3.8%).

What is the income of a single filer?

Taxpayer, a single filer, has wages of $180,000 and $15,000 of dividends and capital gains. Taxpayer’s modified adjusted gross income is $195,000, which is less than the $200,000 statutory threshold. Taxpayer is not subject to the Net Investment Income Tax.

What is NIIT tax?

The NIIT applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.

What is investment income?

In general, investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities and businesses that are passive activities to the taxpayer (within the meaning of section 469). To calculate your Net Investment Income, your investment income is reduced by certain expenses properly allocable to the income (see #13 below).

What is modified adjusted gross income?

For the Net Investment Income Tax, modified adjusted gross income is adjusted gross income (Form 1040, Line 37) increased by the difference between amounts excluded from gross income under section 911 (a) (1) and the amount of any deductions (taken into account in computing adjusted gross income) or exclusions disallowed under section 911 (d) (6) for amounts described in section 911 (a) (1). In the case of taxpayers with income from controlled foreign corporations (CFCs) and passive foreign investment companies (PFICs), they may have additional adjustments to their AGI. See section 1.1411-10 (e) of the final regulations.

How much is realized gain on a sale?

A’s realized gain on the sale is $220,000. Under section 121, A may exclude up to $250,000 of gain on the sale. Because this gain is excluded for regular income tax purposes, it is also excluded for purposes of determining Net Investment Income.

When did the NIIT tax take effect?

When did the Net Investment Income Tax take effect? The Net Investment Income Tax went into effect on Jan. 1, 2013. The NIIT affects income tax returns of individuals, estates and trusts, beginning with their first tax year beginning on (or after) Jan. 1, 2013.

What is the NIIT surtax?

The NIIT is, broadly speaking a 3.8% surtax on “net investment income”. It applies only to certain high-income individuals. We will discuss very soon, precisely to whom the NIIT applies.

What is the NIIT 3.8%?

The 3.8% NIIT is imposed on the lower of the taxpayer’s net investment income or the excess of MAGI over the income thresholds. Generally, MAGI is adjusted gross income with certain tax deductions added back into the number. You will not find MAGI on your tax return; it must be separately calculated. For Americans overseas to determine MAGI, they must add back all foreign earned income / foreign housing amounts that were excluded under the FEIE rules. In the case of taxpayers with income from controlled foreign corporations (CFCs) and passive foreign investment companies (PFICs), they may have additional adjustments to their adjusted gross income.

What is the self employment tax rate?

The self-employment tax rate is 15.3% imposed on the net earnings. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

When will the NIIT tax be introduced?

In order to earn more tax dollars and to simplify the system, beginning in tax years after 2021, President Biden’s Greenbook proposes to subject all trade or business income of individuals earning over US$400,000 to either self-employment tax or NIIT.

Is a nonresident alien exempt from NIIT?

Nonresident alien individuals are specifically exempt from the 3.8% NIIT. This is important, for example, for the nonresident alien individual owning investments or properties in the US and earning passive rents, dividends or capital gains with respect to the properties. Specific rules apply for dual-status individuals and those making a special election to be treated as a US “resident” for tax filing purposes. The IRS FAQ at number 5 gives further information. It can be accessed here.

Does NIIT apply to IRA distributions?

The NIIT does not apply to distributions from qualified retirement plans (e.g., an employer-sponsored defined benefit plan, profit sharing plan, Employee Stock Ownership Plan, or so-called 401 (k) plan and others) or distributions from an IRA. It also does not apply to payments made on a tax-exempt municipal bond. These NIIT exemptions make good economic sense. Congress does not want to discourage taxpayer’s from investing in their own retirement planning and it does not want to discourage taxpayers from investing in municipal bonds, since these debt obligations which are issued by states, cities, counties and other governmental entities, use the money for projects such as building schools, roadways, and other projects for the public welfare.

Can foreign tax credits offset NIIT?

Sadly, foreign tax credits cannot offset the NIIT due to a very technical reason reflecting how the US Internal Revenue Code is structured. All is not lost, however. If foreign income taxes are taken as an income tax deduction on the tax return, as opposed to taking them as a tax credit, some (or all) of the deduction amount may be deducted against the taxpayer’s net investment income. This is a matter to be carefully examined with your tax return preparer.

What is Medicare surtax?

0 1 minute read. Medicare surtax is the additional Medicare tax that applies to taxpayers with income above a certain threshold. The income threshold depends on the filing status of the taxpayer. Medicare surtax was first introduced in 2010 with the Affordable Care Act of 2010 and applies to investment income.

What is modified adjusted gross income?

The Modified Adjusted Gross Income refers to the household AGI. You won’t be able to find MAGI on your tax return (s), so don’t even bother looking at bit but you can take your Adjusted Gross Income and add back certain deductions and tax-exempt interest income.

What is Form 8960?

Form 8960, Net Investment Income Tax —Individuals, Estates, and Trusts is the tax form where you can calculate the net investment income earned. Upon figuring out your net investment income, you will need to attach it to Form 1040—your federal income tax return and pay the surtax.

What is net investment income?

Net investment income includes capital gains on the sale of investment property and most rentals (property held as a passive activity).

What is not subject to tax?

Excluded are the sale of interests in partnerships and S-Corps where the seller actively participated in the business. The sale of property held by sub-chapter C corporations and property actively used in a trade or business are not subject to the tax because there is a business use as opposed to being held for investment.

What is the surtax rate for real estate?

Many investors selling real estate or other high value investments are often surprised to find out that their tax liability could be subject to an extra 3.8% Surtax in addition to the applicable short-term or long-term capital gains tax rates. The Net Investment Income Tax (“NIIT”) or Medicare Tax is a 3.8% Surtax imposed by Section 1411 ...

What is the NIIT rate?

Long-term capital gains and the NIIT: A taxpayer’s corresponding federal capital gains tax rate depends on the taxpayer’s income which depending on their filing status, falls into one of three brackets and is assigned one of three corresponding rates: 0%, 15%, or 20%.

Does Legal 1031 provide tax advice?

Legal 1031 does not provide tax or legal advice, nor can we make any representations or warranties regarding the tax consequences of any transaction. Taxpayers must consult their tax and/or legal advisors for this information. Unless otherwise expressly indicated, any perceived federal tax advice contained in this article/communication, including attachments and enclosures, is not intended or written to be used, and may not be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any tax-related matters addressed herein. Copyright © 2021 Legal1031. All rights reserved. No rights claimed with respect to fair use and public domain materials.

Is gain and loss taxable income?

Gains and losses that aren’t taken into account in computing taxable income aren’t taken into account in computing net investment income. For example, gain that isn’t taxable by reason of section 121 (sale of a principal residence) or section 1031 (like-kind exchanges) isn’t included in net investment income.

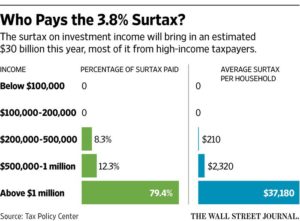

How much surtax is there on Obamacare?

To help fund the Affordable Care Act (also dubbed Obamacare), there was a 3.8% surtax levied against higher incomes. This specific tax took effect in 2013 and, according to the Tax Policy Center, is expected to bring in nearly 30 billion dollars of tax revenue.

How much is Obamacare surtax?

The 3.8% Obamacare Surtax and how to avoid it. This Medicare surtax can be avoided or minimized with a little proactive tax planning. Don’t be surprised if your LA financial advisor or financial planner doesn’t take a proactive approach to help you minimize your tax bills. Proactive tax planning is imperative for those with large incomes. Tax planning is even more valuable for those making big incomes in California, a high tax state.

Why is Medicare surtax higher in the Golden State?

Why? Income levels tend to be higher in the Golden State. The higher the income, the more money those in support of healthcare for everyone will have to pay in taxes. The 3.8% medicare surtax on higher incomes seems to be the tax that surprise and annoy many people who find themselves getting hit with it for the first time. The only good news about paying this surtax is that it means you are making more money than 90% plus of Americans. Of course, I don’t think that will make that big tax bill sting any less.

How much surtax do you owe if you make over $200,000?

To be clearer if you earned $500,000, you would owe $11,400 from just this surtax.

How much surtax is on 1040?

Look for ways to minimize your AGI. The lower your AGI (the number at the bottom of the TAX FORM 1040) the lower the amount of your income will be subject to the 3.8% surtax.

How much can you exclude from selling a home?

Many couples will have nothing to worry about as you can potentially exclude up to $500,000 ($250,000 for singles) profit on the sale of a primary residence. While $500,000 is a nice exemption, that doesn’t go as far around Los Angeles or Palm Springs as it does in Arkansas.

Is Obamacare surtax adjusted for inflation?

The Obamacare surtax trigger points are not adjusted for inflation. Things like a big investment windfalls, or stock option exercise, could increase your income subject to this tax. The medicare surtax considers all forms of income, not just your salary from working.