What services are covered under Medicare Part B?

- A heart attack in the last 12 months

- Coronary artery bypass surgery

- Current stable angina pectoris (chest pain)

- A heart valve repair or replacement

- A coronary angioplasty (a medical procedure used to open a blocked artery) or coronary stenting (a procedure used to keep an artery open)

What is covered by Medicare Part B?

When you have an Advantage plan, Medicare Parts A and Part B do not act as secondary coverage for your Advantage plan. You don't get healthcare services from both, because when you choose a Medicare Advantage plan you are deselecting CMS as the ...

Is Medicare Part B Worth It?

Part B is an elective program that requires a monthly premium, so it’s important to understand if Medicare Part B is right for you. While Part B is not a 100% cover plan, it does tend to cover most people’s needs. Therefore, Part B is one of the more commonly elected aspects of the Medicare service.

How much does Medicare Part B cover?

Medicare Part B covers the cost of outpatient services, including injectable and infused drugs such as cortisone injections that are given by a licensed medical provider. If a doctor confirms that cortisone shots are medically necessary, Part B covers 80% of the cost.

Is Medicare Part B funded by Social Security?

And in 2022, the standard monthly cost of Medicare Part B is $170.10, which is automatically deducted from Social Security payments.

How is Medicare Part B funded?

Part B, the Supplementary Medical Insurance (SMI) trust fund, is financed through a combination of general revenues, premiums paid by beneficiaries, and interest and other sources. Premiums are automatically set to cover 25 percent of spending in the aggregate, while general revenues subsidize 73 percent.

Does everyone have to pay Part B of Medicare?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Is Medicare Part B free of charge?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does the federal government fund Medicare?

Medicare is funded through a mix of general revenue and the Medicare levy. The Medicare levy is currently set at 1.5% of taxable income with an additional surcharge of 1% for high-income earners without private health insurance cover.

Is Medicare funded by taxpayers?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What income is used for Medicare Part B premiums?

The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Is Medicare taken out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Does Wisconsin help with my Medicare premiums?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In...

Who's eligible for Medicaid for the aged, blind and disabled in Wisconsin?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cov...

Where can Medicare beneficiaries get help in Wisconsin?

Wisconsin State Health Insurance Assistance Program (SHIP) Free volunteer Medicare counseling is available by contacting one of two Wisconsin State...

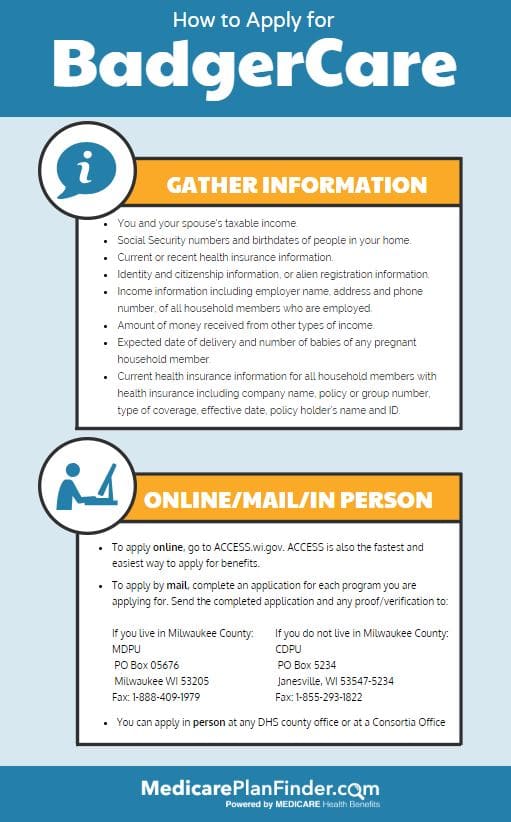

Where can I apply for Medicaid in Wisconsin?

Wisconsin’s Medicaid program is administered by the Department of Health Services (DHS). Individuals can apply for Medicaid or an MSP using this we...

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Medicare Part B Medical Insurance

The insurance provided by Medicare Part B covers medically necessary doctor’s appointments. This includes outpatient medical and surgical services, diagnostic tests and some medical equipment. It also offers coverage for home health care.

Part B Eligible Services

Doctor services, including hospital, clinic, office or home visits, surgery, osteopathy and radiology

Don't miss out!

The Medicare Annual Election Period (AEP) is open from October 15, 2021 - December 7, 2021.

When will Medicare cards be mailed?

You should automatically be mailed your Medicare Card approximately 90 days before your 65th birthday. If playback doesn't begin shortly, try restarting your device. Videos you watch may be added to the TV's watch history and influence TV recommendations. To avoid this, cancel and sign in to YouTube on your computer.

Do you get Social Security if you enroll in Part B?

You enroll in Part B for the first time in 2020. You don't get Social Security benefits. You're directly billed for your Part B premiums (meaning they aren't taken out of your Social Security benefits). You have Medicare and Medicaid, and Medicaid pays your premiums.

What is the number for Medicare in Wisconsin?

Its phone number is 1-800-926-4862. The second page of this document contains several additional resources for Medicare beneficiaries in Wisconsin.

Can an elder law attorney help with Medicaid?

Elder law attorneys can help individuals plan for Medicaid long-term care benefits . The National Academy of Elder Law Attorneys (NAELA) has a search feature beneficiaries can use to find an elder attorney locally.

Does Medicare give you extra help?

Medicare beneficiaries who receive Medicaid, an MSP, or Supplemental Security Income (SSI) also receive Extra Help – a federal program that lowers the prescription drug costs under Medicare Part D. Individuals can also apply for Extra Help through the Social Security Administration if they don’t receive assistance automatically.

What is the phone number for Part B Copayment?

If you’d like to compare your options and tailor a plan specifically for you then please contact me. You can call me at 855-712-7316 or email [email protected].

How much is the 2021 Part B deductible?

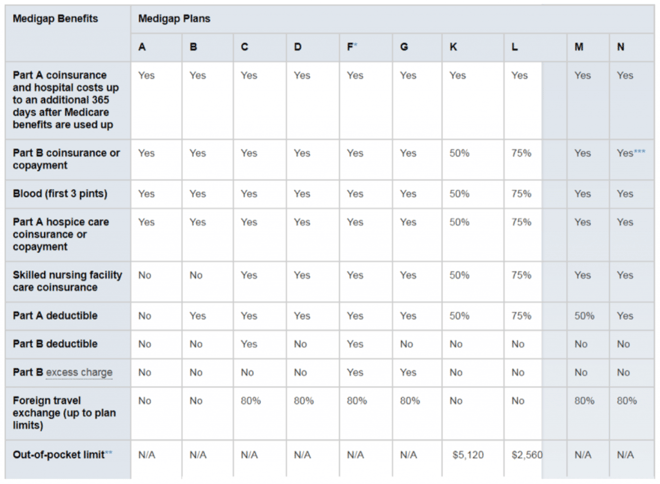

Another option is the Part B Deductible rider, which pays your Part B deductible of $203 for 2021. If you do not have this rider then you will have to pay all costs medical costs for Part B until you meet your deductible. For 2021 that deductible is $203. The good news is this deductible is an annual deductible.

What is the foreign travel emergency rider in Wisconsin?

Wisconsin Foreign Travel Emergency Rider. Provides up to $50,000 of coverage for Medicare Approved medical expenses incurred outside the United States (this includes cruise ships outside of US boundary waters), after meeting a $250 deductible.

How many days does Medicare cover?

A Medicare hospital benefit period is 60 days, and there can be up to four benefit periods in a year. The Part A deductible is NOT an annual deductible. It is per benefit period. You could potentially pay your half of the deductible multiple times per year still.

What is a Part B excess charge?

The Part B Excess Charges Rider will cover the difference between the excess charge and what Medicare approves to pay. An example to help understand looks like this. A doctor does not accept Medicare assignment charges you $115 for a visit. Medicare only approves $100.

How many days of mental health care is Medicare?

Inpatient mental health care – 175 days per lifetime in addition to Medicare. Outpatient mental health. This does a nice job of adding some coverage. But like the name implies, it is still fairly basic coverage. Many seniors prefer to have more comprehensive coverage.

Can you add riders to Medicare Part B?

Most of the riders can be added in any combination but this is an either or none combination with the Part B deductible. With this coverage, you will have to pay the Medicare Part B deductible each year. After that deductible is met, the policy will pay for Part B services.

How to contact Wisconsin Medigap?

Wisconsin offers a variety of resources to help Medicare beneficiaries understand options and solve problems related to their health insurance benefits: Call the Wisconsin Medigap Helpline at 800-242-1060. Contact your local aging and disability resource center. Contact a benefit specialist.

When does medicaid start paying for Medicare?

If you are eligible for the Qualified Medicare Beneficiary Program, Medicaid will start paying for your Medicare Part A and B premiums, deductibles, and coinsurance the first day of the month after your application is approved .

How long does it take for Medicare to adjust for Social Security?

Even though you are enrolled in the Qualified Medicare Beneficiary Program in the month after your application is approved, your Social Security payment may not be increased for one to three months. This is the time that is needed for payments to be adjusted by Medicaid, Medicare, and the Social Security Administration.

Does medicaid pay Medicare Part A?

Medicaid should already be paying your Medicare Part A and B costs (meaning you do not need to apply for Qualified Medicare Beneficiary Program benefits) if you receive Medicare and Medicaid and either of the following apply to you: You are enrolled in the Supplemental Security Income (SSI) program. You were enrolled in SSI but lost it ...

For those who qualify, there are multiple ways to have your Medicare Part B premium paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

Other Part B reimbursement options

There are other ways you can lower or eliminate how much you pay for the Medicare Part B premium. This includes certain Medicaid programs or benefits from some retiree health plans.