The takeaway

- Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums.

- If you or your spouse haven’t worked at least 40 quarters, you’ll pay a monthly premium for Part A.

- You pay a deductible and coinsurance costs for Medicare Part A services when you receive inpatient or skilled nursing care.

Full Answer

Who qualifies for premium-free Medicare Part A?

Nov 29, 2021 · Most people dont have to pay a monthly premium for their Medicare Part A coverage. If youve worked for a total of 40 quarters or more during your lifetime, youve already paid for your Medicare Part A coverage through those income taxes.

Who is covered by Medicare Part?

Who pays for Medicare Part A? Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

Will I have to pay for part an of Medicare?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. Hospital Insurance (HI) Trust Fund How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed Other sources, like these: Income taxes paid on Social Security benefits

What is the premium for Medicare Part A?

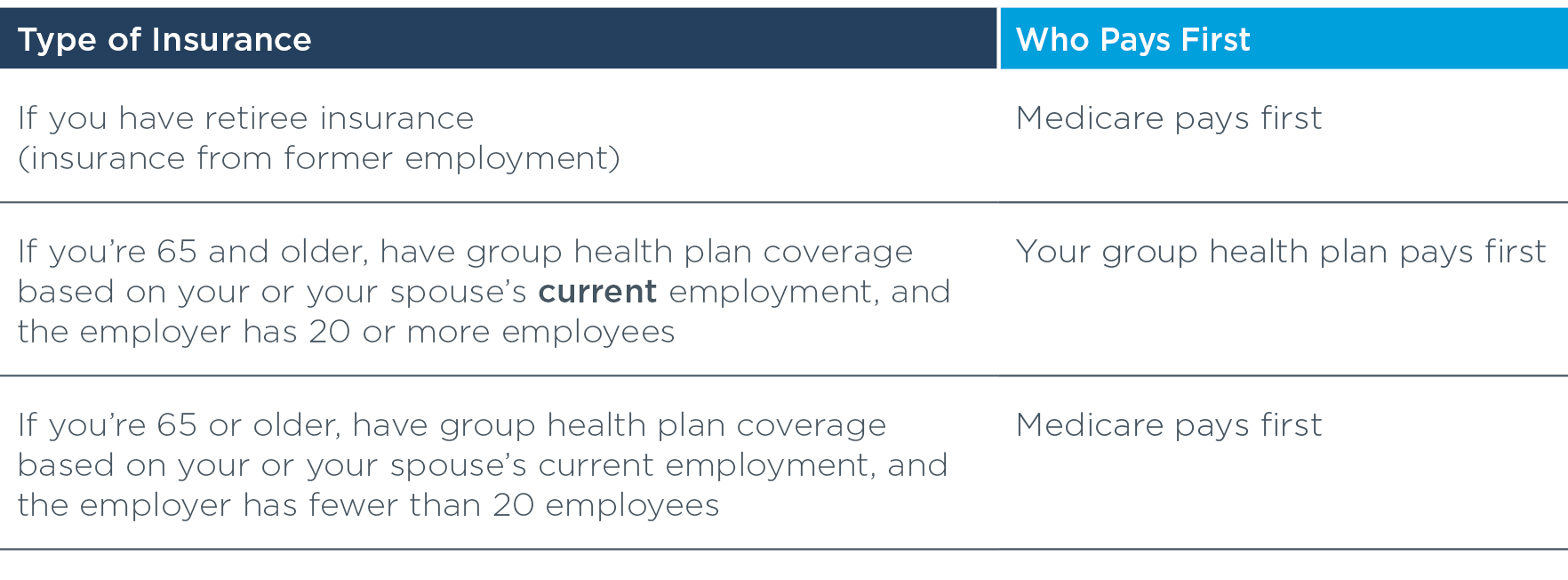

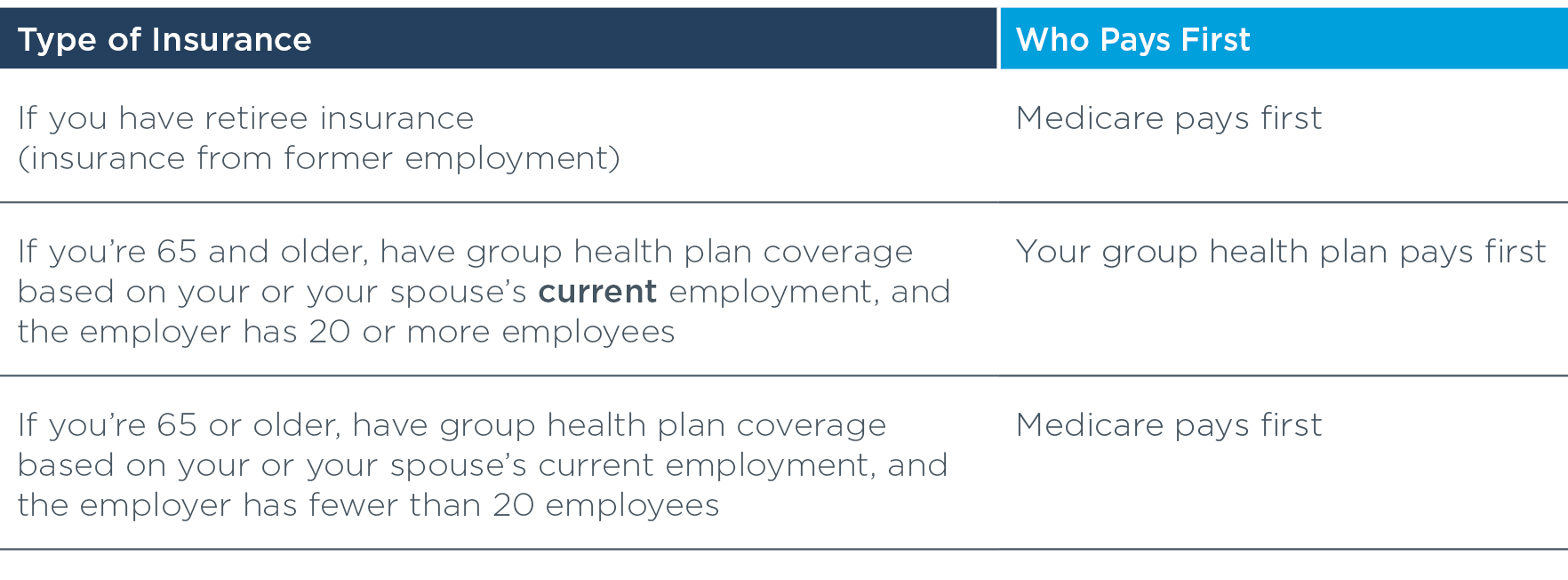

Medicare pays first and your group health plan (retiree) coverage pays second . I’m under 65, disabled, retired and have group health plan coverage based on my family member’s current employer (See page 16 ) • If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Is Medicare Part A free for everyone?

Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

Do patients pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is Medicare Part A funded by?

A: Medicare is funded with a combination of payroll taxes, general revenues allocated by Congress, and premiums that people pay while they're enrolled in Medicare. Medicare Part A is funded primarily by payroll taxes (FICA), which end up in the Hospital Insurance Trust Fund.

Who is eligible for Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is not covered under Medicare Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Who pays for Medicare and who benefits?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Is Medicare paid out of Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare funded by the federal government?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs Medicare. The program is funded in part by Social Security and Medicare taxes you pay on your income, in part through premiums that people with Medicare pay, and in part by the federal budget.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicaid in healthcare?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. programs offered by each state.

Does Medicare cover prescription drugs?

Optional benefits for prescription drugs available to all people with Medicare for an additional charge. This coverage is offered by insurance companies and other private companies approved by Medicare. Other sources, like interest earned on the trust fund investments.

What are some examples of SNF?

Examples of SNF care include physical therapy or intravenous injections that can only be given by a registered nurse or doctor. , home health care. Health care services and supplies a doctor decides you may get in your home under a plan of care established by your doctor.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

What Is Medicare?

The U.S. government created Medicare to offer health care insurance for retired Americans. Until the Affordable Care Act went into effect, many citizens could only receive health insurance through their employers.

How Is Medicare Funded?

According to the Henry J. Kaiser Family Foundation (KFF), spending on Medicare accounted for 15 percent of the federal budget in 2015. The KFF further reveals that Medicare funding comes from three primary sources:

Will Medicare Funding Run Out?

Many people worry that Medicare funding will run out. However, in its current status, Medicare will be able to fund Part A health care expenses for beneficiaries through 2028. Additionally, the program can adjust for inflation and increase deductions to fund the program well into the 2030 decade.

How Can You Protect Your Financial Future?

Whether you’re enrolling in a Medicare program now or planning to in the future, you can take advantage of supplemental health insurance to make sure that your health care costs remain covered. Americans have plenty of options to protect themselves against health care crises.

How long does Medicare coverage last?

Medicare coverage begins as soon as your SSDI begins, and Medicare Part A has no premiums as long as you or your spouse (or parent, if you’re a dependent child) worked and paid Medicare taxes for at least 10 years.

How much is Medicare premium for 2020?

These premiums are adjusted annually. Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly). For 2020, the threshold for having to pay higher premiums based on income increased.

Who is Louise Norris?

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Do you have to pay Medicare premiums?

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don’t pay a premium for Part A. You may also not have to pay the premium: If you haven’t reached age 65, but you’re disabled and you’ve been receiving Social Security benefits ...

When do you enroll in Medicare Part A?

You’re automatically enrolled in original Medicare — which is made up of parts A and B — starting on the first day of the month you turn 65 years old.

What is Medicare Part A 2021?

Deductibles and hospital coinsurance. With Medicare Part A, you’ll also pay a deductible and coinsurance costs for each benefit period. In 2021, these costs are: Each day beyond day 90 is considered a lifetime reserve day. You have up to 60 of these days to use in your lifetime.

What is Medicare for people over 65?

Medicare is a government healthcare program that cover s healthcare costs for people ages 65 and over or those with certain disabilities. The Medicare program is split into several sections, or parts. These include:

How long do you have to work to get Medicare?

If you’ve worked for at least 40 quarters — roughly 10 years — and paid Medicare taxes out of your paycheck, you won’t pay a premium for Medicare Part A. If you worked less than that amount of time, you will pay a monthly premium for Part A. Even if you don’t owe a premium, other costs are typically associated with services covered under Part A.

How much does hospice cost in 2021?

Medicare Part A covers the full cost of hospice care, but there are specific coinsurance costs for skilled nursing care services. In 2021, these costs are: $0 coinsurance for days 1 through 20 for each benefit period. $185.50 daily coinsurance for days 21 through 100 for each benefit period. all costs for days 101 and beyond in each benefit period.

How long do you have to be on Medicare if you are 65?

If you’re under age 65 and receiving Social Security or RRB disability benefits, you’ll automatically be enrolled in Medicare Part A when you’ve been receiving the disability benefits for 24 months. If you’re not automatically enrolled, you can sign up manually through the Social Security Administration.

How much is the Part A premium for 2021?

If you or your spouse worked for 30 to 39 quarters, the standard monthly Part A premium cost is $259 in 2021. If you or your spouse for worked fewer than 30 quarters, the standard monthly Part A premium cost is $471 in 2021.

How is Medicare funded?

The Medicare program was established in 1965 and it set up two separate Medicare trust funds to cover program expenses:

How are benefits paid under Medicare Advantage?

Medicare Advantage plans are offered by private insurance companies contracted with Medicare to provide program benefits. Under Medicare Advantage, the insurance company receives a set amount of money each year per enrollee to cover health care expenses for the year.

Do all private insurance companies have the same Medicare Advantage plans?

Although the Medicare funding is the same for all insurance companies offering Medicare Advantage plans, each company chooses what types of plans and benefits it will offer. No matter what company and plan type you select, however, you are still entitled to all the same rights and protections you have under Original Medicare.

Need more information on Medicare Advantage plans?

I am happy to answer your questions about Medicare Advantage. If you prefer, you can schedule a phone call or request an email by clicking on the buttons below. You can also find out about plan options in your area by clicking the Compare Plans button.