Who really pays for Medicaid?

Who Really Pays For Health Care Might Surprise You

- Before Obamacare we had a free-market health-care system. Government has been part of the business of medicine at least since the 1940s, when Washington began appropriating billions to build private ...

- I fully paid for Medicare through taxes deducted from my salary. ...

- Premiums from my paycheck fund my company health plan. Probably not entirely. ...

What percent does Medicaid pay?

Medicare for most people will only cover 80 percent of the medical costs. Medicare will usually discount a physician or hospital charges and then paid 80 percent of the adjusted cost. The patient will be required to pay the remaining 20 percent either out-of-pocket or through the use of a supplemental policy.

What do I count as income for Medicaid?

- Your adjusted gross income (AGI) on your federal tax return

- Excluded foreign income

- Nontaxable Social Security benefits (including tier 1 railroad retirement benefits)

- Tax-exempt interest

- MAGI does not include Supplemental Security Income (SSI)

What is the annual income limit for Medicaid?

[Please note that the annual income limit for Medicaid for Employees with Disabilities enrollees is $75,000 and asset limits are much higher. For more on Medicaid for Employees with Disabilities, please scroll down this page or visit www.ct.gov/med. For information on applying, please follow this link.

Where does the money come from to pay for Medicare?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Who is paying for Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Who pays for Medicaid in the US?

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage (FMAP).

Who does not pay into Medicare?

Who doesn't have to pay a premium for Medicare Part A? A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don't pay a premium for Part A.

Does everybody have to pay for Medicare?

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check.

Is Medicare federally funded?

Medicare and Medicaid are two separate, government-run programs. They are operated and funded by different parts of the government and primarily serve different groups. Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income.

How much of our taxes go to healthcare?

How much does the federal government spend on health care? The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion. The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1).

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How much does the Affordable Care Act cost taxpayers?

According to the Joint Committee on Taxation, about 73 million taxpayers earning less than $200,000 will see their taxes rise as a result of various Obamacare provisions. The CBO originally estimated that Obamacare would cost $940 billion over ten years. That cost has now been increased to $1.683 trillion.

Is Medicare automatically taken out of Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Can you get Medicare if you never paid into Social Security?

If you are not yet receiving Social Security benefits, you will have to pay Medicare directly for Part B coverage. Once you are collecting Social Security, the premiums will be deducted from your monthly benefit payment.

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

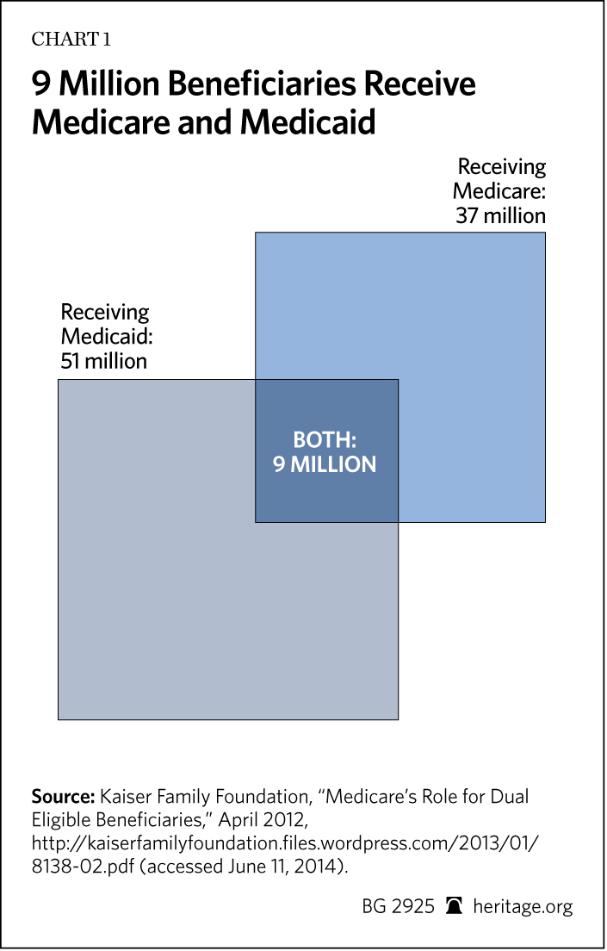

What is Medicare and Medicaid?

Differentiating Medicare and Medicaid. Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. Since it can be easy to confuse the two terms, Medicare and Medicaid, it is important to differentiate between them. While Medicare is a federal health insurance program ...

How to apply for medicaid?

How to Apply. To apply for Medicare, contact your local Social Security Administration (SSA) office. To apply for Medicaid, contact your state’s Medicaid agency. Learn about the long-term care Medicaid application process. Prior to applying, one may wish to take a non-binding Medicaid eligibility test.

How much does Medicare Part B cost?

For Medicare Part B (medical insurance), enrollees pay a monthly premium of $148.50 in addition to an annual deductible of $203. In order to enroll in a Medicare Advantage (MA) plan, one must be enrolled in Medicare Parts A and B. The monthly premium varies by plan, but is approximately $33 / month.

What is the income limit for Medicaid in 2021?

In most cases, as of 2021, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,382 / month. The asset limit is generally $2,000 for a single applicant.

How old do you have to be to qualify for medicare?

Citizens or legal residents residing in the U.S. for a minimum of 5 years immediately preceding application for Medicare. Applicants must also be at least 65 years old. For persons who are disabled or have been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis), there is no age requirement. Eligibility for Medicare is not income based. Therefore, there are no income and asset limits.

Does Medicare cover out-of-pocket expenses?

Persons who are enrolled in both Medicaid and Medicare may receive greater healthcare coverage and have lower out-of-pocket costs. For Medicare covered expenses, such as medical and hospitalization, Medicare is always the first payer (primary payer). If Medicare does not cover the full cost, Medicaid (the secondary payer) will cover the remaining cost, given they are Medicaid covered expenses. Medicaid does cover some expenses that Medicare does not, such as personal care assistance in the home and community and long-term skilled nursing home care (Medicare limits nursing home care to 100 days). The one exception, as mentioned above, is that some Medicare Advantage plans cover the cost of some long term care services and supports. Medicaid, via Medicare Savings Programs, also helps to cover the costs of Medicare premiums, deductibles, and co-payments.

Does Medicaid cover nursing home care?

Medicaid also pays for nursing home care, and often limited personal care assistance in one’s home. While some states offer long-term care and supports in the home and community thorough their state Medicaid program, many states offer these supports via 1915 (c) Medicaid waivers.

What is California medicaid?

California Medicaid. Medi-Cal is California's Medicaid health care program. This program pays for a variety of medical services for children and adults with limited income and resources. Medi-Cal is supported by Federal and state taxes.

What is Medicaid in Illinois?

Illinois Medicaid. Medicaid is a jointly funded state and Federal government program that pays for medical assistance services. Medicaid pays for medical assistance for eligible children, parents and caretakers of children, pregnant women, persons who are disabled,... Medicaid and Medicare.

What is Medicaid in Georgia?

Georgia Medicaid. Medicaid provides health coverage to millions of Americans, including children, pregnant women, parents, seniors and individuals with disabilities. In some states the program covers all low-income adults below a certain income level.

What is Medicaid in Connecticut?

Medicaid provides health coverage to millions of Americans, including children, pregnant women, parents, seniors and individuals with disabilities. In some states the program covers all low-income adults below a certain income level.

What is the Idaho Medicaid program?

Idaho Medicaid is the state and Federal partnership that provides health coverage for selected categories of people in Idaho with low incomes. Its purpose is to improve the health of people who might otherwise go without medical care for themselves... Medicaid and Medicare.

What is the health insurance marketplace?

The Health Insurance Marketplace helps you find health coverage that fits your needs and budget. Every health plan in the Marketplace offers the same set of essential health benefits, including doctor visits, preventive care, hospitalization,... Medicaid and Medicare. Children's Health.

What is Medicaid in Delaware?

The Medicaid program furnishes medical assistance to eligible Delaware low-income families and to eligible aged, blind and/or disabled people whose income is insufficient to meet the cost of necessary medical services. Medicaid pays for: doctor... Medicaid and Medicare.

How much is Medicare paid for?

There is no cap on taxable income, unlike social security tax. However, people earning over $200,000 ($250,000 if filing jointly) pay an additional 0 .9% for a total of 3. 8%.

What happens if we reduce or eliminate Medicaid?

So, what happens if we reduce or eliminate Medicaid? These patients still come into the emergency department and still come into the hospital. In fact, before Ohio’s Governor, John Kasich, enacted Medicaid expansion, about 12% of all patients admitted to our hospital were uninsured and after Medicaid expansion, that dropped to 2.3%. Uninsured patients still require doctor’s time, they still need tests, they still eat hospital food, and they still have to get medications. So, where does the money come from to pay for all of this?

How much does the top 20% pay in taxes?

The highest earning 20% of Americans paid an average of $50,000 in federal income taxes – that equates to 87% of all income tax received by the federal government. The top 1% of Americans (income > $2.1 million) paid 44% of all income tax received by the federal government.

Does Medicare pay for low income people?

The reality is that society will end up paying the same cost to provide care to low income people whether you have Medicaid or not. To understand this, you have to understand the difference in funding for Medicare versus Medicaid. Medicare is largely paid for by payroll taxes – these are 2.9% of all worker’s income.

Do all working Americans contribute to healthcare for the poor?

In this way, all working Americans contribute to healthcare for the poor as a fixed percentage of one’s income. Continue Medicaid programs and pay for them out of income tax. This is what we currently do. In this way, the healthcare for the poor is primarily paid by the wealthiest Americans.

Do all working Americans pay the same amount for healthcare?

This would require those services to be paid for by increasing commercial insurance rates which means that all working Americans would pay the same amount to provide healthcare for the poor, regardless of how much money each working American earns.

Does everyone pay for medicaid?

So, everyone who works pays for Medicare. Medicaid is paid for by income taxes and not payroll taxes. Most of this comes from federal income taxes and a portion also comes from state income taxes. Herein lies the big difference between Medicare funding and Medicare funding – everyone pays for Medicare but you only pay for Medicaid ...

Does Medicare pay for long term care?

Medicare is a program directed by the federal government. Medicare does not generally pay for long-term care services, and is mainly a health insurance program for people over age 65. * Medicare Part A covers skilled nursing care (medically necessary services) such as physical therapy, wound care, and intravenous injections, under certain conditions and for a limited amount of time. Medicare benefits are intended for short-term services, when the medical condition is expected to improve, and acute care, such as emergencies, normally for no more than 100 days. Co-pays are typically required for inpatient stays longer than 21 days.

Does Medicaid cover LTC?

Medicaid pays for the majority of LTC services in the United States. It is a jointly administered program between the state and federal governments. Individuals must meet specific criteria** to qualify for Medicaid services. Once qualified, Medicaid can cover LTC in a variety of settings:

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

Does Medicaid cover cost sharing?

If you are enrolled in QMB, you do not pay Medicare cost-sharing, which includes deductibles, coinsurances, and copays.

Does Medicare cover medicaid?

If you qualify for a Medicaid program, it may help pay for costs and services that Medicare does not cover.

Is medicaid the primary or secondary insurance?

Medicaid can provide secondary insurance: For services covered by Medicare and Medicaid (such as doctors’ visits, hospital care, home care, and skilled nursing facility care), Medicare is the primary payer. Medicaid is the payer of last resort, meaning it always pays last.

Does Medicaid offer care coordination?

Medicaid can offer care coordination: Some states require certain Medicaid beneficiaries to enroll in Medicaid private health plans, also known as Medicaid Managed Care (MMC) plans. These plans may offer optional enrollment into a Medicare Advantage Plan designed to better coordinate Medicare and Medicaid benefits.