Full Answer

What companies offer Medicare Advantage plans currently?

U.S. News & World Report analyzed and ranked insurance companies' offerings in each state based on their 2022 CMS star ratings. They define a Best Insurance Company for Medicare Advantage Plans as a company whose plans were all rated as at least 3 out of 5 stars by CMS and whose plans have an average rating of 4.5 or more stars within the state.

Who qualifies for a Medicare Advantage plan?

- All-Dual

- Full-Benefit

- Medicare Zero Cost Sharing

- Dual Eligible Subset

- Dual Eligible Subset Medicare Zero Cost Sharing Who is eligible for a DSNP? ...

- You must be a United States citizen or have been a legal resident for at least five years.

- You must be 65 years old or have a qualifying disability if younger than 65.

What are the best Medicare Advantage plans?

What to Know About the Best Medicare Advantage Plans

- Most Medicare Advantage plans are PPO and HMO. Most Medicare Advantage plans are either PPO or HMO, representing 46% and 39% of available plans. ...

- Most Medicare Advantage plans include prescription drug coverage. ...

- Vision, dental and hearing benefits are widespread. ...

- Just over half of Medicare Advantage plans have $0 premiums. ...

Are Medicare Advantage plans worth it?

Medicare Advantage plans are certainly worth the zero-dollar premium; however, it’s your choice to decide if the coverage is right. The value of an Advantage plan depends on your location, healthcare needs, budget, and preferences.

Where does the money come from for Medicare Advantage plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the HI and the SMI trust funds.

How does Medicare Part A get paid?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Do you still pay Medicare if you have an Advantage plan?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. You must use the card from your Medicare Advantage Plan to get your Medicare- covered services.

Why am I being charged for Medicare Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Is Medicare Part A free for everyone?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the average cost of a Medicare Advantage Plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Are Medicare Advantage premiums deducted from Social Security?

Medicare Part B premiums must be deducted from Social Security benefits if the monthly benefit covers the deduction. If the monthly benefit does not cover the full deduction, the beneficiary is billed. Beneficiaries may elect deduction of Medicare Part C (Medicare Advantage) from their Social Security benefit.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Reason : They Make You Get A Referral

In the case of HMO plans and some PPO plans, this is true. According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorization Prior authorization is a process used by health plans to control healthcare costs.

Paying For A Medicare Advantage Special Needs Plan

Along with having a qualifying medical condition, you must have Original Medicare to be eligible for a Special Needs Plan . Some people who meet these requirements also have Medicaid. For those who have both Medicare and Medicaid, Medicaid helps pay for most of the costs in joining a plan. These costs include premiums, coinsurance, and copayments.

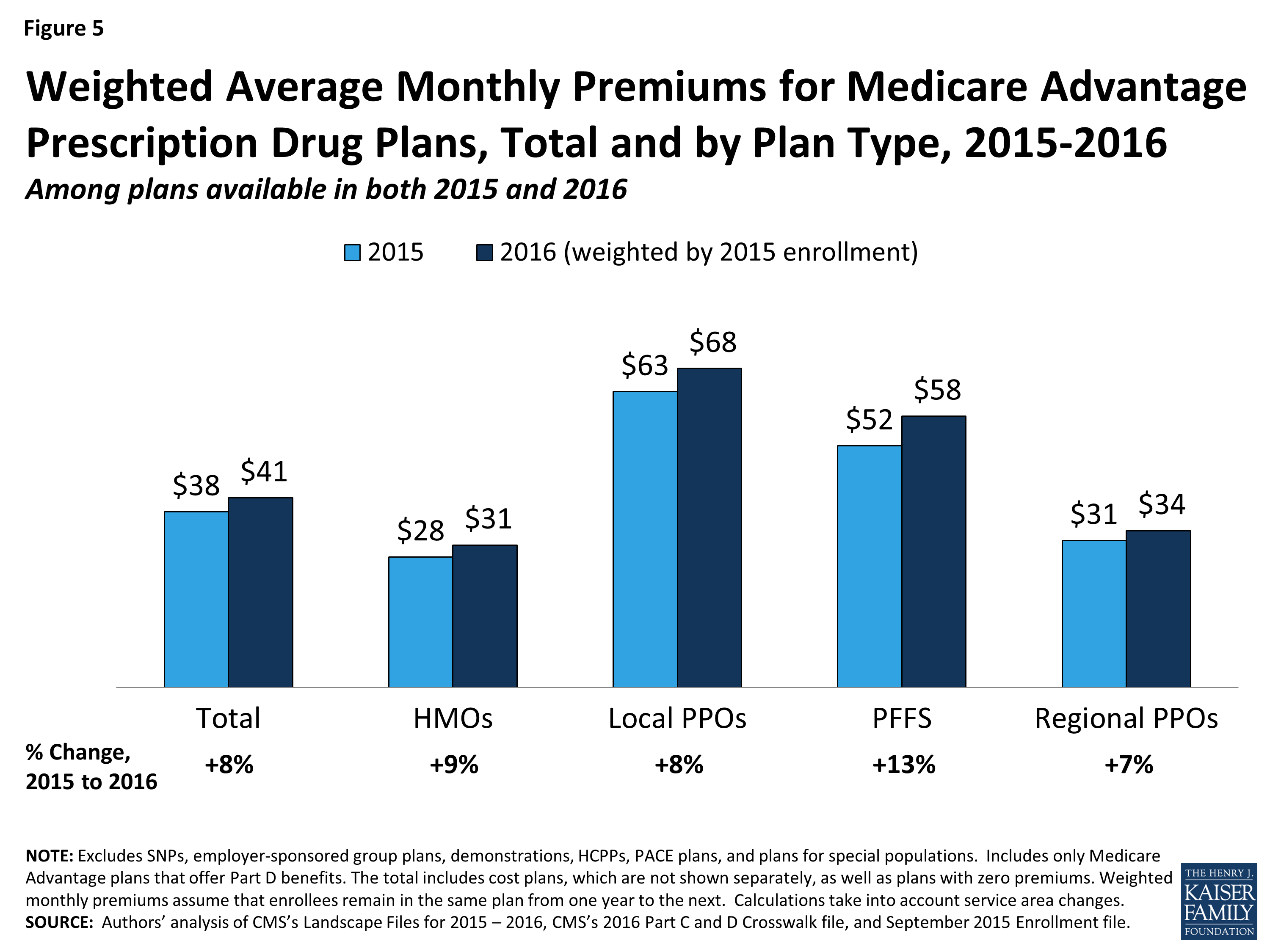

Premiums Paid By Medicare Advantage Enrollees Have Declined Slowly Since 2015

Average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month.

Top 9 Advantages And Disadvantages Of Medicare Advantage Plans

If you are about to make plan election choices for yourself or a loved one, you might find yourself asking what are the advantages and disadvantages of Medicare Advantage plans Medicare Advantage , also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare ….? Well answer that important question in this article..

Medicare Advantage Plans Cant Turn You Down

When President G. W. Bush signed Medicare Advantage into law in 2003, he started the pre-existing condition A pre-existing condition is any health problem that occurred before enrolling in a health plan. The Affordable Care Act law made it illegal for health plans to or charge more due to a pre-existing condition….

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

Why Are Medicare Advantage Plans So Heavily Advertised

Co-Founder of Elite Insurance Partners, a Medicare learning resource center for all Medicare beneficiaries.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What is Medicare Advantage?

A Medicare Advantage plan replaces your Original Medicare coverage. In addition to those basic benefits, Medicare Advantage plans can also offer some additional coverage for things like prescription drugs, dental, vision, hearing aids, SilverSneakers programs and more.

What is the primary payer for a group health plan?

You are 65 or older and are covered by a group health plan because you or your spouse is still working and the employer has 20 or more employees. The group health plan is the primary payer, and Medicare pays second.

How long do you have to be on Cobra to get Medicare?

You have ESRD and COBRA insurance and have been eligible for Medicare for at least 30 months. COBRA is the secondary payer in this situation, and Medicare pays first for qualified services. You are 65 or over – or you are under 65 and have a disability other than ESRD – and are covered by either COBRA insurance or a retiree group health plan.

What is a group health plan?

The group health plan is your secondary payer after Medicare pays first for your health care costs. You have End-Stage Renal Disease (ESRD), are covered by a group health plan and have been entitled to Medicare for at least 30 months. The group health plan pays second, after Medicare. You have ESRD and COBRA insurance and have been eligible ...

Which pays first, Medicare or ESRD?

The group health plan pays first for qualified services, and Medicare is the secondary payer. You have ESRD and COBRA insurance and have been eligible for Medicare for 30 months or fewer. COBRA pays first in this situation.

Is Medicare sold by private insurance companies?

Because each of these types of Medicare coverage is sold by private insurance companies, the cost and availability of plans may vary from one location or provider to the next.

Is Medicare the primary payer for workers compensation?

If you are covered under workers’ compensation due to a job-related injury or illness and are entitled to Medicare benefits, the workers’ compensation insurance provider will be the primary payer. There typically is no secondary payer in such cases, but Medicare may make a payment in certain situations.

How is Medicare Advantage financed?

Medicare Advantage plans are also financed by monthly premiums paid by subscribers. The premium amounts vary by company and plan. Subscribers may also be asked to pay a certain amount of their expenses in the form of a deductible or copayment.

What is Medicare Advantage?

Medicare is a federal health insurance plan for adults aged 65 and over. Original Medicare is provided by the federal government and covers inpatient and home health care (Part A), as well as medically necessary services (Part B).Seniors can also choose Medicare Advantage plans through approved private insurance companies. These plans may bundle Part A and Part B coverage with additional benefits for dental, vision, hearing and wellness (Part C), as well as prescription drugs (Part D).

What is Supplementary Medical Insurance Fund?

The Supplementary Medical Insurance Fund is composed of funds approved by Congress and Part B and Part D premiums paid by subscribers.

Where does federal health insurance come from?

Funding for federal health insurance comes from two trust funds which are dedicated to Medicare use and held by the U.S. Treasury.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.