Does Medicare pay for health insurance for people with disabilities?

If the individual’s employer has more than 100 employees, it is required to offer health insurance to individuals and spouses with disabilities, and Medicare will be the secondary payer. For smaller employers who offer health insurance to persons with disabilities, Medicare will remain the primary payer. Indefinite Access to Medicare

Are Medicare premiums automatically deducted when you receive Social Security disability?

In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance (SSDI) or Social Security retirement benefits. However, this doesn’t apply to all Medicare premiums. Each part of Medicare has its own premiums and rules for interacting with Social Security.

Why do I have to pay a premium for Medicare Part A?

You'll have to pay a premium for Medicare Part A (hospital insurance) if you aren't "fully insured" under Social Security. Generally, being fully insured means having worked 40 quarters (the equivalent of 10 years) in a job paying FICA taxes.

Do I have to pay insurance premiums if I'm on disability?

The answer is "yes", until the company determines that you qualify for disability income benefits. Once the insurance company notifies you that they have accepted the claim, if the policy contains a "wavier of premium" clause, you no longer have to pay your premiums.

How does disability affect Medicare?

Medicare coverage is the same for people who qualify based on disability as for those who qualify based on age. For those who are eligible, the full range of Medicare benefits are available.

What insurance do you get with Social Security disability?

Everyone eligible for Social Security Disability Insurance (SSDI) benefits is also eligible for Medicare after a 24-month qualifying period. The first 24 months of disability benefit entitlement is the waiting period for Medicare coverage.

Does Medicare automatically come with disability?

You will typically be automatically enrolled in Original Medicare, Part A and B, after you've received Social Security disability benefits (or certain Railroad Retirement Board disability benefits) for two straight years. Your Medicare coverage will start 24 months from the month you qualified for disability benefits.

What happens when a person on disability turns 65?

Nothing will change. You will continue to receive a monthly check and you do not need to do anything in order to receive your benefits. The SSA will simply change your disability benefit to a retirement benefit once you have reached full retirement age.

What is the monthly amount for Social Security disability?

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Does Social Security pay for Medicare?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Can you collect disability and Social Security at the same time?

Yes, you can receive Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) at the same time. Social Security uses the term “concurrent” when you qualify for both disability benefits it administers. However, drawing SSDI benefits can reduce your SSI payment, or make you ineligible for one.

How do you pay for Medicare if you are not on Social Security?

If you don't get benefits from Social Security (or the Railroad Retirement Board), you'll get a premium bill from Medicare. Get a sample of the Medicare bill. An extra amount you pay in addition to your Part D plan premium, if your income is above a certain amount.

Which pays more Social Security or disability?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

At what age does Social Security Disability end?

65To put it in the simplest terms, Social Security Disability benefits can remain in effect for as long as you are disabled or until you reach the age of 65. Once you reach the age of 65, Social Security Disability benefits stop and retirement benefits kick in.

At what age does disability convert to Social Security?

65When you reach the age of 65, your Social Security disability benefits stop and you automatically begin receiving Social Security retirement benefits instead. The specific amount of money you receive each month generally remains the same.

How can I increase my Social Security disability payments?

You can increase Social Security Disability payments by working at least 35 years before retiring, understanding the benefits of working past retirement age, and avoiding Social Security's tax consequences. If you are married, married applicants can maximize their disability payments by claiming their spousal benefits.

Does disability pay more than Social Security?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

What state pays the most in Social Security disability?

States That Pay out the Most in SSI BenefitsNew Jersey: $1,689 per month.Connecticut: $1,685 per month.Delaware: $1,659 per month.New Hampshire: $1,644 per month.Maryland: $1,624 per month.

What are the benefits of long term disability?

Long term disability typically pays benefits equivalent to 40-70% of your income, but for a longer period. To decide how what level of coverage you would need, calculate your monthly expenses, and consider additional medical bills you may have to pay if seriously sick or injured.

What is covered by Medicare?

Coverage includes certain hospital, nursing home, home health, physician, and community-based services. The health care services do not have to be related to the individual’s disability in order to be covered.

How long can you get Medicare after you have been disabled?

Indefinite Access to Medicare. Even after the eight-and-one-half year period of extended Medicare coverage has ended, working individuals with disabilities can continue to receive benefits as long as the individual remains medically disabled.

What are the requirements for Medicare for ESRD?

The requirements for Medicare eligibility for people with ESRD and ALS are: ALS – Immediately upon collecting Social Security Disability benefits. People who meet all the criteria for Social Security Disability are generally automatically enrolled in Parts A and B.

How long do you have to wait to get Medicare?

There is a five month waiting period after a beneficiary is ...

How long does Medicare coverage last?

Medicare eligibility for working people with disabilities falls into three distinct time frames. The first is the trial work period, which extends for 9 months after a disabled individual obtains a job.

How long do you have to wait to collect Social Security?

There is a five month waiting period after a beneficiary is determined to be disabled before a beneficiary begins to collect Social Security Disability benefits. People with ESRD and ALS, in contrast to persons with other causes of disability, do not have to collect benefits for 24 months in order to be eligible for Medicare.

Why should beneficiaries not be denied coverage?

Beneficiaries should not be denied coverage simply because their underlying condition will not improve.

How long after Social Security disability is Medicare free?

You are eligible for Medicare two years after your entitlement date for Social Security disability insurance (SSDI). (This is the date that your backpay was paid from; see our article on when medicare kicks in for SSDI recipients ). Medicare isn't free for most disability recipients though.

How to save money on Medicare?

You can often save money on Medicare costs by joining a Medicare Advantage plan that offers coverage through an HMO or PPO. Many Medicare Advantage plans don't charge a monthly premium over the Part B premium, and some don't charge copays for doctor visits and other services.

How much is the Part D premium for 2021?

Part D Costs. Part D premiums vary depending on the plan you choose. The maximum Part D deductible for 2021 is $445 per year, but some plans waive the deductible. There are subsidies available to pay for Part D for those with low income (called Extra Help).

How much does Medicare cost if you have a low Social Security check?

But some people who have been on Medicare for several years will pay slightly less (about $145) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more. If your adjusted gross income is over $88,000 (or $176,000 for a couple), the monthly premium can be over $400.

How many quarters do you have to work to be fully insured?

Generally, being fully insured means having worked 40 quarters (the equivalent of 10 years) in a job paying FICA taxes. Many disability recipients aren't fully insured because they became physically or mentally unable to work before getting enough work credits.

Does Medicare go up every year?

There are premiums, deductibles, and copays for most parts of Medicare, and the costs go up every year. Here are the new figures for 2021, and how you can get help paying the costs.

Is Medicare expensive for disabled people?

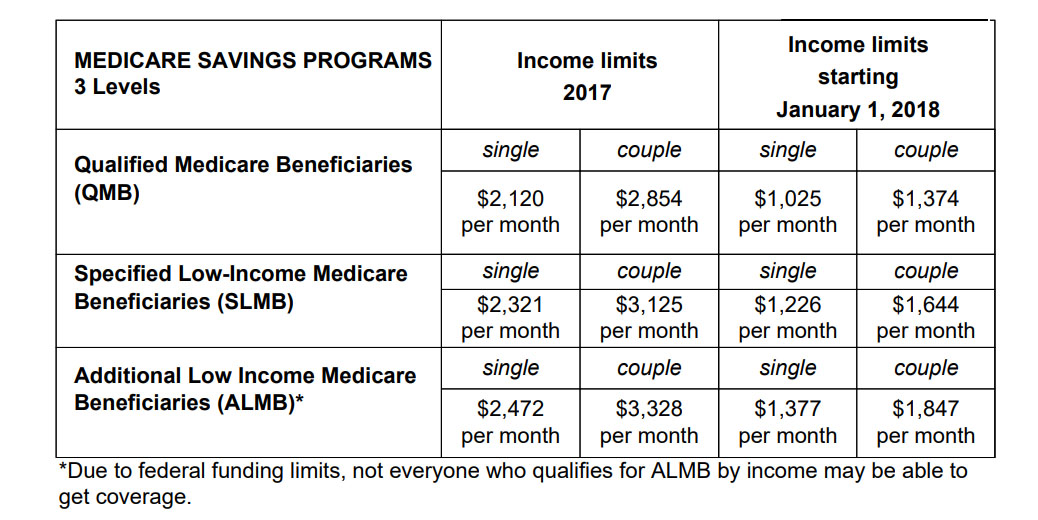

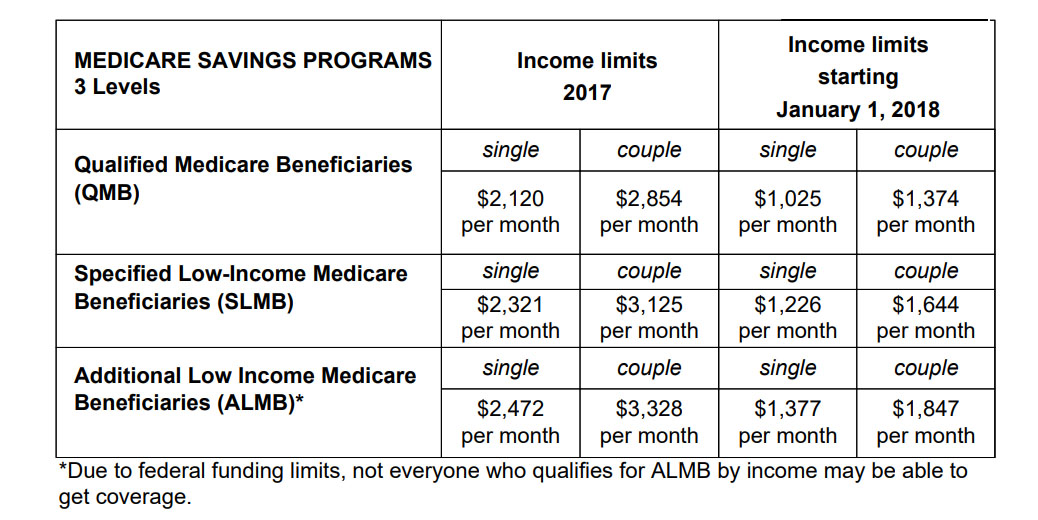

Medicare can be quite expensive for those on disability who aren't fully insured, but if you are eligible to be a Qualified Medicare Beneficiary (QMB) because of low-income, a Medicare Savings Program will pay your Part A premium, and possibly other costs as well.

Does Social Security disability qualify you for Medicare?

Everyone eligible for Social Security Disability Insurance ( SSDI ) benefits is also eligible for Medicare after a 24-month qualifying period.

What kind of Medicare do you get with disability?

People who meet all the criteria for Social Security Disability are generally automatically enrolled in Parts A and B. People who meet the standards, but do not qualify for Social Security benefits, can purchase Medicare by paying a monthly Part A premium, in addition to the monthly Part B premium.

Do you have to pay for Medicare Part B if you are disabled?

Most of the people who receive Social Security Disability benefits do have to pay a premium for Medicare Part B , but you may choose to opt out of this program if you already have medical insurance. Like Medicare Part B , you will need to pay a premium for Medicare Part D.

Does Social Security pay Medicare premiums?

Medicare Costs Deducted From Social Security Individuals enrolled in Medicare need to pay for the coverage. For those receiving Social Security benefits and enrolled in Medicare , the premiums for Medicare are usually automatically deducted from Social Security payments .

How much does Medicare cost on disability?

Most people pay a Part B premium of $144.60 each month. But some people who have been on Medicare for several years will pay slightly less (about $135) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more.

What is the highest paying state for disability?

At 8.9 percent, West Virginia came in at the top of the list among states where the most people receive disability benefits. Residents there received $122.4 million in monthly benefits. West Virginia’s labor force participation rate was 52.7 percent – the lowest in the country.

Does disability automatically qualify you for Medicaid?

Medicaid is a medical insurance program designed for needy, low income people. While many Social Security Disability recipients do receive Medicaid , the program is not limited to the disabled . In most states, those who are eligible to receive SSI automatically qualify to receive Medicaid .

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is SSI disability?

Supplemental Security Income (SSI) Disability & Medicaid coverage. Waiting for a disability status decision and don’t have health insurance. No disability benefits, no health coverage. The Marketplace application and disabilities. More information about health care for people with disabilities.

How long do you have to wait to get Medicare if you have Social Security Disability?

Social Security Disability Insurance (SSDI) & Medicare coverage. If you get Social Security Disability Income (SSDI), you probably have Medicare or are in a 24-month waiting period before it starts. You have options in either case.

Can I enroll in a Medicare Marketplace plan if I have Social Security Disability?

You’re considered covered under the health care law and don’t have to pay the penalty that people without coverage must pay. You can’t enroll in a Marketplace plan to replace or supplement your Medicare coverage.

Can I keep my Medicare Marketplace plan?

One exception: If you enrolled in a Marketplace plan before getting Medicare, you can keep your Marketplace plan as supplemental insurance when you enroll in Medicare. But if you do this, you’ll lose any premium tax credits and other savings for your Marketplace plan. Learn about other Medicare supplement options.

Can I get medicaid if I have SSDI?

You may be able to get Medicaid coverage while you wait. You can apply 2 ways: Create an account or log in to complete an application. Answer “ yes” when asked if you have a disability.

Can I get medicaid if I'm turned down?

If you’re turned down for Medicaid, you may be able to enroll in a private health plan through the Marketplace while waiting for your Medicare coverage to start.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Part C and Part D?

Medicare Part C and Part D. Medicare Part C (Medicare Advantage) and Medicare Part D (prescription drug coverage) plans are sold by private companies that contract with Medicare. Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services.

How much is Medicare Part B in 2021?

Your Part B premiums will be automatically deducted from your total benefit check in this case. You’ll typically pay the standard Part B premium, which is $148.50 in 2021. However, you might have a higher or lower premium amount ...

How many credits do you need to work to get Medicare?

You’re eligible to enroll in Medicare Part A and pay nothing for your premium if you’re age 65 or older and one of these situations applies: You’ve earned at least 40 Social Security work credits. You earn 4 work credits each year you work and pay taxes.

What is the maximum amount you can deduct from your AGI?

The IRS has set that limit at 7.5 percent of your adjusted gross income (AGI). Your AGI is the money you make after taxes are taken out of each paycheck. The IRS allows you to deduct any out-of-pocket healthcare expenses, including premiums, that are more than 7.5 percent of your AGI.

Why do people pay less for Part B?

Some people will pay less because the cost increase of the Part B premium is larger than the cost-of-living increase to Social Security benefits. You might also be eligible to receive Part B at a lower cost — or even for free — if you have a limited income.

Can I use my Social Security to pay my Medicare premiums?

Can I use Social Security benefits to pay my Medicare premiums? Your Social Security benefits can be used to pay some of your Medicare premiums . In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance (SSDI) or Social Security retirement benefits.

Can I deduct healthcare expenses?

Depending on your premiums and other healthcare spending, you might not reach this number. If your spending is less than 7.5 percent of your AGI, you can’t deduct any healthcare expenses, including premiums. However, if your healthcare spending is more than 7.5 percent of your income, you can deduct it.

Do you have to pay disability insurance premiums?

But what happens when you become disabled? Do you have to continue to pay the premiums? The answer is "yes", until the company determines that you qualify for disability income benefits. Once the insurance company notifies you that they have accepted the claim, if the policy contains a "wavier of premium" clause, you no longer have to pay your premiums. Keep in mind that you should have the company reimburse you for any premiums you paid during the investigation period.

Do you have to pay premiums if you have disability insurance?

The answer is "yes", until the company determines that you qualify for disability income benefits. Once the insurance company notifies you that they have accepted the claim, if the policy contains a "wavier of premium" clause, you no longer have to pay your premiums.