It is important to remember that the State Health Plan’s 70/30 PPO Plan is a secondary plan of coverage to Medicare and NOT supplemental coverage. North Carolina law requires State Health Plan benefits to coordinate with Medicare benefits. This means that charges left unpaid by Medicare are paid by the State Health Plan after the combined annual deductible or coinsurance are applied, up to the total allowed charge for the procedure or after the copayment is paid for those services on the 70/30 PPO Plan that require only a copayment.

Full Answer

What Medicare supplement insurance plans can I buy in North Carolina?

During the open enrollment period, a person under 65 and on Medicare disability is only able to purchase Medicare supplement insurance Plans A, D or G. This is a special North Carolina law.

Who is eligible for Medicare benefits in North Carolina?

North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability. North Carolina G.S. 58-54-45 guarantees that individuals under the age of 65 who qualify for Medicare are eligible to purchase a Medigap policy A, D, and G effective January 1, 2020.

What health insurance plans does Mecklenburg County offer non-Medicare eligible retirees?

Non-Medicare eligible retirees (pre-65 years of age) have the option to enroll in Mecklenburg County's active employee plans - PPO (Preferred Provider Organization Plan) and HDHP/HSA (High Deductible Health Plan with a Health Savings Account).

Is Medicare supplement insurance (Medigap) the same as retiree coverage?

Since Medicare pays first after you retire, your retiree coverage is likely to be similar to coverage under Medicare Supplement Insurance (Medigap). Retiree coverage isn't the same thing as a Medigap policy but, like a Medigap policy, it usually offers benefits that fill in some of Medicare's gaps in coverage—like

Do NC State retirees pay for health insurance?

North Carolina takes care of state employees and state retirees by offering health plan coverage to members of the Teachers' and State Employees' Retirement Systems (TSERS). The State Health Plan offers medical and prescription drug coverage.

Do retirees pay Medicare premiums?

Here's how much you may need to pay for it in retirement. To cover premiums and out-of-pocket prescription drug costs from age 65 on, you may need $130,000 if you're a man, and $146,000 if you're a woman, one study says.

How does NC State retirement work?

TSERS is a Defined Benefit Plan, which means retirement benefits are based on salary, years of service and a retirement factor. The formula for TSERS is: Average salary based on the 48 highest consecutive months of earnings. Multiplied by a Retirement Factor of 1.82% (set by state statute)

Do NC State employees pay Social Security?

Workers covered by a Section 218 agreement automatically have both Social Security and Medicare. State and local government employees who are covered by Social Security and Medicare pay into these programs and have the same rights as workers in the private sector.

How much does the average retiree pay for Medicare?

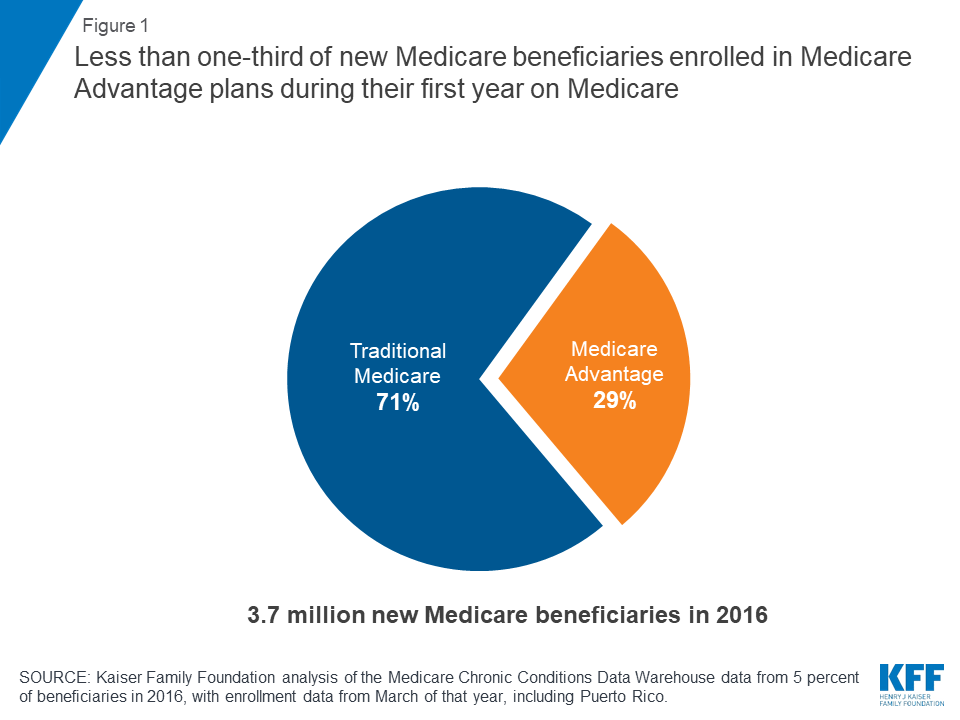

According to an AARP report released in December 2021, retirees with traditional Medicare ended up spending an average of $6,168 per year on covering the costs of insurance premiums and medical services.

Are Medicare premiums deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is my NC state pension taxable?

Social Security income in North Carolina is not taxed. However, withdrawals from retirement accounts are fully taxed. Additionally, pension incomes are fully taxed.

What day of month is best to retire?

For CSRS or CSRS Offset employees, the best day of the month to retire is within the last three days of the current month or the first three days of the following month. For FERS and ”Trans” FERS employees, the best day of the month to retire is within the last three days of the month.

What happens to my NC state retirement if I quit?

A refund of your contributions (along with four percent interest compounded annually) is available to you 60 days after your effective date of resignation or termination. The 60-day waiting period is required by the General Statutes of North Carolina.

Can you collect a pension and Social Security at the same time?

Yes. There is nothing that precludes you from getting both a pension and Social Security benefits. But there are some types of pensions that can reduce Social Security payments.

Do NC teachers get a pension and Social Security?

Public school teachers in North Carolina have pension coverage through the Teachers' and State Employees' Retirement System of North Carolina. North Carolina public school teachers participate in Social Security. The fund covers 310,627 active employees, including 196,876 teachers and other educational employees.

Is Social Security reduced if you receive a pension?

Does a pension reduce my Social Security benefits? In the vast majority of cases, no. If the pension is from an employer that withheld FICA taxes from your paychecks, as almost all do, it won't affect your Social Security retirement benefits.

What is Medicare for people 65 and older?

Medicare. Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD) and. group health plan.

Does retirement insurance include extra benefits?

and deductibles. Sometimes retiree coverage includes extra benefits, like coverage for extra days in the hospital.

What Are Medicare Resources in North Carolina?

The North Carolina Medicare and Seniors’ Health Insurance Information Program (SHIIP) can help you to understand Medicare and related insurances . SHIIP can also connect you to Extra Help, a program that helps you to cover Medicare prescription drug costs.

How to Choose a Medicare Supplement Plan?

Medigap policies offer slightly different coverage, available at different premiums and with different deductibles. Consider using a third-party comparison tool like HealthCare.com to easily see the differences between each plan. When deciding which plan is right for you, you’ll want to think about the types of healthcare that you most commonly need and the premiums that you can afford.

When Can You Enroll in Medigap?

5 The Medigap Open Enrollment Period begins the month that you turn 65 and enroll in Medicare Part B, and goes on for six months. While you’re within the Open Enrollment Period, you can buy any Medigap policy available in your state. You may have access to more policies at better prices than you’d have when buying outside of Open Enrollment. You can also buy any policy, even if you have pre-existing conditions.

How Much Do Medigap Policies Cost?

Medigap policy cost will vary depending on the policy and other factors like your age and whether or not you smoke. The following prices reflect quotes for a 65-year-old female in North Carolina who doesn’t use tobacco. 10 They can give you an idea of what you might pay for a Medigap policy:

What If You Want to Change Your Medigap Policy?

11 You can change your policy if you’re still within the open enrollment period. Certain special circumstances or guaranteed issue rights can also qualify you to change your policy, such as if you move to another state. But because there are limited opportunities to change policies, it’s important to thoroughly research each policy’s coverage to make sure you’re choosing the policy that’s right for you.

What Are Alternatives to Medicare Supplement?

If a Medigap policy isn’t right for your needs, a Medicare Advantage Plan can still give you extra coverage. 12 These plans are provided by private health insurance companies and they help to cover your Medicare Part A and Part B expenses. While Medigap policies don’t offer prescription drug coverage, many Medicare Advantage Plans do, making these plans a practical option if you regularly take prescription medications.

Does Medicare cover medical expenses?

Medicare covers many healthcare expenses, but you might still face bills for expenses that Medicare doesn’t cover. If you know that you’ll regularly need healthcare services that Medicare won’t cover, investing in a Medigap policy can help you to save money. All Medigap policies provide slightly different coverage, so for more guidance, check out How to Choose a Medicare Supplement Plan.

What is 50% contributory notes?

Members indicated as 50% or 100% contributory notes the percentage of the premium for which they are responsible.

What is a 70/30 PPO?

The 70/30 PPO Plan is a Preferred Provider Organization (PPO) plan administer ed by Blue Cross and Blue Shield of North Carolina (Blue Cross NC).

What happens if you don't enroll in Medicare?

If no action is taken, you will remain in your assigned Medicare Advantage Plan until next Open Enrollment, and your non-Medicare eligible dependents will be enrolled into the health plan they were enrolled in while you were an active employee.

What happens if you are 65 and not on Medicare?

If under 65 (and not Medicare-eligible), you will be automatically enrolled in the health plan you were enrolled in as an active employee along with any covered dependents. If you did not have coverage in the State Health Plan as an active employee, you will be automatically enrolled in the Traditional 70/30 Plan retiree-only coverage.

What is membership service?

Membership Service – service credit earned in TSERS while working as an active teacher or state employee.

How long do you have to elect Medicare Advantage?

You will have up to the day before your coverage effective date to elect a Medicare Advantage Plan.

When a member transfers service from LGERS to TSERS, is the LGERS service reclassified as?

NOTE: When a member transfers service from LGERS to TSERS, the LGERS service is reclassified as TSERS creditable service.

When will the state pay for SHP 70/30?

If you were “first hired” before October 1, 2006, and you have five or more years of TS ERS membership service , and have not withdrawn that service or taken a refund , the state will pay all of the cost for your individual coverage under the SHP 70/30 or Medicare Advantage Base Plan as a TSERS retiree.

When do you have to have Medicare Part B?

You and any Medicare-eligible dependents need to have Medicare Part B in place and made effective as of your retirement effective date. *If Medicare-eligible and your retirement process is completed less than 60 days before your coverage effective date, you will be automatically enrolled in the Traditional 70/30 Plan.

What is CMGRA in Charlotte?

If you are a retiree of the Charlotte-Mecklenburg systems, you will be interested in being part of the Charlotte-Mecklenburg Governmental Retirees Association (CMGRA). CMGRA offers a variety of programs, meetings and events of interest to retirees.

Do retirees have to provide verification for health benefits?

Retirees who are covering dependents under the County’s Health Benefit Plan will be asked to provide verification documentation to ensure that people being covered are eligible. Learn more about this here.

Can retirees waive Medicare?

Retirees can also waive coverage to receive a reimbursement for their individual enrollment in a Medicare Supplement/Medigap Plan. More information regarding this option is provided below.

Can you waive Medicare in Mecklenburg County?

Medicare-eligible retirees can elect to waive Mecklenburg County's Medicare-Coordinated medical plan to receive a reimbursement for their own Medicare Supplement plan (up to a maximum amount). For more information, please view the 2022 Medicare-Coordinated Reimbursement Cover Letter . Please return all forms listed below to the Mecklenburg County Human Resources Employee Services Center (700 East Fourth Street, Suite 220, Charlotte, NC 28202) to make this election and to start your reimbursement payments.

When does a retiree get their state health benefits?

* The State Health Plan benefit effective date is the first of the month following their retirement effective date. For example: If the retirement date is January 1, then State Health Plan benefit effective date is February 1.

How much is Medicare Part B premium?

The 2019 standard Part B premium is $135.50 per month for new Medicare Part B enrollees but depending on income, may be as high as $460.50 per month. •If retiree has the 70/30 Plan and they do not elect Part B, the State Health Plan will process as if they have it and they will incur greater out-of-pocket costs.

What is the color of Medicare card?

your red, white and blue Medicare card.

How long is Medicare enrollment period?

Your Medicare Initial Enrollment Period (IEP) surrounding your 65thbirthday is a seven (7) month period that includes the three (3) months before your birthday month, the month of your 65thbirthday, and the three

How long before you turn 65 should you receive your Medicare card?

You should receive your Medicare card approximately 60 –120 days before you turn 65.

How long does it take to get Medicare after turning 65?

The month you turn 65 1 month after enrollment 1 month after you turn 65 2 months after enrollment 2 months after you turn 65 3 months after enrollment 3 months after you turn 65 3 months after enrollment. New Retiree (65 or older) - Enrolling in Medicare.

What is a TPA in NC?

Our current TPA is Blue Cross and Blue Shield of NC. But your medical claims are paid by the state, not Blue Cross. State Health Plan Options for Non-MedicareMembers.