How much does Medicare Advantage cost?

Oct 10, 2021 · With Original Medicare beneficiaries pay about 20 percent of the cost for all Medicare-approved services and Medicare pays 80 percent. With a Medicare Advantage plan, you also pay about 20 percent of your costs, but there is an annual cap that limits your out-of-pocket costs , which solves one of the biggest problems with Medicare Parts A and B.

Why Advantage plans are bad?

3 rows · Nov 08, 2021 · The average monthly premium for 2022 Medicare Advantage plans is $19, according to the Centers ...

Who qualifies for Medicare Advantage?

Whether the plan charges a monthly premium. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium (and the Part A premium if you don't have premium-free Part A). Whether the plan pays any of your monthly Medicare Part B (Medical Insurance) premium. Some plans will help pay all …

Why are Medicare Advantage plans so popular?

Sep 15, 2018 · In addition to the Part B premium, which you must continue to pay when you enroll in Medicare Advantage, some Medicare Advantage plans also charge a separate monthly premium. The insurance company uses this pool of money from the Medicare Trust Funds plus any additional premiums paid by plan members to pay the covered health care expenses for …

Where does the money come from for Medicare Advantage plans?

Are Medicare Advantage premiums deducted from Social Security?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

Who pays premium for Medicare?

How are Medicare premiums paid?

What is the average cost of a Medicare Advantage plan?

Can I drop my Medicare Advantage plan and go back to original Medicare?

Why is Medigap so expensive?

What is the difference between Medigap and Medicare Advantage plans?

Why do doctors not like Medicare Advantage plans?

Does everyone on Medicare pay the same premium?

Do high income earners pay more for Medicare?

How Medicare Advantage Premiums Work

Medicare Advantage, known as Medicare Part C, includes both Medicare Parts A and B (Original Medicare) coverage. When you enroll in a Medicare Adva...

Medicare Part C Cost: How Much Is The Premium?

Medicare Advantage premiums vary depending on the type of plan and the state you live in. Monthly premiums range from $0 to the high $300s. But ove...

How Does Obamacare Affect Medicare Advantage Costs?

Obamacare (Affordable Care Act) made several changes to Medicare Advantage plans. Most of these changes had to do with the health insurance industr...

Can I Get Help Paying For Medicare Advantage?

You can get help with paying for your Medicare Part C plan through Medicare Savings Programs (MSPs) made available by the Centers for Medicare and...

How Do I Choose A Medicare Advantage Plan?

The first step in choosing a Medicare Advantage plan is to compare quotes from different insurance companies. HealthMarkets provides access to Medi...

Who is responsible for paying Medicare claims?

The insurance company becomes responsible for paying members’ claims. Medicare pays the insurance company a flat fee for the cost of paying claims. The insurance company uses this payment to provide members with healthcare coverage.

What is Medicare Advantage?

A Medicare Advantage plan is health insurance offered by Medicare-approved private insurance companies. It’s a single plan that includes all Original Medicare (Part A and Part B) ...

How much will Medicare cost in 2022?

The average monthly premium for 2022 Medicare Advantage plans is $19, according to the Centers for Medicare and Medicaid Services (CMS). 2 Medicare Advantage premiums vary depending on the type of plan and where you live, and can range from $0 to more than $100. 3 Overall, premiums are usually lower than Medicare Part B premiums,* which you must also continue to pay. The Medicare Part B premium for 2022 is estimated to be $158.50. 1

What happens if you don't receive Medicare?

If you don’t receive these benefits, you will receive a bill called ‘Notice of Medicare Premium Payment Due’. You can then pay by mailing a check, use your bank’s online billing to make payments every month, or sign-up for Medicare’s bill pay to have the premium come out of your bank account automatically.

How much is Medicare Part B premium 2022?

Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income. 1 On average, those who received Social Security benefits will pay a lesser premium rate.

What is Medicare Part C premium?

The premium you may pay is used to cover the wider range of services available with Medicare Part C . The Medicare-approved private insurance companies that offer Medicare Part C coverage decide what services the plans will cover, so monthly premiums vary from plan to plan and state to state. Insurance companies are only allowed to make changes ...

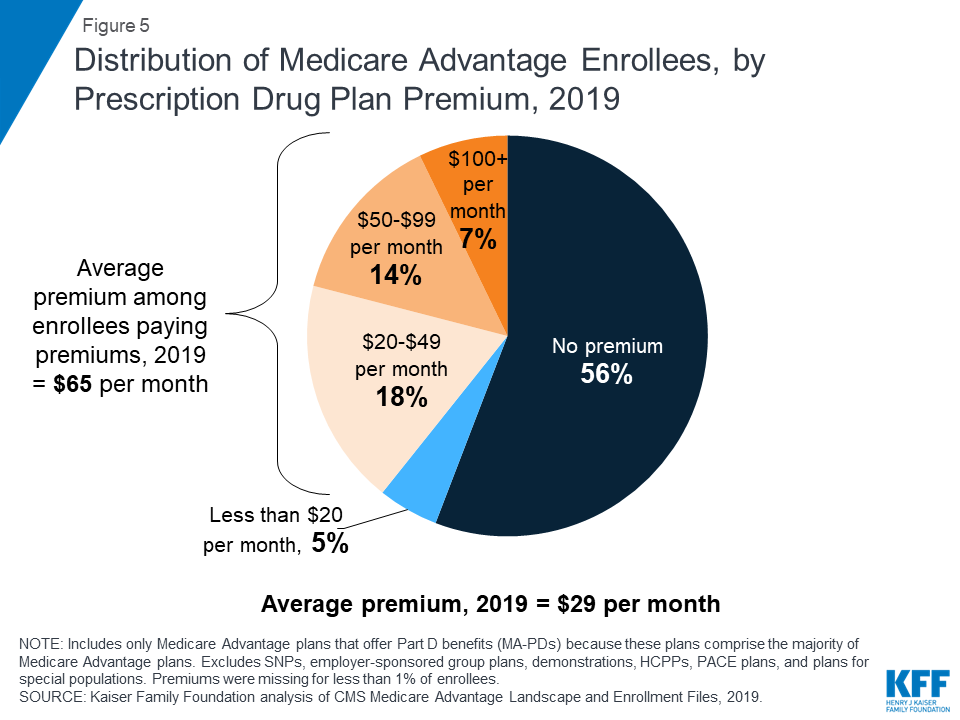

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for plans that include Medicare Part D prescription drug (MA-PD) benefits is $21 according to the Kaiser Family Foundation. 3 The average monthly premium is weighted by enrollment. That means most people are selecting the lower-priced plans on an overall basis.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

What is Medicare Advantage Plan?

By law, Medicare Advantage plans must cover everything that is covered under Original Medicare, except for hospice care, which is still covered by Original Medicare Part A. Some Medicare Advantage plans offer additional benefits such as routine dental and routine vision care. According to 2016 data from the Kaiser Family Foundation, about one in three Medicare beneficiaries are enrolled in a Medicare Advantage plan, or about 17.6 million individuals. This article explains how Medicare funding works with Medicare Advantage plans.

How does HI get money?

The Medicare Hospital Insurance, or HI Trust Fund gets money primarily from payroll taxes. It gets much smaller amounts from income tax on Social Security benefits and Medicare Part A premiums paid by those who don’t qualify for premium-free Part A. The money in this trust fund pays for Part A expenses such as inpatient hospital care, skilled nursing facility care, and hospice.

How does the SMI fund work?

The Medicare Supplemental Medical Insurance, or SMI Trust Fund gets its Medicare funding primarily from money Congress allocates for the program and from Part B premiums and Medicare Part D Prescription Drug Plan premiums. This fund pays for outpatient health care, durable medical equipment, certain preventative services and prescription drugs.

Why do insurance companies have special rules and requirements?

Because the insurance companies have a set amount of Medicare funding each year to cover all of their members’ health care expenses, they often have special rules and requirements to help keep costs down. Many plans require you to get care from network providers or get prior authorization for any expensive tests and procedures.

Does Medicare Advantage pay for claims?

The insurance company uses this pool of money from the Medicare Trust Funds plus any additional premiums paid by plan members to pay the covered health care expenses for everyone enrolled in a particular plan. Claims for people enrolled in Medicare Advantage are paid by the insurance company and not by the Medicare program as they are for those enrolled in Original Medicare.

Does Medicare Advantage charge a monthly premium?

In addition to the Part B premium, which you must continue to pay when you enroll in Medicare Advantage, some Medicare Advantage plans also charge a separate monthly premium.

Is Medicare the same as Medicare Advantage?

Although the Medicare funding is the same for all insurance companies offering Medicare Advantage plans, each company chooses what types of plans and benefits it will offer. No matter what company and plan type you select, however, you are still entitled to all the same rights and protections you have under Original Medicare.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What are the copayments for Medicare Advantage?

Medicare Advantage copayments can vary drastically between plans. Some plans charge copayments for doctors’ visits, hospital stays, ambulance rides, and/or visits to the emergency room. Copayments are sometimes structured on a two- or three-tier system. For example, visits to your primary care physician may have lower copayments than a visit to a specialist. Emergency care copayments, if applicable, are often the most expensive. The Summary of Benefits provides a detailed review of the Medicare Advantage plan and will explain your plan’s particular copayment structure.

How much is the deductible for Medicare Advantage 2020?

Enrolling in a plan with a low MOOP limit could be another way to lower your Medicare costs. The average Medicare Advantage deductible decreased 22% from $129 in 2020 to $116 in 2021 among the plans studied, according to eHealth research.*.

Do you have to pay Medicare Part B premiums?

Even if you enroll in a Medicare Advantage plan, you are still required to pay your monthly premium for Medicare Part B coverage. Medicare Part B premiums must be paid directly to Medicare. The monthly cost may increase based on your annual household income from two years prior.

Does Medicare Advantage charge a monthly premium?

In addition to the Medicare Part B premium, Medicare Advantage plans often charge a monthly premium for coverage. You may even find a Medicare Advantage plan in your area with a monthly premium as low as $0. However, the plan’s other costs might be higher.

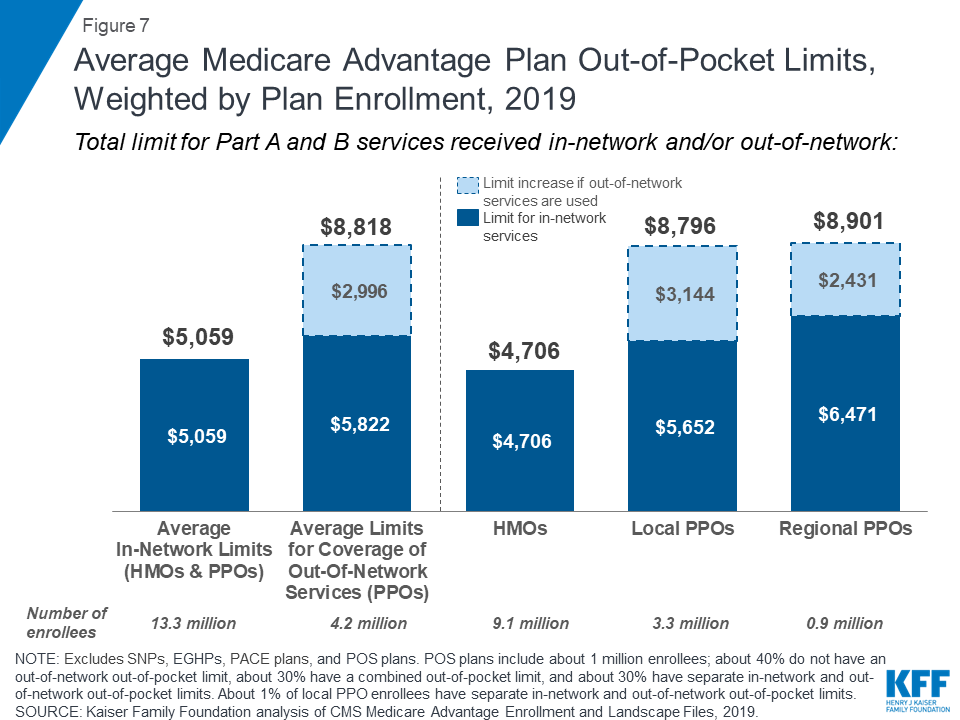

Does Medicare Advantage have out of network spending limits?

It is important to note that most annual out-of-pocket spending limits apply only to in-network Medicare providers. If you choose to go out-of-network for services, you may either be subject to a higher out-of-network MOOP limit or your payments may not be figured into your annual expenditures at all.

Does Medicare Advantage have a deductible?

Medicare Advantage plans frequently offer more benefits than Original Medicare and may have lower out-of-pocket costs. Your health insurance rate and out-of-pocket costs will depend on the particular Medicare Advantage plan you choose. Some plans charge monthly premiums, and many plans have an annual deductible.

Do dental plans have a deductible?

Some plans charge monthly premiums, and many plans have an annual deductible. Other costs may include copayments for each doctor or hospital visit, and premiums for optional benefits, such as vision, hearing, and/or dental coverage.

How is Medicare Advantage financed?

Medicare Advantage plans are also financed by monthly premiums paid by subscribers. The premium amounts vary by company and plan. Subscribers may also be asked to pay a certain amount of their expenses in the form of a deductible or copayment.

What is Medicare Advantage?

Medicare Advantage, a health plan provided by private insurance companies, is paid for by federal funding, subscriber premiums and co-payments. It includes the same coverage as the federal government’s Original Medicare program as well as additional supplemental benefits.

Where does federal health insurance come from?

Funding for federal health insurance comes from two trust funds which are dedicated to Medicare use and held by the U.S. Treasury.

What is Supplementary Medical Insurance Fund?

The Supplementary Medical Insurance Fund is composed of funds approved by Congress and Part B and Part D premiums paid by subscribers.

Who Pays The Premium For Medicare Advantage Plans

You continue to pay premiums for your Medicare Part B benefits when you enroll in a Medicare Advantage plan . Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate.

Look Closely At Your Bill

The type of “Medicare Premium Bill” you get shows if you’re at risk of losing your Medicare coverage for late payments:

Analyze Medicare Premiums With A Licensed Agent

Deductibles, coinsurance and other out-of-pocket costs may not always be predictable expenses, but premiums will be there month after month.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How Much Is Taken Out Exactly

There is no standard amount that is taken out of your Social Security check when you sign up for Medicare. Instead, the amount deducted depends on several factors. Each part of Medicare has a different cost. On top of this, Part C and Part D are offered by private plans, which means their monthly premiums vary even more.

How Do I Know If I Will Have Money Taken Out Of My Social Security Check

If you receive Social Security retirement benefits, your Medicare benefits will be deducted automatically. This means that you do not have to do anything to make this happen it will be automatic when you enroll in Medicare.

Nearly All Medicare Advantage Enrollees Are In Plans That Require Prior Authorization For Some Services

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees are in plans that require prior authorization for some services in 2021.

What is Medicare Part B premium?

Here’s the basics: Original Medicare is made up of two parts: Medicare Part A, or preventative care coverage, and Medicare Part B, or hospital coverage. ...

How much does Medicare cost in 2020?

Under traditional Medicare, most people do not pay a Part A premium. However, there is no way to avoid a Part B premium, which starts at $144.60 per month as of 2020. Generally, this amount increases annually with inflation. This premium is based on income; anyone with an individual yearly Modified Adjusted Gross Income up to $87,000 or a joint income of up to $174,000 will pay the base rate. Pricing for Plan B premiums scales up from there based on income, topping out at $491.60 per month for single taxpayers making over $500,000 and joint taxpayers making over $750,000.

Is Medicare Advantage the same as Original Medicare?

Medicare Advantage premiums are primarily based on the services offered within a plan, not a policyholder’s income. Not all Medicare Advantage plans have premiums; these plans are usually the same price as Original Medicare. Pricing can be even less than Original Medicare if a Medicare Advantage plan pays part of the standard Plan B premium amount but does not require its own premium.

Does Medicare have a higher premium?

However, plans with more expansive coverage, such as those that cover hearing, vision, dental or prescription drugs, will likely have a higher premium. Overall, how much seniors pay in Medicare premiums has two components: the income-based Plan B premium and any additional premium a Medicare Advantage provider charges.

Is Medicare Advantage based on income?

Unlike Original Medicare Plan B, Medicare Advantage premiums are not based on income but rather the options offered within a particular plan. Plans that limit coverage to standard Plan A and Plan B offerings may have little to no additional premium.

Do Medicare Advantage plans pay Part B?

Even Medicare Advantage users must pay Part B premiums, based on their annual income. However, some Medicare Advantage plans may pay a portion of this amount on the user’s behalf, which reduces the total amount of Part B premiums owed. Eldercare Financial Assistance Locator. Discover all of your options.

Does income affect Medicare premiums?

While income doesn’t directly play a part in Medicare Advantage premiums, it can be a factor in the total amount owed for Medicare.

Why do people choose Medicare Advantage?

Millions of people opt for a Medicare Advantage plan for a number of reasons, one of which may be the cost savings that some Medicare Advantage plans may offer. Review this detailed examination of Medicare Advantage costs to learn more about how you may be able to find the right plan for you.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

Does Medicare Advantage cover dental?

While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B , benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees (or not at all).