You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security; Railroad Retirement Board; Office of Personnel Management; If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA).

Full Answer

Does Medicare Part A and Part B have deductibles?

Yes, both Medicare Part A and Medicare Part B each come with a deductible. Medicare Advantage (Part C) and Medicare Prescription Drug Plans (Part D) may also include deductibles as well, although the costs associated with these plans are not standardized like they are in Original Medicare (Part A and Part B).

How much does Medicare pay if you already met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care. There are a few ways you can go about avoiding having to pay the deductibles for Part A or Part B.

How does Medicare Part B coinsurance work?

Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%.

Is Medicare Part B based on income or net worth?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts affect roughly 7 percent of people with Medicare Part B.

Who pays Medicare deductible?

Medicaid may pay your Medicare deductibles and coinsurance. Employer coverage over 20 employees: If your employer has 20 or more employees, the employer group health plan usually is the primary insurance and Medicare is the secondary insurance. Your group health plan may pay your Medicare deductibles.

How does Medicare deductible get paid?

Typically, you'll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you'd be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%.

Who pays the 20% of a Medicare B claim?

After the beneficiary meets the annual deductible, Part B will pay 80% of the “reasonable charge” for covered services, the reimbursement rate determined by Medicare; the beneficiary is responsible for the remaining 20% as “co-insurance.” Unfortunately, the “reasonable charge” is often less than the provider's actual ...

How is Medicare Part B funded?

Part B, the Supplementary Medical Insurance (SMI) trust fund, is financed through a combination of general revenues, premiums paid by beneficiaries, and interest and other sources. Premiums are automatically set to cover 25 percent of spending in the aggregate, while general revenues subsidize 73 percent.

What is Medicare B deductible?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How is Medicare Part B deductible billed?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does Medicare Part B pay 80% of covered expenses?

After the deductible has been paid, Medicare pays most (generally 80%) of the approved cost of care for services under Part B while people with Medicare pay the remaining cost (typically 20%) for services such as doctor visits, outpatient therapy, and durable medical equipment (e.g., wheelchairs, hospital beds, home ...

Does the government subsidize Medicare?

The government paying a portion or all of your Medicare Advantage premiums, coinsurance, copayments, and deductibles is generally considered by most people to be a Medicare subsidy, even if the payment is for a Medicare Advantage plan instead of for Original Medicare.

Is Medicare funded by taxpayers?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

Where does the Medicare funding come from?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

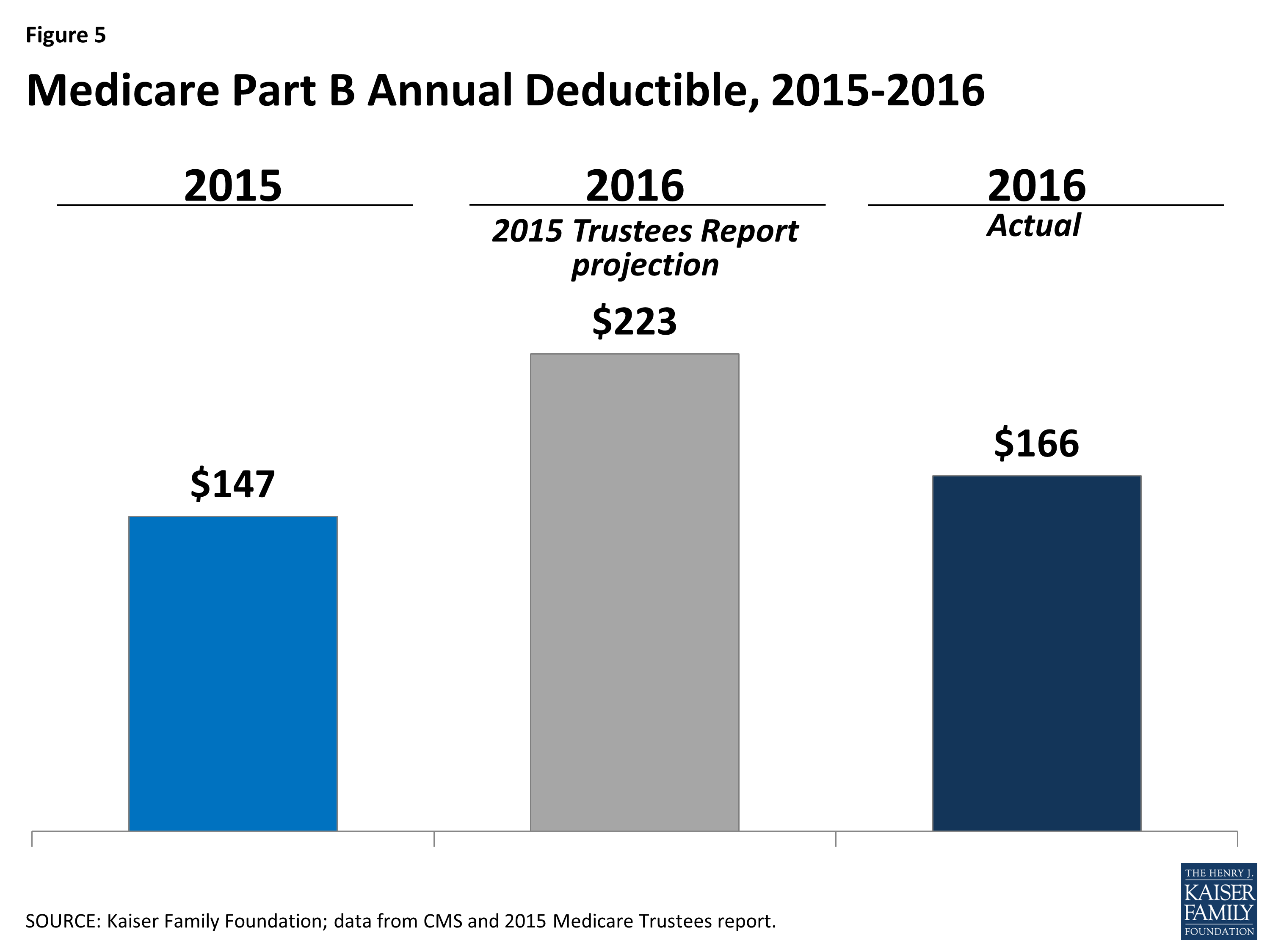

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

Other Medicare Charges Also Rising

The annual Part B deductible will rise $30 next year to $233, up from this year’s $203.

Medicare Premium Reimbursement Arrangement

The type of Section 105 plans employers offers will depend on the employers size and whether they provide a group health plan. A Health Reimbursement Arrangement is a system covered by Section 105. This arrangement allows your employer to reimburse you for your premiums.

Officials Say Substantial Social Security Cola Will More Than Offset The Monthly Hike

Medicare’s Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program’s history, the Centers for Medicare & Medicaid Services announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

Alternative Medicare Assistance Programs

Programs outside of Medicare that can help pay premiums are generally for Medicare Part D plans. Depending on the state you live in, you may be able to get help with paying your Part D premiums through State Pharmaceutical Assistance Programs . These programs provide assistance to adults with disabilities and low-income seniors.

Does The Medicare Part B Premium Increase Each Year

When Medicare debuted in 1966, the Part B premium was $3 per month. But the Part B premium is $144.60 per month as of 2020. Although there have been some stretches of time when the premium declined from one year to the next or remained steady 2013 through 2015, for example, when it was $104.90/month each year it has generally increased every year.

Help Paying Original Medicare Premiums

Most MSPs provide help for Medicare Part A or Part B only. All programs require eligibility for Medicare Part A, but the main difference between each is the income range that those seeking help must be within.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What happens after you meet your Medicare Part B deductible?

What Happens After You Meet the Part B Deductible? After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019. On Jan. 1, 2020, your deductible will reset, and you will have to pay the 2020 Medicare Part B deductible before your Part B ...

What is the Medicare Part B deductible for 2019?

As mentioned above, the annual Medicare Part B deductible for 2019 is $185. So what exactly does that mean? You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019.

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

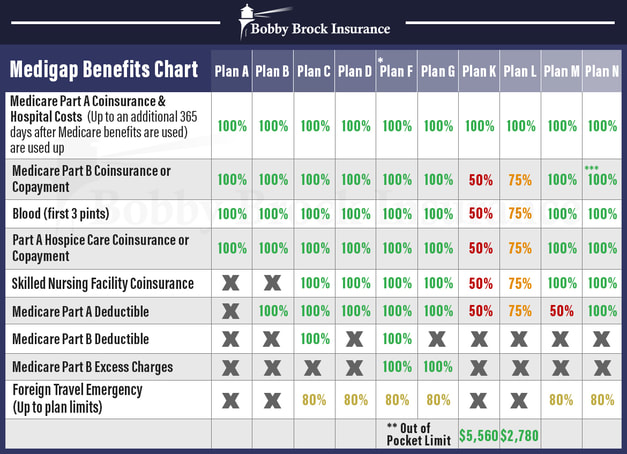

What is Part B insurance?

Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care. Some durable medical equipment (DME) Medicare Supplement Insurance (Medigap) Plan F and Plan C both provide full coverage for the 2019 Part B deductible.

How much is a knee injury deductible in July?

In July, you injure your knee and schedule another appointment with your doctor. This time you are billed $150 for the appointment. You will be responsible for paying the first $65 of the $150 for the appointment out of your own pocket, because that is how much is left on your deductible. After the $65 is paid, ...

How much is it?

The Medicare Part B deductible currently is $198 per year (2020). After your deductible is met, you typically pay 20% of the Medicare-approved amount. If you have a Medigap insurance plan, it pays the 20% for you.

How do I pay it?

Here’s the answer and what’s recommended. The Medicare Part B deductible is applied on a basis of first claim received, first claim applied to the deductible. This means that when the New Year starts, Medicare will apply your first claim or claims received to your deductible until the full deductible has been satisfied.

Need more information?

If you would like more information on this or to speak with me please call me directly at (888) 901-4870 or you can leave me your information by visiting the contact us page.

What is the deductible for Medicare?

Each part of Medicare carries its own deductible. The Part A and Part B deductibles are standard for each beneficiary of Original Medicare. The Part C (Medicare Advantage) and Part D (prescription drug plan) deductibles will vary from plan to plan. Some Part C and Part D plans may have a $0 deductible. Some Medicare Advantage plans also feature $0 ...

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible in 2021 is $203 per year, and the Part A deductible is $1,484 per benefit period. Learn more about these costs and what you can expect.

How much is Medicare Part A 2021?

The Medicare Part A deductible for 2021 is $1,484 per benefit period . Unlike the deductible for Part B that operates on an annual basis, the Part A deductible starts and stops with each benefit period. A benefit period begins the day you are admitted for inpatient care at a hospital or skilled nursing facility, ...

What is the deductible for Part D?

Medicare defines a deductible as: “The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.”.

What percentage of Medicare coinsurance is 20 percent?

A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent of a medical bill, while Medicare would pay the remaining 80 percent. It’s worth noting that the 20 percent you will pay as coinsurance is 20 percent of the Medicare-approved amount.

What is the coinsurance for Medicare Part B?

Coinsurance is the amount of the total bill that you must pay. A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent ...

What is Medicare Supplement?

Medicare Supplement Insurance (also called Medigap) is a type of privately-sold insurance plan that is used in conjunction with Medicare Part A and Part B.