HHSC manages the Medicare Savings Programs, which consists of the following:

- Qualified Medicare Beneficiary (QMB) Program

- Specified Low-Income Medicare Beneficiary (SLMB) Program

- Qualifying Individual (QI) Program

- Qualified Disabled and Working Individual (QDWI) Program

Full Answer

What does the Medicare savings program pay for?

The Medicare Savings Programs (MSPs) are a set of benefits that are administered by state Medicaid agencies and help people pay for their Medicare costs. MSPs are divided into several programs: The Qualified Medicare Beneficiary (QMB) Specified Low-Income Medicare Beneficiary (SLMB) Qualifying Individual (QI) Qualified Disabled Working Individual (QDWI)

What are Medicare Savings Programs (MSP)?

Below is a general guide to the Medicare Savings Program (MSP) application process. Before applying for an MSP, you should call your local Medicaid office for application steps, submission information (online, mail, appointment, or through community health centers and other organizations), and other state-specific guidelines.

How do I get help Paying my Medicare premiums?

Individuals with incomes between 120% and 135% of the federal poverty level [between (FPL x 1.2) and (FPL x 1.35)] may be eligible for payment – through the SLMB program – of their Medicare Part B premium for the calendar year. The individual must have resources below $$7,730 for an individual and $$11,600 for a couple in 2019.

What should I do if I have a Medicare Advantage plan?

Jul 30, 2020 · Medicare savings programs assist people with low income levels.. The programs have tiered levels, based on an individual’s income. If a person’s income is too high for one program, then a ...

What are the three types of Medicare savings programs?

Medicare offers several Medicare Savings Programs (MSPs) that assist people with low income and assets: Qualified Medicare Beneficiary (QMB), Specified Low-Income Medicare Beneficiary (SLMB), Qualified Individual (QI) and Qualified Disabled Working Individual (QDWI). California also offers the 250% California Working ...

What is Texas Medicare savings program?

The Medicare Savings Programs use Medicaid funds to help eligible persons pay for all or some of their out-of-pocket Medicare expenses, such as premiums, deductibles or coinsurance.

What is Medicare Savings Program NM?

HSD administers several programs called Medicare Savings Programs (MSPs) that help low-income New Mexicans pay some or all their Medicare premiums, deductibles, co-pays and/or co-insurance.Jul 12, 2021

How does QMB work with Medicare?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums, Part B premiums, and deductibles, coinsurance, and copayments.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

What is the income limit for QMB in Texas?

Qualified Medicare Beneficiary (QMB): The income limit is $1,063 a month if single and $1,437 a month if married. QMB pays for Part A and B cost sharing, Part B premiums, and – if a beneficiary owes them – it also pays their Part A premiums.Oct 4, 2020

Does Social Security count as income for QMB?

An individual making $1,800 from Social Security cannot qualify for QMB because they are over the $1,133 income limit.

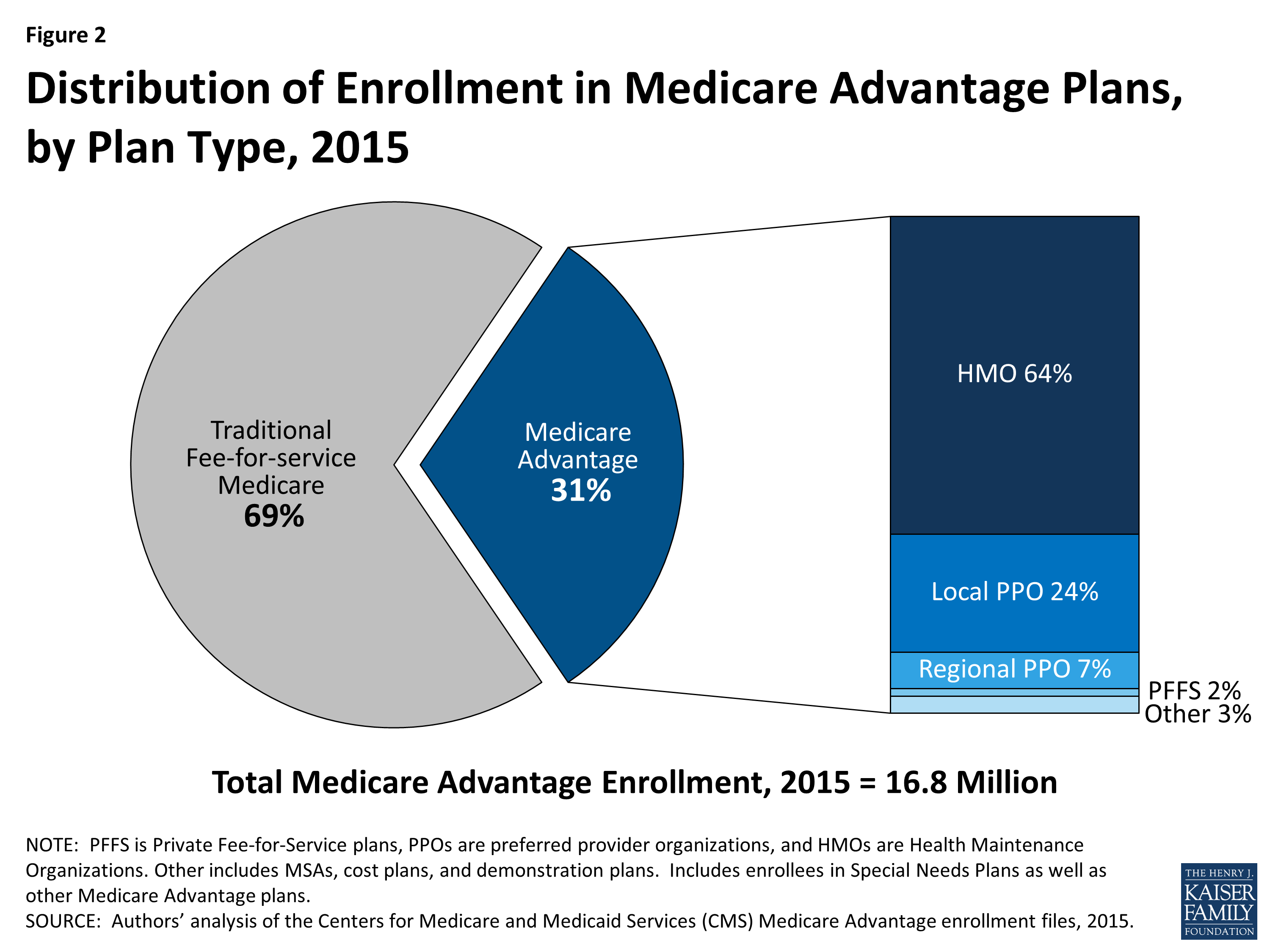

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What does QMB Medicaid pay for?

The Qualified Medicare Beneficiary (QMB) program helps District residents who are eligible for Medicare pay for their Medicare costs. This means that Medicaid will pay for the Medicare premiums, co-insurance and deductibles for Medicare covered services.

What is QMB plan in medical billing?

Medicaid's Qualified Medicare Beneficiary (QMB) program assists low-income beneficiaries with Medicare premiums, deductibles, coinsurance, and Medicare Advantage Plan co-pays.

Will Medicaid pay for my Medicare Part B premium?

Medicaid can provide premium assistance: In many cases, if you have Medicare and Medicaid, you will automatically be enrolled in a Medicare Savings Program (MSP). MSPs pay your Medicare Part B premium, and may offer additional assistance.

What is CMS beneficiary?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that manages Medicare. When a Medicare beneficiary has other health insurance or coverage, each type of coverage is called a "payer." "Coordination of benefits" rules decide which one is the primary payer (i.e., which one pays first).Dec 1, 2021

How long does it take to get a copy of my medicaid application?

If you are at a Medicaid office, ask that they make a copy for you. You should be sent a Notice of Action within 45 days of filing an application. This notice will inform you of your application status.

How often do you need to renew your MSP?

If you are approved, you will need to renew (recertify) your MSP every year. If you do not receive a notice in the mail to recertify, contact your local Medicaid office and ask what you need to do to make sure you receive your MSP benefits in the following year.

How long does it take for a Part B to be paid back?

If you receive an approval : And are found eligible for SLMB or QI, the state will pay your Part B premium starting the month indicated on your Notice of Action. However, it may take several months for the Part B premium ($148.50 in 2021) to be added back to your monthly Social Security check.

When do Medicare guidelines change?

The income guidelines, which are based on the Federal Poverty Level, change April 1 each year and can be found here.

Can a provider charge for QMBs?

Providers are prohibited from charging them. All cost-sharing (premiums, deductibles, co-insurance and copayments) related to Parts A and B is excused, meaning that the individual has no liability. The state has responsibility for these payments for QMBs.

Can a QMB beneficiary be billed for Medicare Part A?

A provider is prohibited from billing a QMB beneficiary for Medicare Part A or B deductibles or co-insurance. In essence, the QMB program operates like a basic Medicare Supplement policy (Medigap). QMB coverage can save a recipient hundreds or even thousands of dollars a year.

Does Medicaid pay for QMB?

This is true even for doctors who are enrolled in only Medicare and not Medicaid. People with QMB are excused, by law, from paying Medicare cost-sharing. Providers are prohibited from charging them.

Can a QMB provider bill Medicaid?

However, provider billing for QMB operates in practice is complex, and many providers are unaware of how to 1) bill the Medicaid program on behalf of QMBs and 2) that even if they do not bill or are not reimbursed by the Medicaid program, they are strictly prohibited from seeking payment from QMB enrollees.

Who funds MSPs?

The federal government funds MSPs, but they are run by the Medicaid program, and enrollment requirements may vary between different states. In this article, we discuss the four MSPs, eligibility, and enrollment. Finally, we look at the Extra Help program.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is QDWI in Medicare?

Qualified Disabled and Working Individuals (QDWI) The QDWI program helps a person pay Medicare Part A premiums. Medicaid limits enrollment to individuals who meet the following criteria: is aged years, is working, and has a disability. returned to work and lost the premium-free Part A.

Does Medicare give priority to a person who was in a program the previous year?

Medicare allocates the benefits on a first-come-first-served basis. People must reapply annually, and a person who was in a program the previous year is given priority. In addition, if an individual qualifies for Medicaid, they cannot get assistance from the QI program.

Can a low income person get Medicare?

A person with a low income may benefit from a Medicare savings program. Medicare savings programs assist people with low income levels. The programs have tiered levels, based on an individual’s income. If a person’s income is too high for one program, then a different program with a higher income limit may suit them.

Does Medicare cover all costs?

Medicare provides health insurance coverage to help people pay for healthcare services. However, Medicare does not cover all costs, and Medicare savings programs (MSPs) are designed to help pay some of those extra costs.

Medicare Savings Programs

Five federally supported programs are designed to help seniors with income and resources that have fallen below specific thresholds. These programs were created because not everyone can handle the expenses of Medicare, such as; copays, coinsurance, deductibles, and prescription costs.

How do I know I qualify for the Medicare savings program?

Medicaid in each state administers these four Medicare cost-cutting measures:

Other facts about Medicare Savings Program

Healthcare providers won’t bill you: You will not be billed for services provided to you in the QMB program; Medicaid will pay the medical providers. Ensure that the doctor is aware you are in the QMB program, so they don’t bill you incorrectly, and also make sure to Inform Medicare of the charge.

How to Apply for Medicare Savings Program

If you are eligible for Medicare, and your income and resources meet or exceed the financial eligibility requirements for a Medicare savings program, see if you can locate your state’s Medicaid office.

Prescription drug coverage

It is an effective treatment, so use it with the care that you would with any other prescription medication.

Savings to cut Medicare costs

Private insurance policies help you cover the costs of Medicare, such as copays, coinsurance, and deductibles. You have ten plans to choose from, all of which provide nationwide coverage.

The Takeaway

Medicare savings programs help low-income people pay Part A and Part B premiums, deductibles, copays, and coinsurance.

What is a QMB in Medicare?

Eligibility for each is primarily based on a senior’s financial resources and income. 1) Qualified Medicare Beneficiary (QMB) – helps pay for Medicare Part A & Part B, as well as deductibles, copayments, and coinsurance. 2) Specified Low-Income Medicare Beneficiary (SLMB) – helps pay for Medicare Part B only.

How long does skilled nursing pay for?

Skilled Nursing Facilities#N#Medicare will pay for 100% of the cost of care for 20 days at a skilled nursing facility and 80% of the cost for 80 more days. The care must be for short term recovery following a hospital stay.

Does Medicare pay for adult day care?

Medicare hospice care is the one notable exception to this rule. Adult Day Care. Medicare does not pay for adult day care services.

Does Medicare cover assisted living?

The care must be for short term recovery following a hospital stay. Medicare does not cover any cost of assisted living.

Does Medicare provide cash payments to seniors?

Medicare Savings Programs provide reductions in Medicare premiums, deductibles and co-payments for the elderly. This program does not provide seniors with cash payments.

What is the FPL for Medicare?

Each of the four Medicare Savings Programs has different financial eligibility requirements. When it comes to income, the federal poverty limit (FPL) is used to determine eligibility in a number of government programs.

What assets are considered eligible for Medicare?

things that can be sold for cash, may make it harder to qualify. This may include cash, bank accounts, stocks, bonds, real estate, and motor vehicles.

How much does a person pay for Part B insurance?

That means that an individual without other assets or financial resources would pay 18 percent of their annual income towards Part B premiums, and a couple, paying $1,608 in annual premiums per person, would pay as much as 24 percent.

Does Medicare pay for health care?

Types of Medicare Savings Programs. Thank goodness there are Medicare Savings Programs available to soften the blow. These programs do not pay directly for your health care. What they do is pay down the costs that Medicare leaves on the table, costs like premiums, deductibles, coinsurance, and copayments.

Is Medicare the most affordable insurance?

Income Limits to Qualify. Asset Limits to Qualify. How to Apply. Medicare may be the most affordable insurance option for American seniors, but that does not mean it's cheap. It still may be hard for some people to make ends meet. A senior who has worked 40 quarters ...

Is Medicare a countable asset?

The federal guidelines, however, exclude the following from consideration: These are not considered to be countable assets. Although Medicare is a federal program, the Medicare Savings Programs are run by the Medicaid programs in each state. This allows the states to set the final terms of eligibility.