Are Medigap premiums regulated?

In California, Medigaps are regulated by two state agencies. The California Department of Insurance (CDI) regulates most Medigap policies, and the Department of Managed Health Care (DMC) regulates Medigap plans sold under the trademark of Blue Cross or Blue Shield.Jul 5, 2021

Which of the following is true about Medicare supplemental insurance plans?

Which of the following is true about Medicare Supplement Insurance Plans? They are regulated by the Centers for Medicare & Medicaid Services (CMS). Plan benefit amounts automatically update when Medicare changes cost sharing amounts, such as deductibles, coinsurance and copayments.

Why does Florida have state laws regulating Medicare supplement insurance?

Why does Florida have state laws regulating Medicare Supplement Insurance? the NAIC model with regard to the federal standard Medigap forms. State laws are introduced for enforcement purposes, as states cannot enforce and prosecute federal laws, only state laws.

What states allow you to change Medicare Supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

What is the difference between a Medicare Advantage Plan and a Medicare Supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What are the negatives of a Medicare Advantage Plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

Can a person have 2 Medicare Supplement plans?

En español | By law, Medigap insurers aren't allowed to sell more than one Medigap plan to the same person.

What is the highest rated Medicare Advantage plan in Florida?

What is the best Medicare Advantage plan in Florida? We recommend AARP/UnitedHealthcare Medicare Advantage as the best overall provider in Florida. The company offers $0 plans in all of Florida's 67 counties. Plus, it is well rated and has in-network providers across the country.2 days ago

Can you switch Medigap plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Can you switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

Can you change your Medicare Supplement anytime during the year?

You can change your Medicare Supplement Plan anytime, just be aware that you might have to answer medical questions if your outside your Open Enrollment Period.

What is a medicaid supplement?

Medigap (Medicare Supplement Health Insurance) A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

Do you have to pay for Medigap?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Can insurance companies sell standardized Medicare?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”. It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that ...

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What are Medicare Supplement Plans?

Medicare Supplement plans, also known as Medigap, are supplement insurance plans that work with Original Medicare Part A and Part B.

Who Regulates Medicare Supplement Plans?

Although Medicare Supplements (Medigap) plans are sold by private insurance companies, the federal government (CMS) regulates each plan’s design in terms of coverages offered.

How Does Medicare Supplement Plans Work?

While there are 10 Medigap plans to choose from in all but three states, each plan, although different from the next, works in the same manner. Medicare would pay its share and then the Medicare Supplement Plan would pay its share.

Which Medicare Supplement Plans Provide the Best Coverage?

Having multiple Medigap plans to choose from enables the policy shopper to select a plan that will best meet their individual needs and their individual budget. It’s also important to keep in mind that the Medigap Plan you select will have a monthly premium charge over and above your Medicare Part B premium.

What are High-Deductible Medicare Supplement Plans?

There are two high-deductible Medicare Supplement Plans available. High deductible Plan F and Plan G both have a regular version and a “high-deductible” version. Since the policyholder is agreeing to accept more out-of-pocket expenses for their annual healthcare expenses, the insurance company offers the plan at a lower monthly premium.

What is Medicare Supplement insurance?

Medicare does not pay for everything. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, services not covered by Medicare, and excess charges when doctors do not accept assignment.

Medicare Supplement Insurance (Medigap)

Medicare Supplement insurance is also called Medigap insurance because it covers the "gaps" in Medicare benefits, such as deductibles and copayments. Medicare Supplement insurance is a private health insurance policy purchased by a Medicare beneficiary. Federal and state law regulates Medicare Supplement policies.

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020.

Medicare SELECT Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

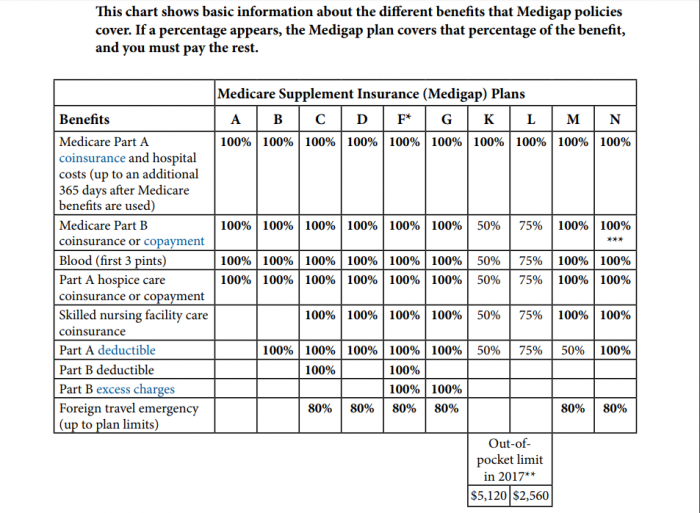

What does Medicare Supplement insurance cover?

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020. View all plans types and the benefits they include. (updated 1/6/2020)

Part A Deductible

The initial amount Medicare does not pay for an inpatient hospital stay per benefit period ($1,484 in 2021).

Part B Deductible

The initial amount Medicare will not pay for covered physical or other outpatient services each calendar year ($203 in 2021). Most people will pay $148.50 (2021) each month for the Part B Premium. Due to changes that were implemented in January 2020, the Part B deductible is not covered unless you were eligible for Medicare before January 2020.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

When did Medicare Supplement Plans start?

The history of Medicare Supplement Plans – Medigap insurance takes us back to 1980. What began as voluntary standards governing the behavior of insurers increasingly became requirements. Consumer protections were continuously strengthened, and there was a trend toward the simplification of Medicare Supplement Plans – Medigap Insurance reimbursements whenever possible. During the 1980s the federal government first provided a voluntary certification option for Medicare Supplement, or Medigap Insurance, insurers in Section 507 of the Social Security Disability Amendments of 1980 , commonly known as the “Baucus Amendment.” In order to meet the Baucus Amendment’s voluntary minimum standards, the Medicare Supplement plan was required to:

What is Medicare Select Supplement?

The Medicare SELECT Supplement plans provided a managed-care option for beneficiaries with reimbursement within a limited network. The Act to Amend the Omnibus Budget Reconciliation Act of 1990, ...

What was the unintended consequence of the Omnibus Budget Reconciliation Act?

Therefore, The Omnibus Budget Reconciliation Act had the unintended consequence of insurance companies refusing to sell Medicare Supplement Insurance – Medigap insurance, policies to Medicare beneficiaries who had any other type of private non-Medicare insurance coverage regardless if the other coverage was very limited.

What was the Omnibus Budget Reconciliation Act of 1990?

It was during the 1990’s The Omnibus Budget Reconciliation Act of 1990 replaced some voluntary guidelines with federal standards. Specifically, the The Omnibus Budget Reconciliation Act of 1990 did the following: Provided for the sale of only 10 standardized Medicare Supplement Plans – Medigap Insurance (in all but three states); ...

What is a felony in Medicare?

The Medicare and Medicaid Patient and Program Protection Act of 1987 provided that individuals who knowingly and willfully make a false statement or misrepresent a medical fact in the sale of a Medicare Supplement Plans – Medigap Insurance Insurance, policy are guilty of a felony. The Omnibus Budget Reconciliation Act of 1987 permitted ...

When did Medicare become standardized?

The second group of plans, labeled Plan A through Plan J, were standardized and became effective in a state when the terms of Omnibus Budget Reconciliation Act of 1990 were adopted by the state, mainly in 1992. Shopping for Medicare insurance can be overwhelming.

What is Section 3210?

Finally, Section 3210 of the Patient Protection and Affordable Care Act of 2010 requested that the Secretary of Health and Human Services request that the NAIC “review and revise” cost-sharing in Medicare Supplement, or Medigap Insurance, Plan C and Plan F.