What is the cheapest Medicare Part D?

Mar 24, 2022 · When you look into Humana’s Part D offerings, the page automatically fills in your location data (if you have location services on) and immediately shows you the plans available in your area. You...

Who has the best Medicare Part D plan?

Oct 14, 2021 · 888-245-4542. Mon - Fri 8am - 8pm ET. TTY/TDD #711. Shop Online for Plan Quotes. Shop Plans. Powered by. Medicare-eligible beneficiaries can enroll in a Medicare Part D Prescription Drug plan from ...

Is Medicare Part D Worth It?

What Medicare Part D drug plans cover. Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site. Costs for Medicare drug coverage. Learn about the types of costs you’ll pay in a Medicare drug plan. How Part D works with other insurance

What is the cheapest Medicare Part D plan?

Unlike your Part D monthly premium, you’ll pay the Part D-IRMAA directly to Medicare, not your Medicare plan. Social Security will notify you if you need to pay the Part D-IRMAA. For more information, contact Social Security at 1-800-772-1213 (TTY users, 1-800-325-0778), Monday through Friday, from 7AM to 7PM.

Can you buy Medicare Part D by itself?

You have two ways to get coverage: Buy a stand-alone Part D prescription drug plan, or sign up for a Medicare Advantage plan that combines medical and drug coverage. Private insurance companies that Medicare regulates offer both types of plans.

Who has the cheapest Medicare Part D plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Does Walmart have a Medicare Part D plan?

With nearly 18 million Americans relying on Medicare Part D for their prescriptions 3, the Humana Walmart-Preferred Rx Plan (PDP) provides an affordable prescription solution for those who need it most.Sep 30, 2010

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

What is the best Part D Medicare plan for 2021?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Can you use GoodRx If you have Medicare Part D?

So let's get right to it. While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.Aug 31, 2021

How do I choose Medicare Part D plan?

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you're interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP). Find a Medicare drug plan.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the cost of Medicare Part D for 2022?

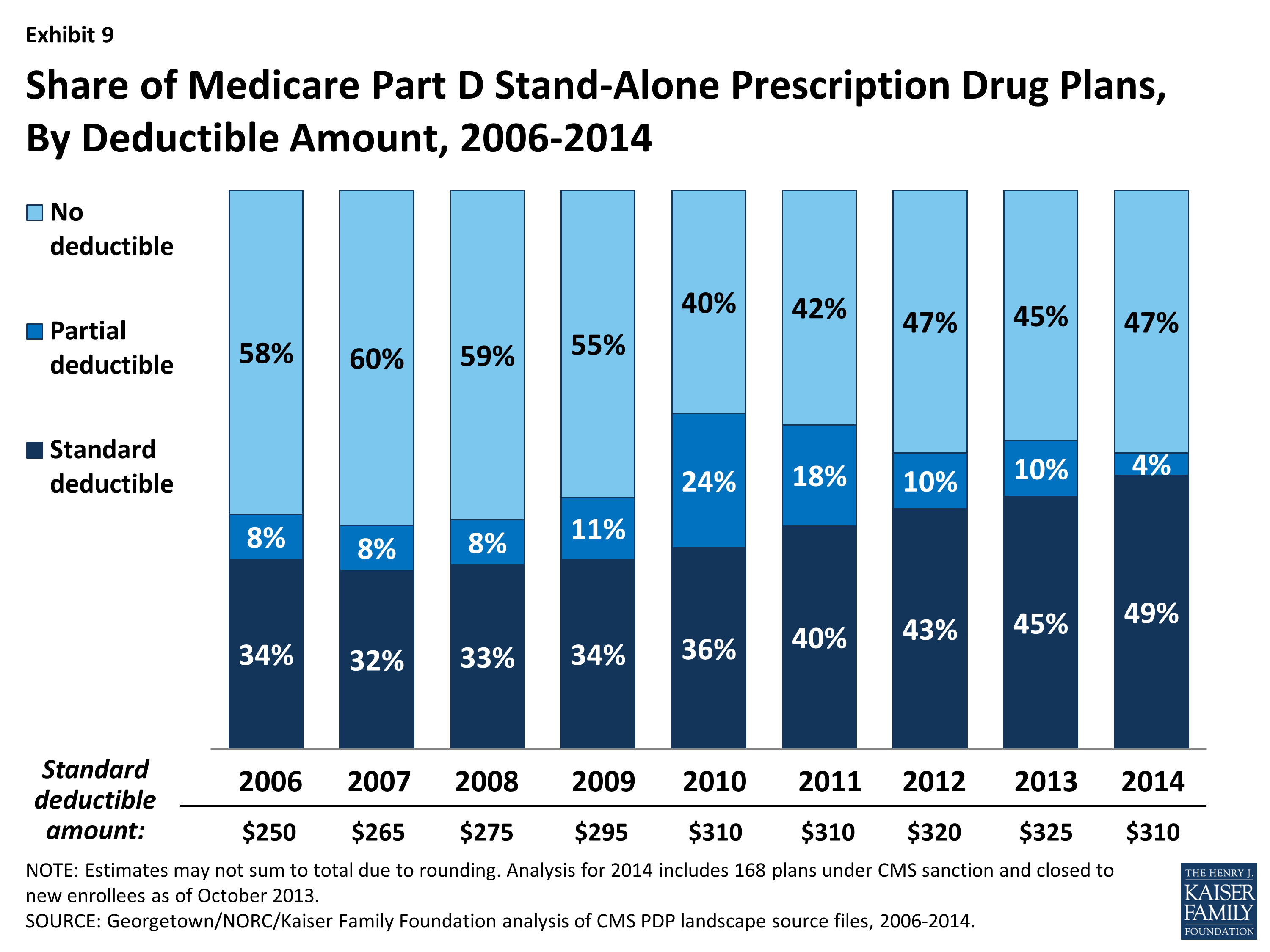

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

Do you have to have a Part D?

En español | Part D drug coverage is a voluntary benefit; you are not obliged to sign up. You may not need it anyway if you have drug coverage from elsewhere that is “creditable” — meaning Medicare considers it to be the same or better value than Part D.

Medicare Part D Eligibility and Enrollment

You’re eligible for Medicare prescription drug coverage if: 1. You’re enrolled in Medicare Part A and/or Part B, and 2. You also live in the servic...

Medicare Part D Late-Enrollment Penalty

Even if you’re not currently taking prescription medications, it’s a good idea to sign up for Medicare Part D as soon as you’re first eligible. As...

Medicare Part D Prescription Drug Coverage

Each Medicare plan that covers prescription drugs has its own formulary, or list of covered drugs. These formularies include coverage of specific g...

Medicare Part D Prescription Drug Costs

Because Medicare plans set their own monthly premiums and other out-of-pocket expenses, your Medicare Part D costs may differ by plan, insurance co...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What happens if you don't enroll in Medicare Part D?

If you don’t enroll in Medicare Part D when you’re first eligible and go without creditable prescription drug coverage for 63 days in a row or more, you could face a late-enrollment penalty if you sign up for Part D later on.

When is Medicare open enrollment period?

Medicare Advantage Open Enrollment Period (January 1 to March 31): If you are enrolled in Medicare Part C and change your mind, ...

Does Medicare Part D cover prescriptions?

Medicare prescription drug coverage is available in two ways. If you have Original Medicare ( Part A and Part B), Medicare Part D isn’t automatically included.

What is a coverage gap?

Coverage gap, or “donut hole”: After you and your plan have spent a certain amount on covered medications (including the deductible), you may enter the coverage gap, which is a temporary increase in your out-of-pocket prescription drug costs.

Does Medicare cover generic drugs?

Medicare Part D prescription drug coverage. Each Medicare plan that covers prescription drugs has its own formulary, or list of covered medications. These formularies include coverage of specific generic and brand-name prescription drugs. All plans must cover certain categories of medications, but the specific prescription drugs covered in each ...

Does Medicare Part D have a monthly premium?

Because Medicare plans set their own monthly premiums and other out-of-pocket expenses, your Medicare Part D costs may differ by plan, insurance company, and location. In general, each Medicare Prescription Drug Plan and Medicare Advantage Prescription Drug plan requires a monthly premium. Keep in mind that the premium for your Medicare Part D ...

Does Medicare have a deductible?

The government sets a maximum deductible for Medicare plans that cover prescription drugs, which may change each year. Some plans may not have a deductible. Copayments and coinsurance: You are responsible for paying these amounts for your medications after you have paid your plan deductible (if required).

Why do agents hand out Part D cheat sheets?

Many agents actually hand this Part D Cheat Sheet out to their clients so they can run their own drug comparison. It can help lighten the load during AEP, and more often, people actually want to compare plans on their own.

What is Medicare Part D?

Medicare Part D is optional prescription drug coverage. It's also called a Prescription Drug Plan, or PDP for short. You may also hear it referred to as stand-alone PDP. Part D plans are run by private insurance companies that follow rules set by Medicare.

How many pharmacies are there in Medicare Part D?

Most Medicare Part D plans have a broad array of preferred pharmacies, such as SilverScript, which has over 65,000 pharmacies including CVS, Walgreens, Walmart, and many small, mom-and-pop pharmacies. Clumsy Kramer GIF by HULU - Find & Share on GIPHY.

Who is Michael Sams?

Michael Sams, a senior market producer and sales trainer, sold an $850,000 annuity – his largest annuity sale ever – to a client who originally only wanted Part D help. "People want leads all the time, and this is the best lead generator you'll ever have ," he explains.

What happens if you don't join Medicare?

If they decide not to join a Medicare drug plan when they're first eligible, and they don’t have other creditable prescription drug coverage or get Extra Help, they’ll likely pay a late enrollment penalty if they join a plan later . The late enrollment penalty is an amount that’s permanently added to the Part D premium.

What is the late enrollment penalty?

The late enrollment penalty is an amount that’s permanently added to the Part D premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Part D or other creditable prescription drug coverage.

What is the AHIP certification?

First up is the AHIP. In order to sell Medicare Advantage and Part D (Prescription Drug) plans, you'll need to receive your AHIP certification and submit it to the carriers you want to offer. The AHIP covers MA and PDP explanations, marketing and compliance guidelines, and laws on fraud in Medicare.

How much is Medicare Part D 2021?

The average cost of a Medicare Part D plan in 2021 is about $32. Be aware, though, that this figure is slightly different depending on where you live. The good news is that basic plans start near $20 per month. To check out your options in Connecticut, browse to this page.

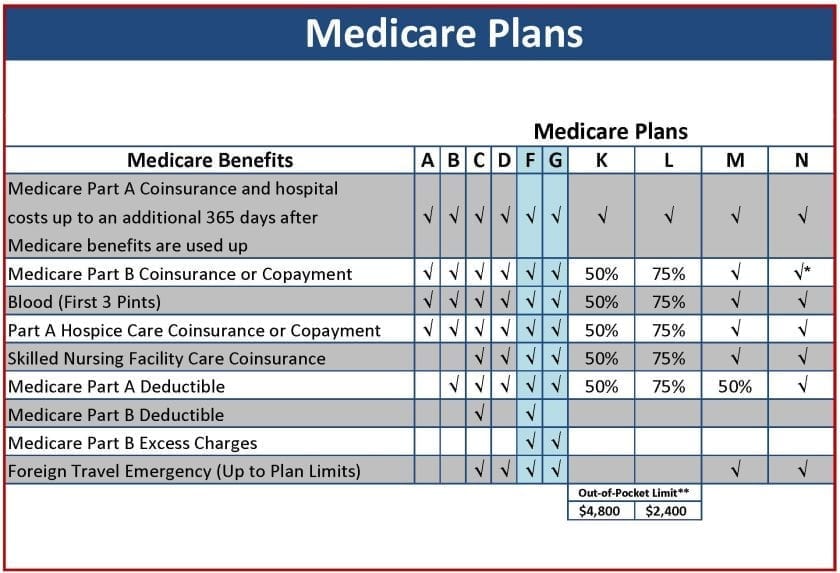

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

What is the initial deductible for Medicare?

The initial deductible is the amount that you pay before your Medicare Part D plan begins paying its share of the costs. So, if you enroll in a 2021 prescription drug plan with a standard initial deductible, you'll spend $10 more out-of-pocket in 2021 before coverage begins. Most Medicare Part D plans have an initial deductible, ...

How much is Medicare deductible?

In the federal Medicare program, there are four different types of premiums. ... , however, the initial deductible is now as much as $445 per year, a $10 increase over last year. This increase is offset by a higher Initial Coverage Limit, which increased to $4,130.

Does Medicare Part D have a deductible?

Most Medicare Part D plans have an initial deductible, but many popular Medicare Part D plans exclude Tier 1 and Tier 2 drugs from the deductible, giving immediate coverage on most lower-cost medications.

What is the ICL for 2021?

The 2021 Initial Coverage Limit (ICL) is $4,130. The Coverage Gap (donut hole) starts when you reach the ICL and ends when you hit the out-of-pocket threshold, which is now $6,550. The Initial Coverage Limit marks the coverage gap entry point. You enter the coverage gap when the total negotiated retail value of your prescription drug purchases exceed your plan’s Initial Coverage Limit.

What is the discount for Part D 2021?

If you reach the 2021 Coverage Gap phase of your Part D coverage, the generic drug discount will be 75%. This means your generic drug costs in the Donut Hole will be 25% of your Part D plan's negotiated retail prices. What you pay counts towards your true out-of-pocket costs (This amount counts toward your TrOOP).

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

When did Medicare Part D go into effect?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government.

Do Part D plans have to pay for all covered drugs?

Part D plans are not required to pay for all covered Part D drugs. They establish their own formularies, or list of covered drugs for which they will make payment, as long as the formulary and benefit structure are not found by CMS to discourage enrollment by certain Medicare beneficiaries. Part D plans that follow the formulary classes and categories established by the United States Pharmacopoeia will pass the first discrimination test. Plans can change the drugs on their formulary during the course of the year with 60 days' notice to affected parties.

What is a Part D benefit?

Beneficiary cost sharing. Part D includes a statutorily-defined "standard benefit" that is updated on an annual basis. All Part D sponsors must offer a plan that follows the standard benefit. The standard benefit is defined in terms of the benefit structure and without mandating the drugs that must be covered.

What is excluded from Part D?

Excluded drugs. While CMS does not have an established formulary, Part D drug coverage excludes drugs not approved by the Food and Drug Administration, those prescribed for off-label use, drugs not available by prescription for purchase in the United States, and drugs for which payments would be available under Part B.

What is part D coverage?

Part D coverage excludes drugs or classes of drugs that may be excluded from Medicaid coverage. These may include: Drugs used for anorexia, weight loss, or weight gain. Drugs used to promote fertility. Drugs used for erectile dysfunction. Drugs used for cosmetic purposes (hair growth, etc.)

What is Medicare Part D cost utilization?

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

How Much Does an Insurance Agent Make on Medicare Sales?

Generally speaking, agents earn two types of commissions selling Medicare plans: a flat dollar amount per application (Medicare Advantage and prescription drug plans) or a percentage of the premium sold (Medicare Supplements).

Commissions With an FMO vs. Without an FMO

Carriers pay agents for the business they write, even if those commissions go through an FMO first (scroll down for a note about assigned commissions). It’s important for agents to know that carriers pay agents and FMOs separately. Your relationship with an FMO is comparable to your clients’ relationship with you.