Which insurance companies sell the most Medicare supplements?

Feb 15, 2022 · Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What are the top 5 Medicare supplement plans?

Feb 22, 2022 · A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not...

Which insurance company is best for a Medicare supplement?

Jul 03, 2021 · Top 10 Supplemental Medicare Insurance Companies in 2022 Mutual of Omaha – Best Overall Aetna – High-Quality Nationwide Availability Cigna – Superior Customer Care United American – Best Enrollment Experience Capitol Life – Competitive Premium Cost Nationwide UnitedHealthcare – Best Underwriting Process Manhattan Life – Best Website Experience

What is the best Medicare supplement insurance plan?

Oct 05, 2020 · Blue Cross Blue Shield (BCBS) companies offer a number of discount programs for Medicare Supplement Plan G. Blue of California, for example, offers a New to Medicare discount for your first year ($25 per month), discounts for using automatic bank payments ($3 per month), discounts for enrolling in a dental plan at the same time ($3 per month), and a 7% …

What is the most basic Medicare Supplement plan?

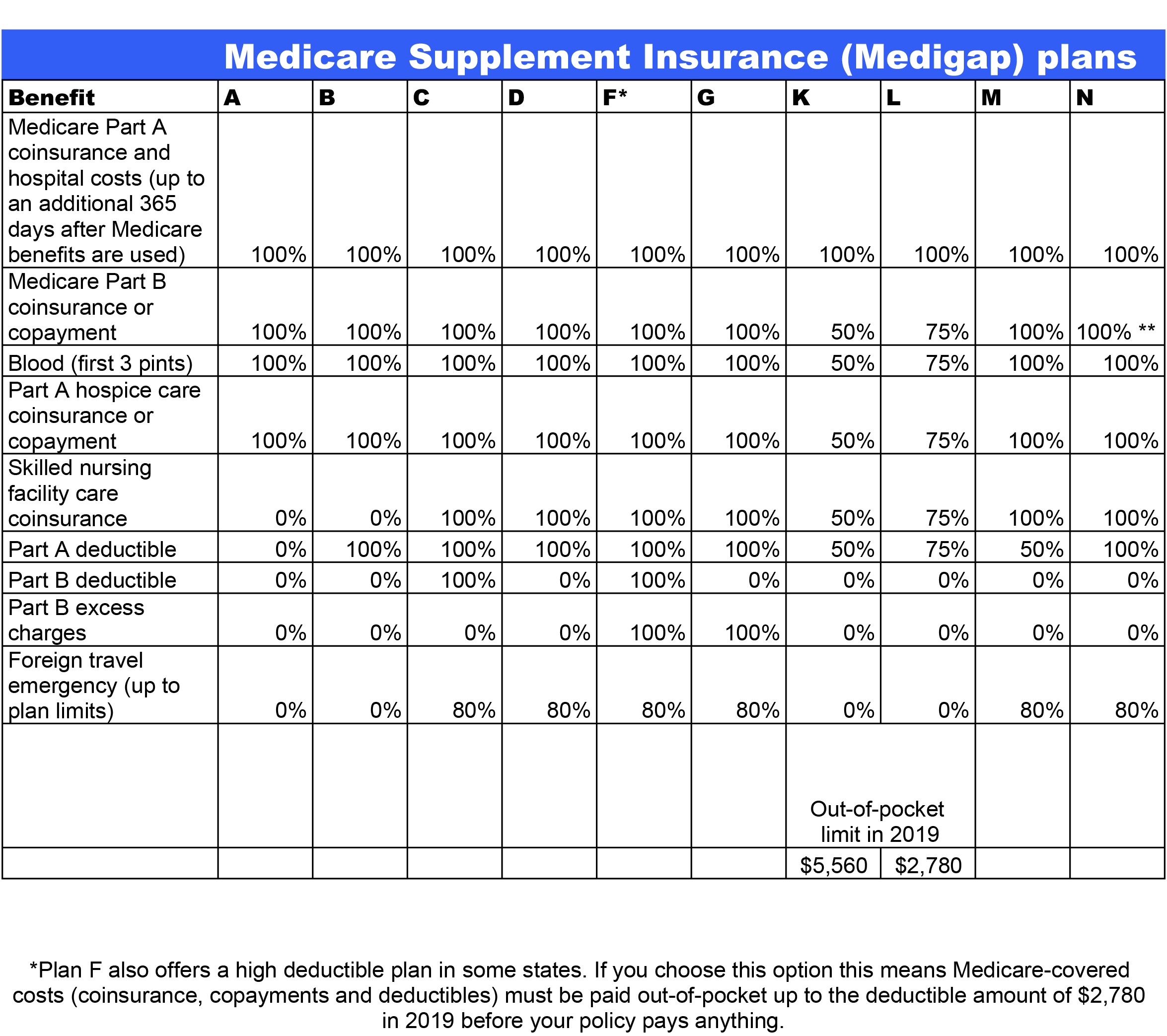

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

What is the most popular Medigap insurance company?

What's notable: Around one out of every three Medigap beneficiaries are enrolled in a plan from UnitedHealthcare and AARP. UnitedHealthcare is one of the top two largest insurance companies in the world....Top 10 Best Medicare Supplement Insurance Companies.AARP/UnitedHealthcare ProsAARP/UnitedHealthcare ConsGenerous plan selectionMust be an AARP member to enroll1 more row

Can you add a Medicare Supplement at any time?

One interesting feature of Medicare Supplement insurance plans is that you can apply for a plan anytime – you only need to be enrolled in Medicare Part A and Part B. However, a plan doesn't have to accept your application, unless you have guaranteed-issue rights.

How much is an AARP Medicare Supplement plan?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

What are the four prescription drug coverage stages?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

What is the difference between an Advantage plan and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Did UnitedHealthcare buy AARP?

UnitedHealthcare Insurance Company (UnitedHealthcare) is the exclusive insurer of AARP Medicare Supplement insurance plans.

What is Medigap plan G?

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.Jan 24, 2022

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

Does Mutual of Omaha offer a discount?

Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company. However, the company only offers three plans (F, G, and N).

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

When was Aetna founded?

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around; an A from AM Best and an A+ from S&P underscore the reasons for this company’s longevity.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

What states have high deductible plan G?

High-Deductible Plan G is available in 13 states, including Alabama, Arizona, Delaware, Georgia, Illinois, Iowa, Kansas, Louisiana, Maryland, North Carolina, Ohio, Pennsylvania, and South Carolina. Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans.

When did Medicare stop allowing Part B deductible?

When Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, it changed which Medicare Supplement Plans could be made available to new Medicare beneficiaries. The law required discontinued plans that paid the Part B deductible. This is why, starting on January 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. There are no current plans to discontinue Plan G, and high-deductible plans were made available for the first time in 2020. 5

Does BCBS offer dental insurance?

Not only does BCBS offer dental coverage, but it also offers vision and hearing aid benefits. To round out your healthcare needs, BCBS offers 4- to 5-Star Medicare Part D prescription drug plans, available for purchase with your Medicare Supplement Plan G. As a bonus, a nurse line is available 24/7.

Does BCBS offer a discount on Medicare?

Although AARP by UnitedHealthcare offers a higher New to Medicare discount in its first year, BCBS offers the most discount savings over time. Check with your state’s plan for details about BCBS discount programs. BCBS prices Medicare Supplement Plan G according to attained-age in most states.

Is Humana a high deductible plan?

It offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan G is available in all of those states except Missouri.

What is Medicare Supplement insurance?

Original Medicare Part A & B + Medicare Supplement + Part D. Medicare Supplement insurance is also referred to as a Medigap policy by CMS. These names are interchangeable. Your client should expect to pay monthly premiums for Original Medicare Part B, their Supplement and their Part D drug plan.

How long does Medicare Supplement pay commission?

Here are the two most important things you need to know about Medicare Supplement commissions. Medicare Supplements pay the same commission for seven years.

What is a plan N?

Plan N is a Medigap plan that covers the same major benefits as Plan G with the addition of a $20 primary care doctor copay and $50 emergency room copay.

How long does Medicare Part B last?

Your clients IEP begins 3 months before the month they turn 65, their birth month and ends 3 months after. Below are some common examples of Medicare Part B covered services: Doctor’s visits. Ambulance services.

Why are Medicare sales so high?

Most companies pay the same commission for seven years and some even pay for life. Plus, Medicare sales are at an all-time high because of the aging population.

How long does it take to get a six figure income from selling Medicare?

Selling Medicare can steadily help you build a six-figure residual income in as little as 3-4 years. At that point, you’ll have a great six-figure salary.

How much is Part B insurance?

Part B premiums can be as low as $134 or as high as $428.60. The range in price is directly correlated to your client’s income. If for some reason your client doesn’t elect Part B on time, they will be subject to a late enrollment penalty of 10% for every full 12 months they delay enrollment.

Why do people get into the Medicare supplement market?

In sum, there are three great reasons to get into the Medicare Supplement market: There are lots of prospects. Medicare is standardized. There's a built-in need for a secondary insurance with Medicare. Back to top.

How much does Medicare cover?

Medicare Supplements are standardized. No networks. Medicare covers about 80% , and the supplement covers about 20%. Here are the two plans I'd recommend for you, and here's how they work.

What is the Medicare Part B deductible for 2021?

When you have a Plan G, everything is covered except the Medicare Part B deductible, which is $203 in 2021. There are no other costs – it’s 100% coverage from there.

Does Medicare Supplements include prescription drug insurance?

Medicare Supplements helps with doctor and hospital costs only – it does not include prescription drug insurance. CMS puts out a publication each year called the Medicare & You Handbook. In the 2019 version, you can refer to pages 69-72 while explaining Medicare Supplements to clients and prospects.

Is Medicare the primary insurance?

Medicare is always going to be the primary insurance. As a general rule of thumb, Medicare is roughly 80% coverage, and the supplement is roughly 20% coverage. Every insurance company has to provide the exact same benefits for each plan.

How does Medicare Advantage work?

Agents selling Medicare Advantage and Part D plans get a flat dollar amount of money per application. This comes to them in the form of initial commissions and renewal commissions. Carriers pay out initial commissions when an agent makes a new sale or when the beneficiary enrolls in a new, “unlike” plan (different type). Each year and beyond, carriers pay out renewal commissions to the agent if the beneficiary remains enrolled in the plan or enrolls in a new, “like” plan (same type).

Do insurance carriers have to pay Medicare Advantage commissions?

The Centers for Medicare & Medicaid Services (CMS) set the maximum broker commissions for Medicare Advantage and Medicare Part D annually; however, insurance carriers aren’t required to pay these amounts. What you earn for Medicare Advantage and PDP sales could be less, depending on the carrier and your contract with them.