Medicare MSA plans are a good choice if you are in good health and have the financial wherewithal to pay out-of-pocket for healthcare expenses. If you typically pay less than $1,000 per year in medical expenses, excluding prescription costs and premiums, you have the opportunity to build a nest egg in your MSA account for future medical bills.

Full Answer

What is a Medicare MSA plan?

Apr 06, 2022 · Who Is Eligible for a Medicare MSA Plan? Though most Medicare Advantage Plans are eligible to anybody who turns age 65 or is under the age of 65 and receives disability payments through Social Security or the Railroad Retirement Board (RRB), the eligibility rules for a Medicare MSA plan exclude certain individuals.

Do MSA plans cover Medicare Part D prescription drugs?

Basic Steps to Using a Medicare Medical Savings Account (MSA) Plan. 1. You choose and join a high-deductible Medicare MSA Plan. 2. You set up a special Medical Savings Account (MSA) with a bank the plan . selects. 3. Medicare gives the plan an amount of money each year for your health care. 4. The plan deposits some money into your account. The money in your

When can I enroll in a Medicare MSA plan?

Aug 17, 2021 · The Medicare MSA Plan is high-deductible Medicare Advantage that comes with a consumer-owned Medical Savings Account. MSA Plans cover everything that regular Medicare does, and can also include vision, dental, and more. Your MSA Plan deposits money into your Medical Savings Account on a regular basis, which you can use to pay for out-of-pocket health …

Do you have to pay for MSA Medicare Plan B?

– A Medicare Medical Savings Account (MSA) plan is a type of Medicare Advantage plan that combines a high-deductible health plan with a medical savings account. Enrollees of Medicare MSA plans can initially use their savings account to help pay for health care, and then will have coverage through a high-deductible insurance plan once they reach their deductible. Medicare …

Who is eligible for an MSA?

How is an MSA different than other plans?

What are the benefits of an MSA?

What is an MSA Medicare plan?

Is there a deductible for MSA plans?

...

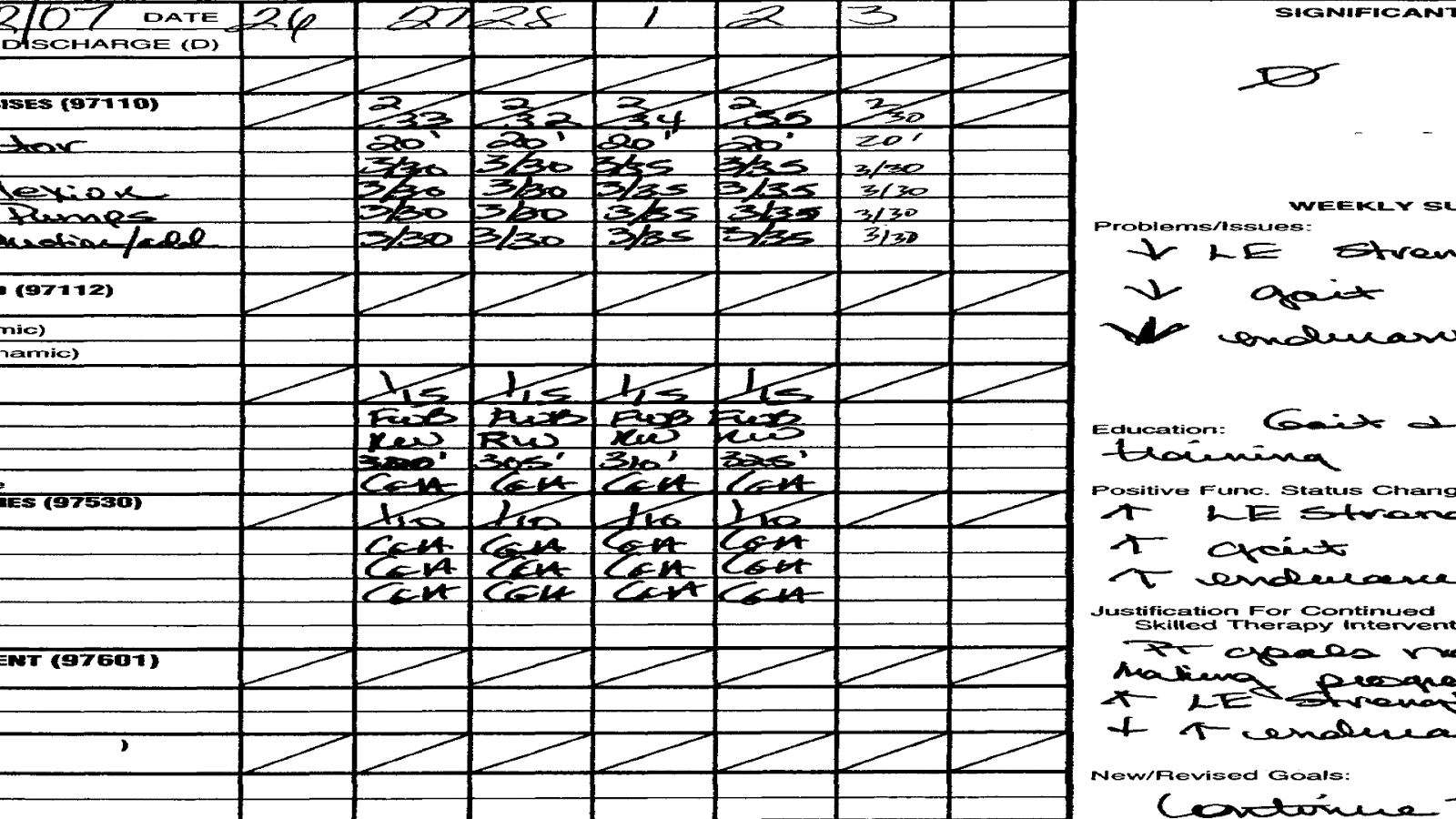

Examples of Medicare Medical Savings Account (MSA) plans.

| PLAN ABC | PLAN XYZ | |

|---|---|---|

| Yearly deposit | $2,500 | $1,500 |

| Yearly deductible | $4,000 | $3,000 |

| What you pay after the deductible | $0 | $0 |

Why do doctors not like Medicare Advantage plans?

How much does Medicare contribute to an MSA?

Can you have a health savings account if you are on Medicare?

Are Medicare MSA contributions tax deductible?

Who can use health savings account?

What is the difference between an HSA and MSA?

How do medical savings plans work?

How to use MSA?

10 steps to use a Medicare MSA Plan. Choose and join a high-deductible Medicare MSA Plan. You set up an MSA with a bank the plan selects. Medicare gives the plan an amount of money each year for your health care. The plan deposits some money into your account.

Do you have to pay for prescriptions before Medicare?

The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . If you use all of the money in your account and you have additional health care costs, you'll have to pay for your Medicare-covered services out-of-pocket until you reach your plan's deductible.

What is out of pocket medical insurance?

out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. . Money left in your account at the end of the year stays in the account, and may be used for health care costs in future years.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . If you use all of the money in your account and you have additional health care costs, you'll have to pay for your Medicare-covered services out-of-pocket until you reach your plan's ...

What is MSA in Medicare?

A Medicare MSA is meant to help enrollees control their medical expenses. Beneficiaries have the risk of paying more out-of-pocket for healthcare services than do those in other Medicare Advantage plans, but those who do not anticipate having significant medical expenses may find the plans economically attractive.

What is MSA plan?

Medicare Medical Savings Account (MSA) Plans are a type of Medicare Advantage plan that offers enrollees a combination of a high-deductible health insurance plan and a Medical Savings Account from which qualified medical expenses can be paid . Once the MSA funds are exhausted, medical expenses are paid out-of-pocket until ...

Who is Caren Lampitoc?

Caren Lampitoc is an educator and Medicare consultant for Medicare Risk Adjustments and has over 25 years of experience working in the field of Medicine as a surgical coder, educator and consultant.

What happens to MSA funds after they are exhausted?

Once the MSA funds are exhausted, medical expenses are paid out-of-pocket until the maximum out-of-pocket deductible is met. These plans resemble the Health Savings Accounts that many employees receive from their employers if they choose a high-deductible health insurance plan, though in the case of Medicare MSAs, ...

What is MSA insurance?

Medicare MSAs combine a medical savings account with a high deductible health insurance plan. The plans are offered by private insurers, and cover any medical expense that Original Medicare covers once the deductible has been met. The Medical Savings Account portion of the MSA plan is funded by Medicare, which pays the private insurer to set up ...

Is Medicare Part B taxable?

The beneficiary is required to pay their Medicare Part B premium and is not permitted to add additional money to their Medicare Savings Account. The funds deposited into the plan are not taxable as long as they are used to pay for qualified medical expenses.

What are the advantages of MSA?

Advantages of a Medicare MSA Plan. Medicare MSA plans offer the advantage of flexibility and control. Enrollees are able to choose their own medical providers and pay a good portion of their qualified medical expenses with funds that are provided by Medicare through the private insurer that provides their high deductible Medicare Advantage health ...

What is Medicare MSA?

Medicare MSA Plans (offered by private companies) are Medicare Advantage Plan options . Medicare MSA Plans are similar to Health Savings Account plans available outside of Medicare. If you choose a Medicare MSA Plan, you’re still in Medicare and you will still have Medicare rights and protections.

What rights do you have with Medicare?

As a person with Medicare, you have certain rights. One of these is the right to a fair process to appeal decisions about your health care payment of services.

How does Medicare work?

Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare Medical Savings Account (MSA) Plan. This type of plan combines a high-deductible health insurance plan with a medical savings account that you can use to pay for your health care costs. Medicare MSA Plans give you freedom to control your health care dollars and provide you with important coverage against high health care costs.

What is assignment in Medicare?

Assignment—An agreement by your doctor or other supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance.

Part one: Low-cost Medicare Advantage plan

Your Medicare MSA Plan is a form of Medicare Advantage. This plan is guaranteed to cover all costs that would be covered by Original Medicare (Parts A & B). In addition, it’s possible to add coverage for things like vision, dental, and hearing, all under one low-cost standalone plan.

Part two: Medical Savings Account (MSA)

The Medical Savings Account (MSA) is what gives the MSA plan not only its name, but also it’s value. This is a personal, tax-advantaged savings account that you can use to pay for qualified medical expenses. From your deductibles and prescription drugs to laser eye surgery, an MSA account can pay for a wide range of medical costs.

Schedule an appointment with your Personal Benefits Manager to get started

Questions about Medicare, Medicare Advantage, or the new Medicare MSA Plan? Your Personal Benefits Manager is standing by to make the whole process easier to understand.

Does Medicare Advantage plan include prescription drug coverage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. drug copayments. The money that you use from your account on Part D copayments counts toward your Part D.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans . drug copayments. The money that you use from your account on Part D copayments counts toward your Part D. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare ...

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. drug copayments.