What is the history of Medicare?

Medicare was established in 1965 under Title XVIII of the Social Security Act as a federal health insurance program for individuals age 65 and older, regardless of income or health status.

What is Medicare (Title XVIII)?

Medicare (Title XVIII of the Social Security Act). More than 55 million people rely on Medicare for their health insurance. About 17 percent of these individuals are under age 65. The program is administered by the Centers for Medicare and Medicaid Services (CMS), an agency of the U.S. Department of Health and Human Services.

What president signed Medicare into law?

President Johnson signs Medicare into law. On this day in 1965, President Lyndon B. Johnson signs Medicare, a health insurance program for elderly Americans, into law.

What is the history of Medicaid?

Medicaid, a state and federally funded program that offers health coverage to certain low-income people, was also signed into law by President Johnson on July 30, 1965, as an amendment to the Social Security Act. FACT CHECK: We strive for accuracy and fairness. But if you see something that doesn't look right, click here to contact us!

Which year was Medicare or Title 18 of the Social Security Act passed?

1965After lengthy national debate, Congress passed legislation in 1965 establishing the Medicare and Medicaid programs as Title XVIII and Title XIX, respectively, of the Social Security Act.

Who started the Medicare program?

President Lyndon B. JohnsonOn July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs.

Which president introduced the Medicare program?

President Lyndon JohnsonOn July 30, 1965, President Lyndon Johnson traveled to the Truman Library in Independence, Missouri, to sign Medicare into law. His gesture drew attention to the 20 years it had taken Congress to enact government health insurance for senior citizens after Harry Truman had proposed it.

When was Title XVII of the Social Security Act?

October 24, 1963Title XVII was added to the Social Security Act by P.L. 88-156, “Maternal and Child Health and Mental Retardation Planning Amendments of 1963”, §5 (77 Stat. 273, 275), effective October 24, 1963; however, it now is inactive.

How did President Johnson fund Medicare?

It was funded by a tax on the earnings of employees, matched by contributions by employers, and was well received. In the first three years of the program, nearly 20 million beneficiaries enrolled in it.

How did Medicare Start?

In 1962, President Kennedy introduced a plan to create a healthcare program for older adults using their Social Security contributions, but it wasn't approved by Congress. In 1964, former President Lyndon Johnson called on Congress to create the program that is now Medicare. The program was signed into law in 1965.

When did Medicare begin?

July 30, 1965, Independence, MOCenters for Medicare & Medicaid Services / Founded

Who was the first person to enroll in Medicare?

At the bill-signing ceremony President Johnson enrolled President Truman as the first Medicare beneficiary and presented him with the first Medicare card. This is President Truman's application for the optional Part B medical care coverage, which President Johnson signed as a witness.

What program started President Johnson?

The Great Society was a set of domestic programs in the United States launched by Democratic President Lyndon B. Johnson in 1964–65.

Which president took money from Social Security?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19648.LETTER TO THE NATION'S FIRST SOCIAL SECURITY BENEFICIARY INFORMING HER OF INCREASED BENEFITS--SEPTEMBER 6, 196515 more rows

In what year did a Presidential health Task Force first recommend that the Medicare program cover outpatient prescription drugs?

1967In January 1967, 6 months after Medicare implementation began, President Johnson requested the Secretary of the Department of Health, Education, and Welfare (HEW) to study adding outpatient prescription drugs to Medicare.

Who was the first president to dip into Social Security?

Which political party started taxing Social Security annuities? A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983.

Medicare Part A (Hospital Insurance)

All Medicare beneficiaries participate in the Part A program, which helps pay for: 1. Inpatient care in hospitals (i.e. critical access hospitals,...

Medicare Part B (Medical Insurance)

The Part B program is voluntary. When enrolling in Medicare, individuals decide whether or not to pay a premium to receive Part B benefits. Part B...

Medicare Part C (Medicare Advantage)

Eligible individuals have the option to enroll in the Part C program, known as Medicare Advantage, as an alternative to receiving Part A and Part B...

Medicare Part D (Prescription Drug Coverage)

Medicare prescription drug coverage is an outpatient benefit established by the Medicare Modernization Act of 2003 (MMA) and launched in 2006. Ther...

When did Medicare Part D start?

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan (PDP) or public Part C health plan with integrated prescription drug coverage (MA-PD). These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies; almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare (Part A and B), Part D coverage is not standardized (though it is highly regulated by the Centers for Medicare and Medicaid Services). Plans choose which drugs they wish to cover (but must cover at least two drugs in 148 different categories and cover all or "substantially all" drugs in the following protected classes of drugs: anti-cancer; anti-psychotic; anti-convulsant, anti-depressants, immuno-suppressant, and HIV and AIDS drugs). The plans can also specify with CMS approval at what level (or tier) they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

When did Medicare+Choice become Medicare Advantage?

These Part C plans were initially known in 1997 as "Medicare+Choice". As of the Medicare Modernization Act of 2003, most "Medicare+Choice" plans were re-branded as " Medicare Advantage " (MA) plans (though MA is a government term and might not even be "visible" to the Part C health plan beneficiary).

What is CMS in healthcare?

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare").

How much does Medicare cost in 2020?

In 2020, US federal government spending on Medicare was $776.2 billion.

What is Medicare and Medicaid?

Medicare is a national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, ...

How is Medicare funded?

Medicare is funded by a combination of a specific payroll tax, beneficiary premiums, and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue. Medicare is divided into four Parts: A, B, C and D.

How many people have Medicare?

In 2018, according to the 2019 Medicare Trustees Report, Medicare provided health insurance for over 59.9 million individuals —more than 52 million people aged 65 and older and about 8 million younger people.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

When did Medicare expand home health?

When Congress passed the Omnibus Reconciliation Act of 1980 , it expanded home health services. The bill also brought Medigap – or Medicare supplement insurance – under federal oversight. In 1982, hospice services for the terminally ill were added to a growing list of Medicare benefits.

What is the XIX of the Social Security Act?

What are the provisions of Title XIX of the Social Security Act? Title XIX of the Social Security Act, also an amendment added in the 1960s, established Medicaid for low income families managed by state governments with contributions from the Federal government. Over time, Medicaid has become the biggest provider of health care for low-income ...

What is the purpose of the XVIII and XIX amendments?

What are Title XVIII and XIX of the Social Security Act? The Title XVIII and XIX amendments to the Social Security Act of 1935 established Medicare and Medicaid and were two of the most important achievements of the Great Society programs. These amendments derive the basis and administration of these programs and became law on July 30, 1965.

What is Medicare+Choice?

As of 2003, the Medicare+Choice program, with the addition of prescription drug benefits have become Medicare Advantage programs. These programs allow a Medicare beneficiary to choose receive their Medicare benefits through a private health insurance plan.

What is the 1847B?

Other provisions include Section 1847B that mandates the competitive process for acquiring medication for patients and Section 1848 that outlines procedures for reimbursing doctors.

What is Section 1801-1809?

The Introductory Sections (Sec 1801-1809) affirm the rights of patients and medical establishments to operate free of government influence and direction. Section 1802 for example, expressly prohibits federal and state authorities from impeding private contracts between doctors ...

When did the Social Security Act become law?

These amendments derive the basis and administration of these programs and became law on July 30, 1965 . The Social Security Act was the first program for the federal assistance to the elderly, and these amendments added provisions for healthcare that were intended to be part of the initial legislation.

Can seniors qualify for Medicare?

The private insurer gets a fixed amount from the state for doing so. The value of one’s home is not assessed in determining eligibility, so even seniors that own a home can qualify for both Medicare and Medicaid so as to maintain their independence and avoid nursing homes.

Teach with this document

This document is available on DocsTeach, the online tool for teaching with documents from the National Archives. Find teaching activities that incorporate this document, or create your own online activity.

Transcript

To provide a hospital insurance program for the aged under the Social Security Act with a supplementary medical benefits program and an extended program of medical assistance, to increase benefits under the Old-Age, Survivors, and Disability Insurance System, to improve the Federal-State public assistance programs, and for other purposes.

What is Medicare XVIII?

As part of the Social Security Amendments of 1965, the Medicare legislation established a health insurance program for aged persons to complement the retirement, survivors, and disability insurance benefits under Title II of the Social Security Act.

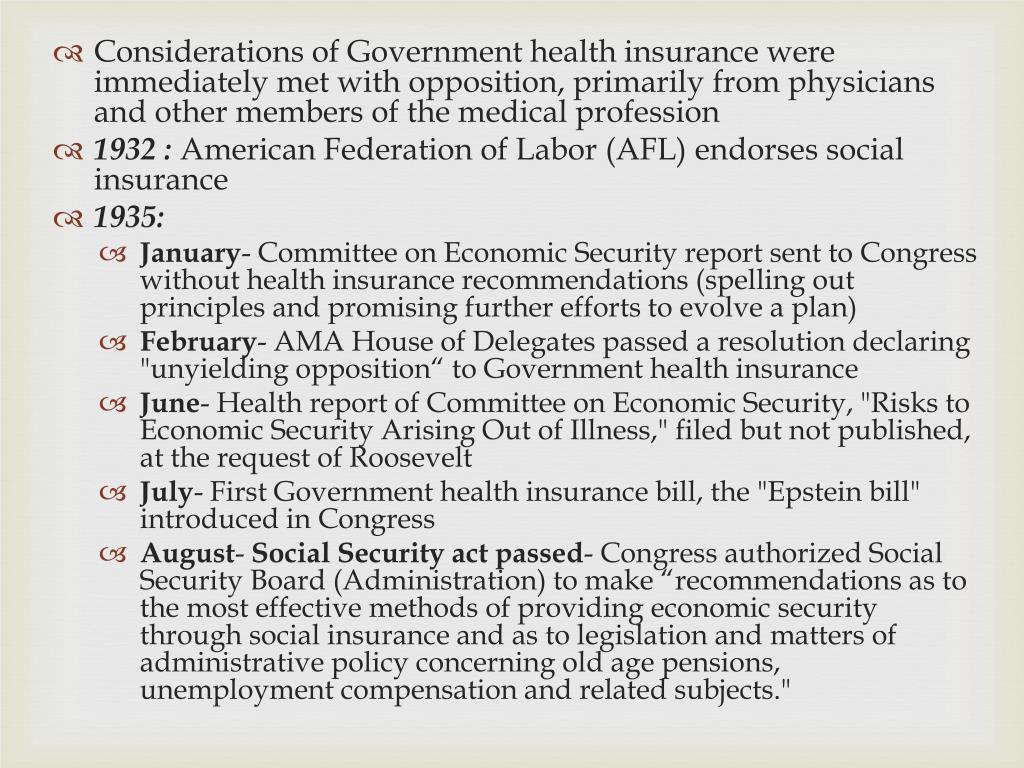

When did health insurance start?

The first coordinated efforts to establish government health insurance were initiated at the State level between 1915 and 1920. However, these efforts came to naught. Renewed interest in government health insurance surfaced at the Federal level during the 1930s, but nothing concrete resulted beyond the limited provisions in the Social Security Act that supported State activities relating to public health and health care services for mothers and children.

How does Medicaid work?

Medicaid operates as a vendor payment program. States may pay health care providers directly on a fee-for-service basis, or States may pay for Medicaid services through various prepayment arrangements, such as health maintenance organizations (HMOs). Within Federally imposed upper limits and specific restrictions, each State for the most part has broad discretion in determining the payment methodology and payment rate for services. Generally, payment rates must be sufficient to enlist enough providers so that covered services are available at least to the extent that comparable care and services are available to the general population within that geographic area. Providers participating in Medicaid must accept Medicaid payment rates as payment in full. States must make additional payments to qualified hospitals that provide inpatient services to a disproportionate number of Medicaid beneficiaries and/or to other low-income or uninsured persons under what is known as the “disproportionate share hospital” (DSH) adjustment. During 1988-1991, excessive and inappropriate use of the DSH adjustment resulted in rapidly increasing Federal expenditures for Medicaid. Legislation that was passed in 1991 and 1993, and again in the BBA of 1997, capped the Federal share of payments to DSH hospitals. However, the Medicare, Medicaid, and SCHIP Benefits Improvement and Protection Act (BIPA) of 2000 (Public Law 106-554) increased DSH allotments for 2001 and 2002 and made other changes to DSH provisions that resulted in increased costs to the Medicaid program.

How are Medicare funds handled?

All financial operations for Medicare are handled through two trust funds, one for HI (Part A) and one for SMI (Parts B and D). These trust funds, which are special accounts in the U.S. Treasury, are credited with all receipts and charged with all expenditures for benefits and administrative costs. The trust funds cannot be used for any other purpose. Assets not needed for the payment of costs are invested in special Treasury securities. The following sections describe Medicare’s financing provisions, beneficiary cost-sharing requirements, and the basis for determining Medicare reimbursements to health care providers.

How much did the US spend on health care in the 1960s?

Health spending in the United States has grown rapidly over the past few decades. From $27.5 billion in 1960, it grew to $912.5 billion in 1993, increasing at an average rate of 11.2 percent annually. This strong growth boosted health care’s role in the overall economy, with health expenditures rising from 5.2 percent to 13.7 percent of the Gross Domestic Product (GDP) between 1960 and 1993.

Who processes Medicare Part A and B claims?

Medicare’s Part A and Part B fee-for-service claims are processed by non-government organizations or agencies that contract to serve as the fiscal agent between providers and the Federal government. These claims processors are known as intermediaries and carriers. They apply the Medicare coverage rules to determine the appropriateness of claims.

Who is eligible for Medicare Part A?

Part A is generally provided automatically, and free of premiums, to persons age 65 or over who are eligible for Social Security or Railroad Retirement benefits, whether they have claimed these monthly cash benefits or not. Also, workers and their spouses with a sufficient period of Medicare-only coverage in Federal, State, or local government employment are eligible beginning at age 65. Similarly, individuals who have been entitled to Social Security or Railroad Retirement disability benefits for at least

When did Medicare become a federal program?

Medicaid, a state and federally funded program that offers health coverage to certain low-income people, was also signed into law by President Johnson on July 30 , 1965, ...

Who signed Medicare into law?

President Johnson signs Medicare into law. On July 30, 1965, President Lyndon B. Johnson signs Medicare, a health insurance program for elderly Americans, into law. At the bill-signing ceremony, which took place at the Truman Library in Independence, Missouri, former President Harry Truman was enrolled as Medicare’s first beneficiary ...

How many people were on Medicare in 1966?

Some 19 million people enrolled in Medicare when it went into effect in 1966. In 1972, eligibility for the program was extended to Americans under 65 with certain disabilities and people of all ages with permanent kidney disease requiring dialysis or transplant.

Who was the first president to propose national health insurance?

READ MORE: When Harry Truman Pushed for Universal Health Care.

Overview

Medicare is a government national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, but also for some younger people with disability status as determined by the SSA, includ…

History

Originally, the name "Medicare" in the United States referred to a program providing medical care for families of people serving in the military as part of the Dependents' Medical Care Act, which was passed in 1956. President Dwight D. Eisenhower held the first White House Conference on Aging in January 1961, in which creating a health care program for social security beneficiaries was p…

Administration

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare"). Along with the Departments of Labor and Treasury, the CMS also implements the insurance reform provisions of the Health Insurance Portability an…

Financing

Medicare has several sources of financing.

Part A's inpatient admitted hospital and skilled nursing coverage is largely funded by revenue from a 2.9% payroll tax levied on employers and workers (each pay 1.45%). Until December 31, 1993, the law provided a maximum amount of compensation on which the Medicare tax could be imposed annually, in the same way that the Social Security payroll tax operates. Beginning on January 1, …

Eligibility

In general, all persons 65 years of age or older who have been legal residents of the United States for at least five years are eligible for Medicare. People with disabilities under 65 may also be eligible if they receive Social Security Disability Insurance (SSDI) benefits. Specific medical conditions may also help people become eligible to enroll in Medicare.

People qualify for Medicare coverage, and Medicare Part A premiums are entirely waived, if the f…

Benefits and parts

Medicare has four parts: loosely speaking Part A is Hospital Insurance. Part B is Medical Services Insurance. Medicare Part D covers many prescription drugs, though some are covered by Part B. In general, the distinction is based on whether or not the drugs are self-administered but even this distinction is not total. Public Part C Medicare health plans, the most popular of which are bran…

Out-of-pocket costs

No part of Medicare pays for all of a beneficiary's covered medical costs and many costs and services are not covered at all. The program contains premiums, deductibles and coinsurance, which the covered individual must pay out-of-pocket. A study published by the Kaiser Family Foundation in 2008 found the Fee-for-Service Medicare benefit package was less generous than either the typical large employer preferred provider organization plan or the Federal Employees He…

Payment for services

Medicare contracts with regional insurance companies to process over one billion fee-for-service claims per year. In 2008, Medicare accounted for 13% ($386 billion) of the federal budget. In 2016 it is projected to account for close to 15% ($683 billion) of the total expenditures. For the decade 2010–2019 Medicare is projected to cost 6.4 trillion dollars.

For institutional care, such as hospital and nursing home care, Medicare uses prospective payme…