In 2022, some of the companies offering Medigap plans throughout Kentucky include: AARP – UnitedHealthcare Aetna

How do Medicare supplement plans work in Kentucky?

In 2019, there were over 230,000 Medicare Supplement enrollees in Kentucky. Plans F and G are the most popular and comprehensive Medigap plan types in Kentucky. Plan F is no longer available to people who are eligible for Medicare after December 31, 2019. Monthly premiums for Plan G for a 65 year old female who doesn’t use tobacco range from ...

How much do Medicare Advantage premiums cost in Kentucky?

5 rows · Apr 16, 2022 · 100% of the total Medicare population in Kentucky has access to a Medicare Advantage Plan ...

What are the Medicare savings programs in Kentucky?

Sep 16, 2018 · If you need to apply for Medicare manually, you may do so in person by visiting your local Social Security Administration (SSA) office. You may also apply via Social Security, either online or over the phone. Visit the Social Security website. Call Social Security at 1-800-772-1213 (TTY users should call 1-800-325-0778), Monday through Friday ...

What types of Medicare coverage are available in Kentucky?

Oct 26, 2021 · Medicare Advantage premiums in Kentucky can range from $0- $140 each month. Over 40% of Kentucky beneficiaries bought an Advantage plan. Advantage policies offer the Maximum Out Of Pocket. Essentially, this protects you from paying over a certain amount. Perhaps you qualify for Medicare because of a disability but aren’t yet 65.

Does Kentucky have Medicare Advantage plans?

Are Medicare Advantage plans offered by private companies?

Who is the largest Medicare Supplement provider?

Who sells the most Medicare Advantage plans?

Can you switch back and forth between Medicare and Medicare Advantage?

What is the difference between Medicare Supplement and Medicare Advantage plans?

Who owns Medico insurance Company?

What is the average cost of supplemental insurance for Medicare?

Are all Plan G Medicare supplements the same?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What are the negatives of a Medicare Advantage plan?

What Medicare plans cover dental?

Types of Medicare Coverage Available in Kentucky

1. Original Medicare, Part A and Part B, refers to federal Medicare coverage. Medicare Part A covers inpatient hospital, skilled nursing facility,...

Local Resources For Medicare in Kentucky

1. Medicare Savings Programs in Kentucky: For beneficiaries with limited income, Kentucky Medicare Savings Programs may offer financial assistance...

How to Apply For Medicare in Kentucky

To apply for Medicare in Kentucky, you must be a United States citizen or legal permanent resident of at least five continuous years. You’re genera...

Does Kentucky have Medicare?

Medicare in Kentucky. Medicare beneficiaries in Kentucky may choose from several Medicare coverage options, ranging from the federally run Original Medicare, Part A and Part B, to private insurance companies contracted with Medicare that offer Medicare Advantage plans, Medicare Part D , and Medicare Supplement insurance plans.

What type of insurance does Kentucky offer?

Medicare beneficiaries in Kentucky may choose from several Medicare coverage options, ranging from the federally run Original Medicare, Part A and Part B, to private insurance companies contracted with Medicare that offer Medicare Advantage plans, Medicare Part D, and Medicare Supplement insurance plans.

How old do you have to be to get Medicare in Kentucky?

You’re generally eligible when you are 65 or older, but you may qualify under 65 through disability or having certain conditions. You will be enrolled automatically if:

What is Medicare Part A and Part B?

Medicare Part A covers inpatient hospital, skilled nursing facility, nursing home care (as long as custodial care isn’t the only care you need), home health, and hospice care, and Medicare Part B provides beneficiaries with coverage for doctor services, some preventive care, and durable medical equipment. Medicare Part A and Part B are available to eligible Medicare beneficiaries in any state in the United States.

Does Medicare cover prescription drugs?

If you have Original Medicare, you can get this coverage through a Medicare Prescription Drug Plan, which offers stand-alone prescription drug coverage for beneficiar ies with Medicare Part A and/or Part B and is offered by private Medicare-approved insurance companies. Costs and coverage details may vary.

What is Medicare Supplement?

Medicare Supplement insurance plans, like Medicare Advantage and Medicare Part D Prescription Drug Plans, are sold by private insurance companies, filling in coverage “gaps” left by Original Medicare. Medicare Supplement, also called Medigap, insurance features up to 10 standardized plans in most states, each with a letter designation (Plan A, B, ...

How many standardized plans are there for Medicare Supplement?

Medicare Supplement, also called Medigap, insurance features up to 10 standardized plans in most states, each with a letter designation (Plan A, B, C, D, F, G, K, L, M, N). Benefits of each lettered plan are the same no matter where the plan is purchased (for example, Plan M that you buy in Maine has the same coverage as Plan M ...

Does Kentucky have Medicare Supplement?

Kentucky Medicare Supplement Plans. Medicare Supplement plans in Kentucky follows standard federal regulations. The benefits Medicare covers, Medigap will cover the balance you’d otherwise pay. Keep reading to learn more about benefits, costs, and options for Medicare in Kentucky.

Does Kentucky have an Advantage plan?

Over 30% of Kentucky beneficiaries bought an Advantage plan. Advantage policies offer the Maximum Out Of Pocket. Essentially, this protects you from paying over a certain amount. Perhaps you qualify for Medicare because of a disability but aren’t yet 65. Kentucky doesn’t require insurance companies to offer Medigap plans for anyone under 65.

Does Medicare cover Kentucky?

Medicare Supplement plans in Kentucky follows standard federal regulations. The benefits Medicare covers, Medigap will cover the balance you’d otherwise pay. Keep reading to learn more about benefits, costs, and options for Medicare in Kentucky.

How much does Medicare cost in Kentucky?

Medicare Advantage Plans in Kentucky. Medicare Advantage premiums in Kentucky can range from $0- $140 each month. Over 30% of Kentucky beneficiaries bought an Advantage plan. Advantage policies offer the Maximum Out Of Pocket. Essentially, this protects you from paying over a certain amount.

How much does a Part D drug plan cost in Kentucky?

Part D drug plans in Kentucky can cost anywhere from $13 -$75 each month. A drug plan covers a portion of your Medications. Guidelines for Part D are federal, each plan must meet requirements; such as the six protected classes. Like all other states, if you don’t choose a policy upon eligibility, you’ll incur a penalty.

Does Medicare cover assisted living in Kentucky?

Medicare will not cover assisted living facility stays in Kentucky. Does Medicare cover routine dental care in Kentucky? Medicare doesn’t generally cover routine dental care in Kentucky. In a genuine emergency, you may receive cover through Medicaid if you qualify.

What is Medicare Advantage?

A Medicare Advantage plan may be your best bet in a situation like this. Some Advantage plans have plans for those with disabilities, like diabetes. Disability-friendly Advantage plans are Special Needs Plans. If you qualify for this plan, then you can enroll using a Special Enrollment Period.

What is Medicare Supplement?

Medicare is a federal health insurance program for people age 65 or older, younger people withdisabilities and people with end-stage renal disease (permanent kidney failure requiring dialysisor transplant). Medicare supplement insurance (also referred to as Medigap) is designed tosupplement Medicare’s benefits and is regulated by federal and state law.Medigap must be clearly identified as Medicare supplement insurance and it must providespecific benefits that help fill gaps in Medicare coverage. Other kinds of insurance may helpwith out-of-pocket health care costs, but they do not qualify as Medigap plans.

Does Medigap pay for co-insurance?

A: Medigap policies pay most, if not all, Medicare co-insurance amounts, and may provide coverage for Medicare’sdeductibles. Some plans pay for services not covered by Medicare such as emergency medical care while travelingoutside the United States and health care provider charges that are in excess of Medicare’s approved amount.

Kentucky Medicare Insurance Trends

The Centers for Medicare & Medicaid Services (CMS) reported the following information on 2021 Medicare trends in Kentucky:

Medicare Offered in Kentucky

Medicare provides health coverage for qualified citizens over the age of 65, along with certain people with disabilities. It’s a federal program, but the state offers many other assistance programs for Medicare beneficiaries.

Kentucky Medicare Enrollment

New Jersey citizens are eligible for Medicare if they are a U.S. citizen and above 65 years old or are under 65 but are permanently disabled, have end-stage renal disease, or Amyotrophic Lateral Sclerosis. Use Medicare’s online eligibility tool if you are unsure if you qualify.

How Do I Enroll in a Medicare Plan?

Our agents are here to answer any questions you have about Kentucky Medicare and your eligibility for supplement or advantage plans. They will discuss your options with you, helping you find the best option that works right for you today!

Your Medicare Supplement Options

You can enroll in a Medicare Supplement plan if you already have Original Medicare ‡ Part A and Part B, and you live in Kentucky. Your open enrollment period lasts for six months starting with the month you turn 65. During this Medicare Supplement open enrollment period, you cannot be denied a policy based on past or current health conditions.

Anthem Offers Medicare Supplement Insurance Plans A, F, G, and N

Plan A is the most basic of Medigap plans, with the lowest premiums. It is the only Medicare Supplement plan that doesn’t cover the Part A deductible.

Prescription Drugs, Dental, And Vision Coverage

Medicare Supplement plans do not include prescription drug coverage, but you can purchase a Part D plan for an additional premium to help cover medication costs.

Medicare Supplement Or Medicare Advantage?

You can have a Medicare Supplement plan or a Medicare Advantage (Part C) plan but not both.

Attend a Free Medicare Event

Sign up for a free Medicare event to learn how Anthem Medicare plans help cover costs that Original Medicare ‡ doesn’t. You can attend a virtual Medicare webinar. Or, if you prefer, come to a live seminar in your area where a Medicare licensed agent will be present to answer your questions.

What are the different types of Medicare Advantage Plans?

Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

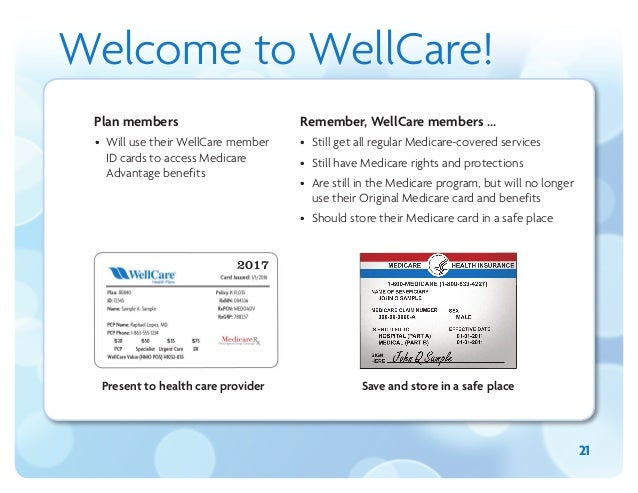

Do you need a red, white, and blue Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is Medicare Advantage?

Medicare Advantage, or Medicare Part C as it’s sometimes known, is an alternative option to Original Medicare Parts A and B. Instead of getting coverage through the government, Medicare Advantage users purchase plans from private insurance providers, similar to standard insurance.

What is Kentucky Disability Benefits 101?

Kentucky Disability Benefits 101 is a Kentucky-related branch of the World Institute on Disability. While the focus of this organization is on disabled adults, it also provides valuable information about Medicare, including Medicaid interaction for those who are low-income or disabled and require additional benefits.

What percentage of seniors choose Medicare Advantage?

The usage of Medicare Advantage plans differs widely from state to state. Nationally, around 34% of seniors choose a Medicare Advantage plan instead of Original Medicare, according to the Kaiser Family Foundation. Kentucky’s penetration rate falls slightly below this level at 31%. Kentucky seniors also fall short of the usage rates achieved in some ...

What is SNP in Medicare?

SNPs are specialized plans available for those who have specific qualifying disabilities or chronic conditions. Unlike most other kinds of Medicare Advantage plan that offers broad coverage for a wide array of health care needs, SNP plans focus on these designated diseases and conditions in order to provide the best care possible under unique circumstances. SNPs aren’t available to general Medicare users but instead are limited only to those who are eligible. Unlike all other forms of Medicare Advantage plans, SNPs must include coverage for prescription drugs.

How long does Medicare Advantage coverage last?

Initial Coverage Election Period: This is the 7-month period during which everyone is eligible to enroll in a Medicare Advantage plan. The period spans from 3 months before the month of one’s 65th birthday to 3 months after one’s birthday month.

When is the Medicare Advantage open enrollment period?

Medicare Advantage Open Enrollment Period: From January 1-March 31 each year, anyone who is already enrolled in Medicare Advantage can switch to a different plan, or disenroll and switch back to Original Medicare. This period is not open to anyone who is not currently enrolled in Medicare Advantage.

Can Medicare Part C be combined with Medicare Part D?

For people who require this level of coverage, choosing a Medicare Advantage plan with prescription coverage is key. Medicare Part C cannot be combined with a traditional Medicare Part D policy; enrolling in Part D triggers an automatic disenrollment from Medicare Advantage plans.