How do I talk to a real person at Medicare?

For specific billing questions and questions about your claim, medical records, or expenses, log into MyMedicare.gov, or call us at 1-800-MEDICARE (1-800-633-4227). TTY users call 1-877-486-2048.

What else do I need to know about Original Medicare?

What else do I need to know about Original Medicare? You generally pay a set amount for your health care (Deductible) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (Coinsurance / Copayment) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket.

How to join a Medicare plan if you are a member?

If you’re a member, the agent who helped you join can call you. Require you to speak to a sales agent to get information about the plan. Offer you cash (or gifts worth more than $15) to join their plan or give you free meals during a sales pitch for a Medicare health or drug plan.

What are the rules for meeting with a Medicare agent?

Independent agents and brokers selling plans must be licensed by the state, and the plan must tell the state which agents are selling their plans. If you're going to meet with an agent, the agent must follow all the rules for Medicare plans and some specific rules for meeting with you.

Who is the best to talk to about Medicare?

If you've contacted 1-800-MEDICARE (1-800-633-4227; TTY: 1-877-486-2048) about a Medicare-related inquiry or complaint but still need help, ask the 1-800-MEDICARE representative to send your inquiry or complaint to the Medicare Ombudsman's Office.

Where can I get unbiased information about Medicare?

Call 1-800-MEDICARE For questions about your claims or other personal Medicare information, log into (or create) your secure Medicare account, or call us at 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

Who do you call with questions about Medicare?

1-800-633-4227Visit Medicare.gov/about-us/nondiscrimination/accessibility-nondiscrimination.html, or call 1-800-MEDICARE (1-800-633-4227) for more information. TTY users can call 1-877-486-2048. Paid for by the Department of Health & Human Services.

How do I enroll in traditional Medicare?

Online (at Social Security) – It's the easiest and fastest way to sign up and get any financial help you may need. (You'll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.) Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is United Medicare Advisors a legitimate company?

Yes, United Medicare Advisors is a reputable company offering legitimate services and insurance products. Its licensed agents can provide free, reliable advice as you navigate the confusing world of Medicare supplement insurance so that you can choose the best plans for your needs and budget.

How does Medicare Helpline work?

The Medicare Coverage Hotline is a private for-profit lead generation campaign and does not offer insurance and is not an insurance agency or broker. Your call is sold to a licensed insurance agent to give you information about your Medicare Advantage Plans.

How do I check my Medicare coverage?

Checking the BasicsYou can use the enrollment check at Medicare.gov.You can call Medicare at 1-800-633-4227.Members can visit a local office to review the coverage in person.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Can you switch back to traditional Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

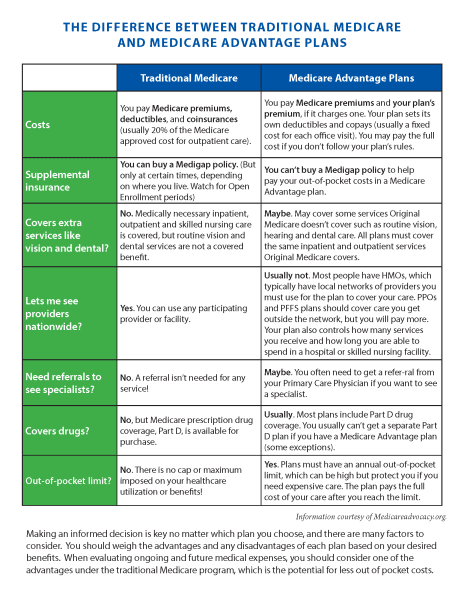

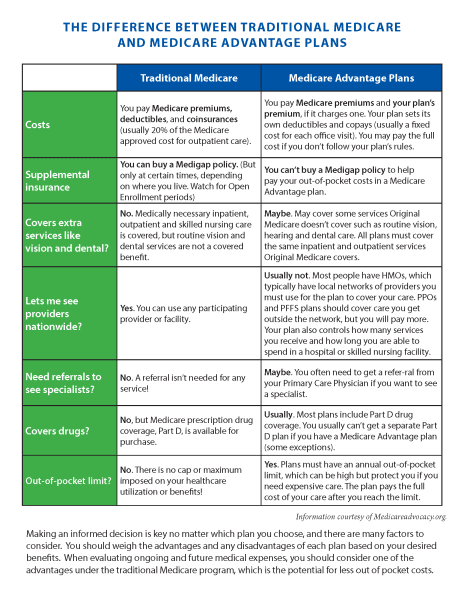

What is the difference between traditional Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

What is the Medicare premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What factors affect Medicare out of pocket costs?

Whether you have Part A and/or Part B. Most people have both. Whether your doctor, other health care provider, or supplier accepts assignment. The type of health care you need and how often you need it.

Does Medicare cover health care?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it. Whether you have other health insurance that works with Medicare.

Does Medicare cover prescriptions?

With a few exceptions, most prescriptions aren' t covered in Original Medicare. You can add drug coverage by joining a

What to know about Medicare Advantage?

Things to know about Medicare Advantage Plans. You're still in the Medicare Program. You still have Medicare rights and protections. You still get complete Part A and Part B coverage through the plan. Some plans offer extra benefits that Original Medicare doesn ’t cover – like vision, hearing, or dental. Your out-of-pocket costs may be lower in ...

How long can you join a health insurance plan?

You can only join a plan at certain times during the year. In most cases, you're enrolled in a plan for a year.

Does Medicare cover dental and vision?

You still get complete Part A and Part B coverage through the plan. P lans may offer some extra benefits that Original Medicare doesn’t cover – like vision, hearing, and dental services.

Can you check with a health insurance plan before you get a service?

You can check with the plan before you get a service to find out if it's covered and what your costs may be. Following plan rules, like getting a Referral to see a specialist in the plan's Network can keep your costs lower. Check with the plan.

Can you pay more for a Medicare Advantage plan than Original Medicare?

Medicare Advantage Plans can't charge more than Original Medicare for certain services like chemotherapy, dialysis, and skilled nursing facility care. Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services.

Do you have to get a service approved ahead of time?

In some cases, you have to get a service or supply approved ahead of time for the plan to cover it.

Does Medicare cover eye exams?

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

What is covered by Medicare?

The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. Original Medicare doesn't cover, like vision, hearing, dental, or prescription drug coverage? (You may have to pay more for these extra benefits.)

Does Medicare Advantage cover prescription drugs?

These plans are offered by insurance companies and other private companies approved by Medicare. Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. . Contact the plan if you don't find these answers in its publications or on its website.