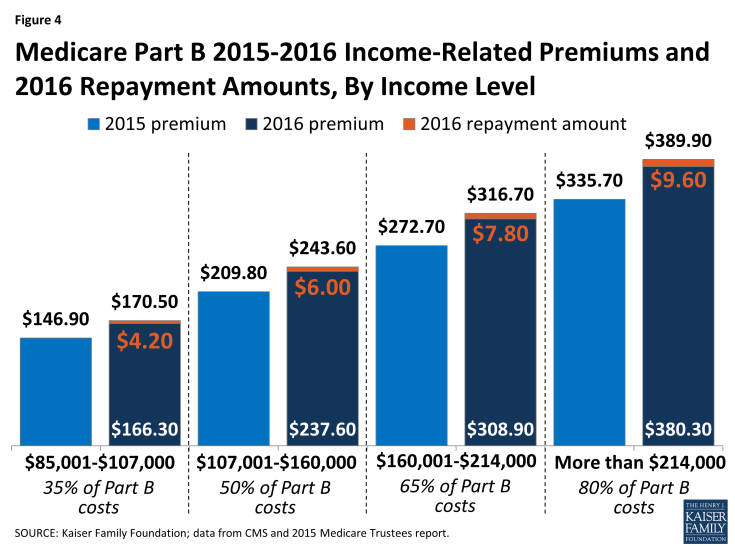

If there is no cost of living adjustment for Social Security in 2016 (just the third time since 1972), then the 7 million people who are not covered under the “hold harmless” law will have to pay the entire Medicare Part B increase in 2016.

Full Answer

What income level causes Medicare premiums to increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How much did Medicare go up in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

Why did my Medicare premium increase for 2022?

The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

WHO raises Medicare premiums?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

Why did Medicare go up so high?

This year's standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer's disease.

Do Medicare premiums increase each year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

Do Medicare premiums change each year based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Will Social Security get a raise in 2022?

Cost-of-Living Adjustment (COLA) Information for 2022 Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022.

What were Medicare Part B premiums in 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

How much will Medicare premiums increase in 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

What is the Medicare deductible for 2016?

The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. The Part A deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. The daily coinsurance amounts will be $322 for the 61 st through 90 th day of hospitalization in a benefit period and $644 for lifetime reserve days. For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 in a benefit period will be $161.00 in 2016 ($157.50 in 2015).

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.

When is Medicare open enrollment for 2016?

The 2016 Medicare Open Enrollment Period (OEP) begins on Oct. 15. Overall, 2016 prices are expected to remain stable. But when comparing costs, this is really a discussion of Part B (medical insurance) and Part D (Prescription Drug Plans).

What was Medicare Part B premium in 2015?

Medicare Part B – The expected 2016 costs for Part B are pending. However, in both 2014 and 2015, the monthly premium was $104.90 and the deductible was $147. These costs have been unchanged for the past two years.

How much is Medicare Part D?

Medicare Part D – The CMS prices has revealed that for 2016, companies carrying Plan D Prescription Drug Plans (PDPs) expect average monthly Medicare Part D premiums to be around $32.50. These premiums vary, due to such factors as consumers’ plan benefits and states. PDP costs have been steady over the past few years (see table); in 2015, premiums were $32 and in 2014, they were $31.

Do you have to pay Medicare Part A if you have not worked?

Medicare Part A – Again, most beneficiaries receive “premium-free” Medicare Part A. But certain individuals under the age of 65 may also qualify, particularly those who have received disability benefits for 24 months. If you have not worked the mandatory 40 quarters, you will have to pay for Part A coverage. 2016 costs, which are similar to 2015, are as follows: