Who will pay bigger Medicare premiums in 2016?

Here's a look at the specific groups of people who will pay bigger Medicare premiums in 2016: New enrollees. Retirees who sign up for Medicare in 2016 will pay $121.80 for Medicare Part B, $16.90 more per month than existing Social Security recipients.

How much will the Medicare Part B deductible increase in 2016?

The Medicare Part B deductible will increase from $147 in 2015 to $166 in 2016, even for existing Social Security beneficiaries paying the lower premium.

Will My Medicare premiums increase if I claim social security?

If you signed up for Medicare before claiming your Social Security payments, you are not protected from Medicare premium increases. Some Medicare beneficiaries haven't signed up for Social Security yet in order to collect delayed retirement credits and qualify for higher Social Security monthly payments when they do claim them.

Who pays the most for Medicare Part B premiums?

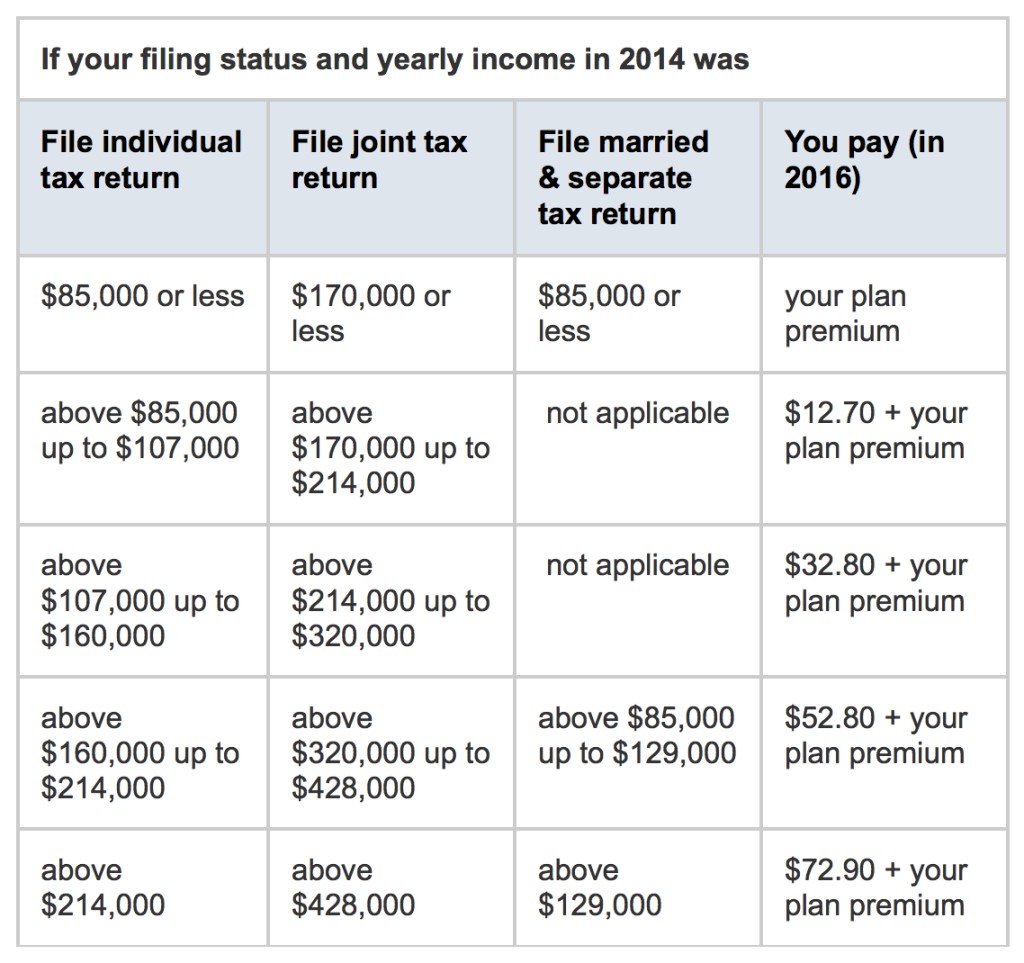

Some Retirees Pay Higher Medicare Premiums in 2016. High income beneficiaries. Retirees with high incomes have been paying bigger Medicare Part B premiums since 2007. Those with retirement incomes between $85,000 and $107,000 ($170,000 to $214,000 for couples) will pay $170.50 in Medicare Part B premiums in 2016.

What were Medicare Part B premiums in 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Does everyone pay the same price for Medicare?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much will Medicare premiums increase in 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.

Do Medicare premiums change each year based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why is my Medicare bill so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How is modified adjusted gross income for Medicare premiums calculated?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

Why did Medicare premiums go up?

The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

Why is Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

How do I get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What was the Medicare deductible in 2015?

$1,260The Medicare Part A deductible, which covers the first 60 days of Medicare-covered inpatient hospital care, will rise to $1,260 in 2015, a $44 increase from 2014.

What is the yearly deductible for Medicare?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the Medicare Part B deductible for 2017?

$183 in 2017CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016).

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

Specific groups of retirees will be charged more expensive Medicare Part B premiums than everyone else

New Medicare enrollees will pay bigger premiums than most existing beneficiaries. (iStockPhoto)

Most Enjoyable Jobs for Older Workers

For flexibility and a sense of purpose, consider these jobs for people over 50.

Withdrawing Money From a Traditional IRA

Taking money from your IRA may seem like a simple matter, but it's a decision that must be timed right.

Retiring on a Part-Time Job

A part-time career could mean a stressful future if you don't use some of these tips to prepare for retirement.

The Case Against Retiring Early

Take a hard look at your savings and upcoming plans before starting an early retirement.

Tips for Retiring on a Small Budget

Look for ways to trim costs and keep items in solid condition to stretch retirement dollars.

How Living Longer Impacts Retirement

Americans are living longer than ever, and that creates some challenges for retirees.

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What is the Medicare deductible for 2016?

The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. The Part A deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. The daily coinsurance amounts will be $322 for the 61 st through 90 th day of hospitalization in a benefit period and $644 for lifetime reserve days. For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 in a benefit period will be $161.00 in 2016 ($157.50 in 2015).

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.

How much is Medicare Part B?

The Medicare Part B premium will remain the same at $104.90 per month for most individuals. The Social Security Administration recently announced that there will be no cost of living increase for 2016.

Do Part B beneficiaries have to pay higher premiums?

Some Part B beneficiaries will have to pay slightly higher premiums. These beneficiaries include those not collecting Social Security benefits, those who are enrolling in Part B in 2016 for the first time, dual-eligible beneficiaries, and those who pay an additional income-related premium.

Will Medicare Part B be held harmless?

Due to this, most Part B beneficiaries will be “held harmless” from premium increases in 2016, according to the CMS release. “Our goal is to keep Medicare Part B premiums affordable,” said Andy Slavitt, CMS Acting Administrator.

Will Medicare increase in 2016?

Medicare beneficiar ies will face higher Medicare costs in 2016. Several costs, including the Part A deductible, the Part A inpatient hospital stay co-insurance, and the Part B deductible will increase in 2016, according to a Centers for Medicare & Medicaid Services (CMS) news release .

Does Medicare Supplement cover out of pocket expenses?

Medicare Supplement insurance policies (also called Medigap plans) will cover some of the 2016 Medicare costs. Each Medigap plan covers different benefits. The table below shows which Medigap plans will cover certain Medicare out-of-pocket costs in 2016.

How much is the 2016 Medicare premium?

Your 2016 monthly premium is typically $121.80 if any of the following is true for you:

How much does Medicare cost a month?

If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, or $411 per month if you’ve worked and paid Social Security taxes for fewer than 30 quarters.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How much of your Medicare plan is covered by generic drugs?

While in the coverage gap, you may have to pay: 45% of your plan’s cost for covered brand-name drugs. 58% of your plan’s cost for covered generic drugs. To learn more about your Medicare plan options, you can call one of eHealth’s licensed insurance agents by calling the number shown below.

How much is coinsurance for 61 days?

Coinsurance for days 61 to 90: $322 per day. Coinsurance for days 91 and beyond: $644 per day. Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period.

What is the Medicare budget for 2016?

The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years. The proposals are scored off the President’s Budget adjusted baseline, which assumes a zero percent update to Medicare physician payments. These reforms will strengthen Medicare by more closely aligning payments with the costs of providing care, encouraging health care providers to deliver better care and better outcomes for their patients, and improving access to care for beneficiaries. The Budget includes investments to reform Medicare physician payments and accelerate physician participation in high-quality and efficient healthcare delivery systems. Finally, it makes structural changes in program financing that will reduce Federal subsidies to high income beneficiaries and create incentives for beneficiaries to seek high value services. Together, these measures will extend the Hospital Insurance Trust Fund solvency by approximately five years.

How many people were on Medicare in 2015?

In 2015, Medicare Advantage enrollment will total approximately 17 million. Over the past ten years, Medicare Advantage enrollment as a percentage of total enrollment has increased by 138 percent. CMS data confirm that beneficiary access to a Medicare Advantage plan remains strong and stable in 2015 at 99 percent, premiums have remained stable, Medicare Advantage supplemental benefits have increased, and enrollment is growing faster than traditional Medicare.

What is the Centers for Medicare and Medicaid Services?

The Centers for Medicare & Medicaid Services ensure s availability of effective, up-to-date health care coverage and promotes quality care for beneficiaries.

How much has Medicare saved?

Cumulatively since enactment of the Affordable Care Act, 9.4 million beneficiaries have saved a total of $15 billion on prescription drugs. The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years.

Why are beneficiary premiums netted out in Part D?

2/ In Part D only, some beneficiary premiums are paid directly to plans and are netted out here because those payments are not paid out of the Trust Funds.

What is Medicare Part C?

Part C ($198.0 billion gross spending in 2016): Medicare Part C, the Medicare Advantage program, pays plans a capitated monthly payment to provide all Part A and B services, and Part D services, if offered by the plan.

How much did the Protecting Access to Medicare Act save?

The 12-month patch itself was estimated by the Congressional Budget Office (CBO) to cost $15.8 billion over 11 years (FY 2014- FY 2024). However other provisions in the law, including extenders, Medicare savers, and other health provisions reduced the CBO estimate to an overall savings of $1.2 billion over 11 years.