So who will be subject to the premium increase? Seniors who are applying for Medicare Part B for the 1 st time in 2016, those who are in the higher income brackets over $80,000 for single seniors or $170,000 for married seniors, and seniors who have yet to collect social security will be subject to the premium hike.

Full Answer

How much will Medicare Part B premiums increase in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

What is the Medicare Part a deductible for 2016?

The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. The Part A deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

How much does Medicare Part a cost per month?

Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to receive coverage under Part A. Individuals with 30-39 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $226. 00 in 2016, a $2. 00 increase from 2015.

How much will Medicare premium mitigation Save you in 2016?

The CMS Office of the Actuary estimates that states will save $1.8 billion as a result of this premium mitigation. CMS also announced that the annual deductible for all Part B beneficiaries will be $166.00 in 2016. Premiums for Medicare Advantage and Medicare Prescription Drug plans already finalized are unaffected by this announcement.

What were Medicare premiums in 2016?

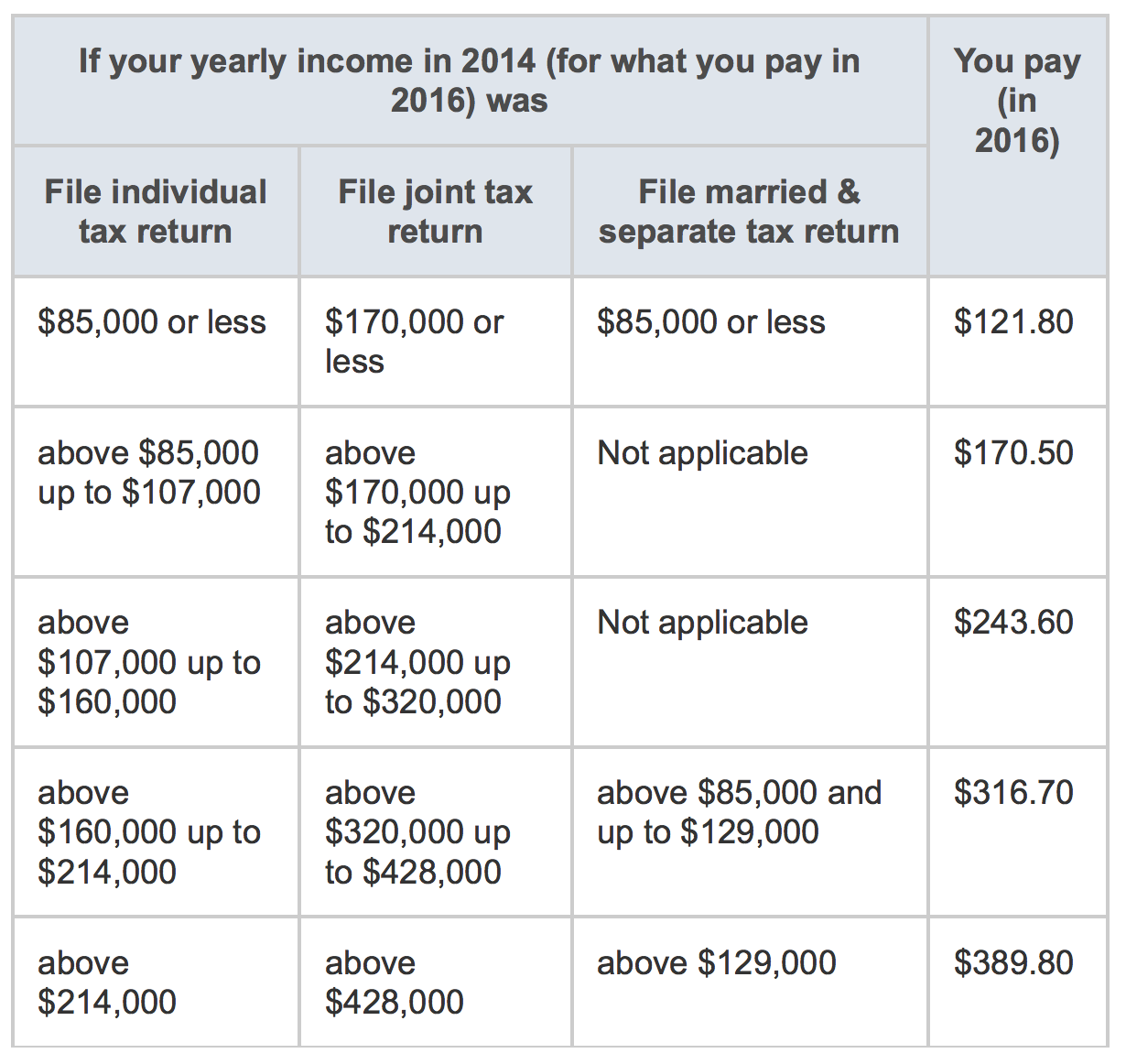

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

Why did my Medicare premium increase for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

At what income level are Medicare premiums increased?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Why has my Medicare payment increase?

The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Will 2022 Part B premium be reduced?

Medicare Part B Premiums Will Not Be Lowered in 2022.

Do Medicare premiums change each year based on income?

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Does Social Security count as income?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Does Medicare Part B go up for everyone?

Does the Medicare Part B premium go up every year? The Part B premium is hardly the only Medicare cost that will go up every year. The Medicare Part A (hospital insurance) premium also increases annually for those who are required to pay it. Medicare Part A and Part B deductibles typically increase each year, as well.

Will the cost of Medicare go up in 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).

Why did my Medicare premium double?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How not getting a raise in Your Social Security impacts your Medicare Part B premiums

As a Social Security recipient you may be disappointed that there will not be a Cost of Living Adjustment COLA for 2016. Most people on a fixed income would argue that the costs of goods and services are getting more expensive.

Medicare deductible and coinsurance changes for 2016

If you have original Medicare you are subject to the Part B Deductible. Part B covers all outpatient services. Most Medicare Advantage plans and two Medicare supplement policies pay your Part B Deductible. If you are required to pay the deductible you’re going to be digging deeper in your pocketbook.

Medicare 2016 and beyond

If you have been enrolled in Medicare for some time you’ve come to expect changes. In most cases changes mean more out-of-pocket costs to you. The 2016 elections throw just a little more uncertainty into the mix. Staying current on Medicare costs and what options you have available is vitally important.