Get ready to pay higher premiums in 2016 if you fall into one of these groups: those who enroll in Medicare for the first time in 2016; those who don’t receive a Social Security benefit at age 65 or who pay their Medicare premiums directly rather than having them deducted from their Social Security payment; and those who are already paying a higher premium because of higher income.

How much does Medicare Part a cost in 2016?

Dec 14, 2015 · 2016 premium will be $316.70; Individuals with annual incomes of $214,000 or more and; Married couples with annual incomes of $428,000 or more 2015 premium was $335.70; 2016 premium will be $389.80; Medicare Part A costs, which cover inpatient hospital, some home health care, and skilled nursing facility services, will also increase.

Will Medicare premiums and deductibles increase in 2016?

Here's a look at the specific groups of people who will pay bigger Medicare premiums in 2016: New enrollees. Retirees who sign up for Medicare in 2016 will pay $121.80 for Medicare Part B, …

Will Medicare Part B cost of living increase in 2016?

Nov 10, 2015 · As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed into law by President Obama last …

How much will Medicare premium mitigation Save you in 2016?

Mar 22, 2016 · What this means is that if your benefits aren’t going up, then you’re not going to pay Medicare anything extra. You’ll simply pay the same monthly premium of $104.90 as you did in 2015. Conversely, if you’re among the 20-30% of people who pay for Medicare directly, then get ready to hand over some additional cash in 2016. The standard Part B premium for 2016 is …

What were Medicare premiums in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Part B premium in 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

Does the cost of Medicare increase every year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

What was the Medicare Part B premium for 2017?

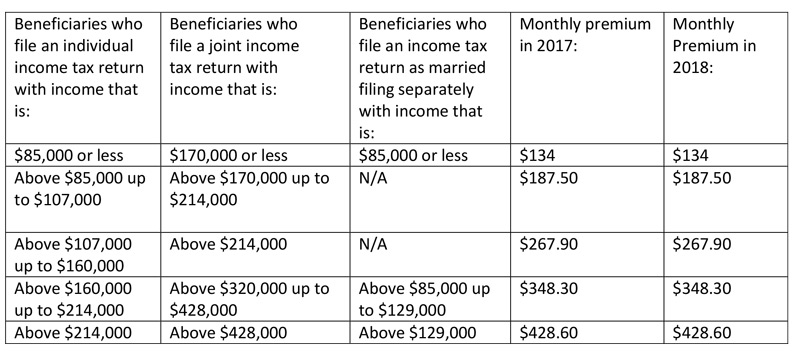

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What were Medicare premiums in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$133,501 to $160,000$267,001 to $320,000$348.305 more rows

What was Medicare Part B premium in 2015?

How much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

How much did Medicare go up in 2021?

2021 = $148.50 per month. 2020 = $144.60 per month.Feb 15, 2022

Why did my Medicare premium go up in 2022?

CMS explained that the increase for 2022 was due in part to the potential costs associated with the new Alzheimer's drug, Aduhelm (aducanumab), manufactured by Biogen, which had an initial annual price tag of $56,000.Jan 12, 2022

Will the cost of Medicare go up in 2022?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

What is the Medicare Part B deductible for 2021?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What is the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

What was Irmaa for 2018?

An upper-income household in 2018 will face an IRMAA surcharge of $294.60/month (which is $3,535/year) once income exceeds $160,000/year, yet even that still only the equivalent of “just” a 2.2% surtax on income. Viewing IRMAA surcharges relative to income is important.Nov 29, 2017

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.