Anyone who is enrolled in Original Medicare (Part A and Part B) may be eligible to sign up for a Medicare Advantage (Part C) plan. This includes people under the age of 65 who have qualified for Medicare because of a disability. People who have End-Stage Renal Disease (ESRD

Chronic Kidney Disease

A condition characterized by a gradual loss of kidney function.

Full Answer

Why you should consider a Medicare Advantage plan?

Why Medicare Advantage Plans are Bad (or Are They?)

- They Feel Nickel-and-Dimed. Medicare Advantage plans usually have copays and coinsurance. ...

- They Mistakenly Thought their Plan Would be Free. Medicare Advantage plans are paid by Medicare itself. ...

- Smaller Networks and Referrals. ...

- Annual Plan Changes. ...

- High Out-of-Pocket Maximums. ...

- Prior Authorizations. ...

- Common Questions. ...

- Talk to a Medicare Expert. ...

What companies offer Medicare Advantage plans currently?

U.S. News & World Report analyzed and ranked insurance companies' offerings in each state based on their 2022 CMS star ratings. They define a Best Insurance Company for Medicare Advantage Plans as a company whose plans were all rated as at least 3 out of 5 stars by CMS and whose plans have an average rating of 4.5 or more stars within the state.

Who can enroll in a Medicare Advantage plan?

You must have Medicare Part A and Medicare Part B to enroll in a Medicare Advantage plan. People can enroll in a Medicare Advantage plan for the first time using the Initial Coverage Election Period.

Why Advantage plans are bad?

disadvantage of medicare advantage plans

- Networks

- Referrals

- Prior Authorizations

- Frequent Expenses

- Out-of-Pocket Maximums

- Plan Changes

- Medicare is no longer managing your healthcare

What are the criteria for Medicare Advantage?

Generally, you can get Medicare if one of these conditions applies: You are at least 65 years old. You are disabled and receive Social Security Disability Insurance (SSDI) or Railroad Retirement disability payments. You have End-Stage Renal Disease (ESRD) and require dialysis or a kidney transplant.

Is Medicare Advantage available to everyone?

Over 24 million Americans have chosen to get their Medicare benefits through a Medicare Advantage (Part C) healthcare plan. Anyone who is eligible for Part A and Part B can enroll in a Medicare Advantage plan.

What patient population is generally excluded from joining a Medicare Advantage plan?

End-Stage Renal DiseasePeople with End-Stage Renal Disease (permanent kidney failure) generally can't join a Medicare Advantage Plan. How much do Medicare Advantage Plans cost? In addition to your Part B premium, you usually pay one monthly premium for the services included in a Medicare Advantage Plan.

Can I be turned down for a Medicare Advantage plan?

Generally, if you're eligible for Original Medicare (Part A and Part B), you can't be denied enrollment into a Medicare Advantage plan. If a Medicare Advantage plan gave you prior approval for a medical service, it can't deny you coverage later due to lack of medical necessity.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

Which of the following consumers are eligible for Medicare if other eligibility requirements are met?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

Can you have Medicare and a Medicare Advantage plan?

People with Medicare can get their health coverage through either Original Medicare or a Medicare Advantage Plan (also known as a Medicare private health plan or Part C).

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is excluded from a Medicare Advantage plan?

Non-medical services, including a private hospital room, hospital television and telephone, canceled or missed appointments, and copies of x-rays. Most non-emergency transportation, including ambulette services. Certain preventive services, including routine foot care.

Can you switch back to traditional Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are the requirements to qualify for Medicare Advantage?

There are 2 general eligibility requirements to qualify for a Medicare Advantage plan (Medicare Part C): 1. You must be enrolled in Original Medicare ( Medicare Part A and Part B). 2. You must live in the service area of a Medicare Advantage insurance provider that is accepting new users during your application period.

Who can sign up for Medicare Advantage?

Anyone who is enrolled in Original Medicare (Part A and Part B) may be eligible to sign up for a Medicare Advantage (Part C) plan. This includes people under the age of 65 who have qualified for Medicare because of a disability.

What percentage of Medicare Part C plans will be available in 2021?

89 percent of Part C plans available throughout the country in 2021 cover prescription drugs, and 54 percent of those plans feature a $0 premium. 2. 6 out of 10 Medicare Advantage Prescription Drug plan beneficiaries are enrolled in a $0 premium plan in 2021.2.

How much is Medicare Advantage 2021?

In 2021, the weighted average premium for a Medicare Advantage plan that includes prescription drug coverage is $33.57 per month. 1. 89 percent of Part C plans available throughout the country in 2021 cover prescription drugs, and 54 percent of those plans feature a $0 premium.

How long does Medicare IEP last?

Initial Enrollment Period (IEP) When you first become eligible for Medicare, you will be given an Initial Enrollment Period (IEP). Your IEP lasts for seven months. It begins three months before you turn 65 years old, includes the month of your birthday and continues on for three more months.

What are the benefits of Medicare Advantage?

Some Medicare Advantage plans may also offer a number of additional benefits that can include coverage for things like: Routine dental and vision care. Hearing care and allowances for hearing aids. Memberships to gyms and wellness programs like SilverSneakers. Some home health care services.

What is Medicare Part C?

Medicare Part C plans are sold by private insurance companies as an alternative to Original Medicare. Medicare Part C plans are required by law to offer at least the same benefits as Medicare Part A and Part B. There are several different types of Medicare Advantage plans, such as HMO plans and PPO plans. Each type of plan may feature its own ...

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

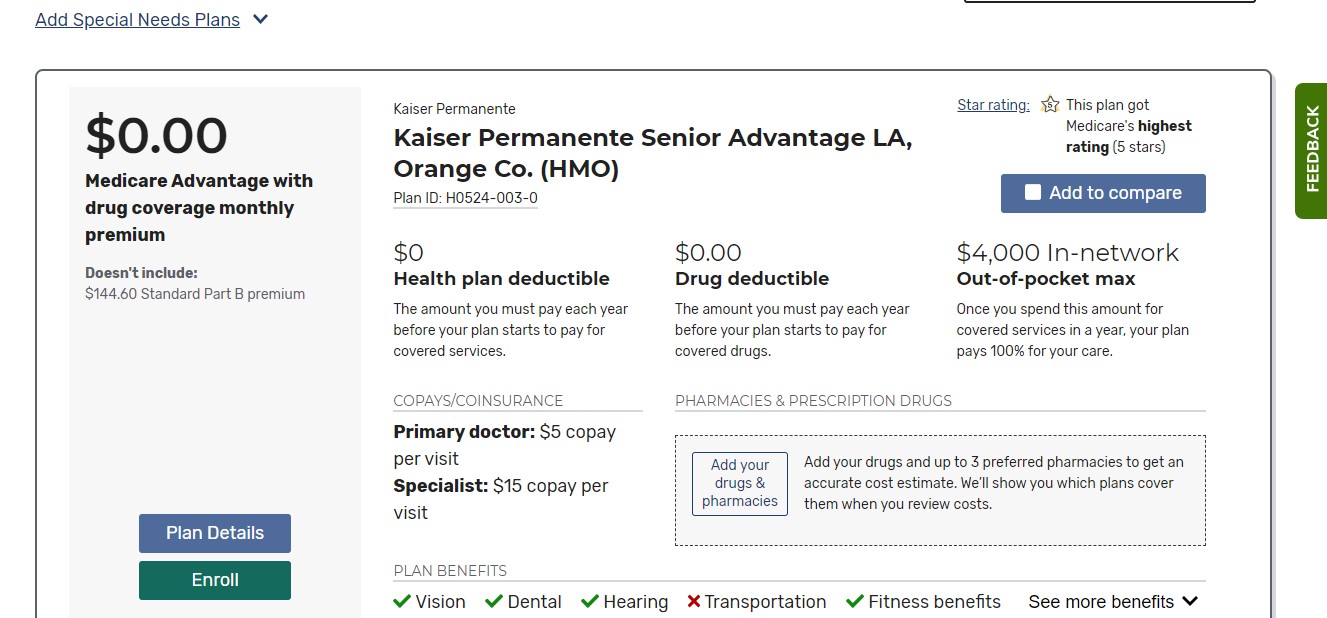

How many stars are Medicare Advantage plans?

Medicare has created a rating system so that patients can see how Medicare Advantage plans perform. A plan rating, which is always between one and five stars, can be clearly seen on the right-hand corner of the plan details on the plan finder. According to a recent CMS study, 81% of Medicare Advantage enrollees are in plans that have a rating of four stars or better in 2020. If you’re looking for a plan in your area, and you realize that the only plans available have ratings of three stars or lower, you’ll want to think seriously about whether or not those plans will be valuable to you.

What if I can't join Medicare Advantage?

If you can’t join a Medicare Advantage plan, you have other options for getting quality, affordable health coverage that includes more than just the basics of Original Medicare. Each of the alternatives to Medicare Advantage listed below is considered a two-payer method of health coverage (Medicare and the other form of insurance are each called a “payer”). Before you read about alternatives, you can learn the basics about how Medicare works with other forms of insurance on the CMS website.

What is Medicare with Medigap?

Original Medicare with Medigap: Medigap is supplemental insurance offered by private companies that is designed to cover Medicare deductibles, copays, and coinsurance. Coverage for these items can be partial or full, depending on the plan. Seniors pay a monthly premium in exchange for the Medigap policy covering many of their out-of-pocket expenses. There are several kinds of Medigap plans which are heavily regulated by the federal and state governments. Learn more about plan types here .

What is ESRD in Medicare?

End-Stage Renal Disease (ESRD, kidney failure) is the final stage of kidney disease in which a patient becomes dependent on dialysis and needs a transplant. Kidney disease leading to ESRD can be caused by a variety of factors including uncontrolled diabetes, high blood pressure, genetic diseases, autoimmune disorders, and more. Those who are diagnosed with ESRD have special opportunities to join Original Medicare even if they otherwise would not be old enough. You can read about how ESRD affects Original Medicare eligibility if you’d like to learn more. Despite the increased likelihood of being eligible for Original Medicare, however, those who have ESRD have unusually limited opportunities to join a Medicare Advantage plan.

How much does Medicare Advantage cost?

The average Medicare Advantage enrollee who gets prescription drug coverage pays just $36 for their health plan premium (s). This is a very reasonable cost, and many seniors would be willing to pay even more than that if it meant quality coverage. However, it’s important to remember that to get Medicare Advantage, seniors also need to pay their Original Medicare premiums. Most seniors will owe a Part B premium of approximately $145 and a Part A premium of $0 in 2020. However, those with high incomes and those who did not pay into the Medicare system via taxes for an extended period of time while they worked may have higher premiums for Parts A or B.

Does Medicare cover mental health?

According to a 2012 study, about one in five seniors struggle with a mental illness and/or a substance use disorder. In many cases, poor health and problems with mobility, chronic pain, and social isolation can exacerbate underlying mental health and substance abuse issues. Original Medicare, in recognition of mental health struggles in older populations, provides many options for mental healthcare, including depression screenings, wellness visits, psychotherapy, and more. For many patients, the level of mental health care provided by Original Medicare may be enough. However, for seniors who have had serious, chronic difficulty with managing their mental health successfully, turning to a Medicare Advantage Chronic Condition Special Needs Plan (C-SNP) may offer the extra support required.

Does Medicare cover prescriptions?

Original Medicare covers very few prescription drugs. Part B of Original Medicare covers prescriptions that are typically given in the doctor’s office- things like specialized infusions, injections, antigens, and blood-clotting medication. However, it does not usually cover medications that one takes at home on a regular basis. With 45% of seniors in 2019 who were in fair to poor health saying that they found paying for their prescription drugs “difficult,” it’s clear that many seniors need help with purchasing prescriptions. Seniors in need can find relief through Medicare Advantage plans, which, unlike Original Medicare, frequently include robust drug coverage (Part D).