Many Medicare Advantage plans offer benefits not usually available through Original Medicare, and American Association of Retired Persons (AARP) Medicare Advantage Plans from UnitedHealthcare are designed to help you make the most of your healthcare spending.

Full Answer

Is AARP’s Medicare supplement plan right for You?

Jan 24, 2022 · USAA Medicare supplement insurance: Our thoughts. Medigap plans sold by any company must provide a standard set of benefits. USAA offers a solid set of coverage options, including plans F, G and N, which are the most popular Medigap plans sold. In most states where USAA sells Medigap, choices are limited to plans A, F, G and N. Additional options are available …

What are the different USAA Medicare supplement plans?

Jun 17, 2021 · About 7 out of 10 of AARP’s Medicare Advantage plans offer $0 premiums. Of AARP plans that have a premium, the monthly consolidated premium (including Part C and Part D) ranges from $9 to $112.

Does USAA cover Medicare gaps?

Dec 27, 2021 · UnitedHealthcare pays AARP for the use of its name. The AARP name is attached to many of the Medicare insurance forms and plans. If an individual wants to purchase a UHC policy with the AARP name, they’ll need to first become a member of the AARP. Membership rates are typically around $16 per year. That may not seem like much for many people ...

How does AARP Medigap work?

May 04, 2022 · AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP Medicare Supplement Insurance Plans. AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

Is AARP good for Medicare?

Who has the best Medicare coverage?

| Provider | Forbes Health Ratings | Coverage area |

|---|---|---|

| Blue Cross Blue Shield | 5.0 | Offers plans in 48 states |

| Cigna | 4.5 | Offers plans in 26 states and Washington, D.C. |

| United Healthcare | 4.0 | Offers plans in all 50 states |

| Aetna | 3.5 | Offers plans in 44 states |

What is the most comprehensive Medicare supplement plan?

Why would someone choose Medigap over Medicare Advantage?

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

Do you automatically get Medicare with Social Security?

Why is Plan F being discontinued?

What is 2022 Plan G deductible?

What is the average cost of supplemental insurance for Medicare?

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

Can you be denied a Medicare supplement plan?

Is USAA Medicare supplemental insurance good?

The quality of USAA coverage matches Medigap insurance offered by other companies, since benefits are standardized. USAA members reported being sat...

Does USAA pay the Medicare deductible?

Deductible coverage varies by Medigap plan. Medicare Part A deductibles are fully covered by Plans F, G and N but not by Plan A. Plans C and F both...

How can I find out about USAA Medicare supplement eligibility?

If you have Medicare and are a USAA member, you can contact the company directly to ask about Medigap eligibility. You also can learn more by acces...

Why can I not purchase Medigap Plans C and F?

Medicare supplement Plans C and F provide coverage for most gaps within the Original Medicare system, so they are very popular. As a cost-saving me...

Why are Medicare Advantage plans so popular?

Medicare Advantage plans have gained popularity since first being introduced by the Balanced Budget Act of 1997. Here are nine reasons why. 1. Low or $0 Monthly Premium Payments. Medicare Advantages plans often have low-cost or even $0 premiums. Costs will vary by plan, so it’s important to shop around. You will continue to pay the Part B premium ...

What is the benefit of Medicare Advantage?

Financial Protection. Medicare Advantage plans provide a financial safety net due to a set annual out-of-pocket limit. If your costs reach the limit, then your plan covers 100 percent of your Medicare-covered health care costs for the rest of the year. Medicare sets a maximum out-of-pocket limit each year, and plans can set their limits ...

Does Medicare cover dental?

Original Medicare doesn't provide coverage for dental, vision, hearing care or fitness. For a simple solution and added health and wellness, most Medicare Advantage plans cover these items as part of their benefit packages.

Does Medicare cover emergency medical care?

You can rest assured that you will get the care you need should you have a health emergency – no matter what state you’re in. All Medicare Advantage plans are required to provide coverage for urgent and emergency medical care throughout the United States.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is primary care oversight?

Oversight by your primary care provider and access to an extensive network allow you to quickly see providers and specialists for the care you need. Your primary care provider can easily refer you to the services you need.

What is Medicare insurance?

Medicare is health insurance for people age 65 and over, and those eligible based on a disability. USAA Life Insurance Company offers plans that help cover what Medicare alone may not.

What is Medicare for 65?

Medicare is health insurance for people age 65 and over, and those eligible based on a disability. USAA Life Insurance Company offers plans that help cover what Medicare alone may not. 1. Start With Medicare. You may get Parts A and B when you turn 65 or become eligible because of a disability.

How to contact Medicare?

Let us help you understand your Medicare options. Call a licensed insurance agent at 800-515-8687. Call a licensed insurance agent at 800-515-8687. For TTY device, dial 711. ( Hours. of Operation, Opens Popup. ) Let us help you understand your Medicare options. Call a licensed insurance producer at 800-515-8687.

How to contact a licensed insurance agent?

Call a licensed insurance agent at 800-515-8687. Call a licensed insurance agent at 800-515-8687. Call a licensed insurance producer at 800-515-8687 Call a licensed insurance producer at 800-515-8687.

Is AARP an insurer?

AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products.

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP Medicare Supplement Insurance Plans.

Who pays royalty fees to AARP?

UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

Is UnitedHealthcare a Medicare Advantage?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare.

What is a dual SNP?

Dual Special Needs (D-SNP) Plans. Dual Special Needs Plans (D-SNPs) are for people who have both Medicare and Medicaid. They offer many extra benefits and features beyond Original Medicare. People who are eligible can get a Dual Complete plan for a $0 plan premium.

What is USAA insurance?

USAA offers a range of insurance products to active and retired service members and their families, and members of certain federal agencies. Banking, investing, and wealth management services are also among USAA's portfolio. The company offers a variety of Medicare Supplement Plans that can be used across state lines. View Top 10 List.

How to contact USAA customer support?

Regardless, USAA customers can contact customer support through a toll-free number, by email, or by dialing #USAA using an AT&T, Sprint, T-Mobile, or Verizon smartphone. Members also have access to a comprehensive FAQ section, articles, and videos.

Where is USAA headquartered?

USAA is a mutual self-insurance company founded in 1922 and headquartered in San Antonio, Texas. USAA offers a range of insurance products to active and retired service members and their families, and members of certain federal agencies. Banking, investing, and wealth management services are also among USAA's portfolio.

What is the difference between Plan C and Plan F?

Plan F - Less expensive than other plans, F covers all the same benefits as C , with the addition of 100% of Part B's excess charges.

Is AARP membership good?

Being smart with your money is important at every stage in life but especially as you near retirement. An AARP membership may be a good deal to some but a waste of money for others. Here is a quick summary of the pros and cons of an AARP membership to decide if it’s worth it for you: Pros.

What is AARP magazine?

AARP The Magazine. Membership comes with a subscription to AARP The Magazine which features health and tech news, celebrity interviews, book and movie reviews, money tips, recipes and more. The magazine also comes in a digital format that can be read using the AARP mobile app on your iPad.

Does AARP partner with Expedia?

Also, AARP has partnered with Expedia so you can search and book hotels, car rentals, cruises and vacation packages with exclusive member discounts. There are no booking fees, and you can also get a cash rebate on hotel reservations. Get up to a 30 percent discount on car rentals through Avis, Budget and Payless.

Do you have to be 50 to join AARP?

You don’t have to be 50 or older to enjoy the benefits of an AARP membership. Since there is no age restriction to join, anyone can subscribe and get access to discounts and savings. While you can become a member at any age, most resources and tools are skewed toward an older crowd.

Is there an age limit to joining AARP?

Since there is no age restriction to join, anyone can subscribe and get access to discounts and savings. While you can become a member at any age, most resources and tools are skewed toward an older crowd. Evaluate the pros and cons of joining AARP and weight it against other memberships you may have such as AAA.

What are some games that help you keep your mind sharp?

The AARP website features many popular games such as Mahjongg, Black Jack, Solitaire, crossword puzzles and more – all free.

What is Medicare insurance?

Medicare is health insurance for people age 65 and over, and those eligible based on a disability. USAA Life Insurance Company offers plans that help cover what Medicare alone may not.

What is Medicare for 65?

Medicare is health insurance for people age 65 and over, and those eligible based on a disability. USAA Life Insurance Company offers plans that help cover what Medicare alone may not. 1. Start With Medicare. You may get Parts A and B when you turn 65 or become eligible because of a disability.

How to contact Medicare?

Let us help you understand your Medicare options. Call a licensed insurance agent at 800-515-8687. Call a licensed insurance agent at 800-515-8687. For TTY device, dial 711. ( Hours. of Operation, Opens Popup. ) Let us help you understand your Medicare options. Call a licensed insurance producer at 800-515-8687.

How to contact a licensed insurance agent?

Call a licensed insurance agent at 800-515-8687. Call a licensed insurance agent at 800-515-8687. Call a licensed insurance producer at 800-515-8687 Call a licensed insurance producer at 800-515-8687.

What is AARP insurance?

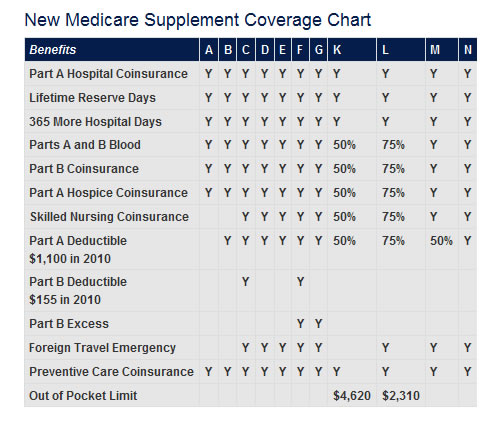

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover. This article looks at the various AARP medical supplement insurance plans.

Is AARP a nonprofit?

Summary. AARP is a nonprofit organization. One of its membership benefits includes discounts on Medigap plans through United Healthcare. The eight AARP Medigap plans offered by AARP cover some of the gaps left in original Medicare coverage, including out-of-pocket costs such as copays, coinsurance, and deductibles.

How does Medigap work?

The premiums for AARP Medigap plans vary depending on a person’s location, and on the method a company uses to set prices. The three systems include: 1 community rated, where everyone who has the policy pays the same premium, regardless of their age 2 issue-age rated, where the premium is based on a person’s age when they first get a policy, but does not increase because of age 3 attained-age rated, where the premium is age-related and may increase as a person gets older

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Does Medicare cover copays?

Original Medicare pays a proportion of covered healthcare costs. However, Medicare beneficiaries must also pay copays, coinsurance, and an annual deductible. Private insurance companies sell supplement insurance plans, known as Medigap, to fill these payment gaps. However, Medigap policies do not cover all healthcare costs.

Does Medigap cover dental?

Private insurance companies sell supplement insurance plans, known as Medigap, to fill these payment gaps. However, Medigap policies do not cover all healthcare costs. Typically, they do not include services such as long-term care, vision or dental care, or private-duty nursing. They also may not cover hearing aids or eyeglasses.

Does Medicare cover hearing aids?

Typically, they do not include services such as long-term care, vision or dental care, or private-duty nursing. They also may not cover hearing aids or eyeglasses. Depending on where a person lives and when they became eligible for Medicare, they can choose from up to 10 different Medigap policies.